There was a time when a loyalty program that issued points or cash back was all a company had to offer to acquire and retain faithful customers. Today, people expect more.

According to BCG’s second annual global survey of loyalty program trends, offering solely tangible rewards no longer creates stickiness or loyalty to the extent it did in the past. In exchange for their continued patronage, people want programs to deliver a differentiated experience beyond monetary value, with personalized benefits, free content, and relevant partnerships. The expectation is stronger with younger consumers, who are increasingly willing to switch brands and loyalty programs compared to older generations.

Our findings reveal that the US is becoming saturated with loyalty programs. As a result, competition between programs is intensifying. Companies are differentiating themselves by offering more individualized benefits—often powered by advanced technologies and AI. Outside the US and in some industries, loyalty programs are still emerging or uncommon. That white space is likely to lead to more programs and competition that spurs innovation.

Companies that want to improve their loyalty programs’ performance must understand how program trends affect the regions and industries in which they compete. They must have the right value proposition and tactics to earn and maintain customer loyalty.

Participation Grows as Loyalty and Engagement Ebb

To understand loyalty and subscription program trends, we surveyed more than 10,000 people in nine countries representing three major regions: North America, Europe, and Asia-Pacific. Respondents were representative of the age groups, gender, ethnicity, and income levels of each country’s population. We questioned people about their loyalty program memberships and preferences, motivations to join and stay, and feelings about the benefits they get or would like to receive.

Our findings confirm that loyalty programs are evolving. They also show how entrenched some trends have become since 2022, when we conducted our inaugural loyalty program survey.

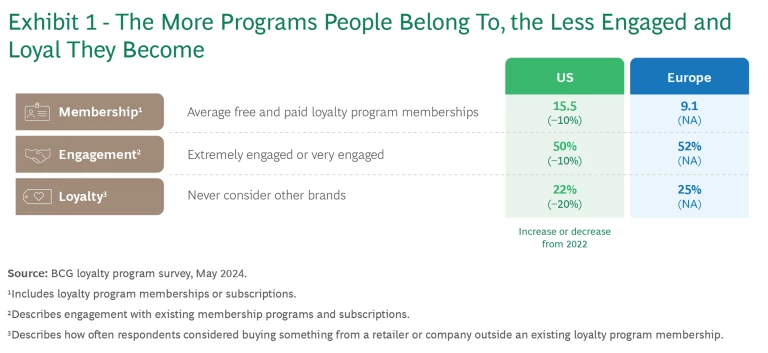

People are joining more programs but are less loyal and engaged overall. In the past two years, the number of programs the average US consumer belongs to increased by approximately 10%, to a total of more than 15. The average European belongs to nine. (See Exhibit 1.)

However, since 2022, as people join more programs, both loyalty—the degree to which a consumer would consider buying from an alternative brand—and engagement—the measure of how often people interact with a loyalty program—have declined. This drop-off implies that as people join more programs, competition for their time, energy, and attention increases.

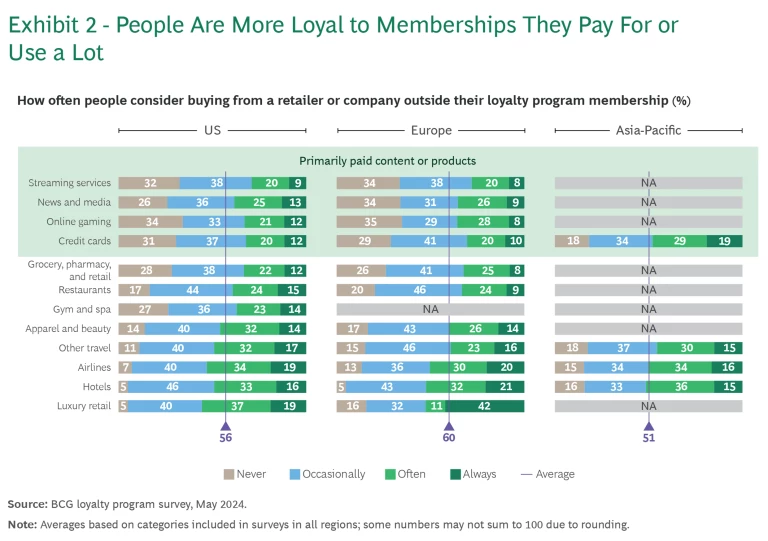

People are most loyal to paid memberships. Loyalty is strongest for paid memberships or programs. Streaming services, online gaming, credit cards, and news and media, which primarily offer paid content or products, have the highest loyalty overall. (See Exhibit 2.) Among non-paid memberships or programs, people are most loyal to grocery, pharmacy, and retail.

Hotel and airline travel loyalty programs, traditional strongholds, are no longer as effective as they once were. In fact, these businesses’ programs were among the least likely of any we studied to lead people to buy exclusively from one brand, a finding that is consistent with our 2022 study. Companies in these sectors may need to rethink the experiences they offer customers ; in particular, medium-frequency travelers whose spending is up for grabs.

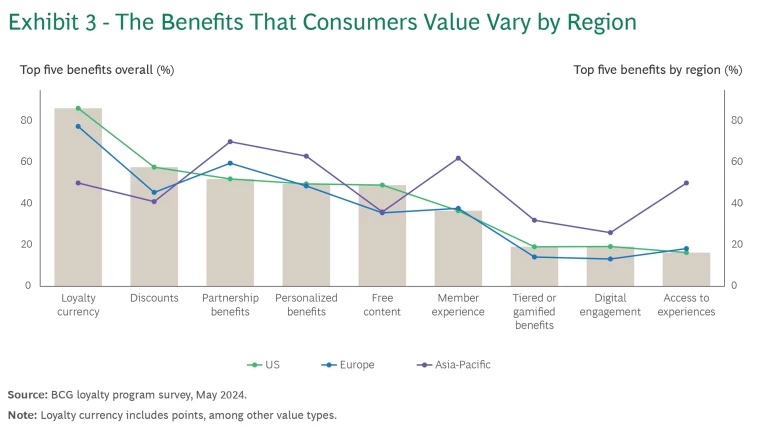

Consumers expect more. As competition has increased, people have become more aware of programs’ benefits and perks, and expectations are higher as a result. In addition to benefits with tangible value, people now want more personalized rewards, content, and exclusive experiences. (See Exhibit 3.) For example, a grocery store could send a member of its loyalty program recipes or cooking tips based on items included in their latest order. Or a restaurant chain could add games to its app to get loyalty program members to earn points and use it more often.

As competition has increased, people have become more aware of programs’ benefits and perks, and expectations are higher.

People are more loyal to programs if the company teams with partners that are a good fit with its brand or purpose, providing valuable, substantial benefits that deepen the user experience. For an airline loyalty program, that could mean partnering with a rideshare app or other travel brand to improve the end-to-end travel experience instead of teaming up with a retailer or other non-travel brand.

Switching has become more commonplace. Higher expectations for loyalty programs offerings have led to a greater willingness to switch or cancel programs. Consumers are 5% to 10% more inclined to consider switching to another loyalty program within the same industry or product category compared to two years ago. More than 35% of respondents told us they planned to cancel some of their memberships in the next year, including more than 50% of respondents ages 18 to 34.

A Mature US Market Is a Bellwether for Program Trends

Loyalty program developments are playing out differently around the world and in different industries and demographics.

Subscribe to our Marketing and Sales E-Alert.

United States. US consumers clearly like loyalty programs, but belonging to more of them is lessening engagement and loyalty. Engagement is down 10% among US consumers since our initial study in 2022. Loyalty dropped by twice as much—20% lower than two years ago. Engagement and loyalty decreased most in the core retail category of grocery, pharmacy, and retail; in restaurants; and key segments of the travel sector, such as hotels and airlines. Credit card and streaming media member programs experienced the lowest declines.

In the US, consumers are switching between loyalty programs in the same industry—from one retailer program to another, for example—more often than they did two years ago. Switching retail and travel loyalty programs is more common, and less common among media and credit card company programs.

US consumers are more focused on benefits with tangible value than people in Europe or Asia-Pacific. The vast majority (85%) rank points, cash back, and promotions among the top five loyalty program benefits, compared to 75% of Europeans and 55% of Asia-Pacific consumers. They are also interested in ancillary benefits like partnership benefits, personalized benefits, and free content, preferring different offerings depending on the brand or industry.

As the US loyalty program market becomes more fragmented and competitive, companies feel increasingly pressured to simplify. Those that deliver a direct, compelling offer can cut through the clutter of options and earn results. Similarly, teaming up with fewer, more relevant partners can drive engagement and loyalty. Increased competition poses a bigger question as well: whether a smaller number of top loyalty programs will emerge as category winners, with others becoming less relevant.

As the US loyalty program market becomes more competitive, companies that deliver a direct, compelling offer can cut through the clutter of options and earn results.

Europe. Fewer European industries have embraced loyalty programs compared to the US, where most sectors have offerings of some kind. As a result, European consumers have joined fewer programs. For industries where loyalty programs have existed longer, such as travel, grocery, and retail, European consumers are slightly more engaged and loyal than their US counterparts.

European consumers’ greater engagement with and loyalty to a smaller number of programs looks a lot like the behavior of US loyalty program members in 2022. This finding suggests that as European loyalty programs proliferate and mature and companies develop more sophisticated loyalty strategies, businesses may follow the US trend of more intense competition for consumer attention. It also suggests that European consumers may follow their US counterparts and become less engaged or loyal as they join more programs.

Consumers in Europe also put slightly less value on benefits with tangible value and loyalty currency than their US peers, although they still rank these benefits as their highest priority. And they are more motivated by partnership benefits than in US consumers and less interested in free content.

Asia-Pacific. The underlying goals of loyalty programs in the Asia-Pacific region mirror those of programs in the US and Europe, including encouraging top customers to spend more and collecting data for customer relationship management (CRM) purposes. However, because mobile payment networks are ubiquitous in the region, people interact with loyalty programs less than people in the US and Europe for the industries included in the survey. When they do, they say that it’s important to be able to easily exchange points and benefits with other payment platforms. The popularity of mobile payment platforms also means that Asia-Pacific companies have more difficulty using loyalty points and currencies to differentiate themselves from competitors.

Asia-Pacific consumers who belong to loyalty programs put less relative worth on tangible value and loyalty currency benefits than US consumers. They are more interested than their US and European counterparts in partnership benefits, personalized benefits, and unique, exclusive services. These preferences suggest that companies must offer much more creative rewards to win them over.

Disparities Between Industries, Age Groups, and Income Levels

The disparities between loyalty program maturity in various industries and between different age groups and income levels illustrate the complexities that companies must accommodate to craft successful strategies and become loyalty program leaders.

Industries face new challenges. The US travel industry, including hotels, airlines, and travel management services, has experienced the biggest growth in the average number of memberships per consumer, followed by credit card issuers.

Media and streaming companies’ membership programs typically have higher-than-average engagement and loyalty. In addition to paying for these types of programs, consumers use these services on a regular basis and receive updated content frequently, all of which drive engagement.

Travel programs’ customer loyalty metrics have improved since 2022 but remain low relative to other sectors, even though the programs’ impact on spending remains high. This finding suggests that travel companies need to innovate before members’ dissatisfaction compels them to take their business to a competitor.

Retail loyalty programs find themselves entering new competitive territory. Top performers such as CVS’s ExtraCare+, the pharmacy chain’s paid membership program, register stronger engagement, loyalty, and positive impact on spending compared to non-paid programs and some peers. But when ExtraCare+ members consider switching, the alternatives they opt for differ from those that members of CVS’s free membership program choose, suggesting that stronger benefits raise customer expectations. This makes it incumbent on companies to consistently innovate and improve what they offer in order to keep their membership programs successful.

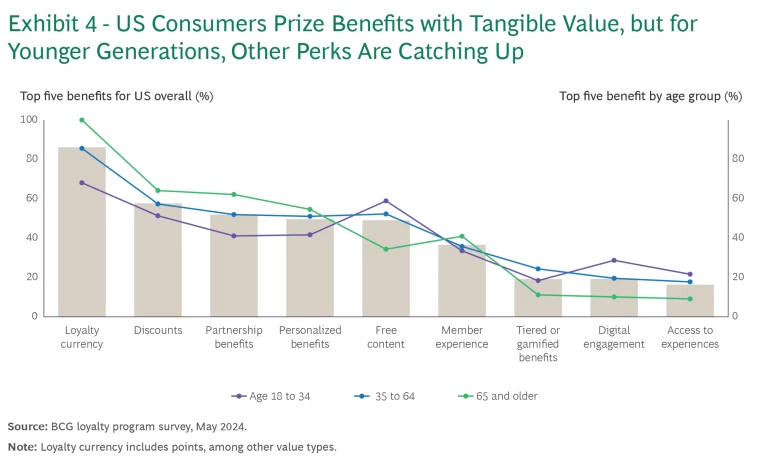

Age groups and income levels have different preferences. Everyone, regardless of age, wants rewards or benefits with tangible value—but to varying degrees. In the US, for example, consumers ages 18 to 34 are more drawn to free content and media, personalized benefits, and digital engagement through social and mobile channels. By contrast, those who are 35 and older are more interested in benefits that offer monetary benefits. (See Exhibit 4.)

People with high incomes, defined as households with income of more than $150,000, care more about programs that offer tangible value than people in lower income brackets. Depending on the industry, high earners can be 5% to 10% more engaged with their loyalty programs than people at lower income levels. People with lower incomes may be less engaged, but they are on average 5% more loyal to the programs they belong to.

Loyalty Program Leaders Innovate to Stay on Top

We found that loyalty program leaders successfully differentiate themselves by innovating in three key areas: customer activation, customer experience, and moving beyond tangible value. Businesses that do this gain consumers’ attention and improve engagement and loyalty.

Customer Activation. Companies with top loyalty programs build consistent touchpoints with their members. They find new ways to engage their loyalty communities and approach relationship development strategically, often turning customers into active brand advocates. Thrive Market, a US-based, members-only online market that specializes in healthy and sustainable products, provides recipes and tips based on what a customer has included in an order.

Companies with top loyalty programs find new ways to engage their loyalty communities, often turning customers into active brand advocates.

Customer Experience. Leaders offer more sophisticated personalization and gamification (where earning rewards is turned into a game), often powered by advanced analytics and GenAI. Innovative offerings improve engagement and loyalty but can also lead to long-term expectations for what a company can deliver.

Wendy’s, the US-based fast-food chain, launched an AI-based platform to generate customized offers to members of its loyalty program across North America. The platform collects data from its app, online ordering system, and customer database to build exclusive promotions tailored to individual customer preferences and uses gamification to drive engagement.

Moving Beyond Tangible Value to Offer Exclusivity. We found that companies must offer tangible value to be competitive, but leaders offer benefits that go beyond monetary rewards. Such benefits include better quality, value, and perks such as exclusive access to special events, experiences, and content. For example, members of Delta’s SkyMiles program get free Wi-Fi on most domestic flights and exclusive entertainment options through the Delta Sync content bundle. Amazon’s Prime program is a longtime example of ever-evolving offerings, including free shipping, special Whole Foods deals for members, and much more.

Many brands have restructured loyalty program tiers and points systems to hang onto their most valuable members. However, catering to top-tier members risks antagonizing other members if the value of their status or points drops.

Loyalty program leaders’ innovations win over new customers and satisfy existing members, setting them apart from laggards with less appealing value propositions. The gap between leaders and laggards in the same industry is largest in the grocery, retail, and pharmacy segments. Customer engagement for retail leaders is 4.3 times higher than it is for laggards in that category. That’s larger than the gap in between leaders and laggards for hotels (3.1 times), airlines (2.9 times), and media companies (1.5 to 2 times).

Where the difference in performance between leaders and laggards is small, it indicates opportunities for brands with more nascent products or services to learn from their category rivals and begin to close the gap. For industries where the gap is larger, top brands have an opportunity to continue innovating and delivering value to maintain and extend their lead.

Improving Your Loyalty Program

To attract and retain members with programs that also support their broader business goals, companies must offer rewards that meet customers’ specific needs. However, a loyalty program’s value proposition must also align with a company’s strategy, product offering, and core economics. Keep the following considerations in mind to build a loyalty program that successfully does both:

Know your member base. Evaluate existing loyalty customers and what they want from a program, the values they care about, and what influences them. For example, Gen Z is the most influenceable generation across age groups, as its members are the most open-minded about the brand they will ultimately buy when they begin their purchasing journey . Use customer data, including data from tracking current and past behaviors, and tailor benefits and offers accordingly.

Have true conviction about what matters to current and future customers. Structure a loyalty program so that it caters to members’ wants and needs but also reaches a target audience of potential customers and allows you to differentiate your offering. Keep in mind that customers of different ages and income levels may want and value different things.

Create a clear framework for your partnership aspirations. To expand and deepen interactions, pursue high-fit, strategic partnerships that resonate with how members engage with your brand.

Do more with less. Lean into ways to deliver high perceived value at a low cost, including offering exclusive access or experiences.

Build on best practices. Even hotels and airlines with successful loyalty programs can improve their performance to solidify their position as sector leaders and keep customers engaged enough not to look elsewhere. Online travel platforms are partnering with credit card issuers to offer special deals and offers to loyalty program members.

Follow the leaders. Laggards can learn from rival category leaders to close the gap before lack of engagement affects them financially. Leaders can invest in solidifying their positions to keep customers from looking elsewhere.

Loyalty programs have long helped companies differentiate themselves, win customers, and add value. But as programs proliferate and competition intensifies, what worked in the past might not work in the future. Loyalty leaders offer more customized, personalized benefits that go beyond points and cash rewards, and they team up with strategic partnerships that enhance a program’s value. Companies looking to catch up would be wise to do the same.