The use of low-Earth orbit (LEO) satellites is reaching an inflection point, with the potential to transform communication. Compared to traditional satellites, LEO technology offers faster communication and lower latency. The satellites themselves are smaller and less expensive to build and launch—with costs projected to continue falling. Thousands of first-generation LEO satellites are already in orbit, but new versions are coming in greater numbers. They will not replace existing satellites but complement them, creating a hybrid solution that will unlock new uses based on seamless connectivity everywhere on Earth—even in the most remote locations.

Low-Earth orbit satellites overcome the limitations of those in geostationary orbit high above the Earth.

Governments—to capitalize on this opportunity—will need to create the right regulatory framework, offering satellite operators a unified set of rules for everything from spectrum allocation to the removal of space debris. The future of satellite technology is promising, but that will only play out with the right level of coordinated support from government.

A New Solution for Ubiquitous Connectivity

The global satellite communications market is on track to reach $40 billion to $45 billion by 2030, according to our analysis, up from roughly $25 billion right now. LEOs are expected to contribute roughly 40% of the market at that point, primarily because they offer features that existing satellites do not. Until recently, most satellites’ usefulness has been limited by geostationary orbit (GEO) high above the Earth, offering slow, low-bandwidth connectivity for a small number of applications.

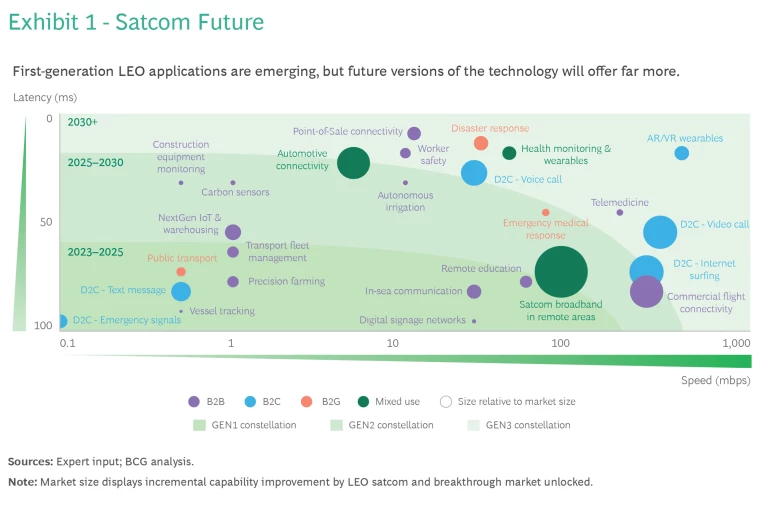

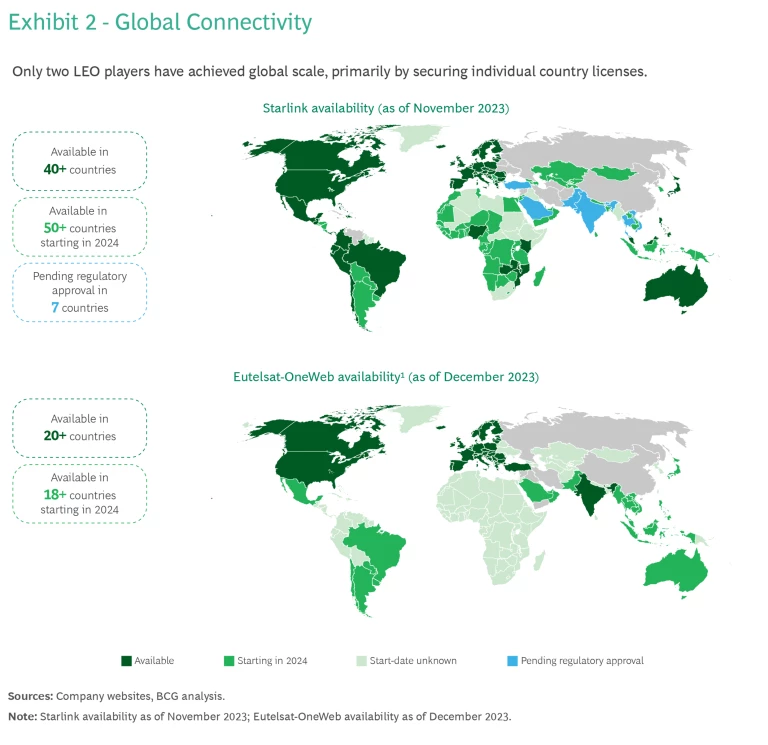

LEO satellites overcome these limits. They orbit at altitudes of 500 to 2,000 kilometers, a shortened distance to Earth that enables higher-speed, lower latency communication. Two pioneering constellations—Starlink and Eutelsat-OneWeb—already have more than 4,500 satellites in orbit, offering speeds of 25 to 150 Mbps and latencies of 25 to 60 milliseconds on land. The satellites launched by these and other players are first-generation LEO satellites that enable such uses as precision farming, fleet management, public transport, and direct-to-cell (D2C) text messaging over mobile phones. (The SOS service on iPhones already uses LEO satellites.)

The range of applications from LEO satellites is going to dramatically expand over the next five to ten years. During that time, the industry will deploy more advanced constellations using even better technology. For example, second-generation LEO satellites will have larger antennas and inter-satellite links (which transfer data directly between satellites) to provide signals that are five times faster than the current satellites and with half the latency and fewer ground stations. These upgrades will spur the development of new consumer and business applications. New players including Amazon Kuiper and Telesat, along with established companies like Starlink and Eutelsat-OneWeb, plan to launch over 45,000 new LEO satellites in total. Google and AT&T jointly invested $155 million in AST SpaceMobile to fund a constellation specifically to compete with established players. Other companies are making similar investments in LEO technology.

Longer term, third-generation satellites already in development plan to carry video calls, video streaming, and other data-rich applications. This massive expansion will enable a broader range of applications—we estimate at least 35 applications across 15 primary sectors, ranging from satellite-enabled broadband in remote areas to automotive connectivity, disaster response, wearable health-care solutions, and AR/VR applications. Collectively, those applications will create up to $20 billion of market value by 2030. (See Exhibit 1.)

Yet LEO satellite connectivity will not replace existing satellites. Rather, the goal is for multiple solutions to complement each other, with ground devices that can communicate with LEO satellites, terrestrial mobile networks, new technologies like high-altitude platform stations, and other telecom technologies. Ultimately, that will enable hybrid connectivity that uses the right technology at the right time. This convergence of technologies is crucial for realizing the vision of a fully connected world, with consumer and industrial applications that capitalize on seamless communication and data transfer everywhere on the planet.

Several improved technologies are needed for these applications to succeed. One is that mobile phones will need different types of antennae to accommodate the new satellite frequencies, along with greater battery power to support the increased energy demands of transmitting signals over the longer distances to LEO satellites.

Also required for this kind of always-on connectivity is a multiple-orbit terminal: a unit that sits in a factory, truck, or other satellite-connected piece of equipment on the ground and receives signals from multiple satellite systems—LEO, GEO, and medium Earth orbit (MEO)—switching among them as needed to maintain constant connectivity. These terminals are in development, but they are complex and costly: projected at $10,000 to $15,000 each. Making these more affordable and accessible will require continued R&D, and economies of scale could bring costs down as production increases. In addition, government subsidies would reduce the cost to end users, potentially as part of broader public financial support. (See the sidebar, “The Evolution of Funding from Public- to Private-Sector Sources.”)

The Evolution of Funding from Public- to Private-Sector Sources

For that reason, many governments have provided initial funding to get satellite programs up and running, such as the British government’s initial investment in OneWeb (prior to that company’s merger with Eutelsat). Such investment underscores the strategic reality that space capabilities are not just about economic returns but also about asserting national presence and influence—key elements of soft power in the geopolitical arena.

As the technology matures, the business case for LEO satcom could become more favorable. For example, SpaceX aims to slash launch costs by up to 90% and manufacturing costs by over 50%, Enhanced speeds, reduced latencies, and broader coverage will unlock new uses and revenue streams, transitioning subscriber counts from the millions to the billions. In this way, government funding is akin to seed capital for the overall industry, with private-sector players such as private equity firms becoming more interested over time, especially as GEN3 satellites come online with their promise of high-margin direct-to-consumer (D2C) applications.

Overcoming the Regulatory Challenge

The significant potential from LEO satellite technology—and the need to remain economically competitive with other countries—is likely to motivate governments to maintain a vibrant market. We believe that the biggest challenge is on the regulatory front. Satellite regulations have already been discussed in global events like the 2023 ENISA Telecom & Digital Infrastructure Security Forum and the World Radiocommunication Conference 2023. But because these are global applications, no single entity can regulate the entire industry. Instead, national governments may need to collaborate. Satcom operators today must navigate a complex web of national and international regulations to secure essential elements such as landing rights, service licenses, ground equipment, and ground station gateway licenses from individual regulators across the globe.

We believe that the biggest challenge to unleashing the potential of LEO satellite technology is from government regulations.

That complexity is a key reason why only two LEO players—Starlink and Eutelsat-OneWeb—have managed to achieve global scale. Both have signed memoranda of understanding with nations and alliances, including the European Union. Even with those agreements in place, some countries are wary of granting operating licenses due to concerns over sovereignty and cybersecurity. As of the end of 2023, Starlink service was only available in about 40 countries, and Eutelsat-OneWeb in about half as many, though more countries are scheduled to start offering it in 2024. (See Exhibit 2.)

Regulatory clarity in two areas could lead to faster progress for the LEO industry: allocating spectrum and setting global standards.

Allocating spectrum

The increasing number of satellites in LEO orbit creates a growing risk of interference across communication frequencies. Regulators can reduce this risk by rethinking their approach to spectrum allocation. Global entities like the International Telecommunications Union (ITU), which currently coordinates global frequency-sharing on Earth, and the United National Office for Outer Space Affairs, along with various regional and national regulators, may need to come together to establish frameworks and standards for how satellite frequencies should be shared to mitigate interference risk and foster healthy competition.

Similarly, frequency regulations should curb the practice of spectrum warehousing, in which satcom operators reserve spectrum even if they have no plans to use it, simply to block their competitors. (Some operators have a legitimate reason for not using their spectrum, such as technical or regulatory issues.) The ITU has already implemented regulations to curb this practice, but greater coordination among national and regional regulators could help enforce them and make underutilized spectrum bands more widely available.

Setting global standards

In addition to frequency allocation, oversight will need to shift from largely national regulations to a unified global regulatory framework. Such a framework could address key issues, such as:

- Space debris management. By 2040, more than 100,000 obsolete LEO satellites may be orbiting the Earth. Managing space debris is becoming a critical concern, but this falls outside the current mandate of the ITU, with only national regulators covering this topic. Individual regulators have started taking steps; for example, the US Federal Communications Commissions recently mandated that operators pull their satellites out of orbit within five years of their mission ending. International collaboration under a clear regulatory body would reduce uncertainty for operators and minimize the risks of space debris.

- Data sovereignty. Currently, each country or economic zone has its unique data sovereignty regulations, such as the EU’s General Data Protection Regulation (GDPR), the US Patriot Act, and others. This fragmented landscape creates complexity for global operators and limits potential satcom uses. (For example, in-air payments on an international flight would require multiple authentications as the plane flies through the airspace of multiple countries.) A single set of aligned global standards regarding data sovereignty would provide needed clarity to LEO operators and companies seeking to provide satellite-enabled applications.

- Public health. Emerging satcom technologies, such as multi-orbital and D2C phone terminals, employ high-frequency bands that some believe carry potential health implications for users. There is no evidence of harm, but unified regulations and certifications are required to ensure the safety of users and protect the interests of businesses.

Satellite technology has put the communications industry at the edge of a connectivity revolution. Despite technological advances, the long-term success of the industry hinges on strategic investments and—more critically—the right regulatory support from governments. Through this approach, countries can capitalize on LEO satellites to integrate with other communications technologies and create a globally connected, technologically advanced future.

Raed Saab, Faisal Alsayed and Rami Suleiman contributed to this publication.