It’s a challenging time for health insurance companies around the world. Private health insurers—whether they have operations in one or multiple countries—face increasing pressure as global healthcare costs continue to rise and profit margins shrink. While patients demand superior services, they are dissatisfied with rising premiums. At the same time, despite significant insurer investments in new products and services, improvements in patient outcomes aren’t keeping pace with healthcare cost increases. This dilemma has given rise to numerous discussions between BCG and leading health insurance executives about how to strategically address these pressures.

There are many reasons for rising costs, some of them beyond insurers’ control. An aging population uses more medical services, while newer and more costly treatments, many of them pricey new drugs, continue to emerge. Many medical advances have revolutionized treatments in recent years, yet they are not always more effective. Overall, a quarter of the treatments patients receive are considered unnecessary, adding needless cost while doing little or nothing to improve health outcomes.

To rein in spending and improve outcomes, we believe that insurers should look to a strategy that, while not new, has yet to reach its full potential: value-based healthcare . Rather than focusing on the quantity of services provided, this approach emphasizes clinical value and best outcomes. It aligns patient, provider, and insurer financial incentives to encourage the use of high-value care and discourage care that is low value.

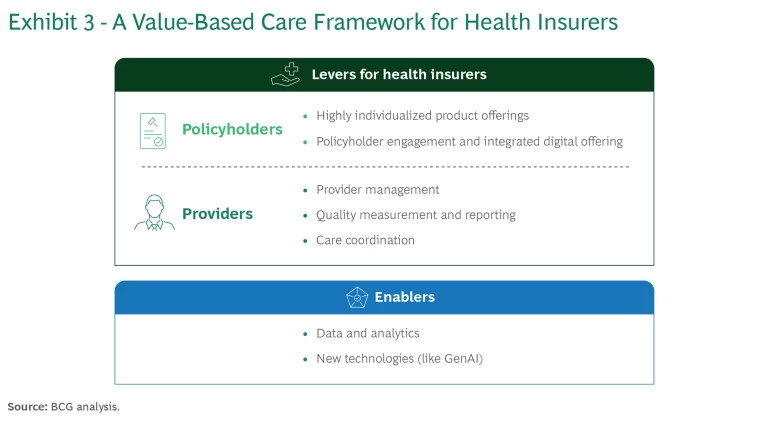

Our approach to value-based care consists of five levers aimed at both insurance policyholders and providers that together can help health insurers begin to implement these practices. The goal, no matter an insurer’s size or market share, is to control rising costs, improve healthcare outcomes, and increase customer satisfaction simultaneously. In this way, insurers can redefine the role of health insurance in promoting good health and truly go from payer to player by focusing on what can be achieved through value-based care rather than chasing reimbursement on a per-service basis.

Market Growth Has Failed to Drive Better Outcomes

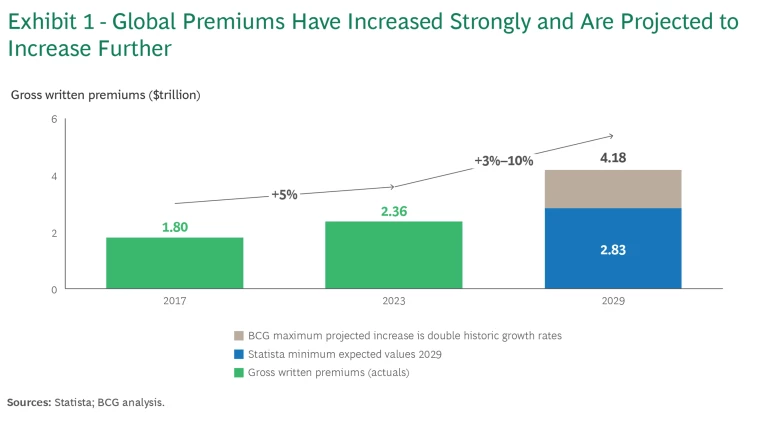

In recent years, the global health insurance market has grown substantially. In 2024, it is projected to reach $2.42 trillion in gross written premiums. Overall, the gross written premium compound annual growth rate from 2024 to 2029 is projected by Statista to be 3.18%, resulting in a market volume of $2.83 trillion by 2029.

Historically, the market has experienced premium growth rates of roughly 5% annually. Going forward, we expect that there may be even more marked increases in global gross written premiums, reaching a maximum estimated 10% annual growth. This would bring the global market size to more than $4 trillion by 2029. (See Exhibit 1.)

Profit margins have remained relatively constant over time. But pressures on health insurance companies are mounting. For example, private sector insurance premiums in many countries are at an all-time high in 2024 due to insurers covering higher healthcare costs in recent years.

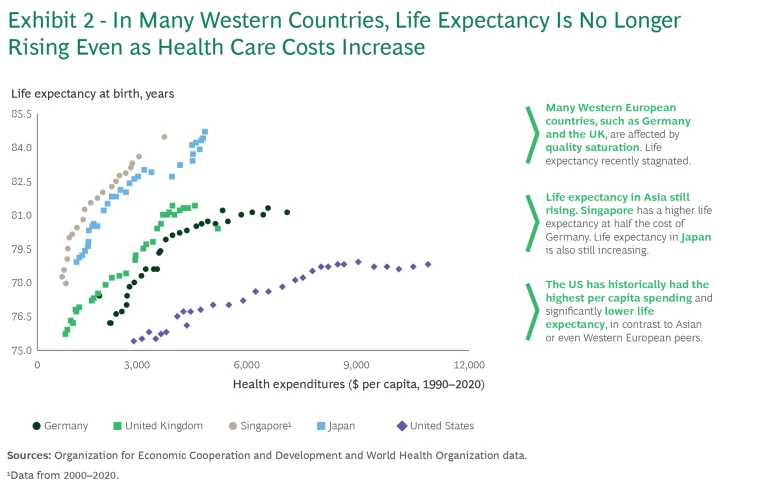

At the same time, despite substantial annual premium increases, patient outcomes have not improved commensurately, and life expectancy worldwide has barely budged in several years. The gap between rising healthcare costs and stagnant life expectancy can be attributed to several factors, including lack of access to care, costs associated with managing chronic conditions, and a focus on treatment rather than prevention, as well as the aging population. These complexities mean that simply spending more on healthcare does not guarantee better outcomes or longer life expectancy.

Looking at the correlation between life expectancy and general health expenditures, we observe that many leading European countries and the US seem to be approaching quality saturation, where higher spending leads to diminishing improvements in health. Some countries such as Singapore, however, continue to show improving life expectancies despite comparatively lower health expenditures. (See Exhibit 2.)

Value-Based Care Can Help Insurers Cut Costs While Improving Patient Outcomes

The concept of value-based healthcare was introduced more than 15 years ago by US business strategy and innovation experts Michael Porter and Elizabeth Teisberg. At its core, value-based care provides financial incentives to patients, providers, and insurers to choose care that has greater clinical value and avoid low-value care.

While the model has gained some traction, primarily among doctors and healthcare systems, insurers have faced several barriers to adopting this approach. Notably, the complexity of transitioning to a value-based model from fee-for-service payment systems, provider resistance, patient unfamiliarity with how the model affects their care, and inadequate data infrastructure have proven difficult for insurers to address. Some insurers have also expressed reservations about whether their comparatively small market share gives them enough power to seriously change practices of healthcare systems they service.

We believe there are important elements of value-based care that health insurers of any size can leverage to bring higher quality care and lower costs to their members. Despite the particularities of different healthcare systems, insurers are very well positioned to drive value-based care and lay the groundwork for a larger transformation of these systems. (See Exhibit 3.)

Key Actions for Insurers to Implement Value-Based Care Principles

BCG‘s approach consists of five interlocking levers that health insurers can use as a framework to begin to advance the practice of value-based care within healthcare systems. These levers apply technology, policy, and data reporting to raise the profile—and the benefits—of value-based care in the health insurer ecosystem.

Develop highly individualized tools to guide policyholder choices.

Today, many of the interactions that health insurers have with policyholders are not focused on their needs. By developing targeted, individualized communications and digital tools, insurers can change members’ expectations and gain their trust on questions unrelated to insurance reimbursement. At the same time, this shift in focus can differentiate insurers from other payers and provide a competitive advantage.

To implement this change, insurers should update products to encourage value-based behavior by policyholders. This can include preferred access to providers that balance quality and cost as well as higher co-payments for choosing non-preferred providers or out-of-network hospitals. Policyholders also can be offered incentives for receiving preventive care.

Engage policyholders with an integrated digital portal.

When policyholders have questions about their health and care that are unrelated to coverage, health insurers are typically not the first partner they turn to for advice. To encourage value-based care behavior in policyholders, insurers need to become the focal point for all of their health-related questions. By implementing easy-to-access and easy-to-use digital portals, insurers are better positioned to influence consumers’ health choices.

Establish value-focused provider networks.

Some countries have a standardized framework for what hospitals are allowed to charge and which treatments they can offer; however, that is not the case in many developing countries. Providers have considerable influence in these countries, including the freedom to determine the exact method of treatment and the rates to charge insurers. Within this framework, by utilizing modern analytics and stringent provider management, health insurers can successfully negotiate rates, develop treatment packages, and have clear governance in place to ensure the highest quality clinical care at an acceptable cost. Even if reimbursement rates are fixed, insurers can still benefit by referring their clients to top providers with the best medical outcomes.

Promote quality measurement and reporting.

Increasingly, health insurance companies have become interested in measuring and reporting on quality of care. Payers see a new role for themselves to change the system proactively by leveraging value-based incentive models. By tracking and analyzing additional data points and reporting them to hospitals, they are also putting in place the foundation for value-based reimbursement. The main issues insurers face in promoting and using quality data is the fragmented provider sector and the lack of quality data about outcomes.

Provide care coordination to help policyholders navigate the healthcare system.

Care coordination solutions focus on addressing policyholder issues within the healthcare system, particularly among different providers. Through care coordination, insurers can guide policyholders through their healthcare “journey” and help them with selecting quality providers while managing treatment costs.

Frequently, insurers are worried that they cannot influence, let alone steer, their policyholders’ health decisions. The implementation of care coordination gives insurers an opportunity to establish trust with policyholders regarding their wellbeing. Therefore, insurers need to build up capabilities to advise and help policyholders navigate the provider ecosystem and select quality specialist services.

Key Technology Investments Fuel Successful Implementation of Value-Based Care

To address mounting cost pressures, health insurers must prioritize the implementation of value-based care. Technology is crucial in these efforts, including adopting generative AI (GenAI) and developing data and analytics capabilities. Without sufficient investment in technology, health insurers will continue to operate programs in silos with limited cross-collaboration and with a typically reactive mindset that fails to generate actionable insights. Concerns that a single insurer is too small or not powerful enough to implement the value-based care model should no longer be a limiting factor with the help of new tools. Two actions will be key to successful implementation.

Develop a cutting-edge data and analytics platform.

As healthcare costs rise and governments or consumer demand limit insurance premium increases, insurers are increasingly interested in using data and analytics more systematically. There is an ever-increasing need to drive faster, more proactive insights; increase transparency across programs; and better leverage technology to accelerate the rate of learning across insurance organizations. Building the foundational technological capabilities, including an augmented set of dashboards that leverage AI to generate cross-cutting insights, has become a necessity.

Adopt new technologies like GenAI that promote individualized interaction.

In the past, many interactions with policyholders used standardized materials and approaches because tailoring information was prohibitively expensive. But with the help of new technologies, individualized interactions can be affordable to design. “Digital first” is becoming the dominant new approach at companies, and prioritizing digital channels helps address many pain points for policyholders—such as access to medical records and examination results and long wait times for appointments—while facilitating provider interactions with insurers.

While the value-based-care transformation of the world’s healthcare systems is just beginning, these steps will enable health insurance companies to position themselves for its successful adoption, improving their costs in the short term and providing policyholders with the best possible care in the long term. We believe that even smaller insurers can benefit from the levers of value-based healthcare outlined in this article. They can control rising costs, increase customer satisfaction, and offer themselves as a true healthcare player rather than “just” a payer. Importantly, insurers don’t need a dominant market share to benefit from these strategies, but moving toward value-based approaches can improve their competitive position very early on.