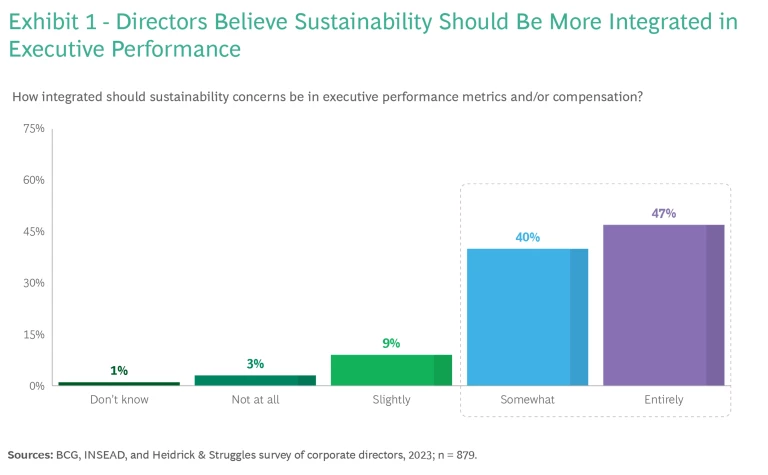

Boards and CEOs are increasingly using financial incentives to hit corporate sustainability goals . BCG research shows that 47% of corporate directors say that sustainability should be “entirely” integrated in executive performance metrics and/or compensation. And another 40% say it should be “somewhat” integrated. (See Exhibit 1.)

But our analysis of sustainability incentives at nearly 100 large corporations across industries—shows that many environmental, social, and governance (ESG) schemes are not designed in a way that yields meaningful

The So What

Designing effective sustainability incentives is complex, given the diverse expectations of stakeholders, the complexity of many sustainability interventions, and the challenges to measurement. Our analysis highlights six barriers to success.

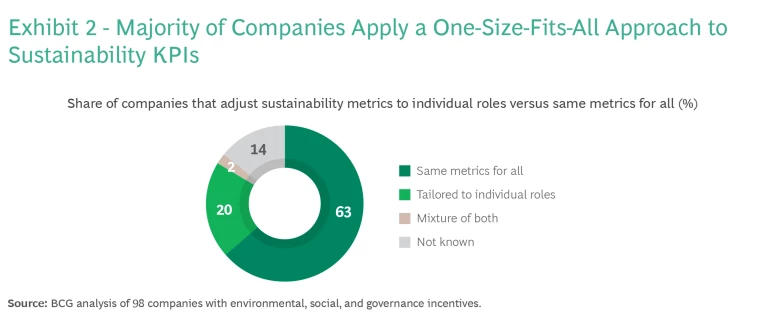

Generic KPIs. Only 20% of companies tailor KPIs to specific job functions. (See Exhibit 2.) The rest use one-size-fits-all KPIs that are likely not specific enough to change behaviors of key individuals, with limited relevance to their daily roles. As a result, they’re easy for leaders to ignore.

Overreliance on Qualitative Metrics. Many incentives rely on subjective measures, such as “progress against the net zero roadmap,” resulting in minimal accountability and limited impact. Qualitative metrics can be loosely defined and broadly interpreted, with leaders focusing more on checking a box rather than tangible impact.

Strategic Disconnect. Often sustainability metrics do not clearly link to financial or strategic materiality for the company. As a result, they drop down among leaders’ priorities.

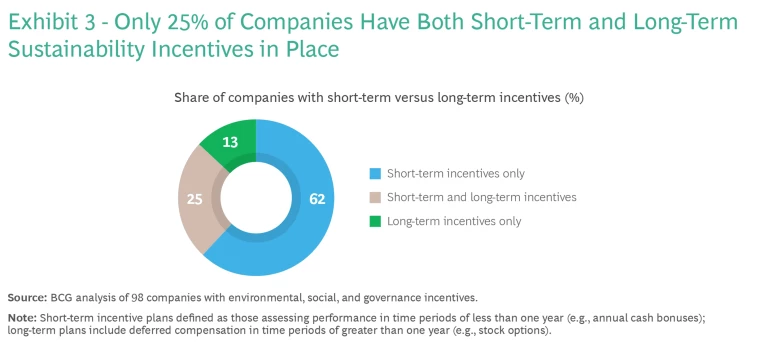

Short Timelines. In our analysis, 62% of companies incorporate sustainability goals into annual performance bonuses only, neglecting the long-term commitment required to address such a complex topic. Only 38% embed sustainability objectives into long-term incentives spanning three to five years. (See Exhibit 3.)

Low Weight. In our benchmark, sustainability incentives most frequently account for only 10% to 20% of the total incentive pool, with an even smaller percentage per specific metric. Such allocations are unlikely to drive substantial behavioral changes.

Too Few People Covered. Approximately 75% in our sample limit sustainability incentives to top executives, just 16% extend them to senior management, and a mere 7% to all employees. This narrow focus fails to engage people in crucial operational roles that are vital for embedding sustainable practices—for example in

supply chain

, facilities, and sales. The exclusion of midlevel managers, who are pivotal for driving day-to-day sustainable actions, further diminishes the potential impact of these incentives.

What Else

The challenge is not going away. Regulators, external ratings agencies, and investors are all pushing companies to integrate sustainability into performance incentives. Many of these stakeholders are also building the topic into their data collection and scoring. For example, LSEG (formerly Refinitiv), a provider of financial markets data, now includes the existence of leadership incentives into its sustainability ratings. In the UK, the Transition Plan Taskforce has set out guidance that will require information on executive incentives to be disclosed as part of corporate transition plans.

Moreover, when structured correctly, performance incentives can lead to real change. According to CDP, a global nonprofit that tracks and reports climate-related information about companies, 100% of the top-rated companies in its database offer management incentives related to climate performance, compared with just 52% of the overall pool of companies.

Now What

To make sustainability incentives more effective, our research points to seven clear priorities.

Use material and measurable metrics. Base incentive schemes on clear, quantifiable metrics. Ensure clear alignment between these sustainability goals and the company’s strategic direction and ambitions—for example, a certain percentage of sales from product lines that are more sustainable.

Develop tailored incentives to cover more people. Ensure that most of the senior leadership team and middle management—not just a few executives—has sustainability-linked compensation. Tailor metrics to an individual’s scope of influence and the timeline of impact. For example, KPIs for short-term incentives may be more tactical—such as the percentage of suppliers reporting emissions performance according to science-based targets. Metrics in long-term incentive schemes can be more strategic, such as the overall reduction in greenhouse gas emissions.

Raise the stakes. To send a clear signal of the strategic importance of sustainability, and to spur meaningful change, sustainability incentives must be financially significant for individuals—more than 20% of the variable element, included in both short- and long-term incentives.

Keep it simple and transparent. If the scheme is complex to understand and the linkage between actions and potential payout is not obvious, it will have minimal value for leaders, investors, and the planet. Companies should prioritize a small number of KPIs, explained in simple language. One approach is to use a sustainability multiplier. For example, Apple adjusts the total incentive amount up or down by up to 10% based on predefined metrics tied to their core values.

Think through unintended consequences. A focus on sustainability may create competing priorities. For example, incentivizing a manager to implement an equipment-as-a-service model, or urging procurement to choose more energy-efficient machinery, requires reexamining established KPIs such as financial ratios, including payback time, lifetime costs, and other metrics.

Consider nonfinancial incentives. These can be even more powerful than some financial levers and can be applied to much larger groups. For example, companies can offer internal recognition such as “climate champion” for employees who take noteworthy steps. They can also reward top performers with access to training programs or fast-track them for promotions or new roles.

Review and update regularly. Even after the right incentive strategy is in place, it’s essential to reassess it over time. Stakeholder expectations, regulatory frameworks, and competitive environments are all changing rapidly.