Personalization has transformed retail more than any other industry sector. Retail has the highest average score of any sector on our BCG Personalization Index™, but the individual scores of dozens of retailers around the world show significant disparities between leaders and laggards. (See “About the BCG Personalization Index.”) The revenue growth of retail personalization leaders is 10 percentage points higher than the growth of retail companies that lag in this area. Given the share gains and category growth these leaders are driving, we estimate that $570 billion in incremental growth will accrue to these companies before the decade’s end. This accounts for almost 30% of the total personalization opportunity available across industries.

The size of that prize—combined with the competitive pressure from digitally native e-commerce players and from established retailers that are investing heavily in personalization—makes it imperative for retailers to harness their first-party data from each touchpoint to make the next customer interaction faster, easier, and more convenient.

Four Trends Driving Personalization in Retail

Whether consumers are shopping for groceries, dining out, picking up a prescription, or buying materials and equipment for a home improvement project, retailers can track their behaviors and preferences, both during the purchase and between purchases. Across categories, retailers large and small are using this data to pioneer personalization use cases. Our research and work supporting hundreds of retailers globally has revealed four trends across these use cases that will further reward retailers that personalize their customers’ experiences.

1. Competing on the scale of digital customer relationships and loyalty

Competition for the loyalty wallet is intensifying as both e-commerce sales and loyalty program membership continue to grow. Statista estimates that digital channels will account for nearly one-quarter of global retail sales by 2026, an increase of more than 10 percentage points since 2019. According to Similarweb, several e-commerce marketplaces—including Amazon, eBay, Rakuten, Shopee, and Mercado Livre—have more than 500 million monthly active users worldwide.

Customers on average were members of 19 loyalty programs in 2024, up from 11 a decade ago, but they engage actively in only nine of them, similar to a decade ago, according to Bond Brand Loyalty research. Retailers are investing further in their loyalty programs to deepen their digital customer relationships. Target and Nordstrom recently redesigned their programs, and others such as CVS, Walmart, and Kroger launched subscription loyalty programs with a paid option.

Sephora, the global beauty retailer, is investing to better orchestrate personalization across its owned and paid channels. The company’s customer data platform enables it to tie 95% of transactions, both online and in its hundreds of physical retail locations, to loyalty member accounts.

2. Shifting more promotional investments to personalization

But in the broader mass retail landscape, retailers are shifting the promotional mix more toward personalized offers. One large convenience chain established a “customer investment council” that actively manages funds in its customer “value stack,” which represents its total investments across pricing, promotions and markdowns, loyalty discounts, and personalized offers. In advance of each quarter, the council decides how much of the company’s investments will go into everyday value (list-price cuts), promotions, personalized offers, and loyalty rewards. They base their decisions on sales goals as well as an understanding of how much vendors will co-invest. As a result, the company’s share of investment in personalized offers increased from 1% to 10%, generating $250 million in incremental sales. While this retailer still plans to rely on mass promotions for large seasonal events and for reaching customers who are not digitally engaged, it expects to continue shifting more investments to personalized offers.

Woolworth’s, the leading Australian grocer, has scaled personalized offers to boost returns from promotional spending as well as drive engagement in its loyalty program, taking advantage of its Woolies X data science and engineering capabilities. The company is also investing in generative AI (GenAI) virtual assistants to manage returns and customer inquiries.

3. Taking content to customers instead of taking customers to content

4. Offering GenAI virtual assistants that transform how consumers search for products

DoorDash has said that up to half of restaurant call-in orders go unanswered. To address this, the company has white-labeled a voice-ordering AI assistant that can take orders when employees are unable to answer the phone. Large restaurant chains, meanwhile, are working on menu-discovery AI agents that allow customers to learn about items they have not tried yet and to customize their orders.

In other sectors, Woolworth’s is investing in GenAI virtual assistants to manage returns and customer inquiries. L’Oreal has a GenAI assistant called Beauty Advisor that helps customers create a look for any occasion, such as a job interview, holiday party, or an important presentation, and then order the right products.

The Role of Retail Media in Personalization

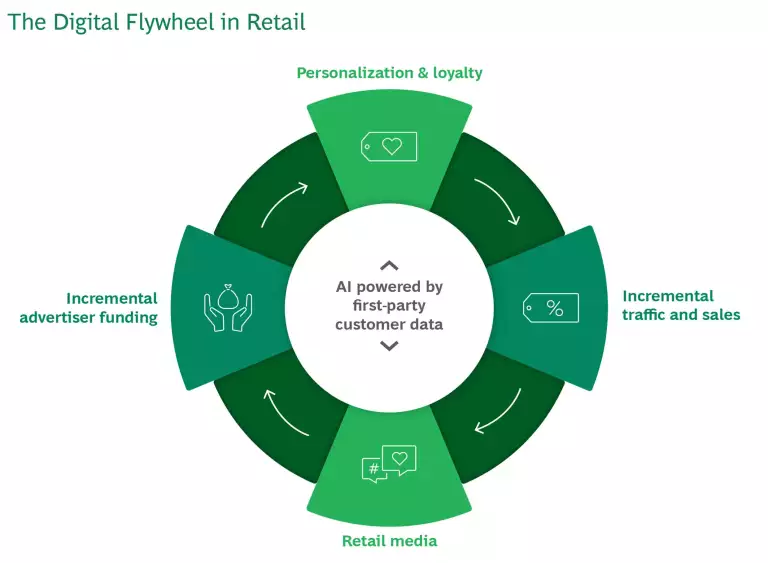

Building on these trends, leading retailers are rapidly building a digital flywheel that spans personalization, loyalty, and now also includes an advertising business fueled by first-party data. (See exhibit.)

Retail media is changing the traditional economic model of retail. In aggregate, the retail media advertising business is growing by 25% per year, and we estimate that it will exceed $100 billion worldwide by 2026. Onsite retail media—which is targeted ads on a retailer’s website and other digital channels—can generate gross margins in excess of 85%. Retailers are using this highly profitable incremental revenue stream to fund the significant tech, data, and people investments required to drive the digital flywheel. Some retailers are now making as much money or more from data-driven advertising as they do from the products they sell.

Amazon Advertising has led the way in retail media, while large retailers such as Walmart, Target, Kroger, and Instacart have built billion-dollar businesses. Category specialists such as Home Depot, Macy’s, Ulta Beauty, and Walgreens have also established sizeable positions. Most retailers with more than $5 billion in annual revenue have already built retail media businesses with revenues of $100 million to $200 million and have plans to double or triple those businesses over the next three years.

Subscribe to our Marketing and Sales E-Alert.

Defining the Personalization Agenda in Retail

Guided by the trends driving personalization, we have identified specific investment areas than can generate over $100 million of topline impact for large retailers:

- Personalized offers at scale. Retailers should set explicit targets for how much of their and their vendors’ customer investments should go to personalized offers, because the returns are as much as three times higher than for mass promotions. Some retailers are also using personalized offers based on loyalty points to boost returns. Investments in automation and off-the-shelf vendors such as Eagle Eye and OfferFit can help scale the execution of personalized offers. Sweetgreen, the US salad chain, uses off-the-shelf technologies to personalize offers and recommendations in its app and also engages customers with fun challenges that entice them to explore more of the menu and discover new items.

- Precision-targeted ads. To grow their retail media networks, retailers can expand their sales force, add offsite and onsite ad products, and invest in advanced measurement and increasingly sophisticated decision engines. Some retailers are also using the same data to increase the ROI on their own digital advertising spending by a factor of two or three and using non-endemic advertisers as an additional growth driver.

- Product recommendations. Personalized product recommendations can drive 10–20 percentage points of cross-sell for multi-category retailers, because many customers have needs that span categories but may initially buy only in one category. Home Depot, for example, helps project-buyers find exactly what they need next by using its robust retail media network to power personalization for high-value audiences across its owned channels. Tying recommendation models with real-time inventory data is also a massive opportunity for retailers, because abandon-cart rates can drop by half if the model recommends a suitable substitute product. This can increase the sell-through rates for perishable items by 10 percentage points or more.

- Next-best experience engines. When one large pharmacy retailer established an “air traffic control” engine to coordinate its diverse mix of push communications, it achieved twice the engagement with only half the outreach. New customers were much less likely to disengage by uninstalling the app or unsubscribing from emails. By managing email, push notifications, SMS, and outbound calls with the engine, the retailer also saw an increase in high-value actions, such as prescription redemptions.

Achieving these kinds of returns from personalization will take significant investment. We have found that large retailers leading in personalization are making annual investments of $10 million to $40 million in customer data platforms, marketing automation tools, AI models and decision engines, and content creation and management. They are also hiring marketers, data scientists, engineers, and martech experts to operate these tools at scale, both in-house and by working with trusted vendors. Given these large investments, CEOs are appointing leaders who can orchestrate the cross-functional teams to scale personalization efforts, while some CFOs are insisting on a gated approach, with early wins in some of the bigger use cases used to unlock further investments.

The Personalization Playbook

We have developed a simple framework to use with your teams to assess how well you are delivering on each of the five promises of personalization. This framework will guide the next phase of your personalization journey, no matter where you are along the maturity curve.

1. Empower Me. Understand each customer’s needs and how best to meet them.

- Do we personalize experiences at each step of engagement throughout the customer journey ?

- Do we provide cross-channel personalization capabilities?

- Is every communication channel used for personalization?

2. Know Me. Win customers’ trust and permission to use their data to improve their experience.

- Does customer data live in a single repository?

- Is customer data integrated throughout our other marketing systems?

- Do we have high-quality identity resolution in place?

3. Reach Me. Reach out to the right customer, in the right channel, at the right time.

- Do we conduct A/B testing on our personalization efforts?

- Have we deployed a next-best-action decisioning or product recommendation engine?

- Do we automate customer segmentation?

4. Show Me. Tailor unique content to be relevant to each customer, enabled by generative AI.

- Do we offer tailored experiences on a 1-to-1 basis for every customer? 10-to-1? 100-to-1?

- Are we able to launch personalized experiences or campaigns quickly from ideation to launch?

- Do we use GenAI to automate the production of marketing collateral?

5. Delight Me. Design new ways of working and ensure continuous improvement, so a customer’s experience feels magical.

- Do organizational or technological impediments prevent us from measuring progress on personalization?

- Do we run weekly tests related to personalization?

- Do we implement improvements on a weekly or more frequent basis?

Most retailers have started their personalization journey and made substantial investments. But for many, significant work lies ahead to go from good to great and realize the full potential. Answering the playbook questions will help you decide what your teams can do quickly to drive even more value from personalization and capture your share of the $570 billion personalization prize in retail.

This article is part of a series looking at the role of personalization in a variety of industries.