This article is part of a series examining the competitive outlook for key global process industries and how they can prosper in an uncertain future.

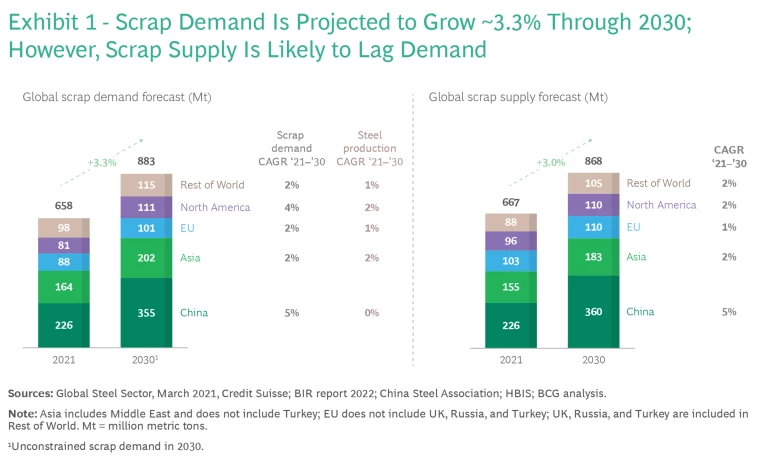

The global supply of carbon steel scrap is in a losing battle against demand growth. This crisis has been in the making for many years, and the pattern will continue unabated. According to a BCG analysis, global scrap demand will increase at about a 3.3% compounded annual growth rate (CAGR) over the next eight years, while supply will rise at only about 3% CAGR. (See Exhibit 1.)

That boost in demand will in part be the result of scrap increasingly becoming a material of choice for steel production, especially as industries attempt to reduce carbon emissions from their raw materials. By volume, scrap will account for 50% of the global iron content in steel by 2030, up from 35% today. By that point, annual scrap consumption in both China and the US will likely be 40% to 50% higher than today, much of it to make more steel. And these increases in domestic demand for scrap by major steel producing countries will reduce the global scrap trade by about 15%. By 2030, today’s 9 million metric ton steel scrap surplus will become a 15 million metric ton deficit, further underscoring why neglecting the problem is not an option.

Such a drastic change in steel industry dynamics will greatly impact steel manufacturers and scrap metal providers —some a lot more than others—who must take steps to prepare for the new landscape. To do this will require, first, a comprehensive assessment and understanding of regional steel scrap imbalances and availability now and into the future, and second, implementing strategies and technologies designed to secure supplies of scrap metal. The shortfall will also influence policymakers’ decisions aimed at ensuring that the domestic steel industry is well supplied with raw materials to support economic growth at home while, when necessary, competing on a global scale.

Reasons for the Looming Supply/Demand Deficit

Mounting demand for scrap will primarily be driven by trends that have been accelerating over the past few decades. A key factor is the shift to electric arc furnace-based (EAF) steelmaking, which uses recycled steel scrap (also called ferrous scrap), and away from the traditional blast furnace–basic oxygen furnace (BOF) route of steelmaking. Moreover, some BOF steelmakers are increasing the amount of steel scrap, commonly known as the charge, in the latter part of their manufacturing processes as well. Overall, current and future EAF plants will over the next decade represent an increasing share of the global appetite for steel, especially for large, durable products, such as automobiles and appliances, and for new construction.

While EAF mini-mills have been around since the 1980s, they are becoming more attractive as they ramp up production of advanced high-strength steel using fewer carbon-heavy raw materials. Besides being more environmentally friendly, EAF steelmaking provides flexibility in planning and in making changes to production volume and manufacturing capacity. It is expected that, globally, EAF operations—currently about 29% of steelmaking capacity—could surpass 41% by 2030, especially as new EAF plants open in Europe and China.

The availability of shredded scrap in the short term will depend on how much metal can be recycled from end-of-life car bodies, industrial equipment, refrigerators, washing machines, and other large goods. The situation worsens in the medium term. As global economies slowed in the financial collapse of the late 2000s and again during the COVID-19 pandemic and its aftermath, fewer big products were made and sold, reducing the amount of heavy scrap in the pipeline now. And since it can take many years before new items are ready to be recycled, products made today or in the immediate future will not be useful for EAF steelmaking for anywhere from 15 to 50 years.

By contrast, prime scrap—essentially a cleaner by-product of manufacturing continuously recycled from factories and also known as pre-consumer or prompt scrap—is prized for high-quality applications and is easier to process with fewer CO2 emissions. But its volume, too, is impacted by periods of economic volatility when manufacturing production falls substantially, generating less waste for reuse. The availability of prime scrap will be hit hardest by the scrap supply and demand imbalance. A deficit of nearly 30 million metric tons is possible by 2030. The soaring demand for prime scrap will come from the increasing need for cleaner scrap to produce high-quality, flat-rolled sheets of steel suitable for many manufacturing and construction projects as well as the need for higher proportions of scrap charge in blast furnace operations.

Developing countries, such as India and China, have the added problem of nascent recycling infrastructure. In these regions, scrap collection logistics are underdeveloped, circular supply chains are in their infancy, and sorting equipment is at a premium, making scrap accumulation at scale difficult. In addition, the cost of moving scrap from recycling sites to steel mills is often prohibitive, making the operation unprofitable.

Shortfall Will Alter Global Scrap Trade Flows

Currently, about 17% of the world’s annual scrap supply—about 110 million metric tons—is traded globally. (See Exhibit 2.) For instance, Turkey is reliant on the EU, the US, the UK, and Russia for its 25 million metric tons of primarily lower-grade scrap imports each year. In fact, the US is such a large supplier to Turkey that some Turkish steelmakers have established sourcing units in North America to secure the country’s supply. The US, however, is running a shortage in prime scrap and turns to Canada to make up for it. Meanwhile, Japan exports its excess prime to Korea, Southeast Asia, and China.

As scrap availability tightens through the decade, we anticipate that trade in the raw material will moderate significantly, to around 93 million metric tons by 2030, as domestic consumption rises and countries reduce exports. In particular, the US and EU scrap flow will take a major hit; for instance, by 2030 prime scrap exports from Canada to the US will plunge by 50% and European exports of this material will decrease by nearly one-quarter. Countries that import a higher percentage of their scrap needs will be meaningfully affected if they are unable to secure sufficient scrap of the required grades or ore-based metalics alternatives, such as pig iron, direct reduced iron (DRI), and hot briquetted iron (HBI). Certain high-growth markets, like India, remain particularly vulnerable. In that country, lagging scrap supplies will raise the cost of operating EAFs and threaten the decarbonization agenda unless significant efforts are made to build carbon steel scrap recycling infrastructure.

Preparing for the Scrap Market Disruption

Although there are still a few years before the carbon steel scrap shortage is keenly felt and upends business plans for the steel industry and its customers, companies and policymakers must use this time to prepare for it and begin to put themselves in advantageous positions. As a starting point, scrap stakeholders need to calculate current availability and develop short- and long-range forecasts.

Multiple levels of the supply market for all scrap grades should be assessed. Examining the national market, the following issues should be addressed:

- What is the demand-supply balance in the country? How will it evolve?

- How does international trade fill the gap?

- What are the constraints on trade—or the incentives to trade—in countries that are currently scrap sources?

The answers to these questions can help steel companies plan for maintaining supplies, but they are even more important for policymakers to determine the best approach for protecting the domestic steel industry and scrap market. As scrap imports dry up, inflated prices of raw material will likely squeeze steel industry profit margins. In the past, to minimize the damage of higher raw materials prices, steel mills have explored importing semi-finished goods—such as billets, blooms, and slabs that need further processing—often produced via carbon-intensive methods in low-cost countries.

However, with policies focused on reducing the cumulative carbon footprint in steelmaking, adding semi-finished goods to the material mix in steel mills is becoming less viable. As a result, to stay in operation, some steelmakers may need outside help. For instance, the scrap shortfall will almost certainly be felt squarely in Turkey; in turn, some of its high-cost mills may idle without government support.

Particularly in large countries, a zonal analysis may also be necessary to determine scrap availability by grade and distance because the logistics of hauling scrap to and from recycling facilities can be complex and expensive, particularly over long distances. This can enable steelmakers and scrap providers to identify and draw up future supply chains—factoring in potential costs and difficulties—to establish viable goals for market participation and growth. For example, scrap may be more expeditiously exported to other countries through a nearby port than transported domestically via truck or train.

Strategic Choices Are Complex but Necessary

Based on the future supply and demand analysis, steelmakers and scrap processors need to consider their best strategic options for navigating this changing landscape.

Steelmakers taking proactive steps are focusing on three dimensions: sourcing, quality, and melt optimization.

- In the sourcing realm, to lock in consistent supplies, some steelmakers are acquiring scrap yards. For example, in the US, 25% to 30% of scrap supply is already managed by scrap yards owned by steel mills. In Europe, the share of mill-owned scrap yards is increasing as transition to EAF-based steelmaking intensifies. For example, Luxembourg-based ArcelorMittal recently bought a series of scrap recycling facilities from Germany’s Alba International. By contrast, some companies are choosing organic growth. India’s Tata Steel has invested in developing an auto shredding unit near its new EAF plant.

- To improve quality and reduce the presence of residuals, which are impurities that accumulate on steel each time it is recycled, large EAF mills in the US and EU are also setting up scrap sorting and testing facilities within their mill gates. The idea is to take control of quality categorization from recyclers. In the best circumstances, visual checks are initially conducted to jettison patently low-quality scrap supplies. Following that, handheld spectrometer guns may be used to assess four scrap samples—one from the top of the pile, one from the bottom, and two others at random—before okaying or rejecting the shipment.

- And to increase melt optimization, steelmakers are using advanced techniques including programs aided by artificial and machine intelligence to assess their scrap purchases and determine the most cost-effective mix of these raw materials to produce the desired steel grades. This results in significant efficiency gains and cost savings from production to specification, rather than overspending on manufacturing steel that doesn’t meet immediate quality and classification needs. In short, these melt optimization approaches represent the most effective use of the increasingly scarce scrap.

Carbon steel scrap processors are driving recycling efficiency, yield, and increased profitability through new technologies and consolidation.

- Recyclers are exploring advanced visualization technologies, such as Laser Induced Breakdown Spectroscopy (LIBS) and X-ray fluorescence, to increase the amount of high-quality scrap that can be extracted from a bucket of steel waste. And some have adopted workflow management tools to improve the efficiency of their operations.

- Recent consolidation efforts are motivated primarily by the need to increase scale, reduce overhead, and generate higher volume yields. For instance, France-based scrap processing and trading firm Derichebourg Environment recently acquired Luxembourg-based Groupe Ecore Holding. As consolidation—and, thus, scaling—is likely to continue, it will be increasingly difficult for smaller processing yards to compete with larger rivals.

How Other Players Might React

Besides steelmakers and scrap processors, other companies in the value chain may also be impacted by the scrap shortage and may have to take steps to navigate or address it. For instance, integrated ore miners should assess whether participation in the scrap recycling business could allow them to hedge against losing a portion of their traditional revenue streams as steelmakers switch to EAF. This would enable ore miners to significantly diminish their own end-to-end carbon footprints, which could protect them against possible carbon generation fees and tariffs in the future.

Policymakers also must explore how to handle the scrap scarcity problem, especially since a thriving domestic steel industry is essential to support other critical sectors—including automakers, construction, and durable goods—and for global economic competitiveness. Moreover, a robust scrap business that can keep up with demand will help promote growth of the circular (recycling) economy to achieve sustainability goals.

Policymakers must explore ways to handle scrap scarcity, especially since a thriving domestic steel industry is essential to other critical sectors and global economic competitiveness.

One option for policymakers is to incentivize steel scrap recycling, primarily through tax and fee breaks. For instance, India has eliminated new car registration fees and is offering road tax rebates for businesses and people turning in old vehicles. And the US lets taxpayers claim accelerated depreciation for the purchase of machinery or equipment used to collect, distribute, or recycle scrap. Trade rules are another approach to expand a nation’s scrap supply. As many as 60 countries already restrict scrap exports; China is the largest and is also extremely selective about allowing only higher quality scrap to be imported. And encouraged by steel industry lobbyists, the EU is considering a series of measures to put into place protective trade regulations for scrap in the next few years.

Even as steelmakers and other scrap ecosystem players ponder their strategic choices, they must be prepared for continued uncertainties that are wild cards in any attempt to forecast the future. For instance, new scrap upgrading technologies may emerge and become cost-feasible, allowing better separation and utilization of lower quality scrap, which could serve as a replacement for prime scrap and limit the squeeze on prime supply.

Moreover, there is growing interest in hydrogen-based direct-reduced iron (DRI) manufacturing processes which emit fewer greenhouse gases. When used as a feedstock in mini-mills, DRI can be combined with lower grades of scrap to produce quality steel. Separately, a new academic study produced by the Steel Manufacturers Association offers evidence that in key steel manufacturing and consuming countries average steel lifespan may be lower than previously thought, about 25 years rather than 40 years. If that is the case, more prime ferrous scrap will be available sooner, altering forecasts for the volume hitting the market in the near- or mid-term. Yet another unknown is the degree to which unanticipated trade and policy barriers will worsen the prime shortage, or, on the other end of the spectrum, whether higher energy prices will slow the shift towards electricity- and scrap-intensive EAF-based steelmaking in energy-constrained countries.

Still, however the scrap market evolves—and we believe that despite the range of supply possibilities, a shortage sometime in the future is unavoidable—stakeholders in the public and private sector must be prepared for volatility and perilous landscapes. The severity of the shortfall will vary based on grade and region. Only planning and strategic designs formulated now can forestall significant challenges later.