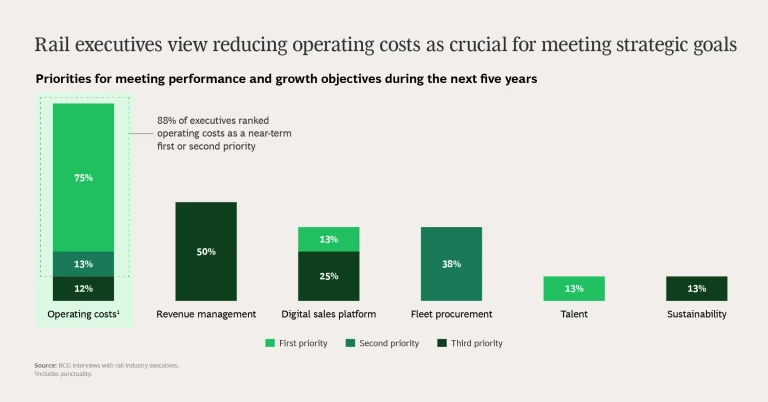

Excellence in cost management has vaulted to the top of the agenda in the rail industry. Rail companies must find ways to curb costs strategically. In recent interviews with BCG, most executives of passenger, freight, and infrastructure companies cited reducing operating costs as their top priority for achieving performance and growth objectives during the next five years.

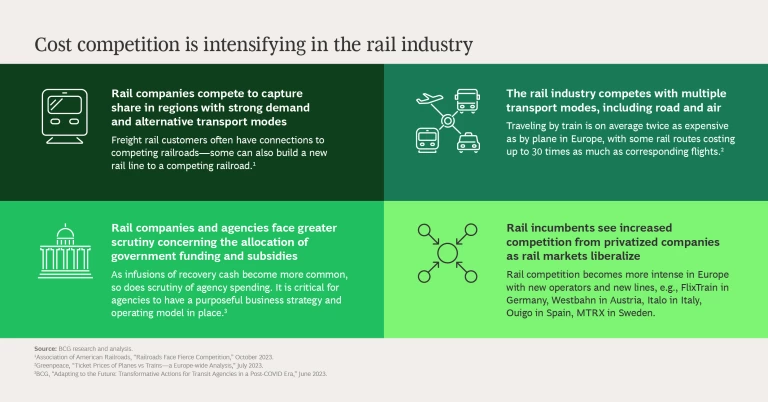

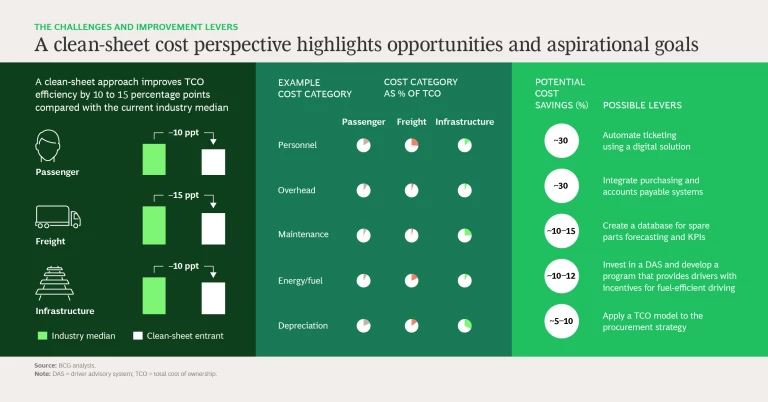

The prioritization reflects the intense cost competition in the rail industry. Rail companies must compete for market share and government subsidies not only with one another but with different transport modes. It also indicates that executives recognize the need for a more rigorous approach. Unlike companies in other industries, such as manufacturing, many rail players have not continuously managed costs strategically. Consequently, we find that introducing a systematic approach often yields substantial cost savings—in the range of 10% to 20%.

The slideshow provides insights into the value of cost excellence as well as the challenges and improvement levers, as revealed by a recent BCG study.

Understanding the Value

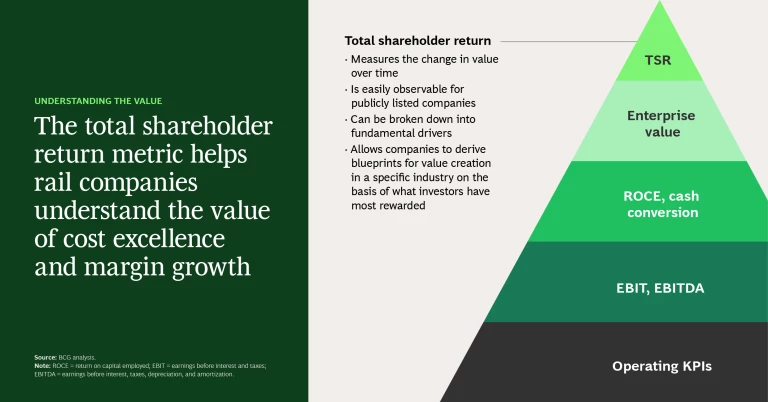

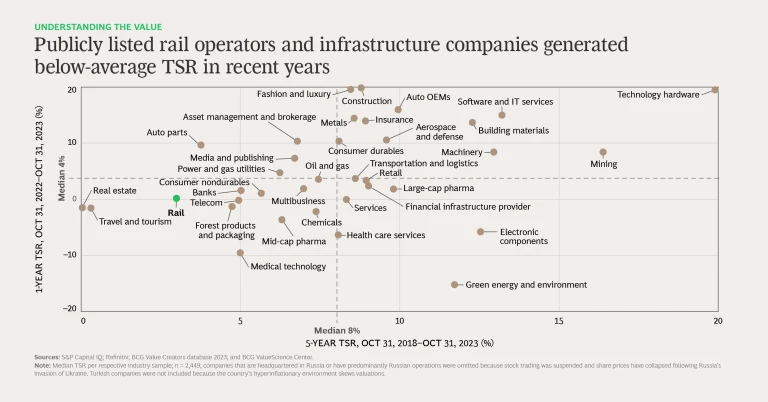

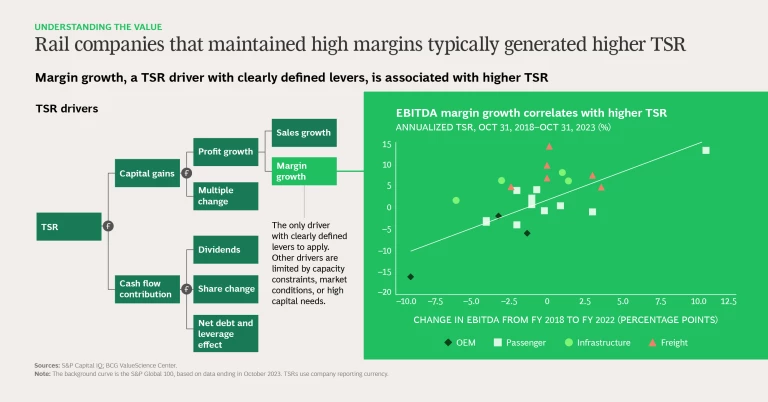

The metric total shareholder return (TSR), used by firms in many industries, could help rail companies understand the value of shrinking costs and boosting margins. TSR is an indicator of a company’s performance from an investor's perspective, gauging the effectiveness of its strategy and operations in creating value for shareholders.

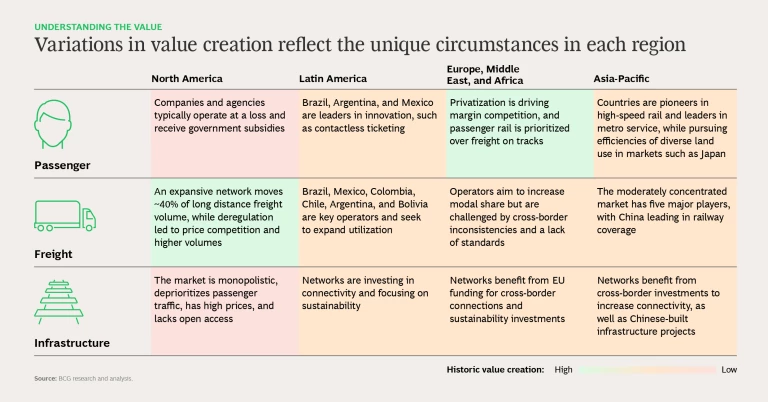

Over the past five years, the rail industry achieved a median annual TSR of 3%, compared with a median of 8% across all industries. But rail companies that successfully managed margins typically generated a higher TSR.

The Challenges and Improvement Levers

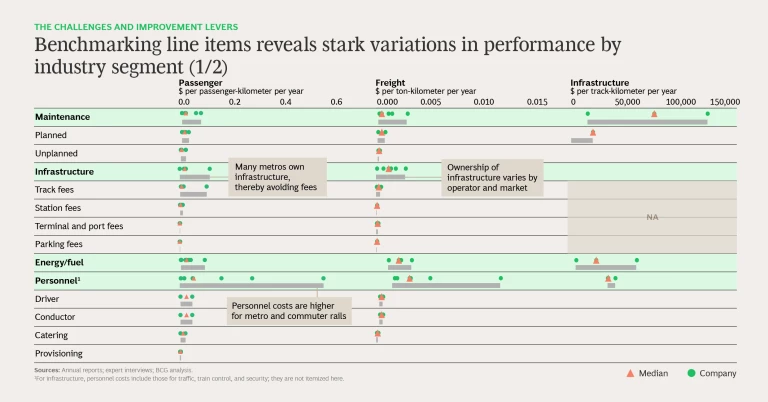

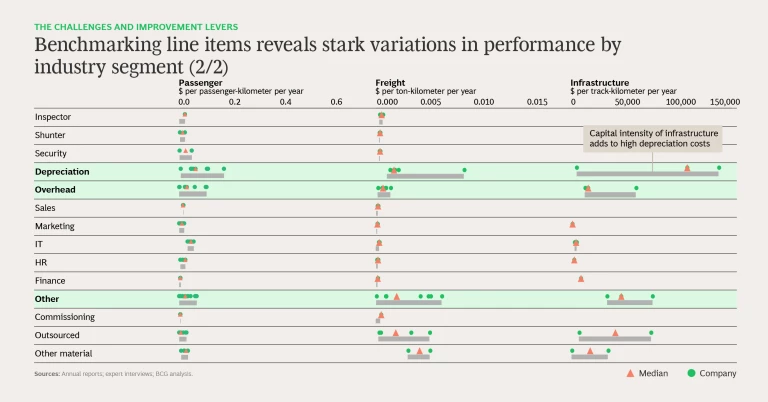

Our study’s benchmarking of cost structures reveals stark variations in performance between and within rail industry segments. For instance, in freight rail, personnel expenses typically surpass maintenance costs, whereas in passenger rail these cost items are typically more balanced. Within passenger rail, however, some transit authorities incur personnel costs that are more than ten times higher than those of their most efficient counterparts.

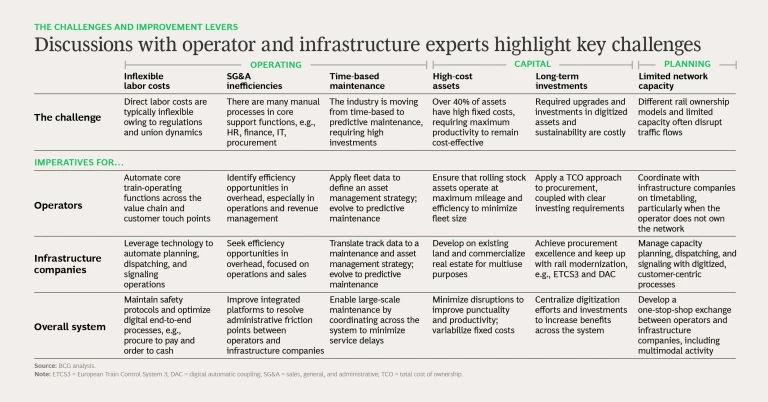

The executives we interviewed made clear that achieving cost excellence is far from straightforward. They cited several key challenges, including inflexible labor costs, administrative inefficiencies, new maintenance regimes, high fixed costs, long-term investments, and network capacity limitations.

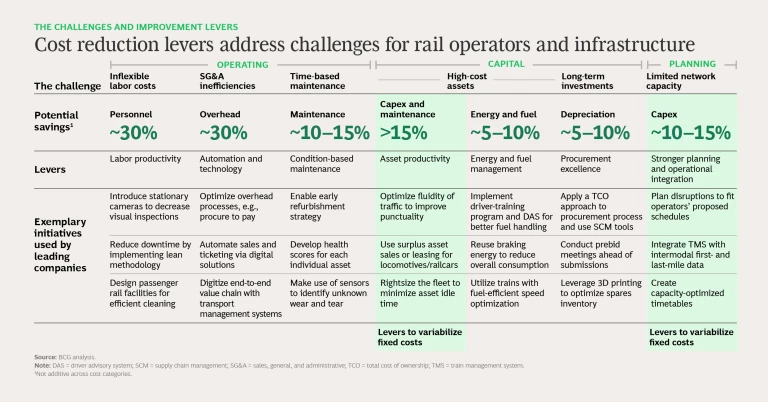

To address these challenges, leading rail companies are emphasizing a variety of cost reduction levers.

Labor Productivity. Initiatives to boost productivity can trim personnel expenses by up to 30% and solve shortfalls in the availability of trained staff by curbing hiring needs. For example, to eliminate manual steps in detecting track defects, Norfolk Southern uses AI to analyze images from trackside cameras and transmit the information directly to operations teams.

Automation and Technology. Rail companies are leveraging automation and technological innovations to cut overhead costs by approximately 30%. To rein in its sales costs, Renfe Alta Velocidad, Spain’s high-speed train operator, plans to invest more than €160 million to update its ticketing system using cloud technology.

Rail companies are leveraging automation and technological innovations to cut overhead costs by approximately 30%.

Condition-Based Maintenance. Adopting condition-based maintenance allows rail companies to decrease maintenance expenses by 10% to 15%. The UK’s Network Rail, for instance, is transitioning to predict-and-prevent maintenance regimes to minimize costs. Telematics and wayside monitoring in rail maintenance assist rail operators in optimizing maintenance schedules and maximizing fleet availability. The Swiss Federal Railways (SBB) network employs an advanced wayside train-monitoring system, which enriches raw data with train numbers, vehicle information, and route details for efficient alarm processing. The system has been instrumental in reducing potential delays by 300,000 minutes annually and improving train path availability.

Asset Productivity. Enhancing asset productivity can cut capex and maintenance costs by more than 15%. For example, freight company Canadian National sells and leases its surplus rolling stock, equipment, and railroad material. The program allows the company to recover value and variabilize the fixed cost of its surplus inventory.

Energy and Fuel Management. Optimizing energy and fuel use can lower related costs by 5% to 10%. CSX has partnered with Wabtec to test proprietary technology that uses air-brake control and signal-aspect information to optimize trips, thereby saving fuel and improving operations. Similarly, Siemens’ Vectron locomotives represent a best-in-class European example for integrating real-time driver advisory systems into operations. These locomotives, equipped with advanced energy management capabilities, continuously monitor energy consumption, allowing for optimization per route and customer.

Procurement Excellence. Enhancing procurement can bring depreciation costs down by 5% to 10%. BNSF, for instance, works with current and prospective providers to find ways to procure at the lowest total cost of ownership (TCO) , which covers all major cost categories incurred throughout the lifespan of rolling stock. Advanced digital tools for supply chain management can support these initiatives. For example, a state-of-the-art organization for spare parts supply chains should include advanced and predictive planning, active supplier management, and seamless cross-functional connections. These approaches use analytics and digital twins of trains for precise spare-parts demand planning, thereby improving efficiency and decreasing costs. Some companies, such as Everysens, offer transport management systems specifically for railways. These provide end-to-end visibility and real-time incident management, significantly boosting supply chain performance and agility.

Stronger Planning and Operational Integration. Passenger and freight companies can improve punctuality and service levels by strengthening planning and operational integration with infrastructure companies. Capex reductions of 10% to 15% are possible. For example, Swiss rail operator SBB recently revised its timetables to accommodate capacity constraints arising from infrastructure renewals.

To promote cost excellence in the rail industry, BCG is launching the Rail Cost Comparator initiative. It will collect cost data and best practices in cost excellence from participating companies. Participants will be able to benchmark their costs with peers and review the best practices of other leading companies industrywide.

The authors thank their BCG colleagues Rosanne Wijgman and Kanu Bhargava for supporting this study.