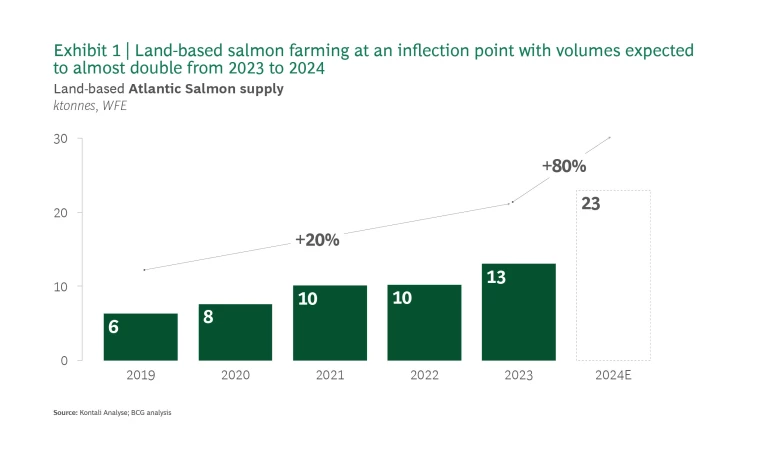

Land-Based Salmon Farming is at an Inflection Point

Conventional sea-based salmon farming (>99% of volume in 2024) faces growth constraints due to limited locations, strict regulations, and productivity challenges. Atlantic salmon supply growth is expected to remain low at 2-3% p.a. CAGR 2024-2030, while demand stays strong, with global consumption value projected to grow 7-9% p.a. (CAGR 2024-2030).

To meet this demand, farmers and new entrants are increasingly seeing land-based farming as a viable alternative to growth.

Strategic Context

Fundamentals Are in Place for Volume to Finally Ramp-Up

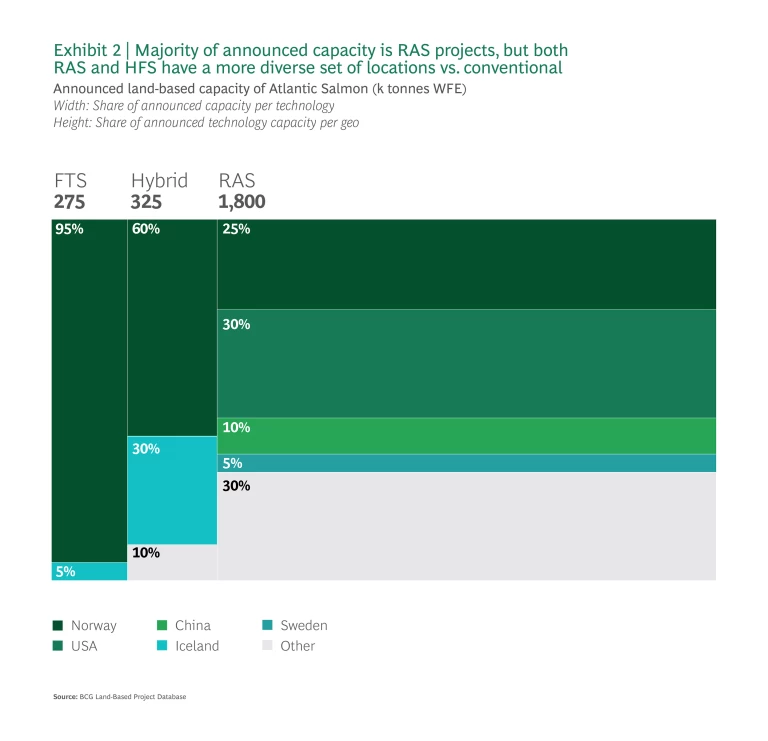

- Several technologies are delivering promising results. Operational stability has been improving over recent quarters as both FTS, hybrid, and RAS technologies show signs of maturing. For instance, Salmon Evolution, Nordic Aqua Partners, and Proximar have delivered harvests at high quality, with superior share >95% and increasing harvest weights.

- Unit economics at scale are expected to be competitive. Land-based facilities are yet to reach full scale, but scaled facilities are expected to reach unit economics and returns on par with growth in conventional production. Estimated EBIT cost at scale for land-based is 5-5.5 EUR/kg HOG vs. ~5.3 for conventional in 2024.

- Investor confidence and government support tis increasing. Attracting funding and government support is key to unlock further scaling. Evidence of different types of investor funding projects and supportive government policies in several markets is encouraging.

Opportunities Ahead

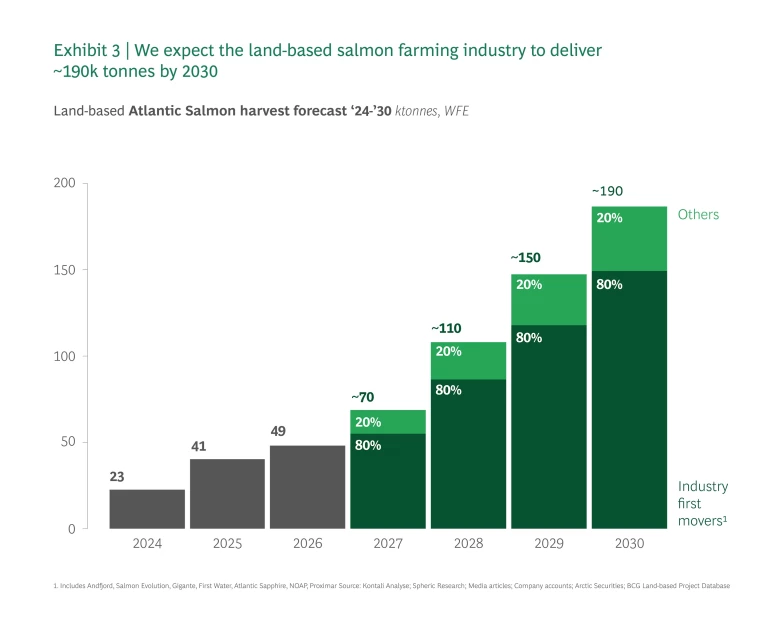

Long-Term Outlook is Strong and Will Be Led by Today’s Front-Runners

The global backlog of announced project capacity amounts to ~2.4 million tonnes WFE spread across 110 projects globally. However, only ~25% of these projects have started construction or completed a harvest as of 2024, with most likely never materializing due to hurdles associated with e.g. financing, competence or regulation.

Front-runners (companies already with fish stocked or constructed underway) are expected to deliver the majority of the ~190k tonnes WFE by 2030. These players have proven their operational stability, giving them a competitive edge in scaling production.

Five Strategic Focus Areas

We believe the industry players should focus on five focus areas in the upcoming years to increasingly attract interest and support from stakeholders:

- Deliver stable production volumes: Stability and predictability in production are key to reducing funding risk. Proof of concept through steady state operations and unit economics is essential for scaling.

- Implement strategies to increase cash flow: Reducing cash burn and achieving positive cash flow is critical. Strategic harvesting and selling post-smolt to conventional industry can drive early margins.

- Focus on value chain positioning: Farmers should maximize production efficiency before integrating into areas like feed production or processing.

- Attract and build human capital: Scaling requires skilled talent in farming, engineering, biology, and project management.

- Collaborate with governments: Engage with governments early to streamline permitting processes and ensure effective policies.