It’s increasingly difficult for companies to attain the highest level of maturity in data, analytics, and AI—in part because generative AI has so rapidly changed the landscape. Among the companies in our 2024 Data and AI Capability Maturity Assessment (DAICAMA) survey, 95% are attempting to use AI to drive new business value. But the proportion of companies qualifying as the most mature declined from 13% in our 2021 survey to 8% today. As data and AI capabilities become more sophisticated and harder for companies to develop, it becomes more and more difficult to join or remain in the most elite group.

Leading companies are wasting no time leveraging their edge and pulling away from their peers. They are using their capabilities to better ideate, prioritize, and ensure adoption of more differentiating and transformational uses of data and AI. As a result, they have four times more use cases scaled and adopted across their business than laggards in data and AI, and for each use case they implement, the average financial impact is five times greater.

These are some of the key insights from the fourth DAICAMA survey conducted since 2015. Almost 1,200 companies worldwide participated, representing nine major industry clusters. As in the past, we asked respondents to rate their company’s current level of maturity and describe their ambition for the next three years. (See “Our Methodology.”)

Methodology

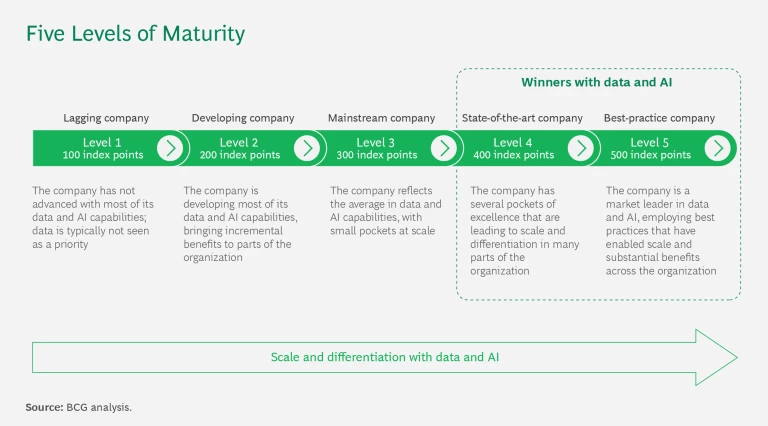

For each competency, companies could choose one of the following scores: 100 points (laggard), 200 points (developing), 300 points (mainstream), 400 points (state of the art), or 500 points (best practice). We aggregated these scores to derive average maturity scores by company, sector, region, and globally. For each competency, we also asked companies to set a maturity target for three years from now. (See the first exhibit, below.)

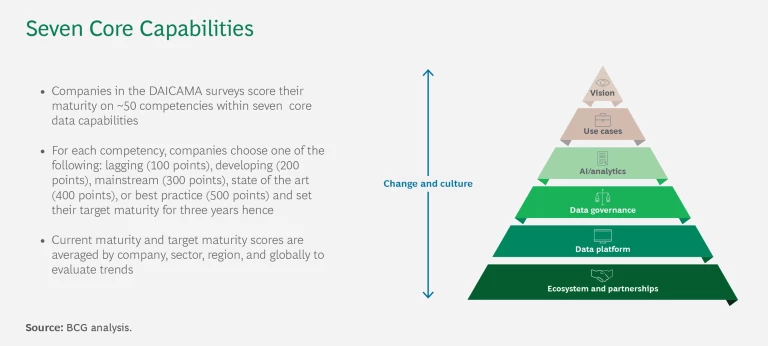

As shown in the second exhibit, below, we conceive of the seven core capabilities as a pyramid surmounted by a company’s vision for data and AI. Each of the remaining six capabilities is informed by those above it, with “change and culture” cutting across all seven to ensure organizational alignment every step of the way, from use cases to ecosystems and partnerships.

We regularly update our model and set the bar higher for each maturity level on the basis of new technologies, new management practices, and the rate of their adoption by organizations. As a result, a company that merely maintains its capabilities from one survey to the next will score lower, perhaps even dropping a full maturity level for capabilities that evolved very rapidly. Survey results undergo quality controls by a network of experts in data and AI to ensure reliability.

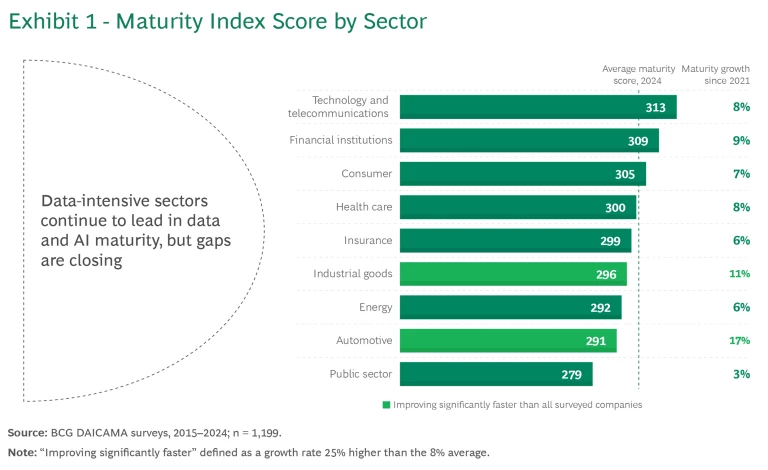

Maturity Gaps Are Generally Closing

While the traditional data-rich sectors—technology, financial institutions, and consumer (including retail, consumer packaged goods, and travel and tourism)—maintained their top positions in this year’s survey, all sectors improved their maturity, with some making significant strides. (See Exhibit 1.) The automotive sector, for example, was once on the lowest rung on the data maturity ladder but is now advancing at twice the rate of other industries. This makes sense. Automotive companies are using the vast amounts of data produced by electric and other sophisticated modern vehicles to transform the driving experience (autonomous driving being one example) and optimize the vehicle life cycle (such as through improved design and predictive maintenance). Health care also has good representation in the top tier, as managing patient and other data becomes increasingly critical.

Meanwhile, the public sector registers the slowest growth and remains the least mature sector, despite some countries making heavy investments. Most public-sector organizations have not faced much pressure to adopt new digital applications. We expect that will change over time in response to the public’s rising expectations, but the sector may struggle to attract the talent needed to accelerate its path forward after so many years of lagging behind.

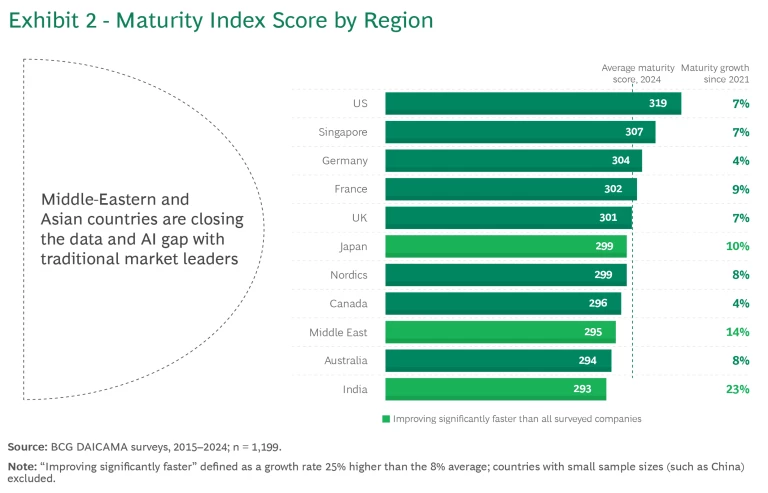

In terms of geography, the US is the top performer—as it was in all previous surveys—with a 7% increase in the average maturity score of companies surveyed since 2021. (See Exhibit 2.) Singapore passed Germany to grab the number-two spot, while Indian companies surged 23%, almost knocking Australia out of the top ten.

India traditionally lagged in data and digital prior to the pandemic, but government and private-sector investments, combined with the growth in mobile adoption, have paved the way for breakthrough improvements. For example, the Unified Payments Interface, which facilitates instant mobile payments across the country, is the second largest digital payment system in the world after China’s. Meanwhile, for the first time in the DAICAMA survey’s ten years, the Middle East broke into the top-ten most mature regions. That is likely owing to the billions invested in AI, resulting in cutting-edge advances such as the United Arab Emirates’ Falcon 2 open-source large language model.

While these maturity rankings by sector and geography have not changed much since the 2021 survey, an important takeaway is that the maturity gaps are closing. That’s good news, although it also means that competition for scarce data and AI talent is likely to become intense.

Tech + Us: Harness the power of technology and AI

Setting Realistic Ambitions Is Critical

Of the 95% of companies in our survey that are attempting to use AI to drive new business value, half aim to reach scale within the next three years, thus transforming the business and realizing substantial benefits. But if past survey results are any indication, most of these companies will be disappointed. Over the last ten years, the growth in maturity of data and AI capabilities has averaged 8% every three years (with the exception of the three years from 2018 to 2021, when online activity driven by the pandemic spurred 15% growth). That means it’s taken the average company ten years to move up one maturity level—for example, from developing its capabilities (leading to incremental benefits in parts of the organization) to becoming what we consider to be a mainstream company in data and AI (with scaled benefits in small pockets of the organization).

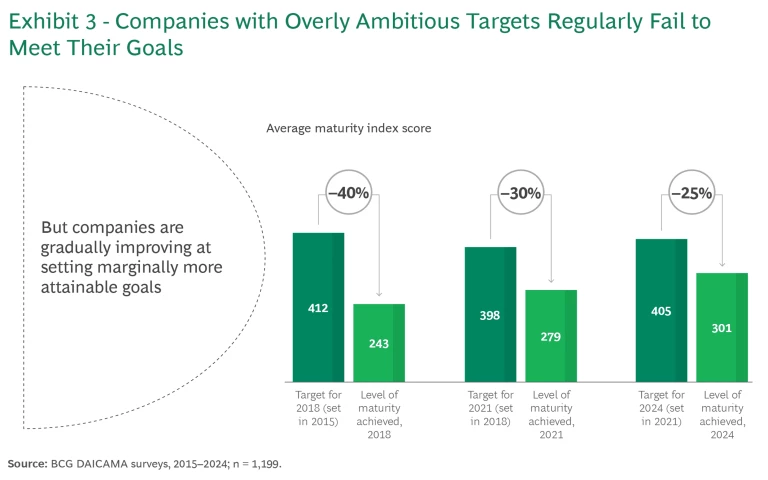

This slow pace of growth has surprised many executives. Indeed, according to our survey results, companies consistently fail to achieve the data and AI maturity ambitions they set for themselves over a three-year period. As a result, executives can get frustrated and lose enthusiasm for the transformation. It’s therefore critical to set ambitions appropriately, and we do see some signs that this is starting to occur. Over the course of our four surveys, executives have gradually been recalibrating their ambitions to achieve more modest gains in maturity. (See Exhibit 3.) In our latest survey, companies set their ambitions well below the assessment’s state-of-the-art threshold, which they typically targeted in past surveys.

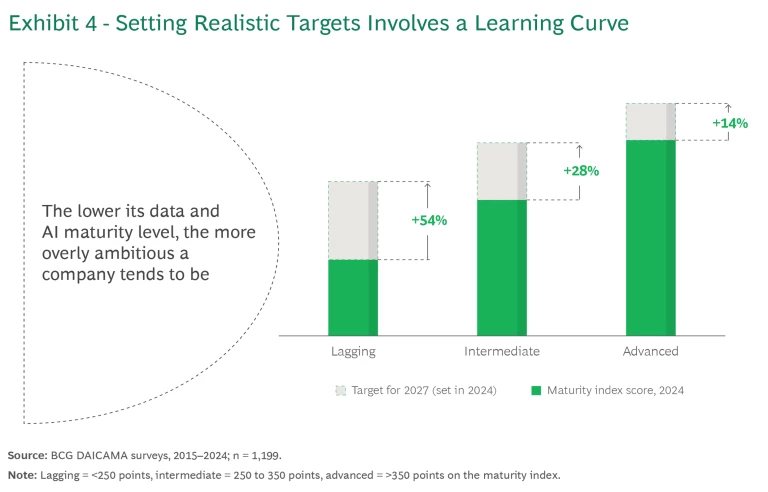

It appears that as companies put more effort into building data and AI capabilities, they develop a better understanding of the challenges involved and set more realistic targets as a result. One sign of this acquired wisdom is that the most mature companies aim to achieve maturity growth rates just slightly above the global average. In contrast, the least mature companies with the least experience in building those capabilities regularly aim for extremely rapid maturity growth. (See Exhibit 4.)

Of course, it’s not impossible for companies with low levels of maturity to achieve such aggressive ambitions. With data and AI becoming more generalized, and with more mature services and products available, companies may now be able to move faster than companies that started earlier. Still, they should take care not to set ambitions that will frustrate the organization. If a company promises its employees that data and AI will make their lives easier and those promises aren’t realized, they are likely to lose confidence in the entire data transformation journey.

Improving Maturity Across All Seven Capabilities

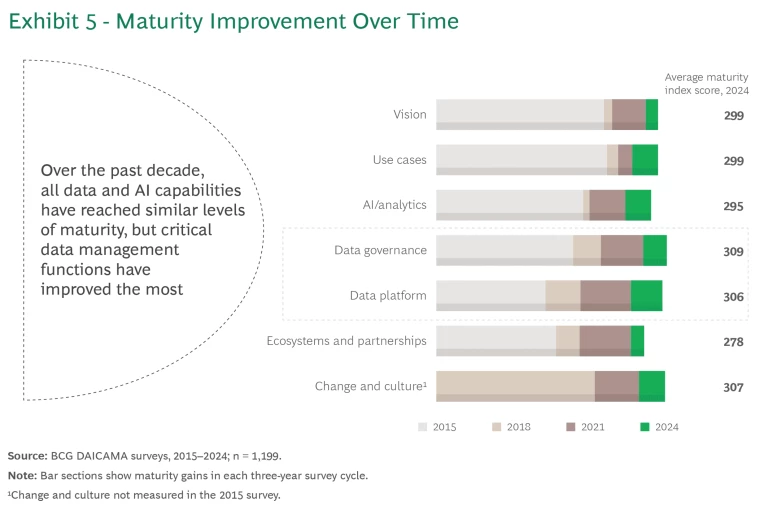

Another sign of the wisdom companies have acquired is that they are now focusing on improving all of the assessment’s data and AI capabilities. (See Exhibit 5.) Over the past decade, companies have come to recognize the interdependence of these capabilities in unlocking the full value of data. They have realized that they can only be as strong as their weakest link and have worked to bring all seven capabilities to equivalent levels of maturity.

In the early years (2015–2018), companies invested heavily in data platforms (often relying on external IT vendors) and in data governance to comply with emerging regulations. This allowed them to start scaling solutions and generating measurable value. Once they brought these “basic” capabilities up to reasonable levels of maturity, companies turned their attention to use cases (executive support, talent management, and AI algorithm performance, for example). Now the maturity of these capabilities has equaled or even surpassed other dimensions. In 2015, the difference in maturity scores between leading and lagging capabilities was more than 50 points (equivalent to half a step-change in maturity), but now all seven capabilities are at similar levels of maturity.

Five Areas Where Leaders Outperform the Most

Since our last survey, the proportion of highly mature companies has dropped to just 8%. In some respects, that is not altogether surprising. To reflect the evolution of the market, we recalibrate maturity levels for each survey. As a result, a company could more easily reach the highest level of maturity three years ago.

This smaller elite group is scaling many more use cases than companies lagging in data and AI maturity, and the financial impact is significantly greater. The top players lead across all seven capabilities—and the 50 competencies that they comprise—by a considerable degree and are accelerating away from the others. Of those 50 competencies, there are five in which leaders are outperforming by especially large margins. (Bear in mind, however, that while the difference between leaders and others is most pronounced in these five areas, companies looking to catch up should not view these as a shortcut; rather, improvement in all 50 competencies is necessary in order to achieve the highest levels of data and AI maturity.)

Since our last survey, the proportion of highly mature companies has dropped to just 8%.

Encourage ideation and prioritization. Top companies empower business leaders to innovate and encourage them to embrace the art of possible. Instead of investing in many small, incremental data and AI use cases, they focus on transforming large parts of the value chain to differentiate themselves from competitors. Activities include regularly running structured sessions that bring together multiple disciplines, tapping into market trends to ideate potential innovations, defining a process to prioritize initiatives, and aligning the full organization on these priorities.

Attract and retain top AI talent. Leading companies make investments to secure top-tier AI talent in all roles. Their data scientists and AI/machine learning engineers are well rounded, with expertise in cutting-edge AI methodologies and software development, as well as strong business acumen.

Establish business-driven data governance. While most companies orient their data governance organization to comply with regulations, top players go beyond that in order to respond to specific business needs. Often using a federated model, they make the various parts of the business accountable for their respective data domains and enable them to proactively address data issues.

Create data ecosystems. By establishing data partnerships and alliances, the most mature companies create new business models that are difficult to replicate or displace. They look for ways to combine their data in secure and compliant ways within and across industries to generate new value pools. For example, a leading manufacturer in the airline sector pulls in data from numerous other actors in the industry, creating a vast ecosystem that provides airlines with insights into ways to improve reliability and safety and decrease operating costs. As a result, an airline can improve predictive maintenance by tapping into a manufacturer’s data on all planes delivered industrywide, rather than just examining data from its own fleet.

Foster a data-driven culture. Leading companies define the behaviors necessary to foster a data-driven culture. They establish structures, processes, and policies that encourage the adoption of those behaviors across the organization—and they monitor results. For example, by leveraging behavioral science, some companies create a systematic set of “nudges” to elicit the right behavior.

Looking Ahead

Companies’ maturity targets for 2027 are more realistic than in the past but still ambitious. Indeed, despite historical evidence that it takes ten years on average to climb a full maturity level, the average company is aiming to improve almost that much in the next three years. Many will be disappointed. We expect that their priorities to 2027 will remain in the areas of data governance and platforms—two key enablers for ensuring that data is meeting business needs. Companies will also work urgently to improve their AI and analytics capability, which is currently one of the weakest but is crucial to future competitiveness given the rapidly developing fields of AI and generative AI.

Despite historical evidence that it takes ten years on average to climb a full maturity level, the average company is aiming to improve almost that much in the next three years.

Also worth noting is that several sectors are making big bets to disrupt. Half the technology and telecommunications companies, financial institutions, and consumer companies in our survey are aiming for state-of-the-art maturity. Given their current leadership positions and experience, they are well aware that innovation will be necessary—so initiatives in the next three years could be exciting to watch. Another sector to keep an eye on is energy, which has set the overly ambitious goal of climbing from laggard to leader—but surprises are always possible. Meanwhile, the public sector will continue to lag, even as countries in the Middle East, as well as Japan and Australia, aspire to state-of-the-art capabilities by 2027.

For all of these companies, our advice is to begin by assessing their current level of maturity, then calibrate (or recalibrate) ambitions to achieve some realistic business outcomes. Finally, anchor those ambitions by identifying a prioritized set of high-impact use cases and developing the specific capabilities necessary to achieve them. Shaping a unified, integrated approach with data and AI that avoids silos is critical to accelerating the path to value.