Many companies want to pivot away from last year’s cost focus toward a more growth-oriented stance. But with GDP gains tepid and macro budgets mostly flat, the reality is organizations need to squeeze some mature areas of the budget to fund IT investments elsewhere. While cloud and security remain focus areas, not surprisingly generative AI (GenAI) is what’s taking center stage as companies pursue productivity gains. GenAI investment is expected to grow 30% in 2024, with industry leaders penciling in ROI three-times higher over the next three years compared with companies with little to no GenAI investment.

Those are some of the key takeaways from Boston Consulting Group’s latest IT Spending Pulse, conducted in collaboration with GLG, an insight network that provides access to expert perspective. (For last year's IT Spending Pulse, please refer to this link .) The survey was conducted during Q1 of 2024 and captures insights from 330 IT buyers at the director and senior director level or higher. The respondents span industry verticals, with 66% coming from North America and 34% from Europe. (See the sidebar on separate Asia-Pacific data.) The IT Spending Pulse focuses on large (greater than $1 billion in revenue) and midsize companies, with approximately 60% of respondents leading IT spending at large enterprises and 40% holding roles at midsize companies.

First-Year Findings from APAC

Of the 150 IT buyers surveyed, 84 were from Australia and New Zealand, 55 from Singapore, and 11 from Hong Kong. Of these companies, 76 are large (>$1 billion in revenue) and 74 are midsize. Respondents were at the director and senior director level and above and worked in industrial goods, tech, banking, health care, and retail. We did not combine all APAC findings with North America and Europe in the main report because we did not have 2023 data for comparison.

IT buyers in APAC project a 6%-7% average increase in IT spending for 2024 (compared with 3.3% in North America and Europe), with a focus on driving digital transformation. Almost half (46%) plan to increase their GenAI budgets over the next three years. Companies are prioritizing growth and cost control equally, with 44% of buyers listing each as a top-three priority. Similar to North America and Europe, companies in APAC are investing in transformative technologies such as AI, security, cloud, and analytics, while mitigating their spending in other areas.

While companies in APAC are prioritizing strategic advantage initiatives above risk management, both stand out as key focus areas. Transforming data into business insights through big data analytics is listed as the top priority by 60% of IT buyers. Additionally, 52% identified digital customer experience––along with leveraging EPP/EDR (endpoint protection platform and endpoint detection and response) solutions for cybersecurity––as top priorities to drive revenue growth.

It is also clear that APAC companies see the value of GenAI, with 25% qualifying as high maturity (compared with 13% and 11% in North America and Europe, respectively), and only 16% with little to no adoption (compared with 18% and 23% in North America and Europe, respectively). Although companies are struggling to find enough skilled talent to implement GenAI, those who are implementing GenAI project an ROI seven-times greater than companies with little to no implementation.

Budgets Expand but Spending Overall Remains Uneven

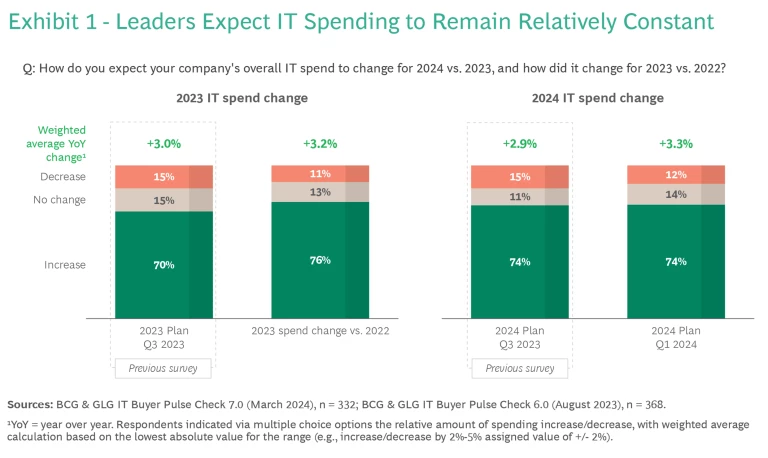

Respondents give equal importance to cost control and enabling growth, with 54% indicating each is a top-three priority—a slight tilt toward growth since Q3 2023. Growth increased in importance by 5% while cost as a priority decreased 2%. Reflecting that dual focus, IT budgets are increasing at a modest but consistent rate. In 2023 they grew 3.2% compared with 2022. Going into 2024, budget growth has nudged up 3.3%. (See Exhibit 1).

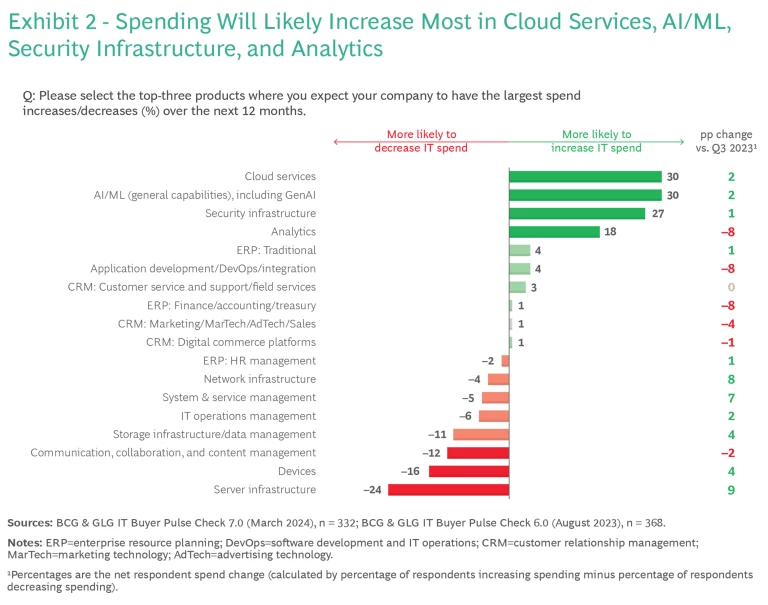

Besides cost control and enabling growth, top of mind issues for leaders include security (61% rated it a top-three priority) and driving digital transformation (60% rated it a top-three priority). And it’s clear that they plan to focus spending on growth priorities considered high-impact and high-necessity, which include AI/ML (30% net spend increase as shown in Exhibit 2), security infrastructure (27%), cloud services (30%), and analytics (18%).

Interestingly, while spending on analytics, app development, and enterprise resource planning for finance is still positive, their rates of growth declined sharply from Q3 2023—potentially due to the increased focus on cloud and infrastructure. Meanwhile, respondents expect the largest net spend decreases to occur in server infrastructure (24%) and devices (16%).

Besides cost control and enabling growth, top of mind issues for leaders include security and driving digital transformation.

In our experience, however, these expected decreases in infrastructure should be taken with a grain of salt. Leaders often aspire to cut budgets in infrastructure, but ultimately companies are forced to increase their investment in these critical operations. Moreover, the deceleration of spending since Q3 2023 might indicate that some products have reached their spending floors, with little or no more room to cut.

GenAI Skirts the Vendor Consolidation Trend

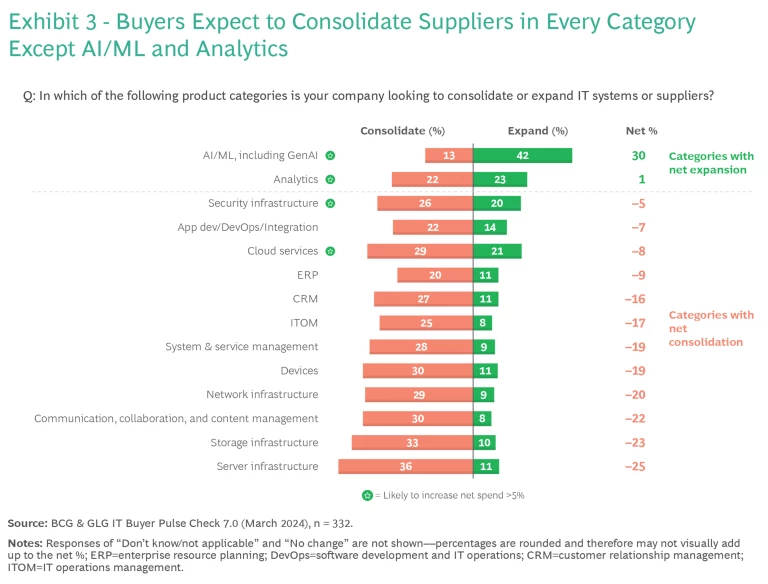

As part of their efforts to control costs, leaders plan to consolidate vendors across virtually all products, especially those associated with infrastructure. Among respondents, 33% expected to consolidate storage infrastructure, while 36% say the same for server infrastructure. Even security infrastructure—a top-three product priority—is expected to undergo consolidation by 26% of respondents.

Vendors should take special note that IT leaders expect to consolidate cloud services and security infrastructure vendors while increasing their spending by more than 5% in these areas. If this plays out as predicted and fewer vendors end up sharing a bigger pie, vendors should look to leverage this trend and consolidate customer spend.

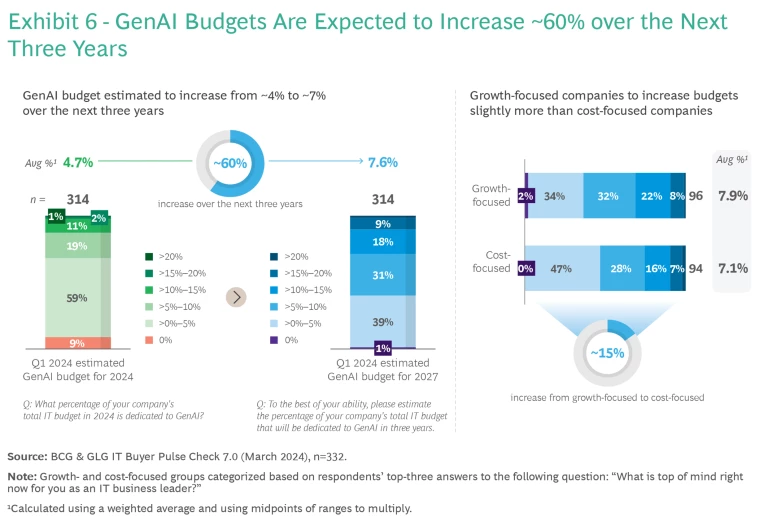

The clear outlier in this consolidation trend is AI/ML. About 42% of respondents plan to expand vendors, while just 13% expect to consolidate, as companies explore the many GenAI products coming to market. (See Exhibit 3.) At the same time, spending on GenAI is increasing. GenAI accounts for ~4.7% of a company's IT budget on average in 2024, and over the next three years companies expect spending to grow 60% to account for ~7.6% of IT budgets on average.

Companies need to engage with a variety of GenAI providers and test different products to find the tools that work for them.

Given how new GenAI technology is, how quickly it is evolving, and the money companies are pouring into the technology, it makes sense that many leaders are expanding their roster of vendors. Companies need to engage with a variety of providers and test different products to find the tools that work for them. Moreover, because the technology is relatively new, there are no network effects yet. This, in turn, is putting pressure on GenAI providers to differentiate themselves to keep customers.

GenAI Maturity by Industry and Geography

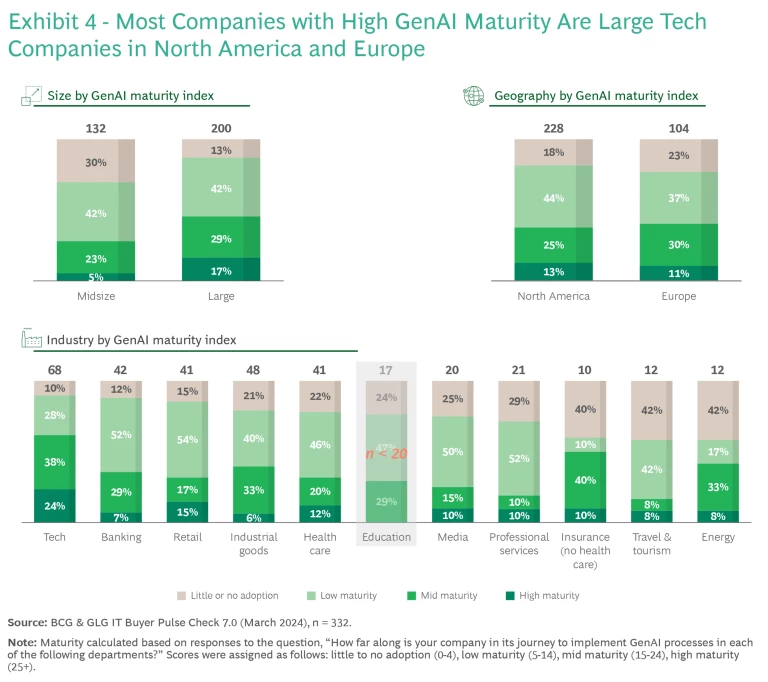

Given the growing importance of GenAI, we created a GenAI maturity index to understand where companies currently land in their development. Based on the level of implementation across ten business functions, we grouped companies into four categories: little to no adoption, low maturity, mid maturity, and high maturity. We found that interest in GenAI is definitely increasing. Only about 20% of companies have little or no GenAI adoption, down from about 24% in Q3 2023. Although the percentage of companies with high maturity adoption has stayed constant (~12%), the percentage of mid maturity companies jumped from ~18% to ~27%.

When we sliced this data by industry, we found that tech companies lead the way with 62% qualifying as mid or high maturity. That makes sense since many of these companies are developing GenAI products they hope to sell to other industries. Banking, retail , industrial goods and health care all followed tech, with between 32% and 39% falling into the mid or high maturity categories. (See Exhibit 4). Among the laggards are the energy, travel and tourism, and insurance industries, all with at least 40% adopting little or no GenAI.

When looking at adoption by company size, large companies are significantly more likely to be mature, with 46% having mid or high maturity and only 13% in the no-adoption category. Midsize companies are much less mature, with more than 70% reporting low or no GenAI adoption.

While industry and size matters for GenAI adoption, geography doesn’t seem to factor in as much. Adoption in North America and Europe is largely similar, with about 40% of companies qualifying as mid or high maturity. In Asia, the results were slightly stronger, with 45% reporting mid or high maturity. Also, in Asia just 16% reported little to no GenAI adoption, while in North America and Europe the numbers were 18% and 23%, respectively––despite recent European regulations around GenAI.

Great Expectations

Delving deeper into our GenAI results, we found that companies with higher maturity perceive greater value in GenAI tools and are more likely to expect future benefits. While that’s not too surprising––after all, companies wouldn’t invest in areas where they don’t foresee a return—learning what goals GenAI adopters have set for themselves is still instructive for companies considering GenAI investments.

Companies with higher maturity perceive greater value in GenAI tools and are more likely to expect future benefits.

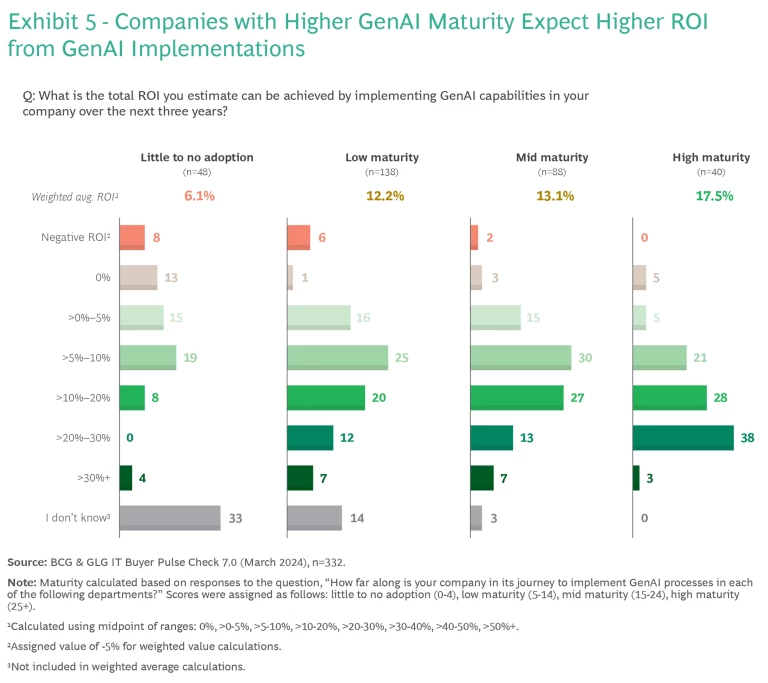

Two important metrics became clear in our examination of the data. First, companies with high GenAI maturity estimate ROI three-times higher over the next three years, compared with companies with little to no GenAI adoption (18% versus 6% ROI). Second, 38% of high maturity companies expect ROI of 20%-30%, and just 3% expect more than that. By comparison, only about a third as many low and mid maturity companies expect 20%-30% returns, yet twice as many expect more than 30% returns. (See Exhibit 5.)

A further clue that GenAI investments are paying off is the willingness of companies to spend beyond their allotted budgets. In 2023, companies expected to dedicate ~4% of their IT budgets to GenAI but wound up spending ~4.5%. Average GenAI budgets for 2024 will be higher still, at 4.7% of IT budgets, and they are predicted to grow ~60% over the next three years to 7.6% by 2027. (See Exhibit 6.) Growth-focused companies say they will increase their GenAI budgets 15% more than cost-focused companies (7.9% versus 7.1% of overall IT budgets).

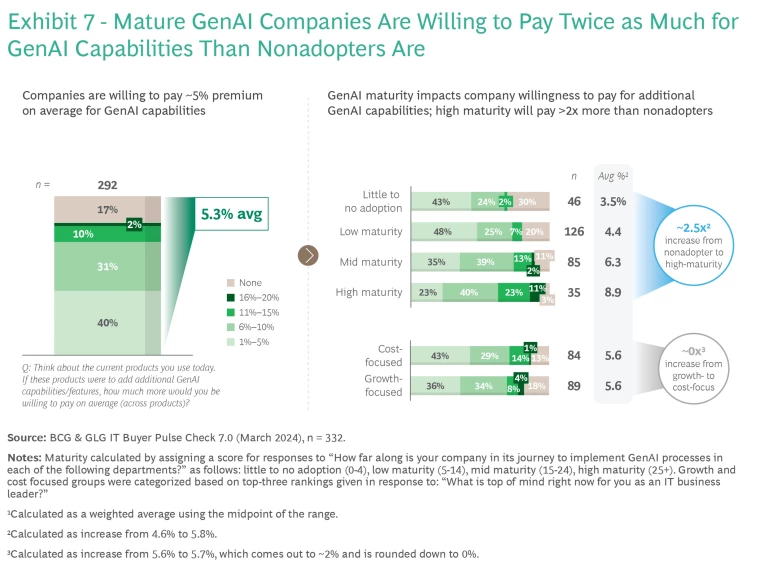

One reason high maturity companies might be going over budget—and another sign of their faith in the technology—is their willingness to pay more for additional GenAI capabilities on current software products (see Exhibit 7). Those companies are prepared to shell out ~9% more, on average, which is significantly higher than what the average company is willing to pay (~5% more).

Barriers to IT Investment and Implementation

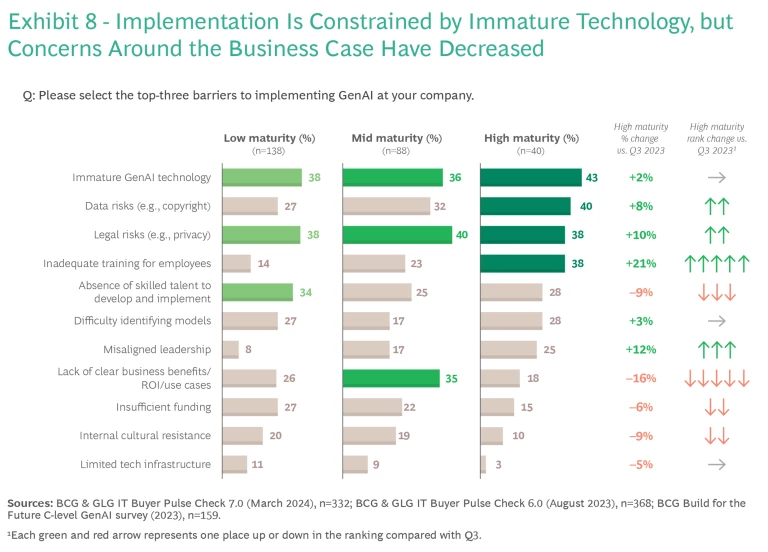

So what does the future hold for GenAI adoption? Where are the friction points that could inhibit speedy implementation? To answer these questions we asked leaders about the barriers they perceive to investment and implementation. The leading challenge is the immaturity of GenAI technology, which was cited as a barrier by 43% of high maturity, 36% of mid maturity, 38% of low maturity, and 50% of companies with little or no maturity. Furthermore, about 30% of this last group have no plans to implement GenAI technology over the next three years. Vendors can help to lower this barrier by providing case studies of GenAI products that have saved costs or generated revenue.

High maturity companies perceive fewer business risks as use cases and ROI become more clear—another indication GenAI investments are yielding concrete results.

Among high maturity companies, other areas causing implementation challenges include data risks, legal risks, and inadequate training, which have increased 8%, 10% and 21%, respectively, since the Q3 2023 survey. Interestingly, high maturity companies perceive fewer business risks (down 16%) as use cases and ROI become more clear—another indication GenAI investments are yielding concrete results, giving companies confidence to move forward. At the same time, respondents cited “misaligned leaders” as a growing problem—perhaps because of functional interdependences and the difficulty scaling up GenAI use cases. (See Exhibit 8.)

Planning Future Budgets

Despite the justifiable excitement around GenAI, IT leaders need a clear strategy to win support from CIOs. Hype doesn’t sell in today’s tough budgetary environment.

CIOs, for their part, need a systematic approach, whether the request from IT is for greater investment in GenAI, the cloud, security, or some other priority. When fielding various asks, therefore, CIOs should take the following steps:

- Plan for the appropriate level of resourcing to ensure there’s a fair shot at success.

- Ask for a clear business case and how leaders plan to measure outcomes.

- Ensure vendor support; it is fair to ask for a level of commitment commensurate with the company’s spending with each vendor.

The emergence of GenAI has forced the hand of many companies. Not investing and simply controlling costs is not an option given the technology’s rapid development and widespread adoption. Successful companies will be those that can manage a difficult balancing act: allocating IT budgets to keep pace with GenAI without cutting budgets too drastically for more mundane but vital day-to-day operations.