The US health care market has weathered a storm over the past few years. Although health care deal volumes were significantly lower in 2023 than in past years, we now appear to be approaching calmer waters. There is reason to be cautiously optimistic that more robust transaction volumes will return , driven by strong underlying market fundamentals (US health care spending continued growing at 5%, and patient needs remain high as the population ages) and the slow convergence of seller and buyer valuation expectations. Buyer confidence must continue to grow, however, if transaction activity is to accelerate.

Two factors are likely to lead to more high-quality assets reaching the market. Many owners—both corporate and private equity —have spent the past year making operational improvements across their portfolio companies which should result in stronger businesses that they are more confident about bringing to market. Private investors also have a rising need to offload assets and return capital to their limited partners, leading to an increase in assets coming to market. The average holding period for North American private equity funds hit a 20-year high of 7.1 years in November 2023.

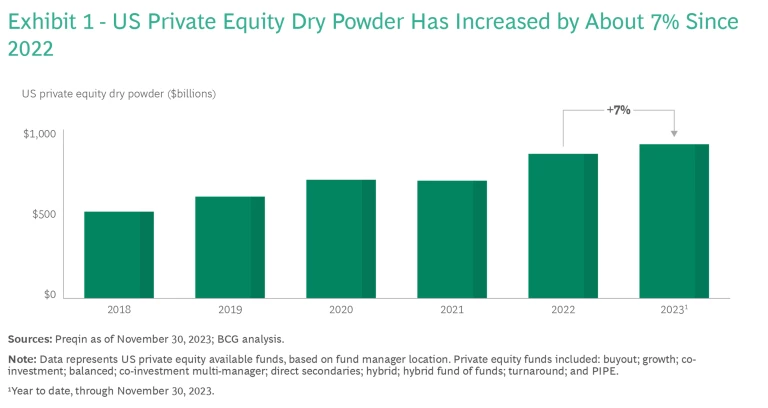

The buyer outlook remains mixed for 2024, with about 40% of investors feeling bullish about prospects for the next year, down from 50% in June. However, in BCG’s latest investor survey, 65% report an optimistic outlook over the next three years, with potential for confidence about 2024 to increase if macroeconomic conditions improve. In addition, dry powder held by US private equity investors has reached an all-time high of some $1 trillion, evidence that the capital is there to make deals happen once confidence grows. (See Exhibit 1.)

Here are some key market trends to consider in health care investments in 2024 and beyond. While it’s impossible to detail all of the trends affecting the health care sector and its individual segments, we have tried to capture the key trends that investors need to consider as they set their 2024 investment strategies and look at specific opportunities.

Health Care Sector Trends in 2024

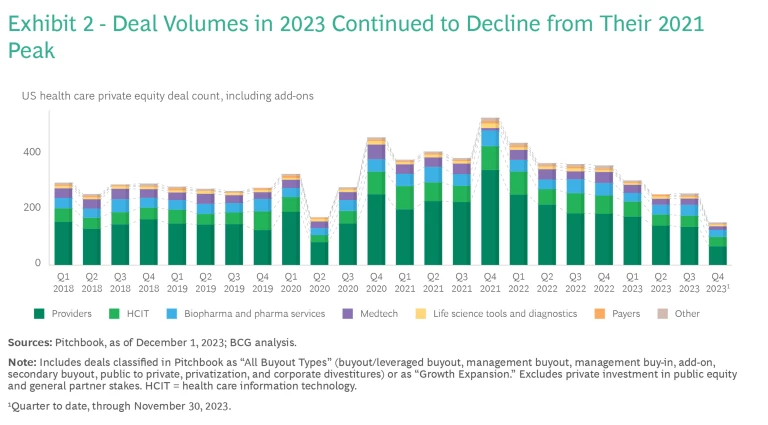

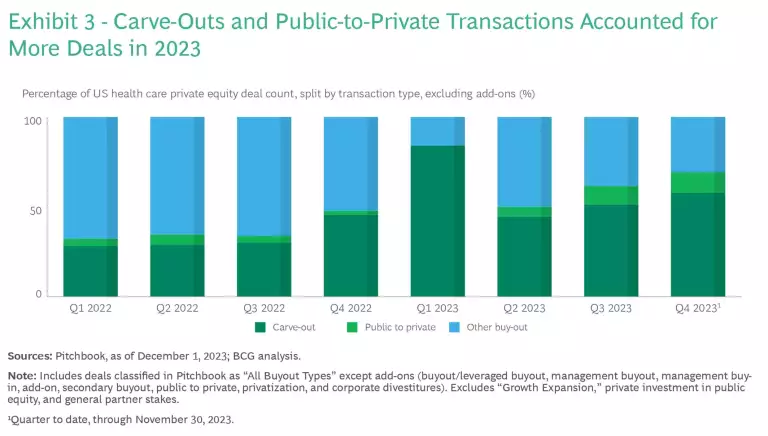

More normal trends returned to the health care sector in 2023, but mismatched valuation expectations between buyers and sellers perpetuated uncertainty, causing the deal market to remain slow. (See Exhibit 2.) A drop in private-to-private deals led to greater interest in take-private transactions and corporate carve-outs, which increased as companies doubled down on high-growth, high-margin businesses and looked to divest lower-value business lines. (See Exhibit 3.)

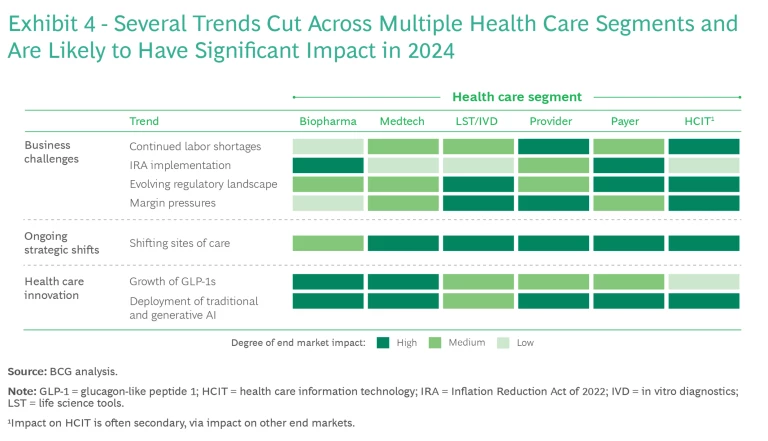

Several key challenges remain in play, including difficulties in ensuring a sufficient supply of high-quality labor, geopolitical turmoil, worrisome interest rates and inflation, and the continuation of a tight credit market. These, along with a number of health-care-specific trends, will have varying levels of impact across industry segments, which investors should keep top of mind as they formulate theses and conduct diligence on target companies in 2024. (See Exhibit 4.) Here’s a summary of the major trends.

Continued Labor Shortages. Providers have faced labor market tightness since the pandemic. Low levels of staff satisfaction and high levels of burnout are continuing problems. Providers are looking for solutions that reduce staff workloads and increase efficiency. They are also paying more attention to remote-care and home-care solutions that can reduce the demands on in-house staff. The search for labor-related solutions is creating opportunities for suppliers of medtech and life science tools (LST).

Inflation Reduction Act (IRA) Implementation. Enacted in August 2022, the IRA will soon have its biggest impact on the health care landscape as implementation of the most significant Centers for Medicare & Medicaid Services (CMS) components start in January 2024. Biopharma, payers, and providers will be the most affected industry segments. The CMS changes support a biopharma shift toward biologics and provider-administered medications while increasing the pressure to shorten development timelines to maximize new drug revenue. The changes could disrupt the pharma services market, providing growth opportunities for differentiated contract research organizations (CROs) and marketing services firms that can expedite time-to-launch. The IRA will also push payers to cover a higher share of CMS drug costs, pressuring payers to reduce costs by shifting the burden to providers where possible and by investing in efficiency-boosting health care information technology (HCIT) solutions.

Evolving Regulatory Landscape. Recently passed and proposed regulations from multiple federal agencies, including the FDA, the CMS, HHS, the FTC, and the Consumer Financial Protection Bureau, will inject uncertainty throughout the health care landscape. A proposed FDA rule on laboratory developed tests (LDTs) is likely to raise costs for labs with novel tests. The risk adjustment and coding updates embedded in the new CMS V28 model will affect payer operations and reimbursements. A slew of data laws (such as the Health Privacy Act of 2023, the No Surprises Act of 2022, and the Trusted Exchange Framework and the Common Agreement of 2022, to name a few) should propel development of HCIT solutions that lead to increased price transparency, better and more secure data sharing, and digital preauthorization.

Margin Pressures. In recent years, organizations in multiple health care segments have faced challenges to profitability from a range of factors, including staffing shortages, rising labor costs, inflation, and supply chain disruption. We expect medtech and LST manufacturers, providers, and payers to focus on maintaining or increasing their profitability in 2024 through operational improvements, more rigid supplier price negotiations, innovative use of technology, and portfolio reshaping.

Shifting Sites of Care. Payers, patients, and physicians are helping to drive the continued transition of care away from hospitals and toward outpatient care settings. Payers welcome the lower costs of care, patients appreciate the convenience, and physicians see an opportunity to take ownership stakes in the new facilities. The ongoing shift will drive increased revenue growth for specialist outpatient centers and provide roll-up opportunities for investors in relevant specialties such as cardiology, orthopedics, personal care, and home and ambulatory infusion. This shift to outpatient care will drive demand for built-for-purpose HCIT solutions, including revenue cycle management programs, digital front-door solutions, and specialist electronic medical records (EMR) platforms. IT will also encourage strategic shifts in medtech as demand rises for new remote patient monitoring devices and other solutions to serve these alternative care settings.

Growth of GLP-1s. GLP-1s were the center of attention in biopharma in 2023, and they are likely to see further strong growth in 2024, with possible ramifications for company valuations and increased demand for relevant pharma services. The growth of GLP-1s has potential implications for some specific sectors of the MedTech market, possibly reducing demand for certain devices and increasing demand for others, although the overall outlook remains uncertain.

Deployment of Traditional and Generative AI. Traditional AI has been gaining traction over the past few years, and generative AI (GenAI) saw strong initial uptake in 2023, with wider deployment likely in 2024. Traditional AI will increasingly be used to streamline administrative tasks (such as medical note taking, coding, and marketing) for providers, payers, and OEMs, while GenAI should see widening adoption for clinical and science-based applications such as clinical decision support and drug discovery.

Segment-by-Segment Impact

The trends described above interact with one another and affect each segment—

providers

,

payers

,

biopharma

,

medtech

,

LST and in vitro diagnostics (IVD)

, and

health care IT

—differently. In addition, trends specific to each segment will play a role in shaping investment opportunities.

Providers

Providers have faced challenges from multiple directions in recent years. The biggest of these relate to ensuring continued access to skilled labor, boosting profitability through better resource allocation and efficiency, and adapting nimbly to shifting dynamics in the marketplace.

Labor. Providers will continue to invest in solutions to reduce burnout, boost retention, and ensure a robust labor pipeline. They will prioritize improving the mix of labor they use as well as investing in education and partnering with medical schools to ensure that they capture the top of the professional funnel. Other areas of focus include investing in IT and service solutions, including GenAI tools, to lessen the administrative burden on staff; ensuring more efficient scheduling; and streamlining workflows. The immediate emphasis for AI is on administrative functions such as HR, billing, customer service support, enrollment, claims processing, and coding. But adoption will rapidly progress to clinical support in the form of clinical note taking via voice transcription and AI/natural language processing, and discharge note summarization. Ultimately, GenAI use will extend into aspects of clinical decision support, including automated diagnoses and care planning.

Profitability. Hospitals and outpatient care centers are seeking to boost profitability in multiple ways:

- Optimizing care pathways and internal processes

- Reducing staff costs and turnover

- Delaying capital expenditures

- Expanding outsourcing

- Investing in revenue-generating and operation-optimizing IT solutions

Providers want to reduce friction in their internal processes in order to boost efficiency through strategic shifts and investments. They are looking to reduce labor costs, which may involve decreasing their use of temporary staff in some areas, such as nursing, while increasing it in others. These efforts have varied implications for staffing agencies. Providers are also expected to reduce capital expenditures in the short term, creating a headwind for some medtech and LST suppliers.

Robust demand will continue for IT solutions that generate incremental revenue and deliver demonstrated ROI by increasing patient volume and enhancing interaction and stickiness. Revenue-cycle management solutions, patient access tools, digital front doors, and patient portals should benefit. Providers are also looking for advanced payment solutions that improve the patient experience and increase providers’ success at collections. Providers will likely try to reduce their administration and cost burden through increased outsourcing, especially for functions that benefit from the scale that outside vendors can provide, including IT, HR, payroll, lab services, supply chain management, and marketing.

Shifting Sites of Care. Payer and patient pressure to shift care to outpatient settings is driving growth of specialist outpatient services and more rethinking of provider footprints. We expect a growing volume of acquisition and roll-up opportunities, particularly in specialties that are traditionally offered in acute settings but that can be shifted to outpatient care to deliver cost savings. These include orthopedics, infusion, cardiology, gastroenterology, and potentially urology. Specialist providers that focus on chronic care may also see growth from payers’ sharper focus on value-based care in specialties where significant savings seem achievable (renal care, cardiology, and oncology, for example). The growth of outpatient specialist care centers could also drive demand for specialist IT solutions, such as EMR and workflow tools and software to handle the interface between provider and payer systems. As care and access issues in rural America remain in the spotlight, we expect to see innovative solutions in these areas; however, labor supply will be an ongoing concern.

Payers

The payer landscape continues to evolve. Payers are facing margin pressure due to rising costs of care and altered regulations. Value-based care continues to gain traction. In addition structural shifts are underway in the commercial insurance landscape as more employers embrace “administrative services only” contracts and third-party administrators (TPAs).

Margin Pressure. Payers have seen the cost of care rise as a result of many factors, including a post-COVID-19 rebound in patient volumes, clinician wage inflation, and increased use of specialty pharmacy. These margin pressures are likely to continue, driven in part by regulatory developments, motivating payers to invest in back-office automation tools that will drive organizational efficiencies and middle-office tools that will reduce cost of care (network management and utilization management, for example). IT solutions that facilitate data exchange—particularly between payers and providers of smaller-scale, non-acute care—are another payer priority. Payers are also investing in member analytics and experience tools, as they seek to improve their understanding of members as consumers.

Regulation. The IRA and new CMS rules further increase pressure on payers’ margins and engender uncertainty in the market. The IRA will lead to higher drug costs for payers, while new CMS rules relating to coding and marketing will limit revenue growth. Utilization management restrictions will limit how payers can manage cost of care. To boost operating efficiency and effectiveness and to reduce the overall administrative burden in this new environment, payers will likely turn to technology, including GenAI tools that reduce workloads and associated costs—such as solutions that focus on prior authorizations, customer and member support, and coding review.

Value-Based Care. Value-based care started to gain significant traction during the past year. This trend is expected to continue, driven in part by the growing margin pressures that payers face. Expanding adoption will fuel more investment in analytics that enable value-based care (such as member and network management, contract enablement, financial risk analysis, and payment and reimbursement reconciliation) and preventive care platforms, including chronic-disease management programs, to manage population risk.

Evolving Commercial Insurance Landscape. The payer landscape is evolving, with potential for significant disruption from—and opportunity to invest in—TPAs. As health care expenses increase, demand is growing for efficient management and for cost containment solutions that TPAs provide. A new class of modern TPAs is emerging with best-in-class technology and customer-focused (employee and employer) interfaces and capabilities. TPAs are increasingly moving upstream, with a value proposition focused on flexibility and a tech stack unburdened by legacy constraints.

Biopharma and Pharma Services

Biopharma will see plenty of change, led by the implementation of the IRA, the growth of GLP-1s and other advanced modalities, and the continued development of AI and GenAI capabilities.

IRA. This signature legislation will have at least three major effects on the biopharma segment:

- It will boost biologics-focused CROs and contract development and manufacturing organizations (CDMOs). Companies will continue to base their investment decisions on an asset-by-asset analysis, of course. But direct negotiation rules now incentivize the development of biologics over small molecules because the latter are subject to price negotiations four years earlier than the former. CROs and CDMOs with biologics capabilities (such as biomanufacturing, mammalian cell culture, and cold chain logistics) may see increasing demand.

- It will increase demand for differentiated tech-driven CROs and site management organizations (SMOs). Direct negotiation rules will put greater emphasis on development timelines and early approval for multiple indications, benefiting CROs and SMOs that can support faster development (for example, by using such tools as eCOA and ePRO, digital- and AI-supported patient recruitment, and decentralized trials to increase efficiency).

- It will benefit differentiated commercialization and advisory services. IRA implementation may pull forward some spending as biopharma companies adapt their commercialization strategies and try to maximize opportunities while their drugs are under exclusivity. Some pharma companies are accelerating pricing or payer analyses, and subsequent negotiations, in response to the IRA and growing pressure from pharmacy benefit managers. They are also expediting outreach to providers and key opinion leaders. The IRA-driven shift toward biologics will boost demand and budgets for outsourced services, since biologics generally require more spending on commercialization. Greater focus on development and commercialization timelines, as well as on exclusivity periods, will provide opportunities for differentiated and tech-enabled players that run streamlined processes.

Advanced Modalities. Oher pharma developments are likely to focus on antibody drug conjugates, radiopharmaceuticals, and cell and gene therapy. The need for additional manufacturing capabilities for these treatments will drive demand for many relevant derivative services—CROs, CDMOs, and other R&D service providers and commercialization companies, including hub service vendors. As advanced modalities frequently target small patient populations, there is also a need for differentiated CROs and SMOs that can effectively and efficiently run trials on small populations, providing an opportunity for tech-driven players. In addition, we expect to see increased investment in patient-facing HCIT and hub service solutions as pharma companies look to connect directly with patients to ensure medication uptake and adherence, improve outcomes, and offer payment support programs.

GLP-1 Demand. Growth in GLP-1 demand is likely to continue, adding pressure to enlarge manufacturing capacity and providing a lift to GLP-1-capable CDMOs (such as those with microbial fermentation capabilities). The expansion of approved applications for current GLP-1s (possibly to include chronic kidney disease and sleep apnea) and the launch by major players of new GLP-1s into a crowded field will increase the need for patient and commercialization support. GLP-1 growth may generate headwinds for certain other treatments in related therapeutic areas, such as drugs for cardiovascular disease, but the outlook remains uncertain.

AI and GenAI. Pharma companies are pursuing greater use of AI and GenAI at multiple stages of the value chain, including drug discovery and development and drug commercialization, but traction has been limited thus far, and private equity may see limited AI-related investment opportunities over the next few years. Medical communications and marketing services are generally more susceptible to GenAI disruption, which may cause difficulties for incumbent businesses.

Medtech

Like pharma, medtech is facing change on multiple fronts. Medtech companies want to head off rising margin pressures, ensure supply chain security, and adapt to the changes introduced by GLP-1s. The shift toward home-based care and the expanding adoption of AI are fueling growth in digital-enabled devices.

Portfolio Reshaping and Margin. Higher interest rates, coupled with the resetting of price expectations and the rash of supply interruptions following COVID-19, have led medtech companies to reevaluate their portfolios. This trend is likely to continue, providing opportunities for investors to acquire noncyclical, resilient businesses that can benefit from operational improvement. We also expect to see more outsourcing of manufacturing to CMOs as medtech OEMs strive to reduce costs and focus on core R&D and commercialization capabilities. Equipment suppliers are showing nascent interest in CRO services to support clinical development of medtech products.

Outpatient Care. With the rise of outpatient-based care services, demand is increasing for devices and implants designed with outpatient procedures in mind and for remote monitoring devices and accompanying direct patient engagement software. The shift to outpatient care is also driving medtech companies to adopt new commercial models to engage providers in more fragmented settings.

Supply Chain Resilience. Supply chain risks and disruptions have risen in recent years, causing OEMs to reassess their supply chain resilience. This provides opportunities for on-shore, near-shore, or low-cost friend-shore CMOs and suppliers. OEMs are also looking for supply chain management IT solutions and vendor consolidation to increase resilience—both of which provide opportunities for health care investors.

GLP-1s. The continued volume growth of GLP-1s will have a mixed effect on medtech, driving increased demand for injectors and potentially having a positive impact on some devices but a negative effect on others. In the short term, GLP-1s may make more patients eligible for certain procedures, such as joint replacements, while undercutting alternative treatments such as insulin injectors. In the longer term, GLP-1s could have a detrimental impact on bariatric procedures and orthopedic implants, as fewer patients will suffer from obesity and associated osteoarthritis. Overall, the jury is still out regarding the mixed array of implications of GLP-1 growth, but the generalized disruption will certainly provide opportunities for investors.

AI. Expanded use of AI and GenAI in imaging, robotic surgery, and implant manufacture is enabling greater personalization of care that could boost demand for additional supportive services. OEMs may look to build, buy, or partner on AI and GenAI capabilities, giving investors the opportunity to gain exposure to higher-growth areas within medtech by investing in companies that focus on AI capabilities.

Life Science Tools and In Vitro Diagnostics

The life science tools (LST) and in vitro diagnostics (IVD) markets underwent a lot of change following the onset of COVID-19. LST has strong fundamentals, with ongoing activity in discovery, research, and manufacturing that should drive continued growth despite some tightening of biopharma and biotech budgets from pandemic highs. IVD OEMs have seen revenues normalize as the pandemic has receded, with some declines in profitability for large players and bigger declines for players newer to the scene.

Robust Demand for LST. Established offerings for biopharma R&D and production continue to draw strong demand as a result of underlying market growth. Academic labs are looking for more innovative instrumentation and continue to buy high-quality research-grade reagent inputs. Investors can expect opportunities for growth in both one-time capital and recurring revenue streams, but they should keep an eye on supplier consolidation trends and lab purchasing behavior. Bioproduction facilities will need materials across categories of single-use consumables, bioreactors, and chemicals to support the strong growth expected from new modalities such as antibody drug conjugates and biologics. As a result, input suppliers remain attractive and have a reliable growth outlook as they benefit from recurring revenue and diversified exposure to a broad range of end markets. Support services such as lab automation, inventory management, and testing, inspection, certification, and compliance can be attractive, too, as they offer investors critical support functions and a recurring revenue stream along with exposure to innovative growing modalities without scientific risk.

IVD Profitability Challenges. Large IVD OEMs face a different set of difficulties than smaller OEMs and laboratory developed testing (LDT) companies. Most established OEMs have experienced declining revenues as the urgency surrounding COVID-19 has faded, causing a modest drag on profitability, but their outlook remains relatively stable. Smaller OEMs and LDTs have faced more significant challenges to profitability stemming from their small scale, and this has resulted in falling valuations. LDTs may also face challenges from proposed FDA regulation changes that could raise development costs for labs with novel tests. Scale is the most viable path to regained profitability, presenting an opportunity for investors to combine assets into single platforms. Specific strategies could entail combining product portfolios to achieve single-vendor scale in sample processing, and combining back office and overhead functions to help restore companies’ profitability and create value during a private ownership period.

Services companies that provide logistics, reagent inputs, and market access to LST and IVD players are likely to see robust growth and are worth keeping an eye on.

Health Care IT

As indicated in the preceding segment descriptions, all players in the health care market are looking for solutions that drive revenue, reduce workloads, improve operational efficiencies, and cut costs, providing an extensive range of opportunities for HCIT vendors and investors. The shift to different sites of care, continued deployment of value-based care, ongoing digitization of health care, and rapid improvements in AI capabilities have opened additional areas of opportunity. Here’s a wide-ranging but undoubtedly incomplete list of the opportunities in various industry segments.

Providers

As noted above, providers are looking to health care IT providers for solutions that will help them deal with labor shortages, profitability pressures, and shifting sites of care. These include:

- Revenue-generating IT solutions that generate incremental revenue, such as revenue cycle management and digital front-door solutions

- Workforce management solutions that enhance staffing efficiency and decrease reliance on expensive travel resources

- EMR and workflow solutions that serve outpatient care settings, specialist OP centers, and home care

- AI back-office administrative support solutions and GenAI solutions for clinical decision support, translations, note taking (including voice transcription), and note summarizing

- Patient-facing HCIT tools that improve the consumer experience

- Provider-focused analytics solutions to enable value-based care, such as population health management

Payers

Payers are looking for IT help with solutions and technology related to value-based care in order to ease margin pressures and deal with regulatory shifts. For example:

- Back-end automation tools that bring efficiencies to routine functions such as claims processing and payment integrity

- Tech-enabled solutions to manage cost of care, such as utilization management, network management, risk assessment, and preventive care

- Solutions that facilitate interoperability between payer and provider systems, especially in out-patient care settings

- Member engagement solutions that enhance the member experience and boost member interactions

- Digital sales analytics for member acquisition and retention and for benefits assessments

- Payer-focused analytics solutions to enable value-based care, such as population health management

Biopharma and Pharma Providers

Operational efficiency tools, data analytics tools and services, and AI and GenAI are priorities for pharma and pharma services:

- Software to improve operational efficiency, such as laboratory information management systems and expanded laboratory management solutions

- High-tech discovery and research tools, such as GenAI-driven drug discovery tools that incorporate large language models

- Real world evidence and data analytics tools and services for market access, provider and direct-to-consumer marketing, medical affairs, R&D, precision medicine, predictive analytics, genome profiling, and more

- Pricing tools, models, and services for market access, gross-to-net optimization, and pharmacy benefit management, such as copay accumulators and maximizer tracking

Medtech

Medtech IT priorities include software for remote care, supply chain management IT solutions, and AI and GenAI:

- Software to support wearables and remote monitoring devices

- Go-to-market and logistics support for the ambulatory continuum

- AI and GenAI solutions for product enhancements and workflow support, such as use of AI algorithms for diagnostics interpretation, implant design, and surgical robotics

- Supply chain management IT solutions

Optimism is returning to health care M&A, but investors must consider many sector-wide and segment-specific trends for 2024 and beyond. Understanding the trends and their underlying drivers, and taking into account their potential implications, can help health care investors maximize value and mitigate risks as they set their investment strategy and perform deal due diligence in the coming year.

The authors thank the following BCG health care colleagues for their input into this article: Erik Adams, Sandra Andersen, Chris Bennani, Nate Beyor, Aaron Brown, Lu Chen, Kristen Cook, Victor Corzo, Colleen Desmond, Mike Duffy, Anders Faeste, Steve Filler, Erik Gilbertson, Austin Gispanski, Daniel Gorlin, Charles Hendren, Bas Indraneil, Jon Kaplan, Jim Meyers, Shashanka Muppaneni, Mrunalini Parvataneni, Sanjay Saxena, Susan Schriver, Brett Spencer, Ranjani Srinivasan, Sid Thekkepat, Johannes Thoms, Gunnar Trommer, Derek Wang, Chris Young, Kazim Zaidi, and Ery Zhu.