The 2024 New Drug Modalities report builds on last year’s analysis to offer an up-to-date perspective on the evolving biopharmaceutical landscape. Like last year, we tracked the progress in each of the six categories of novel modalities in terms of number of products and pipeline revenue, and we identified emerging trends. Once again, our goal was to determine which modalities are perceived by analysts as progressing most rapidly, which hold the greatest promise, and what these findings imply for patients as well as for biopharma sponsors.

Since acquisition and licensing deals are a good indicator of which assets and products hold the most promise, this year’s report includes a new feature: an analysis of new-modality deals by the top 20 largest biopharma companies over the past three years.

New Modalities Still Growing Rapidly

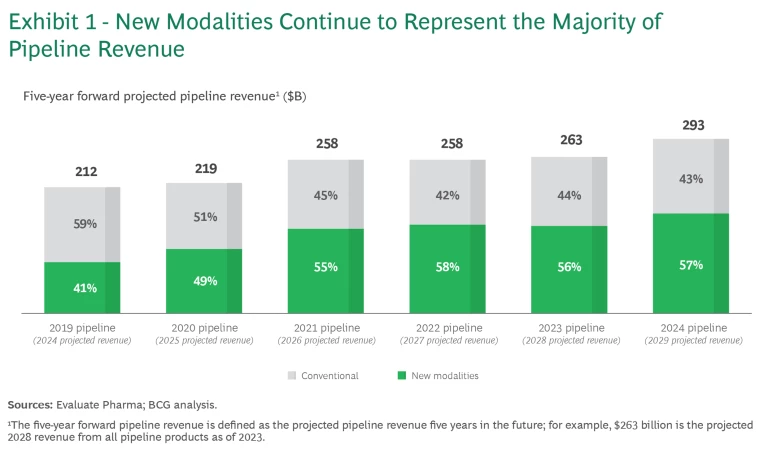

From 2019 to 2021, new modalities experienced significant growth (28% CAGR), driven by monoclonal antibody (mAb), ADC, recombinant protein, bispecific antibody (BsAb), and mRNA drugs. After that, new modalities stabilized at 55% to 57% of the total projected pipeline value. (See Exhibit 1). In 2024, new modalities represent $168 billion in projected pipeline value, up 14% from 2023.

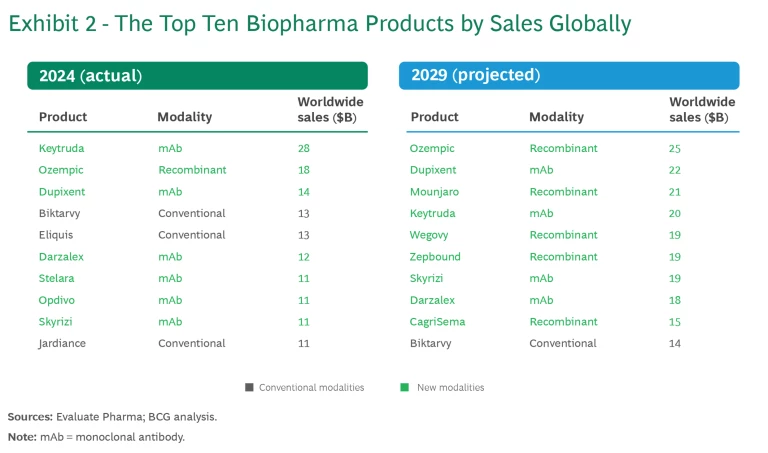

Seven of the top 10 selling biopharma products in 2024 are new modalities. (See Exhibit 2.) Pfizer/BioNTech’s and Moderna’s COVID-19 vaccines and AbbVie’s Humira have dropped out of the top 10, replaced by Darzalex, Skyrizi, and Jardiance. The remaining seven products have all maintained or increased revenue from year to year. Keytruda remains the uncontested leader.

Analysts project that in 2029, nine of the top 10 drugs by revenue will be new modalities, including five recombinant proteins, specifically GLP-1 agonists. While we have high confidence in the overall GLP-1 market, it remains to be seen whether the market will support five such drugs with relatively comparable share. We’ve often seen one leader within the same drug class taking disproportionate market share and several others competing for the rest. This has occurred, for example, with flu vaccines as well as with PD-1 and PD-L1 inhibitors

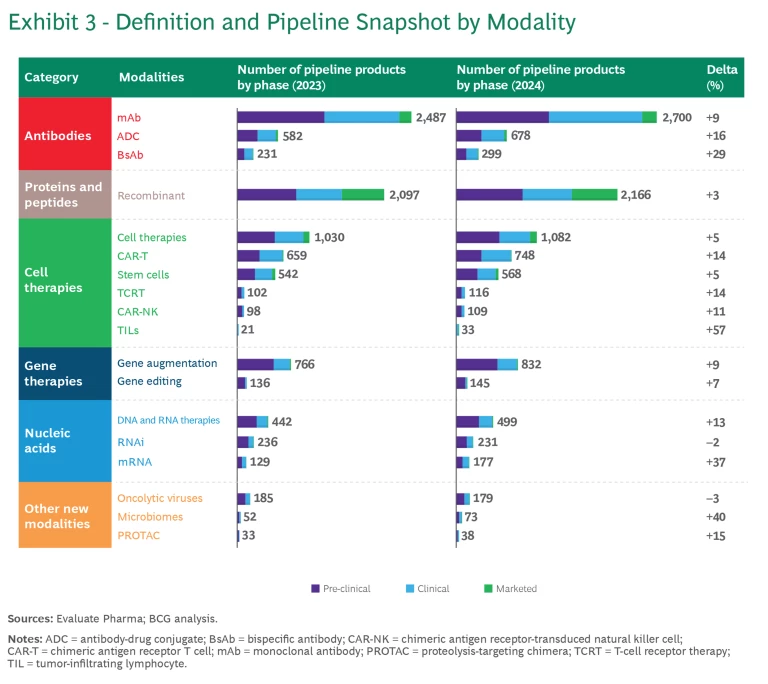

The Six Categories of New Modalities All Show Progress, Though Trajectories Differ

Like last year’s report, the 2024 analysis monitors the progression of six categories of modalities in terms of the number of pipeline products and pipeline revenue. (See Exhibits 3 and 4, respectively). To track pipeline revenue, we examined the projected revenue for pipeline products five years into the future. For example, “2024 five-year forward-projected revenue” is the revenue projected for 2029 of all the products within a particular modality that are in industry pipelines as of 2024. The projected growth in revenue reflects the product’s ability to progress through the pipeline and an underlying belief in the modality’s economic potential.

Antibodies: Still Going Strong

Even though antibodies are the oldest of the new modality categories, it’s clear that pipeline progress, growth, and interest remain strong:

- Monoclonal antibodies (mAbs). The mAbs clinical pipeline is the largest across all modalities, with 18% growth in the past year. While mAbs have a long track record in oncology and immunology, recent approvals have targeted novel mechanisms and diseases such as amyloid beta for Alzheimer’s disease. This expansion across therapeutic areas may enable mAbs to continue their high pace of growth.

- Antibody-drug conjugates (ADC). ADCs have continued to grow rapidly, with 22% growth in the past year. As part of a trend taking place across several new modalities, ADCs are expanding beyond their initial focus in oncology to immune system, dermatological, gastrointestinal, and musculoskeletal diseases. This is reflected in the five-year projected revenue share of ADC for non-oncology growing from 6% to 15% of the total.

- Bispecific antibodies (BsAbs). This platform targets two antigens, thus enabling novel mechanisms of action. The technologies continue to advance as companies develop innovative modalities such as tri-specifics, NK-cell engagers, and gamma delta T-cell engagers. Different companies innovate with different antibody structures (for example, nanobodies). By and large, the pipeline continues to grow but is not getting the same level of attention as ADCs.

Recombinant: Rapid Growth Driven by GLP-1s

Over the past year, products leveraging the recombinant platform also have experienced rapid growth, mostly because of the success of GLP-1 agonists.

Most of the innovation in this space centers around three areas. The first is combination therapies, such as CagriSema, a combination of semaglutide and cagrilintide, a long-acting amylin analog, which is forecasted to reach $15 billion of revenue by 2029. The second area is oral forms of incretin currently used for type 2 diabetes management. These drugs are undergoing evaluation for obesity treatment, with the potential to further expand the market. Third, GLP-1s are expanding beyond diabetes and obesity and are being assessed for the treatment of neurodegenerative diseases, non-alcoholic steatohepatitis, cardiovascular diseases, and renal diseases.

Cell Therapies: Steady Progress in the War on Cancer

The cell therapy pipeline has steadily targeted the oncology space in recent years, while the focus on central nervous system and systemic anti-infective therapeutic areas has declined.

- CAR T-cell therapies. Since FDA approval of the first CAR T-cell therapy for cancer in 2017, an additional five have been approved, some demonstrating efficacy as early as the first relapse in several indications. According to a 2023 article in Nature, the industry is developing next-generation therapies that address the limitations of current therapies and push applicability beyond blood

cancers.1 1 Malvika Verma, Kyle Obergfell, Shana Topp, Val Panier, and John Wu, “The Next-Generation CAR-T Therapy Landscape,” Nature Biobusiness Briefs, 2023. These will have improved safety, efficacy, ease of administration, and manufacturing cost and speed. - TCRT, CAR-NK, tumor-infiltrating lymphocyte (TIL), and stem cells. These nascent therapies have shown encouraging progress. Most notably, the first cell therapy for type 1 diabetes (Latindra) received FDA approval in 2023; the first TIL (Lifileucel), in 2024; and the first TCR-T therapy has been submitted for FDA approval. But because of concerns about risks associated with cell therapies, analysts have taken a conservative view of the revenue potential of these treatments.

Gene Therapies: Major Inroads Against Sickle Cell Anemia and Diabetes

Gene therapies, many of which have the potential to be curative, have made significant progress in R&D and manufacturing, and several obtained approval in 2023 and 2024.

While the first gene therapies primarily used adeno-associated virus (AAV) vectors, some novel forms of gene therapy have recently made it to market. These include Krystal Biotech’s Vyjuvek for dystrophic epidermolysis bullosa, the first FDA-approved topical gene therapy. Additionally, Vertex achieved a major milestone with the approval of Casgevy, the first CRISPR-based gene-editing treatment, designed for sickle cell disease. And Orchard Therapeutics’ Lenmeldy, using a lentiviral vector, became the first FDA-approved gene therapy for early-onset metachromatic leukodystrophy.

The gene therapies currently in the pipeline aim to broaden the range of treatable diseases, improve safety and longevity, and reduce cost of goods sold and manufacturing complexities. Given that gene therapies usually have very high price tags, health-care systems across major markets will need to find a way to support access to these treatments.

Nucleic Acids: New Therapeutic Applications After the Height of the COVID-19 Pandemic

The mRNA modality has grown more modestly since the pandemic hit its peak. However, the success of COVID-19 vaccines has accelerated the clinical development of new mRNA vaccines for combating other respiratory pathogens, such as influenza and respiratory syncytial virus (RSV). We also see exciting advancement in mRNA assets targeting oncology, cardiovascular, and gastrointestinal diseases. The pipeline value of these assets has continued to grow. Merck and Moderna’s mRNA vaccine for the treatment of melanoma, a personalized treatment that uses the patient’s tumor, has entered Phase 3 development. Earlier in the pipeline, in vivo cell reprogramming products, where mRNA payloads encode for CAR cells, have demonstrated the potential to be transformative.

Other New Modalities: Slow Growth

Proteolysis targeting chimeras (PROTACs) and other new modalities are still nascent, with clinical pipelines growing slowly or even declining.

- PROTACs. Currently, there are over 20 PROTACs in clinical trials, the result of several large pharmaceutical companies partnering with biotechs focused on protein degradation. In 2023, the most advanced PROTAC, which Pfizer and Arvinas developed for metastatic breast cancer, entered Phase 3 trials.

- Microbiomes. Vowst became the first microbiome-based drug to receive FDA approval in 2023 for the prevention of recurrence of C. difficile infection. Companies are also assessing the value of microbiomes for treating gastrointestinal, immunological, and oncological diseases. But the microbiome modality has encountered many challenges. Kaleido Therapeutics closed in 2022, and Flagship Pioneering–founded Evelo Biosciences shut down in 2023.

- Oncolytic Viruses. Nearly a decade ago, oncolytic viruses saw their first FDA approval with talimogene laherparepvec (T-VEC), also known as Imlygic, which is used for the treatment of melanoma. But no additional products have come to market since then. Current clinical trials focus on the efficacy of the viruses in combination with other therapies, such as immune checkpoint inhibitors, to enhance cancer treatment outcomes. The research is particularly active in conditions where tumors are accessible for direct injection, a method commonly deployed for administering these therapies. There are also ongoing investigations into intravenous delivery methods that could potentially address more deep-seated tumors.

Significant Deal Activity in the New Modality Space

Acquisition and licensing deals are a good indication of where the large biopharma companies see the most value and are placing their bets. We assessed large pharma acquisition and licensing deals for early-stage assets (defined as preclinical or Phase 1) and late-stage products (Phase 2 and later) over the past three years. We did not include deals for research projects in this analysis.

Between 2022 and 2024 year-to-date, companies spent nearly $200 billion on new modality deals. (See Exhibit 5.) This is likely an underestimation of the total deal value, since the value of many deals is not disclosed. Thanks to mega M&As such as Pfizer’s acquisition of Seagen, the total value of deals was by far the greatest in 2023.

Approximately $85 billion of the $200 billion was spent on 28 acquisitions. The rest was spent on 69 licensing deals, with early-stage deals outnumbering late-stage deals two to one.

ADC Deals Lead the Way

Relative to pipeline value, deal activity was disproportionately concentrated in ADC, CAR-T, and RNAi. (See Exhibit 6.)

- There have been five ADC acquisitions since 2022. Following Pfizer’s $43 billion acquisition of Seagen, several pharmaceutical companies quickly followed suit with their own ADC deals. In addition, there have been many licensing deals for early-stage assets, reflecting the promise and the proven pathway of the technology.

- Gene therapies have seen a disproportionate amount of deal activity. But the individual deals have been relatively small, averaging less than $500 million versus more than $2 billion in mAbs and ADC.

- CAR T, CAR-NK, TIL, and mRNA modalities have exclusively early-stage licensing deals. CAR T and mRNAs have a larger average deal size because of the recent progress and commercial success in these modalities.

- RNAi deals are gaining traction, with $4 billion spent on Phase 3 products. Most of the value is concentrated in licensing deals between Novartis and Argo, Roche and Alnylam, and AstraZeneca and Ionis.

- mAbs have seen significant deal activity simply because there are so many assets in the pipeline. But the total value of these deals over the past few years has declined by more than half, from $32 billion in 2022 to $14 billion in 2023.

Recombinant and Emerging Modality Deals

Activity has been lower in recombinants and emerging modalities. Recombinant deals have been low in both number and value, most likely because the most promising assets are being developed internally by large pharmaceutical companies, such as Novo Nordisk and Eli Lilly. The number and value of deals may increase as companies looking for ways to enter the weight-loss space develop next-generation platforms.

Emerging modalities such as stem cell, TCRT, CAR-NK, TILS, gene editing, oncolytic virus, microbiome, and PROTAC have seen limited deal activity, most likely because they are still unproven. None has had more than one deal per year, and no transaction, either acquisition or licensing, has exceeded $1 billion. Biopharma companies are likely waiting for more assets to progress or for a more proven pathway to approval and commercialization to emerge.

The next few years are likely to be exceptionally competitive for new modalities. The success of each new modality will hinge on its unique value proposition and its capacity to enhance the standard of care. While the industry and the public market are clearly still committed to advancing the wide array of modalities that have emerged, not all new modalities can be winners. This especially holds true of modalities with oncological origins that address the same pathways and therapeutic targets. In addition, speed to market will be particularly important for any curative therapies because of the winner-take-all dynamics.

Acknowledgements

The authors would like to thank BCG colleagues Erica Dalla and Garrett Boyce for their contributions to this article.