The AI revolution is underway, transforming the telecommunications, media, and technology sectors. Our 2024 TMT Value Creators Report clearly shows the results: companies that deploy, deliver, and create the infrastructure for this remarkable technology enjoy some of the strongest rises in revenues and valuations.

For this report, our core metric is total shareholder return, measured over five years to limit the impact of short-term market moves. All data is annualized, and median figures are used for sectors to reduce the influence of outliers. The data analyzes 343 public companies globally.

The AI revolution is underway, transforming the telecommunications, media, and technology sectors.

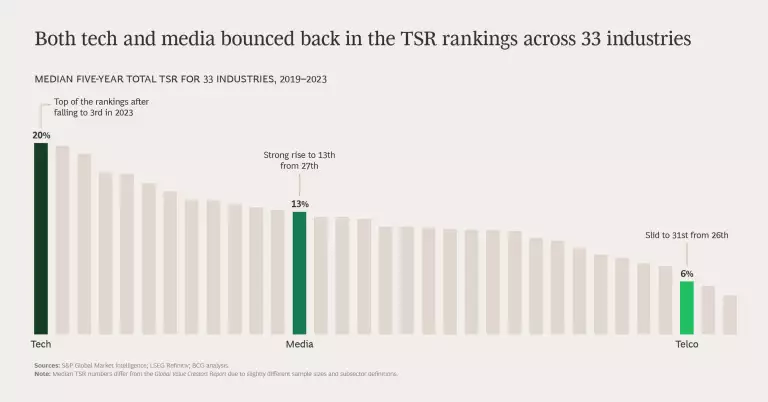

The mood is very different from our previous report, when the “tech winter” slashed returns, a downturn so severe that tech companies slipped from first place to third in our ranking of five-year TSR from 33 sectors. The impact on the media sector was still more severe; it slipped from mid-ranked 15th to almost the bottom of the rankings at 27th. Only the telco sector improved its five-year ranking, from 29th to 26th, as investors valued its utility-like characteristics.

Fast-forward to the end of 2023, however, and tech companies’ valuations had rebounded with such velocity that they were back at the top of the rankings—and with a lead over other industries unprecedented in the 26 years of BCG Value Creator reports. Media stocks, too, moved up significantly, to 13th from 27th place. For telcos, median shareholder return improved, but by much less than most other sectors; as a result, their ranking slid to 31st from 26th.

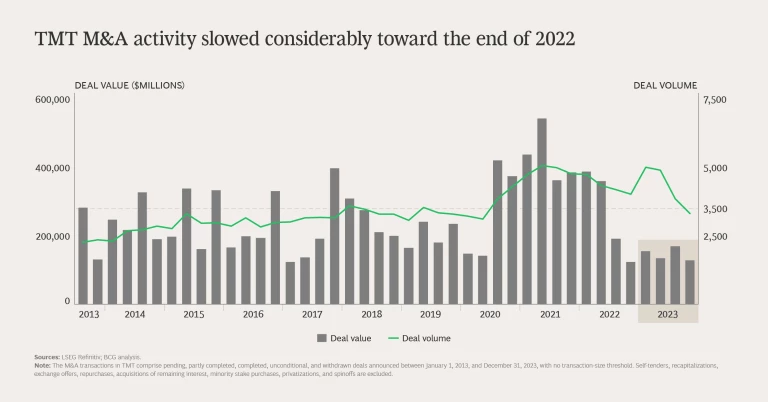

Across the board, TMT benefited from cooling inflation and a brighter economic outlook in many markets, particularly the US. Demand continued to be driven by the digitization of every facet of business and personal life. For some companies, fast-recovering margins turbocharged the rebound; improved revenues fed straight into the bottom line thanks to previous cost optimization. And the outlook for dealmaking appears brighter: global M&A deal value in the first quarter of 2024 was 18.5% higher than the same quarter of 2023, according to S&P Global Data, although the volume of deals remains depressed. (See “ Three Strategies for Future Value Creation ” later in the report for strategies to maximize this opportunity.)

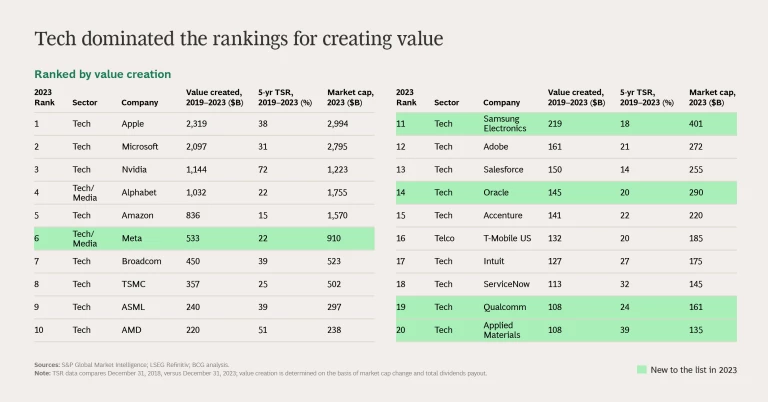

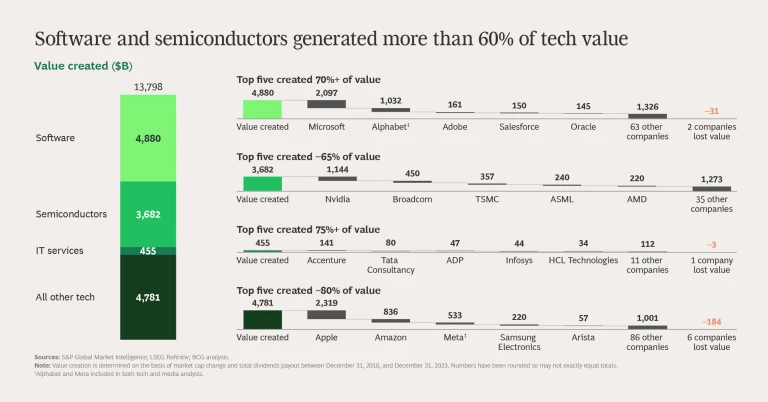

Our other key metric is value creation , measuring the absolute increase in market capitalization plus dividends distributed over five years. TMT companies created an astonishing $15 trillion in value during our five-year study period, with $14 trillion coming from the tech sector alone, more than 90% of the total. This performance was enough to boost the entire US market, the world’s largest by capitalization. Much of the buzz about the US stock market in 2023 centered on the “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla), all of which, apart from Tesla, are in our study. (We count Meta and Alphabet as both tech and media stocks but adjust overall totals to prevent double counting.) The six TMT powerhouses generated almost $8 trillion over five years—more than 50% of the total value created across TMT.

Within individual sectors, a few players dominated value creation:

- In tech, the top three value creators—Apple, Microsoft, and Nvidia—generated 40% of the total sector value, some $5.6 trillion.

- In media, the concentration is yet more extreme: Alphabet and Meta delivered $1.6 trillion in value, more than 75% of the sector total.

- In telco, the top five value creators were responsible for $332 billion, about 60% of the sector total.

Tech: Upturn Powered by AI, Cloud, and Cost Cuts

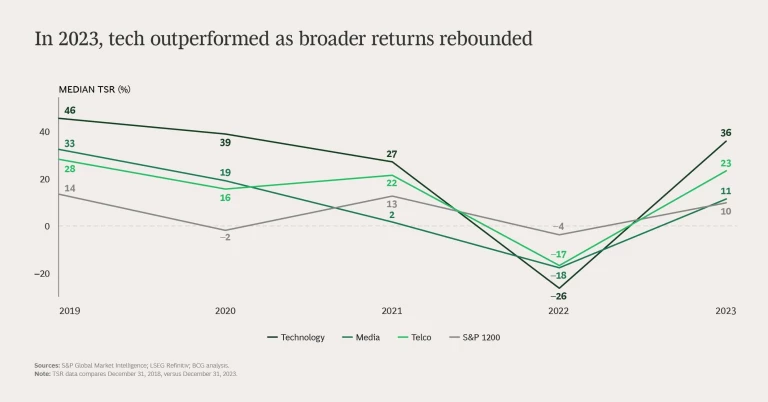

Technology firms delivered a five-year TSR of 20%. This is an increase of 7 percentage points since we last reported the five-year TSR figure in our 2023 report, a remarkable boost.

Many of the top-ranked companies are manufacturing chips or are involved in their design or testing; they make up seven of the top ten companies by TSR ranking. Demand is soaring. Partly, this is due to the digitization of modern society, with every product, from doorbells to cars, getting increased processing power. But there has been an additional recent surge because generative AI systems such as ChatGPT and other large language models require vast computing power.

Another driver is the shift to cloud computing, which has delivered growth not only for Amazon and other giants but for some specialists too. Taiwan’s Wiwynn, for instance, which provides servers and storage for large data centers, had a five-year TSR of 51% and was one of the top-20 ranked firms by this metric.

For other companies, a leaner cost structure and the return of investor favor proved to be a powerful combination.

Both cost control and the drive to the cloud are evident at Amazon, where margins have improved after the company implemented a cost optimization process that reduced the cost of sales, marketing spending, general and administrative costs, and fulfillment expenses as a percentage of revenue. Amazon also enjoyed top-line growth in many areas, such as advertising revenues, which rose by 24% in 2023. It expects its AWS cloud-computing division to start benefiting from the expansion in GenAI. The company was a top-five value creator in TMT, generating $836 billion over five years.

There are strong returns elsewhere. Oracle, for instance, has seen a rapid increase in sales coupled with an improvement in net margin. It invested in its cloud business and partnered with other tech companies, including Microsoft, to penetrate the space further. In 2023, its valuation was also supported by its work in building infrastructure to support AI workloads and integrating GenAI into a wide array of products and services. Oracle generated $145 billion in value over five years, putting it in the top 20 companies by value creation.

The biggest beneficiary of the drive for AI was Nvidia, the most dramatic rollercoaster story in this report. In 2022, it posted a one-year TSR of –50% after US export regulations banned sales of its most powerful chips to Mainland China. The company was also hit by weak sales of its chips for computer gaming. Its resurgence in 2023 was largely due to its super-powerful processors, such as its H100, widely used for AI training. By the end of 2023, Nvidia’s five-year TSR was 72%, with value creation of $1.1 trillion—and the company generated a further $1 trillion in value during the first quarter of 2024, helped by blowout fourth-quarter results.

By subsector:

- Semiconductors. This subsector posted a remarkable five-year TSR of 38%. Demand was not driven just by AI; automotive and industrial markets showed secular growth, and the electrification of the economy (such as the move to electric vehicles) led to a surge in demand for next-generation power semiconductors. Performance was strong not only at companies producing chips but across the value chain, validating the maxim “in a gold rush, sell shovels.” Other strong performers included specialists such as Disco of Japan, which makes specialist saws, laser cutters, and grinders needed in chip manufacturing; the company delivered a remarkable five-year TSR of 55%.

- Software. Recovering from its woes of 2021 and 2022, this subsector showed a five-year TSR of 17% and value creation of $4.9 trillion, around a third of the tech sector total. Cost optimization helped companies such as Microsoft, where revenues grew 18% while the cost of revenue increased by just 12% in the last quarter of 2023. The move to the cloud is still powering growth: worldwide public cloud services revenues rose 19% in the first half of 2023, according to IDC data. GenAI has begun to build value for select players such as Oracle, although the long-term potential still needs to be realized.

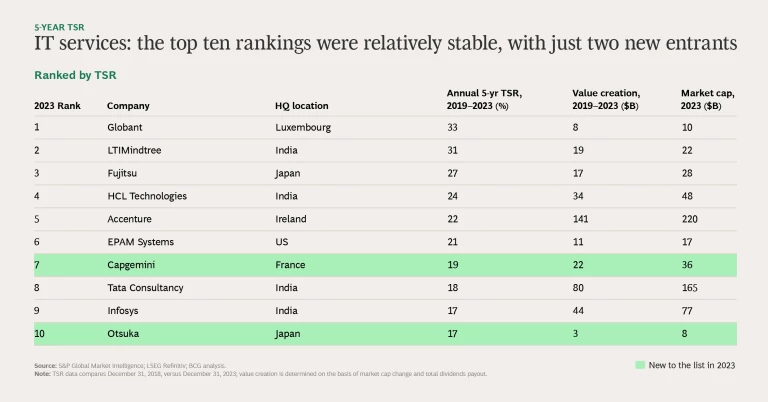

- IT Services. This subsector posted a five-year TSR of 17%. The move to cloud and digital transformation drove revenues, and skills shortages at clients helped pricing power. Valuations were depressed in 2022 but improved in 2023 as the economic outlook brightened, leading to expectations of higher demand. GenAI is likely to be a net positive for IT services firms. Although automation will likely cut demand for products such as outsourced customer service, it should support sustainable long-term growth for some providers as their clients ask for help putting AI to work.

For more details about each subsector, see the slideshow below.

Media: A Sharp Upturn Despite Some Challenges

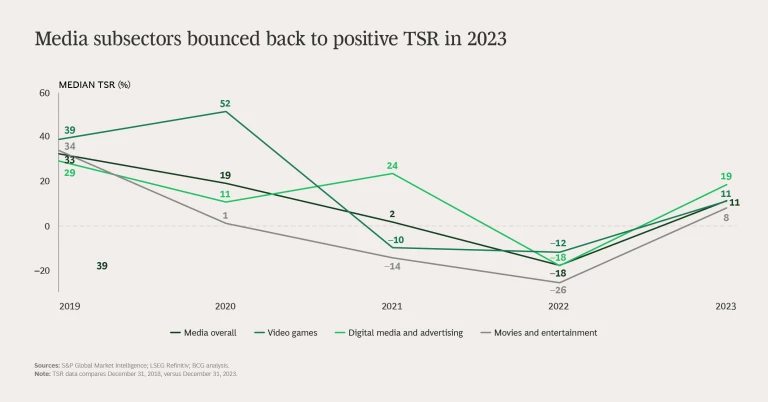

Companies in the media sector experienced a strong rebound as they moved beyond their postpandemic hangover. Their five-year TSR rose to 13% from the previous 4%, putting them at a creditable 13th of the 33 sectors we track.

Performance varied substantially; some of TMT’s biggest value creators were in the media sector, along with some of the most challenged companies.

A big driver of the sector’s value creation was Meta. Its five-year value creation was $533 billion, more than a quarter of the entire media sector and a remarkable change from the –$197 billion in 2018–2022 (yes, that is a minus sign at the front of that figure). The company more than recovered from 2022, which was a year of woes caused by many factors, including the economy, changes to the advertising ecosystem, and investors recalibrating their long-term growth forecasts.

In contrast, 2023 saw Meta revenues rise strongly through innovations such as the use of AI to increase engagement on its Facebook and Instagram platforms. The company also benefited from improved margins after its “Year of Efficiency” campaign in 2023; its operating margin in the last quarter of 2023 was 41%, a substantial improvement from the 20% a year earlier. Underlying most of this is the long-term trend toward the digitization of advertising—one estimate reckons Meta captures as much as 18% of all digital ad revenues worldwide. A sign of its financial strength: in February 2024, the company announced it would pay its first dividend.

By subsector:

- Video Games. This subsector benefited significantly from the stay-at-home culture of the pandemic, boosting its five-year TSR to 17%. The industry showed innovation in business models, such as introducing in-game advertising that now composes 38% of video-gaming revenues worldwide, up from 25% in 2019. The subsector’s growing cultural importance increases the potential for transmedia revenues, a notable trend across the media sector, where strong intellectual property can generate revenues in multiple new channels. A case study in success: The Super Mario Bros. Movie was the second-highest-grossing movie worldwide in 2023.

- Digital Media and Advertising. Still benefiting from the shift away from legacy formats such as print and cable, this subsector posted a five-year TSR of 13%. Revenues were propelled by the near doubling of digital ad spending in the past five years, although growth is expected to slow. Another challenge is competition from retailer ad platforms, such as Amazon selling advertisements on its site.

Movies and Entertainment. There were big winners here and some players with substantial challenges: netted out, the five-year TSR was 4%. The victors were digital and streaming players such as Roku, which has transformed itself from a device manufacturer to a major streaming platform, generating a 24% five-year TSR. Netflix was another success story, with a five-year TSR of 13%, showing flexibility in its business model in late 2022 by introducing an ad-supported tier in some markets (similar to many other streaming services).

The ranks of the challenged included companies that historically relied on revenues from cable TV channels. These firms sometimes try to adapt by offering streaming services, but this new business model is structurally less profitable for traditional networks owing to significantly higher operating costs, reduced per-customer revenues, and greater churn caused by low switching costs. Traditional film is another business model under stress: despite Barbenheimer, global box office receipts in 2023 were 22% lower than five years ago, according to industry data.

Telcos: Modest Returns but Plenty of Opportunities

Telcos, too, have been under pressure to become more profitable. Multiple organization-wide cost transformation programs coupled with the adoption of digital tools to drive automation have had an effect: margins have improved, and investors have become more confident.

But telco business models remain utility-like, doing relatively well in challenging times such as 2022 but underperforming in a robust investment environment like 2023. No surprise, then, that this sector’s five-year TSR was 6%, far below the S&P 1200’s TSR of 13%, putting it 31st out of the 33 sectors we track.

Nevertheless, telcos have many ways to avoid commoditization, including:

- Expanding the Core. Innovative telcos can provide new sticky, high-value products and services by enhancing core products such as mobile and fixed line. GenAI is often key: for instance, it can improve the customer value in traditional telco services through personalization. GenAI can also boost the top line of the core business by reducing churn, expanding cross-selling, and increasing sales productivity.

- Driving Expansion Outside the Core. Growth in areas such as financial services for B2C customers and IT services for B2B customers can offset stagnant and, in some cases, declining revenues in the core businesses. But managers should not underestimate the challenges: success requires agility, innovation, and an astute understanding of the market being entered.

- Radically Optimizing Costs. In core and noncore business, companies need to think beyond one-off cost cutting to implement end-to-end cost transformation. Many of the largest telcos have already undertaken multiyear cost transformation initiatives, such as BT Group, where AI is integral to its plans to reduce its workforce by approximately 40% by around 2030.

- Maximizing Asset Leverage. Given this industry’s capital-intensive nature, telcos are finding ways to segment and share infrastructure while maintaining individual control and management capabilities.

GenAI presents a massive opportunity for the telco industry because it can catalyze a profound transformation along the entire value chain. From cutting costs to creating new products and experiences, the benefits of GenAI are tangible and far-reaching. For instance, GenAI-enabled customer service is expected to be able to reduce service interactions by 50% or more while improving customer satisfaction.

Although large-scale applications are still to come, first movers in commercializing this technology within the telco sector may very well populate the upper levels of the TSR rankings in future years.

To discover the seven ways telcos can generate value in 2024 and beyond, see

The 2024 Telco Value Creators Report

.

Three Strategies for Future Value Creation

The rebound for TSR and value creation in 2023 was remarkable. But much more is possible if managers consider these three strategies:

- Accelerated deployment of AI to optimize their own internal processes but also, crucially, to boost the top line with new, exciting products and services.

- A reimagination of costs to take a strategic approach and avoid the problems of conventional cost cutting.

- Savvy M&A that achieves strategic outcomes such as ensuring access to key innovative technologies balanced with the ongoing high cost of borrowing.

Accelerated Deployment of AI

We have already underlined how this technology, particularly GenAI, has begun to drive value creation for TMT companies. But the revolution is just starting. A sign of its potential: ChatGPT reached 100 million users just two months after launch, a milestone that took TikTok nine months and Instagram 2.5 years, according to Sensor Tower data. OpenAI, the company that created ChatGPT, saw its revenues spike from a reported $34 million in 2021 to an annualized $2 billion in 2023.

In terms of internal use, initial deployments look very promising. For example, GenAI-enabled conversational assistants have led, in individual cases, to a 14% increase in productivity for customer service agents. GenAI can also drive down the cost of software development—a significant expense for many in TMT. BCG data from pilot projects indicates that mid-level developers with two to four years of experience save 2.5 hours daily with a GenAI coding tool (although other developers save less). AT&T recently launched an internal GenAI tool to improve coding productivity and quickly translate documents into different languages.

But it would be a mistake to see AI just as an internal efficiency tool. AI can improve the top line, such as by boosting customer experience. As noted earlier, Meta used it to drive user engagement on its Facebook and Instagram platforms. Another example is Synopsys, which created the industry’s first full-stack AI-driven chip design suite. The company said in 2023 that nine of the world’s top ten semiconductor companies were using the product. Synopsys has been a consistent top performer on TSR and, for its size, value creation: five-year TSR was 44% and, over the same period, it created $66 billion in value—remarkable for a company with a market value of around $13 billion at the start of our five-year survey period.

The impact is not limited to tech companies. Media companies can use AI in their workflow, such as creating storyboards from scripts or building 3D models at scale for video games. They can also use AI to slash the cost of tasks such as dubbing and localizing content.

For telcos, AI can drive down customer service costs, transform network design and maintenance, create compelling personalized offerings (reducing churn), and more. In an industry like telecommunications with narrow margins and low growth, the impact can be significant.

Developing or selecting an AI technology is only the first stage, however. To successfully develop and deploy GenAI, managers must embrace the “10-20-70” rule, which recommends spending 10% of the effort on building algorithms, 20% on deploying tech stacks and creating high-quality data feeds, and 70% on transforming the operations.

Managers must:

- Redesign core processes to increase productivity by automating key tasks.

- Provide the right incentives to foster agility, innovation, and constant experimentation.

- Transform the workforce, upskilling and reskilling, opening new career paths, and revamping HR processes to prioritize GenAI competency in areas such as talent acquisition and performance management.

And comprehensive change management must underpin all these efforts.

Every company, inside and outside of TMT, needs to consider where and how it can harness GenAI’s power and consider the fundamental changes required in tools, processes, and people management to turn GenAI’s magic into business impact.

Reimagining Costs

A focus on costs is the other key factor in the TMT sector’s comeback in 2023, and it will be vital in the future.

But this is not cost cutting in the traditional sense, which typically lacks any vision of how to restore growth. This strategic flaw leads to low morale, overloaded teams, and dampened momentum for strategic initiatives owing to frequent changes made by management. Because managers often fail to accurately forecast how the cost cuts will affect growth, they damage essential functions in the quest to rapidly reduce spending instead of thinking more deeply about people, processes, and technology.

Managers must therefore not just cut costs but reimagine them. They need to assess areas of growth, business strategy, and current costs from the perspective of the customer value proposition. The assessment should cover R&D, the cost of production, and other drivers of spending while implementing these principles:

- The overall strategy must be aligned and operationalized at every level of the company.

- Customer experience must be improved with tangible, measurable metrics and market positioning.

- Tactical actions related to people, processes, and tools must translate into impact on the P&L.

One lesson of the value creation data for 2022 and 2023 is that cost reimagination is not only beneficial in an investment winter; it is of immense value when the sun shines, too. Amazon, Microsoft, and Meta are among the companies that improved TSR in 2023 because of their focus on costs. IBM is another giant driving cost reduction; it is about halfway through a program that aims to save about $3 billion a year, some of it through automation and AI, part of which is being ploughed back into productivity improvements and investments in technical skills.

Cost reimagination is not only beneficial in an investment winter; it is of immense value when the sun shines, too.

M&A: A Unique Opportunity

Broadly, M&A is widely tipped to ramp up in 2024, even though interest rates are falling less quickly than expected. For TMT, though, there are additional reasons that deals are expected to rebound.

In 2023, deal value in TMT plummeted in line with reduced overall valuations and a focus on low-cost assets.

But the announcement by Cisco in September 2023 that it would spend $28 billion to buy Splunk, an analytics and big data company, potentially signaled the start of a new era of M&A opportunity. Since then, more big deals have been announced in the sector, including Synopsys’s $35 billion acquisition of Ansys and HPE’s $14 billion purchase of Juniper Networks.

We see two main strands of M&A activity in TMT:

- Strategic Deals to Access Technology. It is often quicker (and cheaper) to purchase a company than create the required capabilities from scratch. Companies that urgently need access to AI know-how may find these deals compelling.

- Transformational Deals to Drive Profitability. Corporations will want to make acquisitions in growth areas or reshape their corporate portfolios through divestitures.

But tech firms, which have the deepest pockets, face multiple barriers to doing deals. The largest of them face heightened regulatory constraints and need to plough capital into AI-related investments. Deals by other companies may be constrained by the continued higher cost of capital, and many companies may opt for transactions that are either smaller in scale or optimize capital allocation through partial ownership or joint ventures.

Although 2023 saw a sharp upturn in value creation, especially in the tech sector, many challenges persist. Geopolitical uncertainty continues to be intense, and a timetable for falling interest rates remains uncertain—indeed, a resurgence of inflation may keep rate cuts on hold or even trigger increases.

But the rapid bounce back from the problems of 2022 shows that the TMT sectors can adjust with agility. The three strategies above—seizing the opportunities of AI, reimagining costs, and pursuing smart M&A—can help managers drive value creation yet further. If the big picture remains stable, the TMT sectors should continue this strong era of value creation.