Where is the M&A market heading? For the first time, decision makers in corporations, private equity firms, and investment banks have access to a quantified and statistically reliable answer. The source is BCG’s M&A Sentiment Index . This newly launched index provides a monthly update on dealmakers' willingness to engage in mergers, acquisitions, and divestitures over roughly the next six months. Its interactive features allow dealmakers to view sentiment globally and across individual regions and sectors.

Dealmakers can use the index along with an understanding of the M&A market's current activity level, deal drivers, and trends. Together, these insights can help them make informed judgments about the market’s trajectory in the near to medium term.

Currently, our M&A Sentiment Index indicates a mixed outlook for dealmaking activity through the remainder of 2024. The current index value of 78 is below the ten-year average of 100, aligning it with moderate M&A activity globally and across many industries. However, the M&A market has gained some momentum, recovering significantly from a low point of 62 in November 2023. M&A sentiment is highest in Europe and in the energy, materials, and technology, media, and telecommunications sectors. However, some dealmakers, especially those in the Asia-Pacific region and the industrials sector, still seem reluctant to pursue transactions. (See “About the M&A Sentiment Index.”)

About the M&A Sentiment Index

To determine the value, we combine two factors:

- Fundamental Drivers. This factor captures sentiment derived from underlying drivers of M&A activity, such as business confidence, valuation levels, and interest rates. We identified more than 15 potential drivers of aggregate M&A activity by considering our empirical studies and conducting an extensive review of the academic literature, especially on the “M&A waves” theory.

- Executive and Investor Sentiment. This factor captures the actual sentiment expressed by decision makers. We employ state-of-the-art generative AI capabilities to extract executive and investor sentiment toward M&A from over 10,000 corporate communications, such as earnings call transcripts.

The expected stabilization in M&A activity indicated by the M&A Sentiment Index is relative to a moderately active market in the first half of 2024. It also aligns with the trends and underlying factors likely to drive dealmaking activity during the next 12 months.

M&A Activity Was Moderate in the First Half of 2024

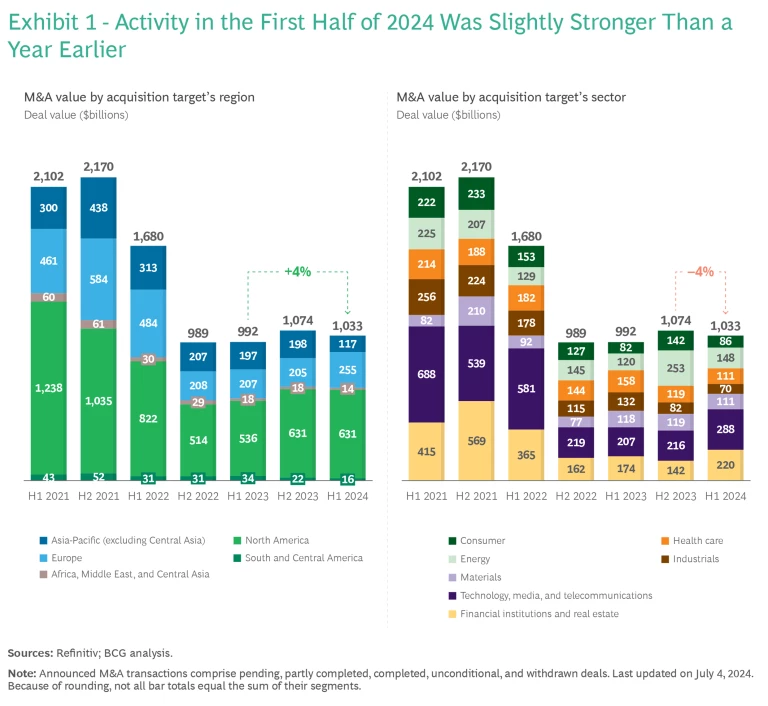

The M&A market has been active in 2024, but its rebound from last year’s trough has been slower than many observers anticipated. (See Exhibit 1.) Even as financial conditions have generally improved, dealmakers remain cautious amid economic uncertainty, concerns about inflation and monetary policy, and regulatory and geopolitical headwinds.

The global value of M&A activity in the first half of 2024 was $1.0 trillion. Although this figure is 4% higher than that of the same period last year, it is below the ten-year average of $1.5 trillion.

Regional differences during the first six months of the year were significant:

- Deals involving targets in the Americas had a total value of $647 billion, an increase of approximately 14% versus the first half of 2023. The vast majority (worth $631 billion) involved targets in North America, accounting for 61% of overall global M&A activity. US companies acquired most of these targets.

- The value of European M&A totaled $255 billion, a 23% increase compared with the first six months of last year. Deal value in the UK increased by 185%, resulting in the country’s highest share of European dealmaking since 2015. Deal value also increased strongly in Sweden (138%), Spain (19%), and the Czech Republic (196%). In France (–25%) and Germany (–32%), aggregate deal value was lower than last year.

- Deal value in Asia-Pacific declined by 40% to an 11-year low of $117 billion. The regional total was marked by declines in Japan (–67%), China (–36%), South Korea (–16%), and Australia (–39%). Brighter spots included India (55%), Singapore (41%), and Malaysia (266%).

Compared to the first half of last year, the telecommunication, media, and technology sector saw the strongest gains in aggregate deal value (39%), driven by technology M&A. Financial institutions and real estate (26%) and energy (23%) also experienced gains. Other sectors—notably industrials (–47%) and healthcare (–29%)—saw declines, reflecting a drop in the number of large deals in these sectors.

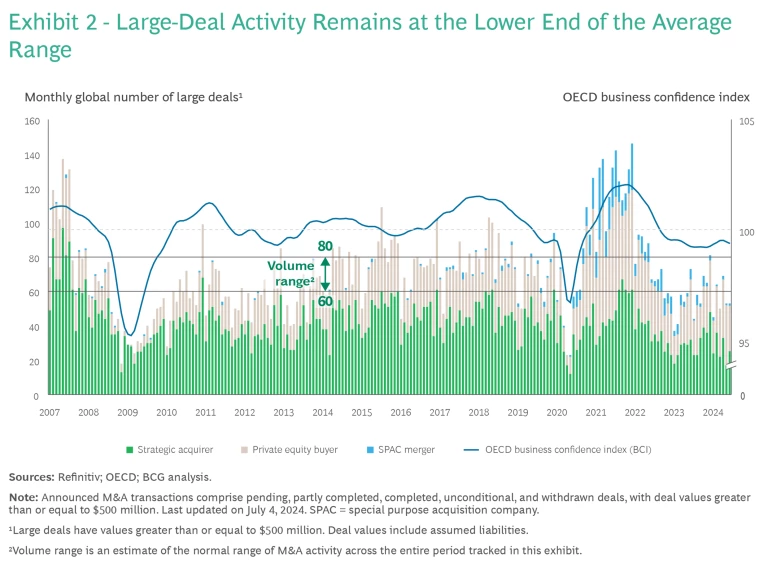

Ten megadeals (deals valued at more than $10 billion) were announced in the first quarter of 2024, compared with six during the same period last year. However, only four were announced in the second quarter—a significant slowdown compared with the average of nine per quarter over the past decade. More broadly, large deals (those valued at more than $500 million) remain on the lower end of the average range of roughly 60 to 80 globally per month, reflecting dealmakers’ cautious mindset even as business conditions improve. (See Exhibit 2.)

Year to date, the three largest announced deals were:

- Australian BHP Group’s bid for UK-based Anglo American, valued at $36.4 billion, which has since been withdrawn

- Capital One Financial Corporation’s merger with consumer lending services provider Discover Financial Services, valued at $35.3 billion

- Synopsys’s bid for simulation software publisher Ansys, valued at $32.5 billion

Private equity deal activity trended higher during the first six months of 2024, increasing in value by 9% versus the same period last year. Financial sponsors continue to feel pressure to invest their large amounts of dry powder. In contrast, early- and later-stage funding for startups is approximately 50% lower than in 2021, despite the strong enthusiasm for AI startups.

The Factors Promoting a Positive Outlook

Many of the trends outlined in BCG’s 2023 M&A Report continue to promote a positive outlook for deal activity. The ongoing push for digitization—now fueled by the latest developments in AI—remains a primary driver of deals. We expect acquisitions that focus on technological capabilities and solutions to motivate many transactions in the coming years. In addition, ESG, decarbonization, and the broader energy transition will lead companies to acquire capabilities, technologies, and other assets that advance their goals. At the same time, companies will pursue more transformational deals to future-proof their business models, strengthen their resilience, and address capital scarcity.

In light of this broad scope of motivations, M&A has become part of every CEO’s strategy toolkit. Most leaders recognize that inorganic-growth strategies are often the best way to achieve specific growth ambitions or transformation goals.

Although the motivations are clear, many tailwinds and headwinds influence the timing of M&A activity. Chief among them is the availability of capital. As mentioned earlier, private equity firms, along with many large corporations, still have abundant dry powder that spurs and funds their dealmaking ambitions. Other acquirers will rely on the proceeds from divestitures.

Even if they have ample capital, however, dealmakers must navigate a mixed macroeconomic environment and business outlook. For example, the European Central Bank has cut interest rates to support the economy, and the US Federal Reserve may follow suit later this year. Stable or declining interest rates provide a favorable environment for dealmaking, while economic downturns can be good times for deal hunting .

Another notable tailwind is the recovery of valuation levels in most sectors. For example, the current price-to-earnings ratio of the S&P Global 1200 is 23.5x, versus 15.5x in October 2022. This recovery has made it somewhat easier for buyers and sellers to agree on a purchase price. At the same time, volatility has decreased, providing a more stable backdrop for decision making. Even so, valuation gaps are still evident in many M&A negotiations, and some parties struggle to align their projections.

Inescapable headwinds that all dealmakers experience include ever-changing—and increasingly stringent—regulations and policies relating to national security, data protection, and ESG. Moreover, escalating geopolitical tensions among major economic powers must be considered in developing many deal theses. Of particular concern in 2024 are the implications of significant national elections that have already taken place, such as in India, the EU, France, and the UK, or will occur later in the year, such as in the US. The complexity of forecasting and evaluating these factors makes it harder for decision makers to formulate reliable predictions and plans.

To understand where the M&A market is heading, executives need more than a quarterly or semiannual snapshot of past deal activity. BCG’s M&A Sentiment Index fills this gap by providing monthly updates of dealmakers’ willingness to make the substantial investments required to buy and sell companies. BCG will refresh the index on the fourth Tuesday of each month, giving dealmakers crucial visibility into the M&A market’s near-term trajectory.