Financial planning, budgeting, and forecasting processes at many companies are slow, rigid, and manual. The annual plan can take months to build, and forecasts each cycle often take weeks—meaning that the updated version is in the rearview mirror as soon as it’s complete.

The So What

Technologies like AI and machine learning can turbocharge planning and forecasting processes, making them far faster and more accurate.

A process we call “dynamic steering” combines AI- and machine learning-based algorithms, data automation, and driver-based calculation models to enable agile, accurate steering of the business.

Specifically, companies can build models that enable them to:

- Generate more accurate financial forecasts.

- Run multiple scenarios at the click of a button.

- Update scenarios more frequently to gain better insights about what’s coming.

Based on our experience with clients, when companies transform planning and forecasting and incorporate AI, the efficiency and effectiveness gains can be substantial.

- Planning cycles are 30% faster.

- Forecasts are 20% to 40% more accurate.

- Overall productivity in finance increases 20% to 30%.

When CFOs have a clear picture of the current business performance and future trajectory, they can help the organization navigate change and quickly adapt to new circumstances. With CFOs and finance teams freed up from rote processes, the focus can shift to insight generation. Employees in finance and across the organization get a better experience, with self-serve models that are convenient and timely.

Dive Deeper

Dynamic steering has three main components.

Put infrastructure in place. Companies need to create a fully automated planning and forecasting system—piping data out of source systems, feeding it into a driver-based calculation engine, and implementing a digital tool for fast analysis, iteration, and scenario-building.

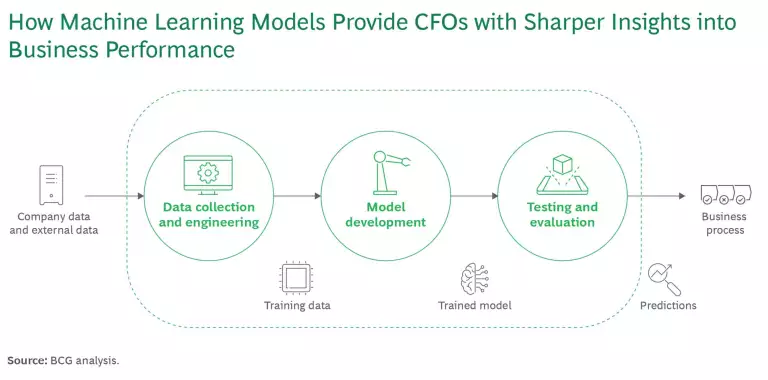

Incorporate predictive models. Teams should leverage AI and machine learning models to build more accurate plans and forecasts, with less bias and variance. Critically, these models include both internal and external data, such as consumer spending. (See the exhibit.)

Generate insights. Finance teams need ways to rapidly generate insights from their data using emerging technologies such as generative AI, which can allow analysts to rapidly uncover higher-order insights when conducting variance and root-cause analysis.

The Idea in Action

A global industrial goods manufacturer saw the accuracy of its financial forecasts decline over time. Persistent and growing forecasting errors led to increased costs in areas like labor and overtime, transport, and inventory. To improve, the company built an integrated forecasting system that used AI and machine learning to more accurately predict demand and revenues.

Through this approach:

- The company’s forecasting model became 50% more accurate, which had cascading benefits throughout the organization.

- Operations margins improved through improved labor planning and plant scheduling.

- Improved visibility in expected demand helped drive procurement savings and a reduction in inventory holding costs freed up working capital.

Now What

Companies that want to implement dynamic steering should focus on three main priorities.

Don’t just implement technology—change behaviors. In our experience, the digital aspects of a digital transformation only account for about 30% of the value and effort. The remaining 70% lies in change management across people, processes, and organization . That requires a structured approach to change management , grounded in the day-to-day behaviors of employees, so they have a clear idea of what they should do differently and why.

Start small and move fast. Avoid the urge to tackle everything at once. Instead, start small to prove the concept and achieve measurable benefits. For example, a company can develop revenue-forecasting models for select products or segments. It can also launch pilots for smarter labor planning, pricing, or distribution. Through that process, the team can build foundational capabilities and start to ramp up the ambition for larger projects. Throughout, the finance team needs to apply a test-and-learn mindset, with a strong willingness to take risks and learn from failures.

Make smart decisions about technology. While the most critical aspects of a transformation are centered around process, people, and value, companies still need to think carefully about the underlying technology. CFOs should make the right buy-versus-build decisions—primarily relying on existing enterprise solutions and platforms and potentially building the AI models that feed into those systems. In that way, companies retain control over the most important IP and develop fit-for-purpose models that best suit their company’s needs.