Over the past two decades, video games have exploded, both onscreen and in the market, growing from a niche pastime to a $220 billion industry. Until recently, the drivers were both potent and reliable. Content proliferation drew in audiences of all ages and backgrounds. The rise of mobile devices made gaming more accessible. Hardware innovation cycles—accelerated by the console wars—created a rising tide that lifted all boats. Even as many industries struggled with the shocks from the pandemic, gaming saw major increases in engagement and users.

But as industry executives know too well, the tide turned. Rising interest rates, players heading back to the office and classroom, high-profile games that became higher-profile misses—the environment changed, and so did the results. Project delays, mass layoffs, and even studio closures have become the norm. The question that everyone in the industry wants answered is, How do we regain the momentum?

It will take new approaches.

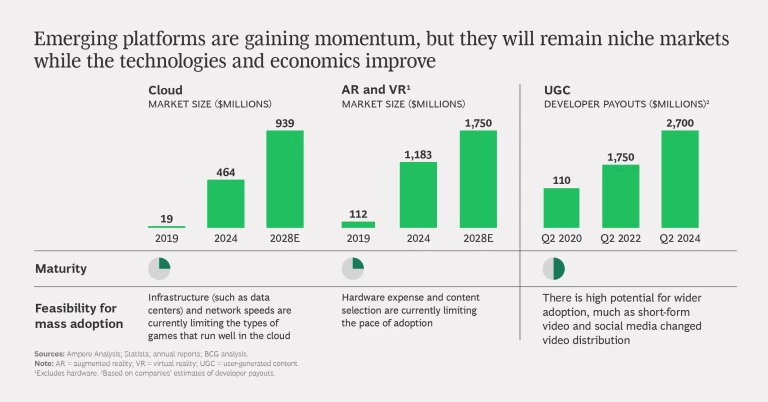

Key platforms—consoles, handhelds, and mobile devices—have reached high levels of penetration, with little room for growth in developed economies. While cloud-based gaming and augmented reality (AR) and virtual reality (VR) are new engines of growth, they’re not in overdrive yet—and won’t propel the market anytime soon. And then there is the cost. With AAA game development now a $100 million endeavor, and often much more, publishers are placing fewer, heftier bets. And they’ve lost some big ones.

If history is a guide, the future of gaming lies in an innovative breakthrough that we’ve yet to imagine. But in the near term, industry players can sustain growth by embracing new monetization strategies and by expanding in markets—and among demographics—they haven’t fully tapped. While returning to prepandemic growth rates is unlikely in the short haul, fundamentals remain strong. People spend more time immersed in games than in any other entertainment medium, and playing games can be a lifelong activity. Publishers and developers who seize new opportunities and adopt new models will find that even amid change, they can move forward.

Game Budgets Are Outpacing Game Revenues

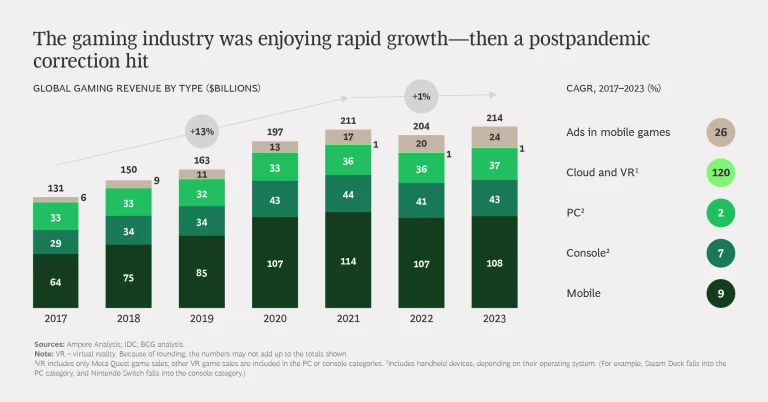

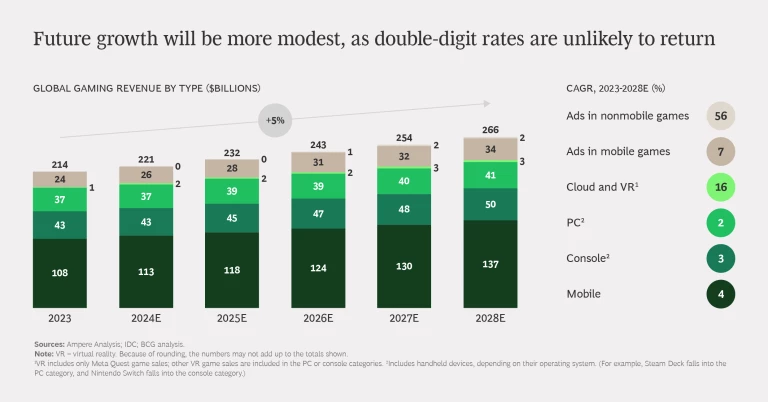

Double-digit growth was long a defining trait of the gaming industry. In the five-year period through 2021, revenues increased from $131 billion to $211 billion—a compound annual growth rate (CAGR) of 13%. But from 2021 through 2023, the CAGR dropped to 1%. And single-digit growth is going to stick around: we estimate that industry revenues will reach $221 billion in 2024 and then grow to $266 billion by 2028, a CAGR of 5%.

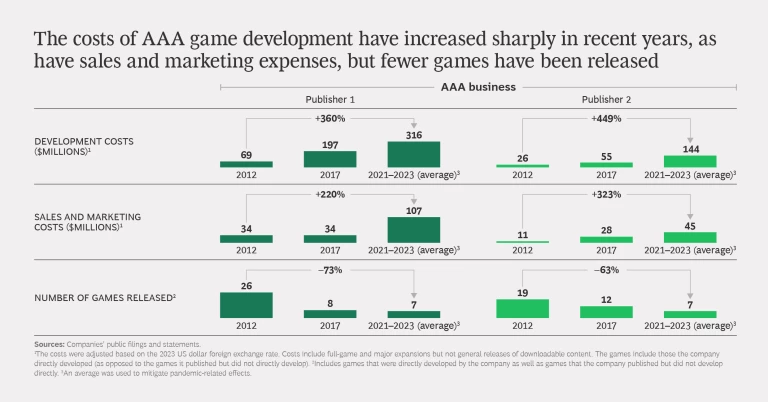

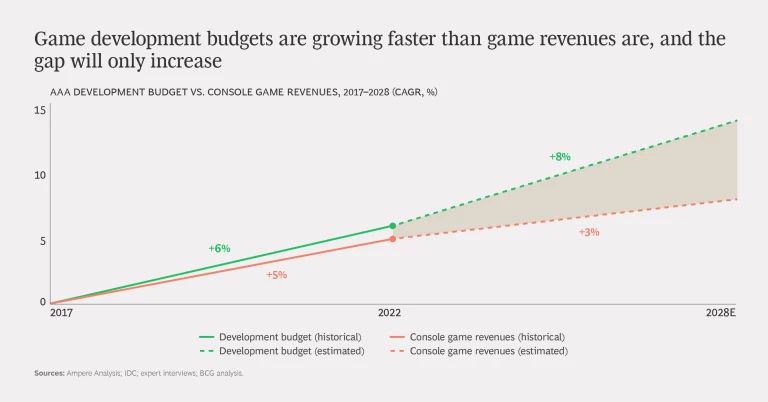

Slowing revenue growth is a worry, but even more so because of what is growing robustly: game development budgets. Costs aren’t just rising; they are now outpacing revenues. From 2017 through 2022, budgets rose at a 6% CAGR for the PC and console AAA market. From 2022 through 2028, they are expected to rise at an 8% CAGR, and nearly all publishers we spoke with expect budgets to rise for the foreseeable future.

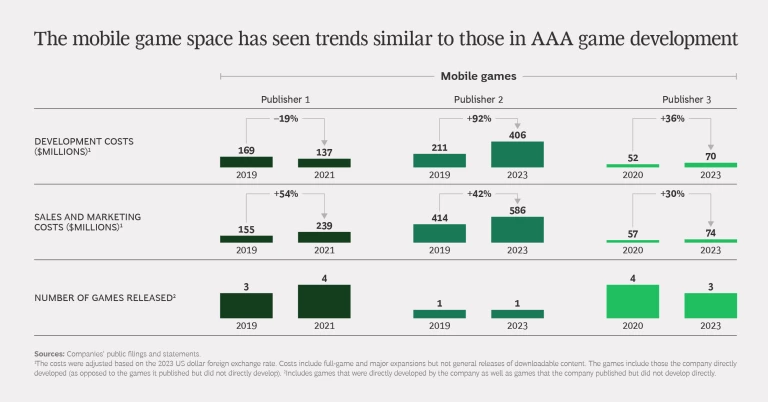

Mounting costs are an equal opportunity challenge. While this trend has gotten the most attention in the AAA console space (a $300-million-plus Spider-Man 2 budget will do that), the mobile space has also seen sharp increases. A key driver: burgeoning user-acquisition costs due to intense competition and the reduced ability to target campaigns effectively and measure their performance—a consequence of Apple’s implementation of privacy measures that limit access to the identifier for advertisers (IDFA), requiring users to explicitly opt-in to sharing their data.

Not surprisingly, development pipelines are constricting. There are only so many ways to slice a pie.

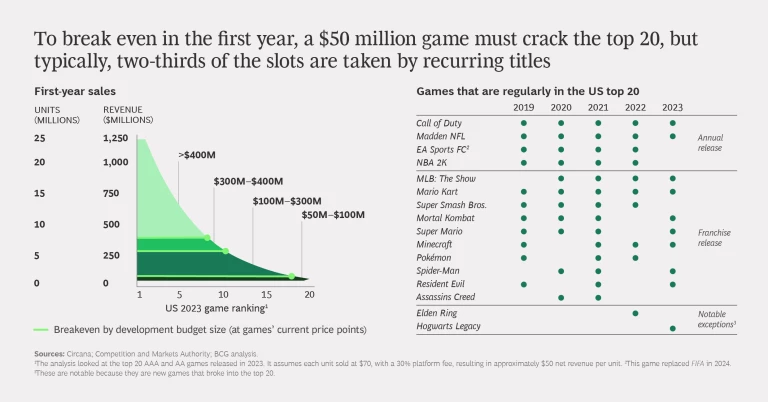

The takeaway is sobering. As budgets and breakeven thresholds rise, publishers have more riding on each game. But with fewer games in development, they have less opportunity to rebound from failure. And some haven’t. Losses from underperforming games have led to layoffs and closures. According to PC Gamer, more than 30,000 people—roughly 10% of the gaming industry’s workforce—have lost their jobs since 2022.

One reason budgets are growing is the move toward live service games, where publishers provide a steady stream of new content to extend the life of a game to several years or, in some cases, decades. A successful live service game can bring outsized rewards, and wanting to be the next Fortnite, publishers are prioritizing them. But launching a new offering is a heavy lift. Live service games require longer development times than more traditional titles do, as well as big investments in data centers, matchmaking infrastructure, community engagement, and personnel for operations and support.

Emerging trends—such as cloud-based gaming, as well as AR and VR gaming—are growing. So, too, are platforms fueled by user-generated content (UGC). But none are on a trajectory to rival the more established gaming platforms (PC, console, and mobile) in the near or even medium term. Gaming AR and VR software, for example, is expected to grow from a market of about $1.2 billion in 2024 to a market of $1.75 billion in 2028. Compare that with the mobile gaming market of 2028, which has an estimated value of $137 billion.

The current landscape reveals an industry where growth is slowing yet is more essential than ever. Costs outpacing revenue is an unsustainable dynamic. So where will growth come from?

Subscribe to receive the latest insights on Technology, Media, and Telecommunications.

Demographics, Monetization Models, and Wildcards

Gaming’s biggest advantage is its broad and lasting appeal. It’s an activity for all ages to enjoy through all their ages. In the near term, we see excitement over flagship titles (such as Grand Theft Auto VI) and hardware (led by Nintendo’s Switch 2) expected in 2025.

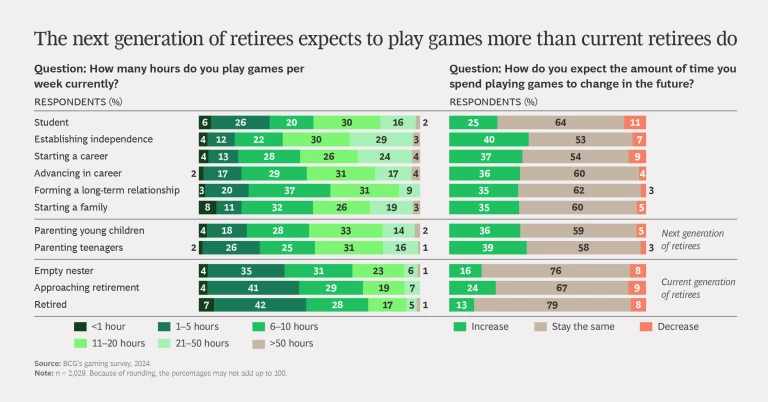

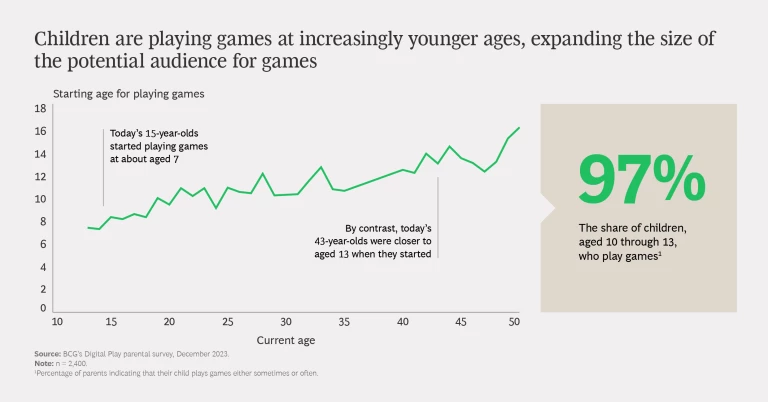

Looking further ahead, our research—which included interviews with industry executives and experts, as well as BCG’s 2024 gaming survey—points to several key drivers. One is demographic-driven growth: a pair of groups, with seemingly little in common, are central to sparking a new wave of player expansion. The next generation of retirees—who were kids and teens when the first wave of home video consoles emerged—expect to play more than do current retirees who didn’t grow up playing games. At the other end of the spectrum, children are gaming at an increasingly younger age. Today’s 15-year-olds started, on average, at aged 7. Thirty years ago, the starting age was closer to 13. These dynamics are giving rise to a structural increase in the total gamer population and multigenerational appeal of gaming IP—evidenced by the success of the Super Mario Bros. movie and parents and kids playing Minecraft together.

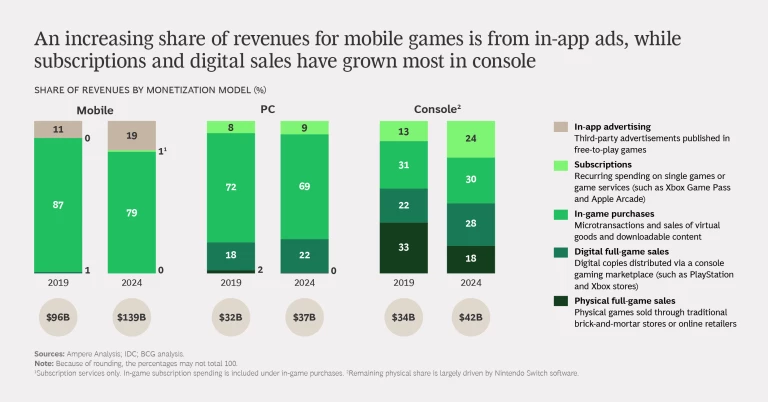

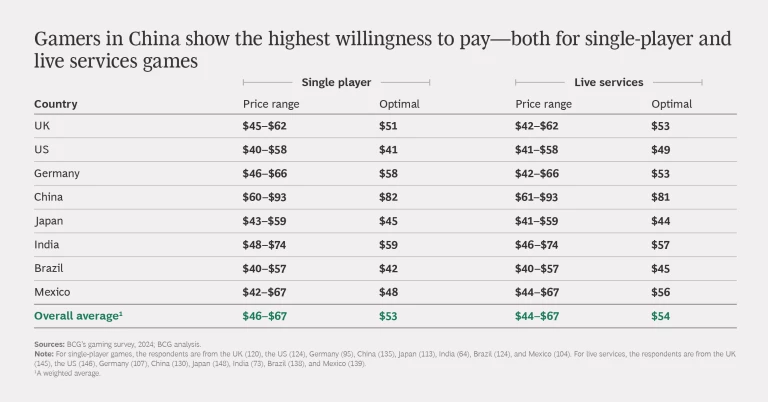

We also see potential in novel approaches to monetization. This could take the form of offering smaller games at a standard price point (say, $70 for an AAA title in the US) and making additional downloadable content available for superfans. Or it could be found in optimizing global pricing and promotional strategy. Our survey found, for instance, that gamers in China show the highest willingness to pay: on average, players will consider spending up to $82 on an AAA single-player game. Yet popular AAA titles in China, such as Black Myth: Wukong, typically sell for just $37 to $45.

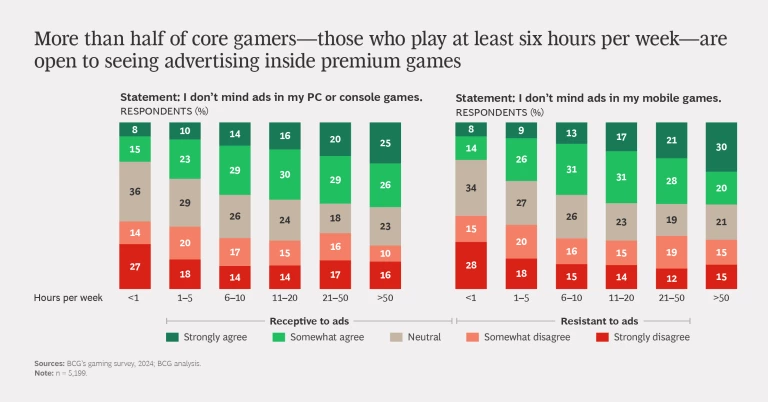

Then there is advertising. Already a $25 billion market in mobile games, advertising is poised to grow in PC and console games as developers experiment more with new monetization models and as the technology infrastructure for programmatic ad placement matures. Our survey finding that only 30% of core gamers (those playing six or more hours a week) oppose advertising supports this expectation. We anticipate ad revenue can bring PC and console games a combined $2 billion to $3 billion in incremental growth by 2028—and more growth down the line.

Some wildcards are also in the mix—factors that may or may not drive growth.

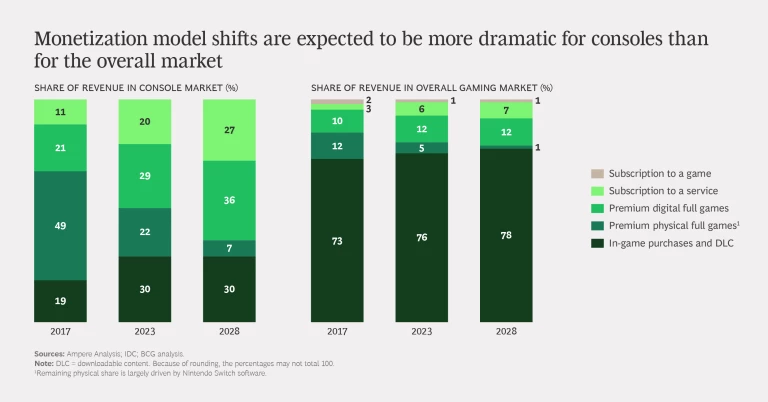

The subscription model—most visible in services such as Xbox Game Pass and PlayStation Plus—has clearly struck a chord with consumers . It now accounts for 25% of console game and services revenues. (The mechanism for paying developers can vary. For example, it may be a fixed upfront fee for putting the game on the service or a revenue share based on the proportion of active subscribers playing the game. The jury’s out on what works best.) The model isn’t perfect: game developers have criticized it for not generating enough revenue to cover the large—and getting larger—development costs of most games. But the subscription trend may usher in a new era of device-agnostic cloud-based gaming. Such a platform could bring in more players and power the next wave of innovation. Or it could crash under the weight of poor unit economics. Time will tell.

Another potential driver of growth is

generative AI

. By accelerating or even automating tasks, such as creating concept art or localizing texts, GenAI can bring new efficiencies to game development. The industry is just starting to experiment with, and leverage, the technology. And at present, GenAI’s output quality is much lower than that of most mobile games (let alone AAA console titles). Yet there’s a long history of successful games that were big on ideas and low on graphical fidelity. By producing content quickly, GenAI lowers the threshold for game development and opens the field—and opportunities for disruption—to more creators.

Navigating the New Gaming Landscape

To capitalize on the new trends and drivers—and keep the growth coming—we recommend developers consider the following steps:

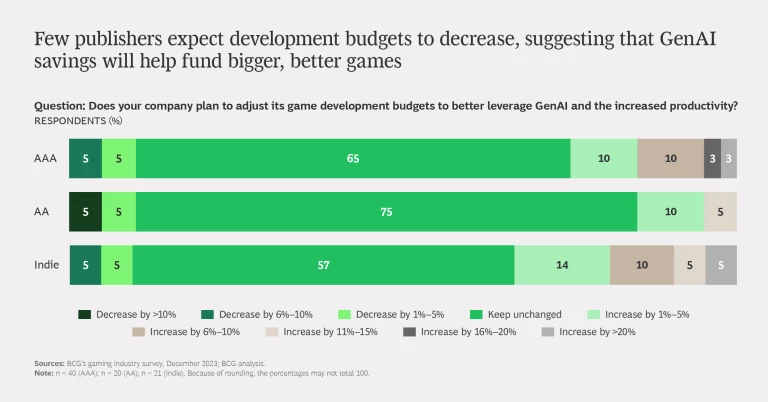

- Embrace AI and automation for efficiency. Along with accelerating the creation of game assets, including level designs and character dialogue, GenAI can automate many of the repetitive tasks involved in game development, such as playtesting, quality assurance, and localization. So far, indie publishers have been more active than AAA giants in running GenAI pilots . But GenAI’s benefits are available for all. Interestingly, in interviews and surveys, many publishers told us that they don’t expect to leverage GenAI efficiencies to lower the cost curve but to raise the revenue curve. The plan: to steer the savings into more immersive, more differentiating games.

- Develop a subscription strategy. The beauty of subscription models is their emphasis on recurring revenue. Games as a service—whether for a single game or a portfolio of titles—can provide steady income beyond initial sales. The models will continue to evolve, and savvy publishers and developers will adopt sophisticated strategies, much like creators and distributors in the streaming video and audio businesses. For example, to avoid cannibalizing traditional game sales, companies may want to consider more advanced windowing, as well as differentiated packaging, for games distributed via subscription.

- Take a nuanced approach to price increases. Revenue growth through price increases can be tricky, controversial, and inevitable: a hit with accountants and a miss with players. A multipronged strategy offers a better approach. The idea is not to raise a price in one fell swoop but in layers: offer premium versions that target different player spending levels, as well as more in-game add-ons (such as battle passes and skins) and microtransactions (implemented in a transparent and trust-building way).

- Explore advertising. Our survey findings on ad perception support making ads a larger portion of the revenue mix, with developers introducing ad-supported models in traditionally ad-free game environments. Implementing video ads that reward players for watching—giving them in-game items—is one example of this approach.

- Go direct to consumer. We expect more developers to seek ways to reduce their platform fees, which typically amount to 30% of a game’s selling price. Emerging laws and regulations, such as the European Union’s Digital Markets Act, may provide support for direct-to-consumer distribution and payment methods. Indeed, many mobile game developers have already launched digital storefronts outside the major ecosystems—a trend that is likely to expand. It’s an evolving area that’s worth watching.

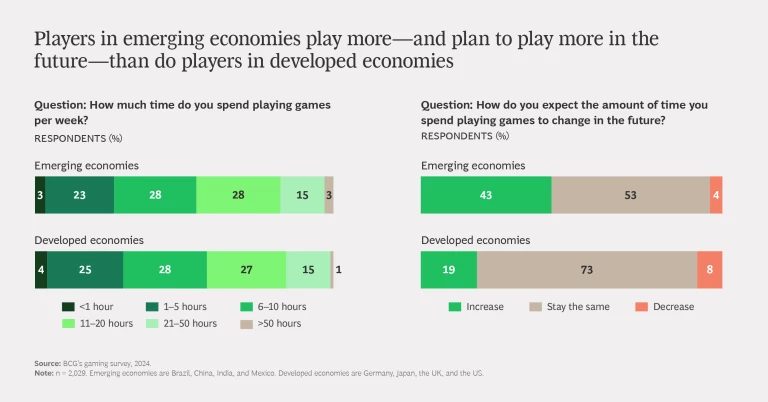

- Monetize emerging markets. Players in emerging economies play more than gamers in developed economies—and we expect the gap to widen. Our survey found that 43% of gamers in emerging economies planned to increase their playing time in the future, compared with 19% of gamers in developed economies. To better monetize large but emerging economies, such as China and Latin America, publishers need to expand monetization strategies (consider ad-based gaming, for example), align pricing with willingness to pay, and partner with alternative payment providers.

- Support cross-platform play. The move to device-agnostic gaming—which Microsoft’s strategy shift from hardware to content may accelerate—will make cross-platform play more accessible. Spending $10 a month to play against a friend can be an easier call than spending $300 for a compatible console. Some of the most popular titles—Fortnite, Minecraft, and Call of Duty: Warzone—have all implemented cross-play successfully, which helped to them to attract hundreds of millions of players.

- Catch the nostalgia bug. Gaming spans generations, and increasingly, players are looking to capture a bit of their past. Developers can find new hits—and growth—in reintroducing beloved franchises. But innovation trumps cash grab. Cut-and-pasted remasters won’t fly anymore. Instead, consider how advanced technology (say, a new graphics engine) or features that didn’t exist back in the day (such as an online multiplayer capability) can reinvigorate a classic.

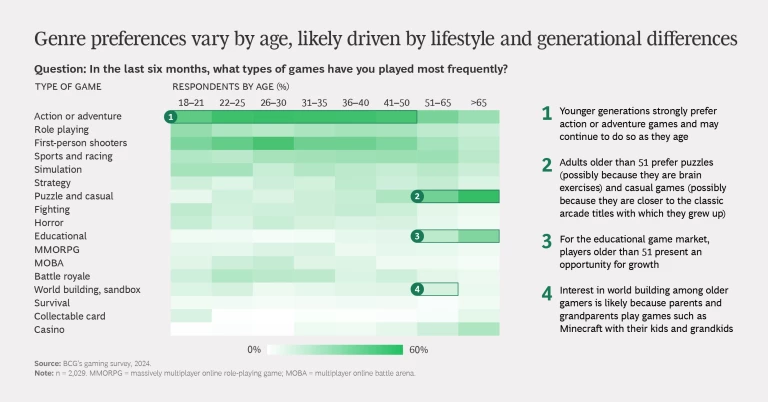

- Focus on untapped demographics. Older adults and young children are two promising segments for growth, even—indeed, especially—in markets such as the US, where platform penetration rates are very high. Keep in mind, too, that these generations often play together. So, while publishers can find value by appealing to specific demographics (say by stressing puzzles and casual games for older players and games that blend entertainment and social aspects for children), they can also spark growth by focusing on the intersection points. We see, for example, that world-building, sandbox games—such as Minecraft and Roblox—bring together generations. One strategy, then, may be to consider how games can evolve to encourage and support these connections.

The game industry is on a new playing ground—and the rules have changed. Double-digit growth is no longer a given, and bigger bets are bringing bigger risks. But opportunities for growth haven’t disappeared—they’ve just changed, too. Game companies that think creatively, and act quickly, will find that success is a quest they can complete.

The authors wish to thank Henry Anderson, Niels Danielsen, Christian Kluge, Luis Alonso Lazo de la Vega, Yixue Li, Arthur Libanio, and Dana Reik for their contributions to this article.