Imagine a world in which every locale competes for the brightest minds. Of course, that’s not the world we live in. While most governments have agencies to draw tourists and investors, very few commit to proactively attracting and retaining top talent. As a result, highly skilled individuals often struggle to move where they’re needed most, and the world is missing out on their inventions.

Tech hubs, cities, states, and nations that are ready to act stand to gain enduring economic, technological, and geopolitical advantage. Economically, countries with diverse populations of top talent are more innovative, grow faster, and are better able to deliver on their new industrial policy ambitions. Technologically, nations that attract top scientists, engineers, and entrepreneurs tend to dominate in quantum computing, supercapacitors, large language models, and other technologies that will shape our future. Geopolitically, building people-to-people ties among nations can establish valuable cross-border networks , contributing to a country’s soft power.

Public leaders increasingly see the synergy between local workforce development and global talent. In 2023 alone, Australia, Canada, Germany, Japan, Saudi Arabia, and Singapore took steps to ease employment-based migration while investing in the education of homegrown talent. The US, though gridlocked on immigration reform, has taken some measures to speed up visa processes. These are all steps in the right direction but hardly sufficient.

Winning the race for talent—global and homegrown—means making it an institutional priority. Doing so starts with setting a clear goal, naming an agency to truly own the outcome, designing the framework to deliver, and investing appropriate resources. We suggest a novel approach: the creation of public talent investment funds (TFs) that incentivize the private sector and civil society to search for, upskill, relocate, match, and integrate highly skilled talent.

Winning the race for talent—global and homegrown—means making it an institutional priority.

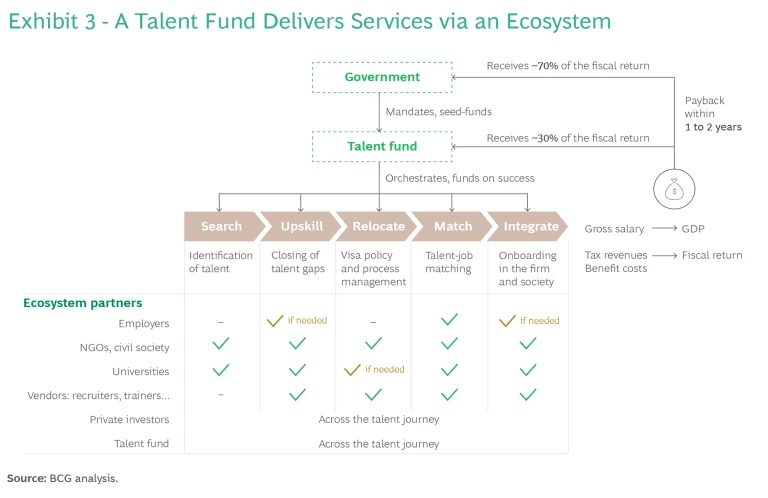

TFs can operate at the tech hub, city, state, or national level. They consist of a small, well-networked team that receives seed funding from a government entity (such as a department of labor or state-level economic development agency) or a pool of private sector actors (a chamber of commerce or philanthropists, for example). Such a fund is empowered to invest the money in an ecosystem of specialized private sector vendors, nongovernmental organizations (NGOs), and higher-education providers—all of which participate in an outcomes-based funding model to ensure that any payments are linked to measurable impact.

On the whole, TFs do not behave like traditional service providers, but like fully empowered owners. Their closest conceptual analog in government are sovereign wealth funds, which operate with an equally high degree of freedom, small teams, and a focus on meeting the fiscal and industrial policy objectives of their host country.

The financial benefits at stake are significant. We modeled the business case for a modestly sized TF that attracts 1,000 highly skilled workers a year who pay income and sales taxes, and draw on public health care and education services. It would require an initial investment of about $15 million, would be self-funding after 20 months, and after four years of operation would generate a net fiscal value of $180 million. These figures illustrate that the attraction of highly skilled talent is a public activity with huge upside potential and outsize returns, making it a government activity with one of the greatest fiscal returns on investment.

The Race for Global Top Talent

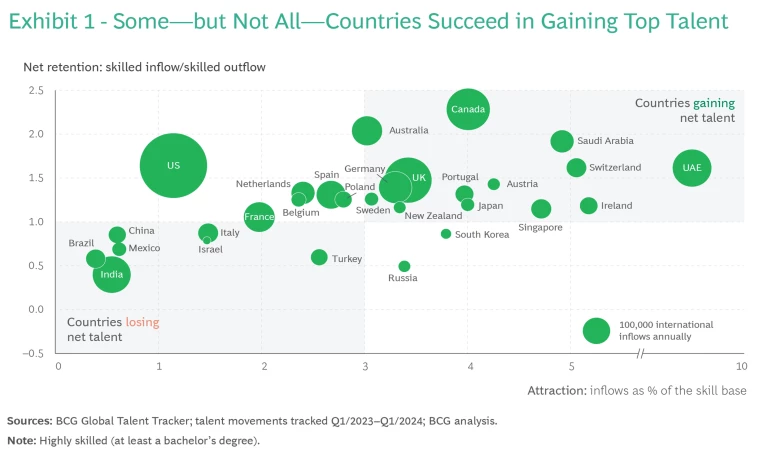

Let’s zero in on international talent. Although global migration is at an all-time high and many cities are becoming noticeably more globally diverse, less than 80 million highly skilled workers live outside their country of birth. Most of these individuals live in just a few places (the US, Canada, the UK, and Germany)—but nations such as the United Arab Emirates and Saudi Arabia are fast catching up, owing to their greater share of worldwide talent inflows and increased retention rates. (See Exhibit 1.)

Meanwhile, labor shortages are costing the world economy more than $1 trillion a year, or more than $3 billion a day. Most of these costs are concentrated in the US, Germany, and the UK. For example, in the US, government programs such as the CHIPS and Science Act and Inflation Reduction Act (IRA) are running up against bottlenecks caused by a lack of talent, leading to delays in the setup of semiconductor foundries and clean-energy projects. In Germany, talent shortages cost the economy up to $85 billion annually.

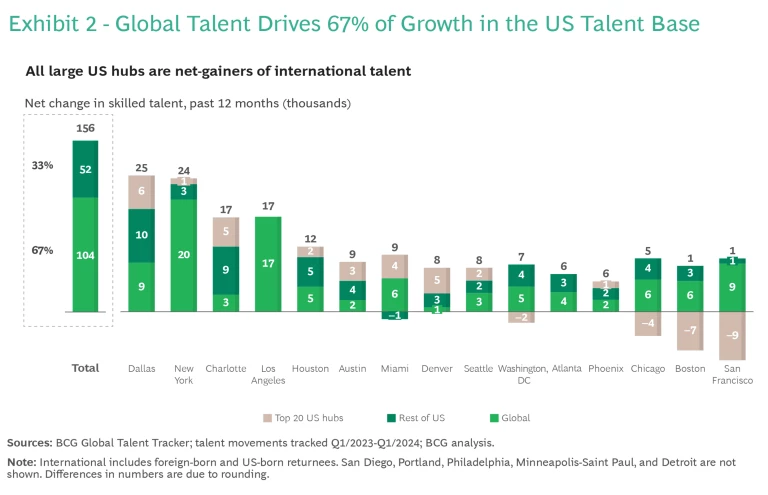

While upskilling local talent can help address these shortages, global talent can be a prime lever as well. In fact, it already makes a meaningful contribution. Nearly all the labor force expansion in the US since the onset of COVID-19 in 2020 came from international workers. This also holds for highly skilled employees. We recently analyzed talent flows to and from the largest US economic hubs and found that two-thirds of the net growth in these hubs’ talent base came from global workers. (See Exhibit 2.) In the absence of international talent, four major hubs (Boston, Chicago, San Francisco, and Los Angeles) would have faced a net exodus of skilled professionals.

Of course, facilitating the movement of highly skilled global talent poses challenges for public leaders. Migration is a complex topic in which cultural, political, and social concerns are intertwined with economic, technological, and geostrategic goals. That’s why before defining and discussing the role of TFs, it is important to acknowledge two issues.

First, the political debate on global talent is extremely polarized. On one hand, some people in destination countries fear that migrants will bring down wages. Such fears are natural, but numerous studies have shown that

global talent

—especially highly skilled talent—tends to raise local workers’ wages, create jobs, and broaden the tax base. On the other hand, people worry about facilitating a potential brain drain in countries of origin. Recent research should alleviate these concerns: two-way knowledge flows between origin and destination contribute to knowledge sharing and technological catchup in developing

Second, while attracting global talent is often linked to the need for visa system reforms, this isn’t always the case. In the US, for instance, there is potential within the existing visa framework, such as using J-1 visas for STEM researchers, tapping O-1 visas for highly skilled individuals, or accessing uncapped H-1B visas via universities and nonprofits. In Europe, the relocation of skilled professionals is usually not quota-restricted; they can move easily if they have a valid job offer.

Because visa systems are not always the main hurdle, and are hard to change, the focus should shift toward facilitating the overall journey of talent. This includes addressing skill gaps, helping with job placements, and aiding companies in relocation and integration of international workers.

Moving from Talent Attraction to Talent Funds

TFs are a step change evolution of existing models, built on the lessons learned from talent attraction initiatives pioneered in prior decades. Previous solutions address only parts of the overall challenge and largely fall into two broad categories.

The first is location branding. The UK, France, and Dubai—as well as US states like Michigan (“You can in Michigan”), among many others—market and brand their locations to global job seekers. These programs focus on the top of the funnel through marketing campaigns, career fairs, and job boards.

The second category is employer support. Initiatives such as Berlin Partner, Work in Finland, and Singapore Global Network include employer-facing services to support businesses by providing visa services and curated lists of recruiters and, in the case of Singapore, by building global talent communities through focused networking events.

TFs expand on these two basic models by covering the entire talent journey (or value chain, from attraction to upskilling, relocation, matching, and integration), through an ecosystem rather than through direct service provision, and by measuring their success in terms of the number of workers placed in the local economy as well as the net fiscal benefit generated. (See Exhibit 3.)

TFs are initially funded by a government, private or philanthropic entity, and pay service providers (including employers if they deliver measurable integration benefits) according to a clear outcome metric. This could be either a fixed sum (for example, $15,000 per employee) or a percentage of the income taxes generated by the person. While taxes continue to accrue to the local, state, and federal public sector organizations, these entities can commit to returning a fee to the TF to make sure that the fund’s budget balances in the long run.

To accomplish their goal of driving economic and fiscal returns, TFs have five key characteristics:

- They establish one executive owner, with clear accountability for the overall number of, and economic impact delivered by, talent moving to a target destination.

- They orchestrate an ecosystem of external partners across the private and not-for-profit sectors to enable the provision of services to search for, upskill, relocate, match, and integrate global talent.

- They operate with a clear ROI logic, as self-financing entities that fund—on an outcome basis—strictly fiscal-return-positive activities that attract and retain talent.

- They serve the industrial policy of their government sponsor by being industry agnostic but have the potential to be embedded in specific innovation clusters or tech hubs.

- They work end to end by ensuring that all activities along the talent journey are covered and reinforcing one another, avoiding the current high degree of fragmentation.

The Creation of Talent Ecosystems

TFs successfully set up an ecosystem to improve talent search, upskilling, relocation, matching, and integration outcomes for individuals and firms. To do so, TFs need to take a de-averaged approach to supporting the talent ecosystem once established. (See “Outcomes-Based Funding Models in Global Talent Ecosystems.”)

Outcomes-Based Funding Models in Global Talent Ecosystems

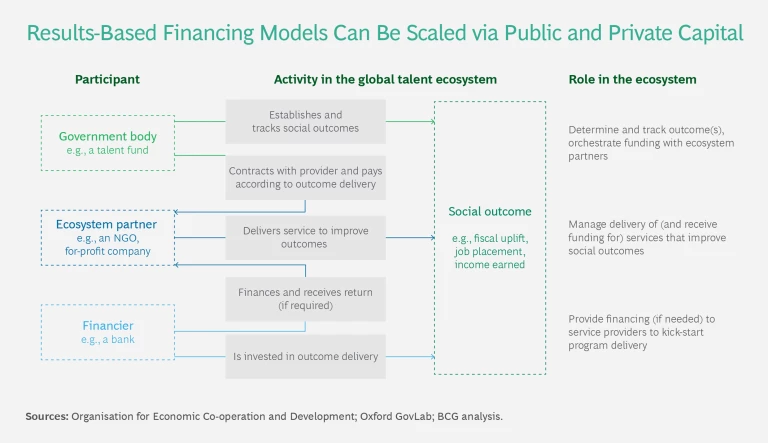

To establish an outcomes-based funding ecosystem, public leaders must consider four threshold questions (and potentially one additional question).

Do private or civil sector players have a comparative advantage? In the case of global talent, the international scale achievable by recruitment firms and other bodies, such as NGOs, may enable them to better experiment with innovative training models than government can.

Are there ways to clearly track outcomes and identify the value created by service providers? The benefit of talent to governments can be quantified through estimates of their fiscal impact (see below); the attribution of outcomes to service providers could be done via a digital ledger that documents talent, services provided, and outcomes achieved.

Can government ensure that service providers act consistently with broader social objectives? Quality standards could define how talent providers engage with potential globally mobile talent and impose constraints (on certain occupations, for example) or other criteria to prevent discrimination.

Is there long-term potential for a viable market to exist? Given the outsize value at stake from improving the flow and outcomes of global talent, government will likely be able to finance ecosystem partners with the fiscal benefits achieved.

(Not required, but desirable) Is there a feasible pathway for government to eventually retreat? Ideally, outcomes-based funding can be successively scaled down as more vendors compete and drive efficiency, creating performance transparency that allows private capital to come in.

The specific role of a TF will vary (both in intensity of involvement and in approach) across the talent journey, depending on the amount of public value at stake at each step and the maturity of the existing service ecosystem. On the basis of our initial assessment, we believe TFs may need to steward a new top-of-the-funnel market for talent attraction and identification, while accelerating upskilling in emerging markets and providing quality management in the existing flourishing market of recruiting and job matching.

TFs do not need to start from scratch when designing a talent ecosystem. They will be able to take advantage of a healthy industry of existing and yet-to-be developed solution providers. When it comes to talent attraction, organizations such as the Edmund Hillary Fellowship, Malengo, and many others run programs to find top talent globally and actively encourage cross-border movement from these individuals to support their growth. For talent upskilling, NGOs (like ReDI and Imagine Foundation) and private sector players (such as Magic Billion) invest in developing global talent through innovative training programs. For talent relocation, there is already a well-functioning market of private sector legal organizations (such as Fragomen, Localyze), global talent solution providers (including Cultural Vistas, Open Avenues’ The Build Fellowship, Labor Mobility Partnerships), associations (like the American Council for Immigration or SHRM), emerging startup players (Plymouth Street, Lima, for example), and recruiting partners.

TFs would create a new market for such service providers by paying them a success-based fee. Success could be defined as placing a global employee in a job paying at least a threshold income (and thus a certain level of taxes and social security), provided the worker remains in that job for at least six months. By closely linking public payments to economic outcomes, the fund can avoid misallocating resources or paying for low-performing programs.

The use of financial incentives to attract and retain workers isn’t entirely new: Tulsa Remote, a program cofunded by the US state of Oklahoma and a philanthropic donor, hands out $10,000 grants to remote workers willing to relocate to the city of

Assessing the Benefits

Overall, this approach improves outcomes for global and local talent, as well as current and future ecosystem partners, compared with the status quo in a few key ways.

Creating a TF is the first step to unifying the fragmented talent journey. Global employees face numerous pain points along their journey, and as a result, many stop pursuing their goal of moving to another country for work. Universities, for example, could play a much more enabling role in helping foreign students stay in the country, by providing early guidance on accessible visa pathways. Schmidt Futures, a think tank, estimates that there are thousands of highly skilled STEM graduates in the US at any given point in time who could stay in the country if universities’ career services and technology offices built stronger visa and immigration support capabilities. In a more competitive landscape of education providers, such services could be a novel source of added value and differentiation. Providing a single entity with end-to-end accountability and complete oversight of outcomes will enable a view of where investments are needed and help smooth the process.

TFs align the incentives of ecosystem partners to deliver net fiscal revenue. Recruiters today have every incentive to place talent in a job but may not have the long-term incentive to ensure that people integrate well and see continual wage growth. Meanwhile, training providers often get paid irrespective of the economic outcomes they enable. The new model provides the ability to generate returns to ecosystem partners that deliver public value, thereby opening the window for inflows of private capital. This could take the form of equity or debt funding to vendors or the provision of income-sharing agreements to talent.

TFs enable scale, specialization, and standalone viability. Current global-talent mobility programs are in many cases inefficient. Many serve only a small number of people (some less than 10, most less than 100) and rely on continued grant funding from governments (often in the millions of dollars), rendering them relatively inefficient on a per capita basis. By bringing private capital onboard and allowing ecosystem partners to specialize along the talent journey, TFs reduce the barrier to entry for new participants, helping them be founded and get funded.

Making the Business Case

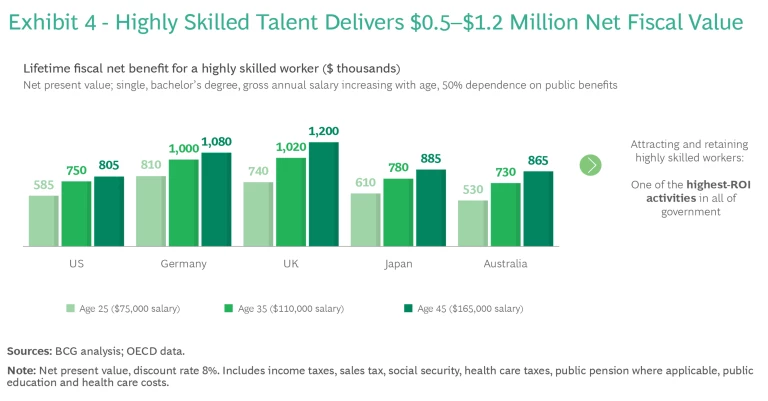

Attracting and retaining global top talent generates a substantial ROI. We have modeled the fiscal costs and benefits of these professionals across countries. While typical wages, taxes, and government services vary, the picture invariably remains true: the net present value (NPV) of a worker successfully attracted and placed in a job typically dwarfs any initial recruitment costs.

For example, a highly skilled person earning a gross annual wage of about $110,000, arriving at age 35 in the US, will alone (irrespective of any potential family members) generate an NPV of $750,000 in fiscal benefits. These numbers are significantly greater in some nations with elevated tax rates and of course depend on the age of the employee at arrival, family structure, and ability of a country to retain its global workers. (See Exhibit 4.)

Compared with these benefits, the full-journey costs of talent attraction are small, amounting to as little as $5,000 to $30,000 when using private sector partners with well-defined targets and experience in finding global talent. On a per capita basis, that’s a 30x to 60x ROI assuming total costs of $15,000 per attracted employee—this return does not even account for the many second-order economic benefits of immigrants’ spouses and children over future generations.

The same logic holds when looking at the fund level. We modeled the initial startup costs and running operational costs of such a fund, including the success-based payments to ecosystem partners. Assuming a modestly sized TF that could attract about 1,000 highly skilled employees per year, some of whom arrive with spouses and kids and stay on average ten years, it would require an initial investment of $15 million with running costs of up to $18 million (driven largely by $15,000 in results-based financing per person plus personnel and operations costs) to generate a total NPV of $180 million after only four years of operation. These numbers take into account federal and state income taxes, sales taxes, social security, and health care taxes as paid by the employee and employer, as well as public health care and education costs for accompanying children. With a fund level ROI of approximately 10x, the successful attraction and retention of top global talent may be a public activity with one of the greatest potential returns for government.

The successful attraction and retention of top global talent may be a public activity with one of the greatest potential returns for government.

Five Steps to Set Up a Talent Fund

TFs can be established on the national, state, or city level, or as part of a new tech hub. They can be geared toward attracting and retaining any type of talent: global, local, or remote; highly skilled or vocationally skilled. Here’s how policymakers can get started.

- Set an ambitious yet achievable target, on the basis of a compelling business case for why change is needed that demonstrates the economic benefit for local residents. Canada, for instance, established a public goal of attracting 500,000 permanent migrants annually by 2025 and recently set a target to lure away 10,000 highly skilled global knowledge workers from the US, making the case that it was vital to the country’s growth prospects. In December 2023, Australia launched its new migration strategy, “getting migration working for the nation,” which puts the value of global talent for domestic workers, businesses, and all Australians front and center in its communication. In Tulsa, the city markets its initiative locally by highlighting the GDP impact of freshly attracted remote workers.

- Identify skill needs and talent pools to tap into when local-talent pipelines cannot reliably fill skill needs in the future. In the US, tech hubs, for example, may choose to prioritize skills suited to semiconductor or clean-energy industries given the requirements of the IRA or may decide to focus on remote workers. Policymakers can also start by using existing analyses of job shortages by occupation that national labor agencies produce, but experience shows that trying to micro steer according to the target occupations of the future can be hard. Given the structural lack of workers, we recommend beginning with highly skilled talent in STEM and health care fields.

- Pilot solutions and build capacity in the ecosystem in the area where the TF, through its ecosystem, is uniquely positioned to make a difference. In the US, for instance, this could mean building firms’, universities’, and cities’ capacity to create pathways for highly skilled global talent—for example, by leveraging cap-exempt H1-B programs or using new J-1-exchange visa guidance from the US Department of State to attract and retain STEM researchers. While pioneering firms like Intel and states like Massachusetts, South Carolina, and Michigan have deployed some of these pathways, there’s significant potential for more uptake. In Germany, it could mean investing in solutions to upskill green-tech workers in specific renewables engineering or language skills before relocating.

- Build the ecosystem using results-based financing, which requires tracking success, including the identification of talent, alongside quality control and guardrails to incentivize the right outcomes in the ecosystem. For example, new ecosystem providers will need to be greenlit by a quality screening process before delivering success-based funded services. Developing a lean digital solution to enable verifiable tracking will be key and could leverage existing software architectures of private sector players.

- Create a small team and clarify the setup (either within an agency or as a standalone entity), bringing the best talent together with backgrounds in recruiting, talent identification, data analytics, and incentive system engineering. The best solution will depend on the level of government. At the national level, it will likely be the cleanest, but politically most difficult, setup to have a new agency start with a clear mandate and accountability. At the state, city, or tech hub level, it will be beneficial to partner closely with other tech hubs and city-level teams to drive synergies. The city of Magdeburg in Germany, which is fast turning itself into a semiconductor hub thanks to a $30 billion investment by Intel, is collaborating with local universities and research institutes to build a local-talent pipeline and broaden global-talent access.

TFs present a novel, actionable, and scalable solution that meets the size of the global talent shortage—the combined cost of which is in the trillions of dollars. These funds come with a clear business case for action and do not rely on changes in visa regulations to scale. They complement existing workforce development efforts and can be deployed to attract and retain all kinds of talent: global, local, highly skilled, or deskless workers. Now is the time for government to join hands with the private and civil sectors to build a new foundation for national economic, technological, and geostrategic advantage.