A quick look at the top-ranked companies in our 2024 Telecommunications Value Creators Report shows varied routes to success. Nevertheless, some strategies appear repeatedly. Top-ranked companies have typically defended their core business, invested wisely in network upgrades, tightly controlled costs, and begun harnessing the power of AI.

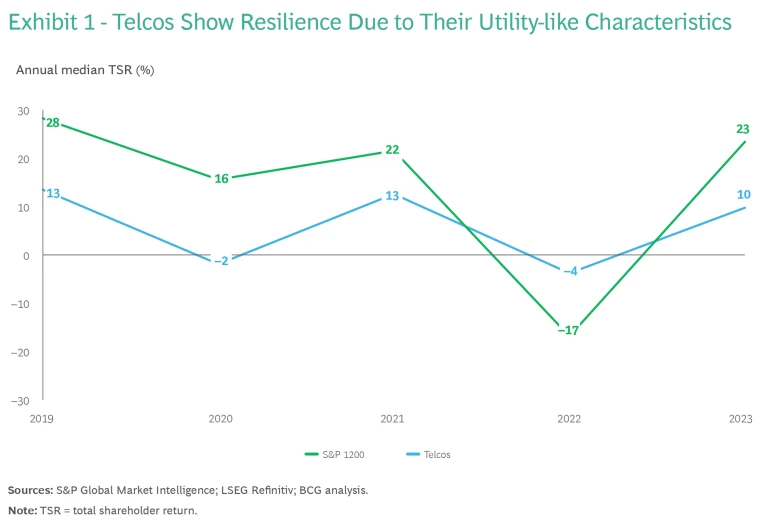

In the five years from 2019 to 2023, the telcos in our survey delivered a median annualized total shareholder return (TSR) of 6%, up from 3% for the five-year annualized TSR we reported 12 months ago.

But before they break out the champagne, telcos should consider some critical context. From 2019 to 2023, the S&P 1200 index of global stocks had an annualized TSR of 13%, meaning that the telco industry performed below the market average. In fact, for the most recent five-year period, telcos ranked 31st among the 33 sectors we track.

A closer examination of the data reveals the industry’s challenges, which include stagnant (and sometimes declining) revenue, and patchy returns from a very substantial investment in 5G.

Telcos’ utility-like characteristics translate into relatively stable returns. As a result, in years (such as 2023) when cross-market returns are strong, telco returns fall short of the average, but in challenging years (such as 2022) they outperform most other sectors. (See Exhibit 1.)

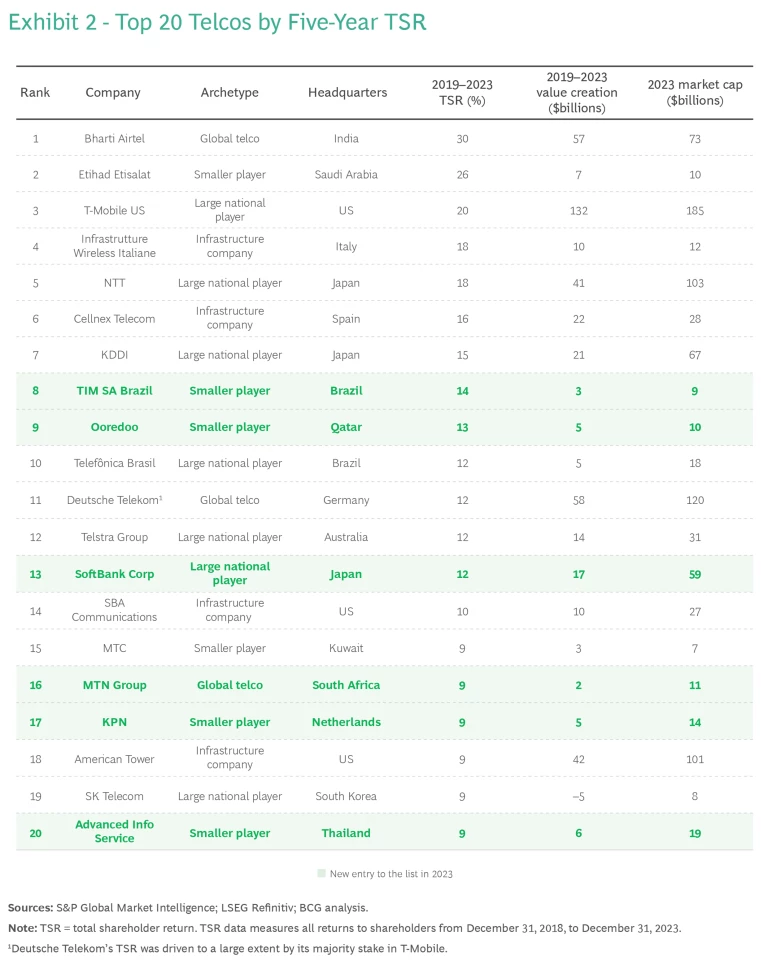

We analyzed 59 public companies in the telco sector globally on the basis of their annualized TSR, measured over five years to limit the impact of short-term market moves. Because of the large time interval involved, changes in rankings are gradual; 70% of the top 20 companies, as ranked by TSR, secured places in last year’s top 20 rankings as well. (See Exhibit 2.)

The other key metric we track is value created, which measures absolute changes in market capitalization and dividends paid out. Despite the telco industry's challenges, 41 of the 59 companies created value between 2019 and 2023, generating a total of $719 billion. The remaining 18 companies collectively lost $147 billion in value. Overall, then, the industry generated a net increase in value of $572 billion.

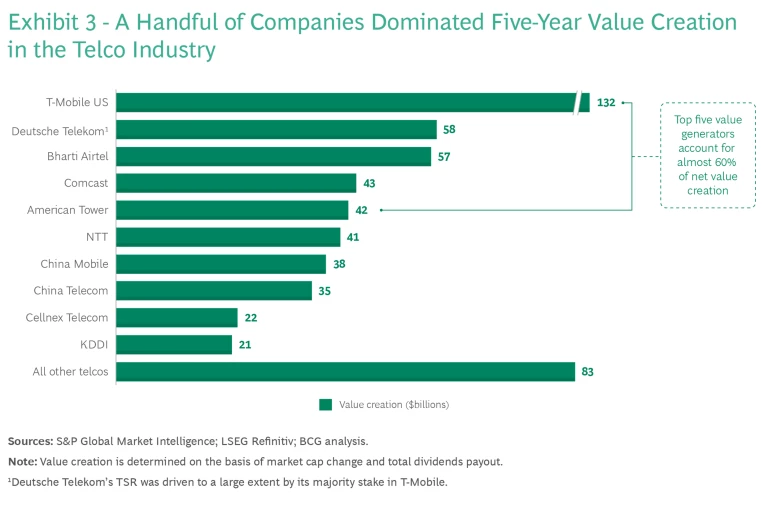

A small number of companies heavily influenced that net value creation number. The three top value creators accounted for a hefty $247 billion, more than 40% of the industry’s net total. (See Exhibit 3.) Among the companies that saw declines in value, two lost a combined $46 billion, more than 30% of the total among telcos that lost value.

Dividends are a key factor in the mix. From 2019 to 2023, dividend payouts totaled $485 billion, 85% of the net value creation. In contrast, telcos created just $87 billion in value through increases in market capitalization, and more than 40% of them ended the five-year period with a smaller market capitalization than they had at the beginning.

Demystifying What Drives Value

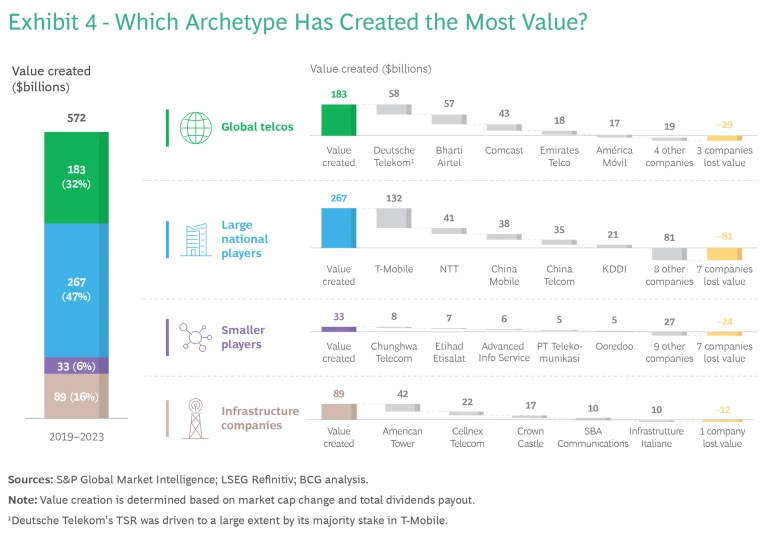

To get a clearer picture of where value in the telco industry is concentrated, we divide the industry into four archetypes: global telcos, large national players, smaller players, and infrastructure companies. (See Exhibit 4.) Each has used its own set of strategies for success.

Global telcos benefitted from margin improvements. These resilient firms saw their median annualized five-year TSR rebound to 7%, up from 3% for the period from 2018 to 2022. These companies make up 20% of the survey sample, but they generated 32% of the total value.

Although global telcos have relied on different performance drivers, TSR disaggregation shows that they have generally benefitted from rising revenues and net margins. Topping the list is Bharti Airtel, which is strong in its home market of India but also operates in other parts of South Asia and in Africa. Over the past five years, Bharti Airtel generated an annualized TSR of 30%—higher than any of the other 58 companies in our sample—driven by an annual 32-percentage-point boost to net income margin and an annual 13-percentage-point increase in sales.

In India, the company has a rising and market-leading average revenue per user (ARPU), as well as an increasing subscriber count. It has moved prepaid customers onto postpaid plans and launched its Airtel Black mobile, TV, and internet bundle offering, generating more consistent revenue against stiff competition. Bharti Airtel’s "customer 360" initiative enhances the customer experience by using demographic and behavioral customer data stored in a single repository to drive personalized offerings. Its value creation has been immense—$57 billion over the past five years, the highest in Asia—although it has also benefited from a recovering Indian telecommunications market.

Large national players show more varied routes to value creation. At 6%, the median annualized five-year TSR for these firms is slightly lower than that for global players, but it still represents an improvement on the five-year mark of 3% posted last year. Large national players account for more than one-third of the companies in the study, and they created $267 billion in value, roughly half of the sector total.

These firms have adopted many formulas for success—from successful network expansion to the reimagination of cost structures—and each has had to find its own ingredients to boost returns. One fundamental challenge faced by large national players is increased regulatory risk: because they draw most of their revenues from a single market, a single government policy decision could have a serious negative impact.

NTT of Japan has the second highest TSR in this group, with a five-year annualized figure of 18%. Over the period from 2019 to 2023, management has its improved net income margin by an annual 3 percentage points, thanks in large part to an internal digital transformation that has driven down costs. The company is currently ahead of schedule on a $7 billion cost reduction program. NTT has also maintained an array of noncore businesses, including an integrated ICT and global solutions business that offers data center and consulting services. In addition, it has generated value through investor-friendly policies such as offering buybacks and maintaining and achieving targets for earnings per share. These have helped NTT increase its P/E multiple, further expanding its value creation and pushing its five-year TSR to the fifth-highest mark in the study.

Smaller players are agile but still face headwinds. The five-year median annualized TSR for these companies is the lowest of the four segments at 3%, showing a slight improvement from last year's 2%. Some smaller players rely on a suite of legacy products that may be declining, especially in developed markets. TSR disaggregation highlights falling P/E multiples and net margins. Although they represent 36% of the companies in our sample, their value generation of $33 billion is just 6% of the total.

Even so, some smaller players are successfully generating value. KPN, the incumbent that runs fixed and mobile networks in the Netherlands, has, despite falling sales, delivered a five-year annualized TSR of 9%, which has vaulted it into the telco industry’s top 20 across all archetypes.

TSR disaggregation shows that the most significant contributor to KPN’s value growth has been an annual 13-percentage-point increase in net income margin, achieved through a comprehensive reduction in operating costs. The company has also significantly reduced personnel expenses, implemented multiple agile digital transformations, and simplified its operating model. Another TSR driver for KPN is dividends. Tight control over expenses has helped increase free cash flow, enabling shareholder payouts to grow by 3% to 5% a year.

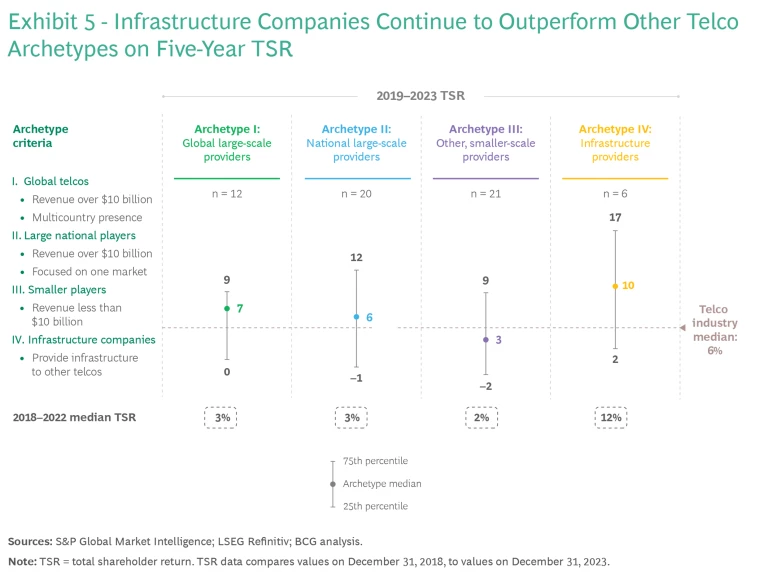

Infrastructure companies have strong returns but confront unique challenges. These companies manage infrastructure for other carriers. The six infrastructure companies in our sample had a median annualized five-year TSR of 10%. (See Exhibit 5.) This is the highest of the four archetypes but down from 12% in 2022. Because these companies are typically highly leveraged, with a 5x to 7x multiple of net debt to EBITDA, consistently high interest rates have depressed their returns during the past two years. They are also feeling the effects of their telco customers’ slowed investment, which peaked in 2022.

Although the six infrastructure companies in our study amount to just 10% of the total, they generated $89 billion, 16% of the sector’s total net value.

Cellnex Telecom, which is based in Spain and manages mobile towers across Europe, shows that infrastructure companies can effectively tackle economic headwinds, as it has delivered a five-year annualized TSR of 16%. TSR disaggregation shows a strong contribution to Cellnex Telecom’s value from sales growth, some 34 percentage points annually. The company invested in acquisitions in 2021 and 2022 and is still seeing benefits from these moves. Cellnex Telecom has maintained its dividend and is adjusting to the higher-rates environment by selling some assets to reduce borrowing costs. It has generated $22 billion in value during the past five years.

The New Formula for Value Creation

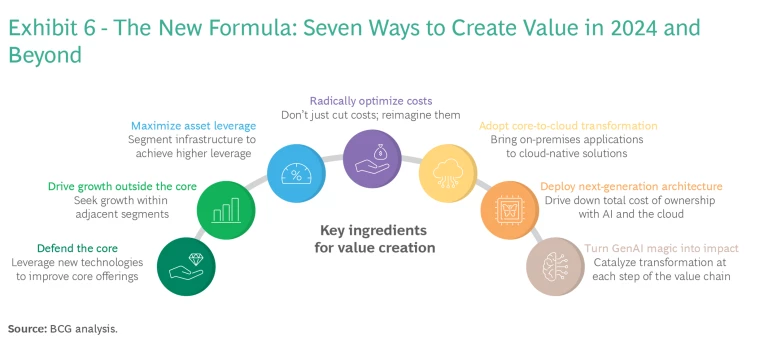

The strategies discussed above show how innovative managers have generated value over the past five years. But new thinking will be needed for creating value over the next five years. In pursuing a formula for success, we have identified seven key ingredients that telcos must deploy to achieve optimal results. (See Exhibit 6.)

Defend the core. Innovative telcos can provide sticky, high-value products and services by overlaying new technologies (such as AI for personalization) on core products (such as mobile, fixed-line, and TV). By acting on its Uncarrier strategy and optimizing its core offering, T-Mobile US continues to be a market leader in managing customer value, as discussed in last year’s report .

Drive growth outside the core. The goal is to capture revenues adjacent to the core network business. MTN, Africa’s largest mobile operator, does this by offering a comprehensive range of financial services under the Mobile Money (”MoMo”) brand across its pan-African network footprint. Besides allowing users to buy airtime and data, MoMo lets them pay bills, send and receive money from family and friends, and apply for personal loans. MTN has launched MoMo in multiple markets and has seen user count soar from 28 million in 2019 to 64 million in 2023.

Maximize asset leverage. Getting better returns from assets can be vital to boosting TSR, so some telcos are looking hard at infrastructure such as fiber, legacy fixed networks, and mobile towers. Softbank and KDDI agreed in 2022 to share network infrastructure in Japan through a multi-operator radio access network (RAN). This system permits companies to share RAN infrastructure such as base station sites and equipment while maintaining individual operations and management capabilities. The telco industry’s move to shared RAN opens many similar opportunities.

Radically optimize costs. Some companies are implementing end-to-end cost transformation programs that go far beyond simple cost-cutting to create a new and more efficient culture. BT Group of the UK is driving down costs through simplification and automation. The company has streamlined its divisional structure and cut the number of customer tariffs by 30%. AI is already helping trim costs and is integral to BT Group’s plan to reduce today’s workforce of 130,000 to as few as 75,000 by around 2030. The company says that it is on track to cut its annualized costs by $3.8 billion by 2025.

Adopt core-to-cloud transformation. Replacing on-premises, legacy applications can reduce time-to-market, enhance customer experience, and simplify and automate processes. One element of Telstra’s T22 program involved adopting a completely new digital, cloud-based business support system (BSS) setup. By consolidating BSS components into a comprehensive end-to-end digital solution, Telstra increased cost efficiency and shortened time to market, while also improving both employee experience and customer experience.

Deploy next-generation architecture. Moving to the cloud is a key step in building a next-generation network—but after the transition, there’s still more to do. Analytics and AI can help a telco plan, build, and operate a truly transformed network that is simpler and offers a less arduous route to net-zero carbon emissions. In 2023, the Japanese telco KDDI deployed what it announced as Japan's first disaggregated IP infrastructure, moving from a single-vendor network model to a more flexible, cloud-native architecture. The solution combines products from multiple vendors, broadening the range of vendor options, and KDDI expects it to yield significant cost savings. This type of next-generation network has the flexibility to add innovative products quickly and to reduce the risk of revenue loss to new, tech-based competitors.

Turn GenAI magic into impact. This area of value creation is so large and the opportunities within it are so varied that we devote the next section of this report to it.

Capturing Value from GenAI

The most innovative telcos have begun harnessing the power of GenAI while managing some of the fundamental risks associated with it. Early applications in areas such as task automation, product and services hyper-personalization, and business process transformation show promising progress toward commercial success. Three areas of GenAI-related work deserve special attention from telcos.

Deliver better and more cost-effective customer support. This use case is being widely explored, and for good reason: customer support can be a significant expense for telcos . GenAI-based chatbots can increase the proportion of customer self-service interactions; and for interactions that require human intervention, an AI assistant can advise customer service agents on the next actions to take in various circumstances.

Recently, telcos have taken preliminary steps toward enabling self-service-heavy customer service. Some telcos have adapted existing GenAI models to translate customer requests into structured output, for instance, significantly reducing service times. These new models extract details ranging from service level agreements to the content of a customer’s request, and then compile this information for agents and suggest next steps.

Others have taken steps toward partnership in this area. For example, Deutsche Telekom and SK Telecom—both members of the Global Telco AI Alliance—are collaborating with GenAI giants such as OpenAI, Google, and Meta to build a telco-specific large-language model that can power a new, more sophisticated digital customer assistant.

Create a more effective sales strategy. AI can use structured and unstructured data to create hyper-personalized marketing campaigns. By integrating predictive analytics, AI can continually improve customer lifetime value. As in the case of AI-enabled customer support tools, AI can directly interact with the customer, and it can turbocharge the productivity of salespeople by handling mundane tasks and helping them craft effective, personalized sales pitches.

Although these capabilities are still in their infancy, some telco companies are already integrating them into their sales offerings, including through the use of GenAI in personalized email sales tools. In place of time-consuming research and writing processes that often resulted in boilerplate emails, new tools leverage customer data to create customized sales pitches almost instantly. This frees sales reps to spend more of their time in front of customers to improve conversion rates.

Drive efficiency across administrative and IT departments. From improving the design, rollout, and operation of a mobile network to performing automated contract analysis, telcos are exploring many ways to use AI to lower operating costs and raise performance. In tech development, GenAI-powered coding assistants can generate code snippets and documentation, freeing developers to focus on higher-level tasks. AI may also strengthen reliability by automating test use-case generation and bug resolution.

Whatever the application, each telco should create its own clear development and implementation strategy, using what we call the “10-20-70" rule. Successful GenAI strategy requires spending 10% of the effort on building algorithms, 20% on deploying tech stacks and creating a high-quality data feed, and 70% on planning and executing the operational transformation, which entails entirely rethinking functions with a focus on people, process, and change management. This rule underscores the importance of the human component in AI implementation. Achieving success here depends on incentivizing agility and experimentation, ensuring that staff members understand and embrace the new tools and processes, and confirming that the strategy adheres to responsible AI principles.

GenAI presents a massive opportunity to the telco industry. It's not merely a technological advance; it can catalyze a profound transformation along the entire value chain. From reducing costs to creating new products and experiences, the benefits of GenAI are tangible and far-reaching. For instance, GenAI-enabled customer service may at some point reduce service interactions by 50% or more, while improving customer satisfaction.

Realizing this potential, however, demands more than just technological integration. Executives must think about where and how to deploy it. With so much potential available for tapping, they should think big.

The strategies above are not instant fixes; they require sustained effort. Falling interest rates may free up more capital to invest, but they will not ease many of the industry’s other problems such as uneven returns from 5G investments and static revenue.

Against this background, it should be no surprise that the industry's value creation tends, on average, to fall below that of most other sectors over a five-year period. Nevertheless, the upper ranks of the telco industry’s TSR tables are occupied by companies whose leaders have achieved much more. These value creators show the way for others; senior leaders can combine and customize the seven ingredients for success above to create their own, company-specific formula for success.