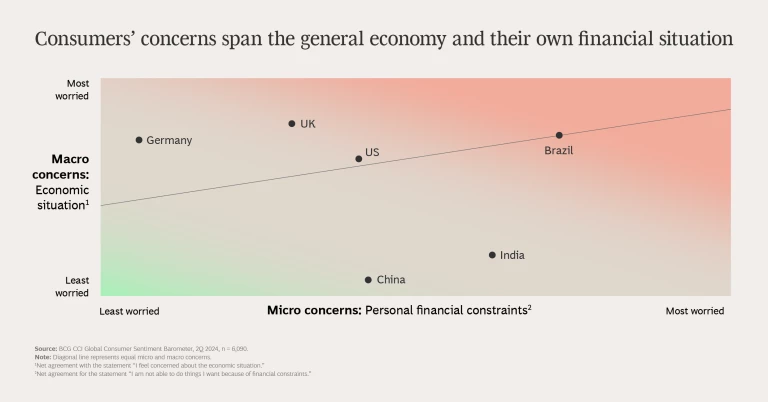

Inflation. The economy. Prices. Geopolitics. When we asked consumers what’s on their minds, these were among the most common replies. Consumers are worried. Their concerns span the general economic situation as well as their personal financial situation, according to a recent survey of more than 6,000 consumers in six countries, conducted by BCG’s Center for Customer Insight (CCI). (See “About Our Research.”)

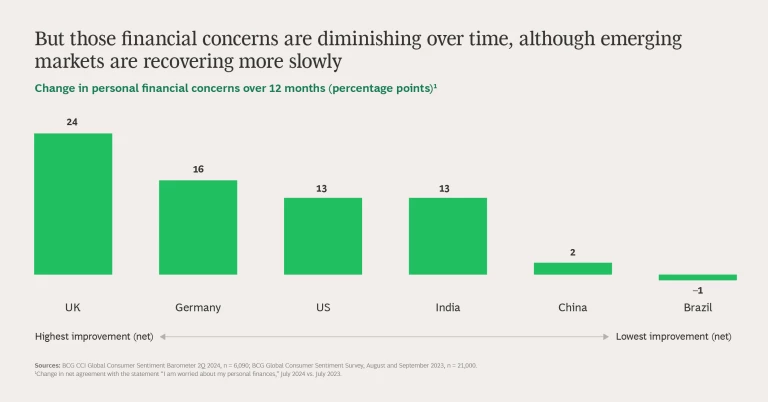

Overall, the level of concern about the general and personal economic situation has improved somewhat since our prior survey, one year ago. But the return of confidence is mixed.

In general, emerging markets are recovering more slowly than the more mature markets we studied. Consumers in Brazil, China, and India—where the gap between high- and low-income levels is particularly pronounced—indicated that they experience greater financial constraints and feel more worried about their personal finances than did those in the UK, Germany, and US. In fact, although consumer concerns have lessened in most markets since last year, consumers in Brazil are still just as worried about their personal finances as they were then. Brazilian consumers express equal concern about the economy in general and their own economic situation.

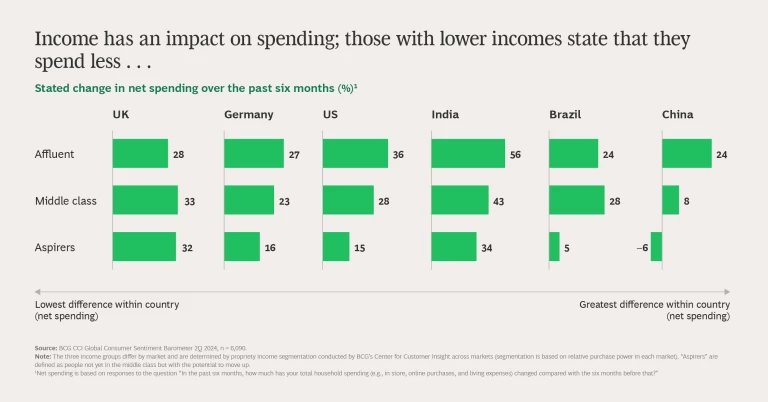

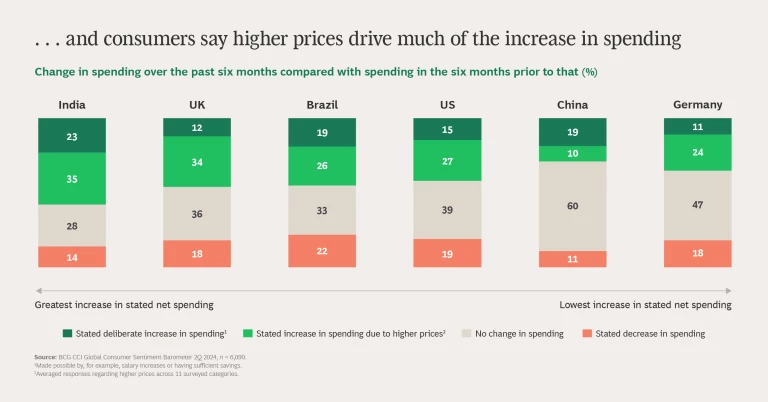

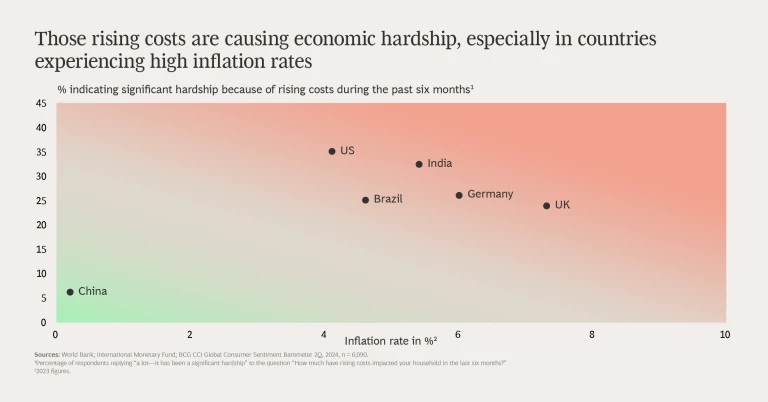

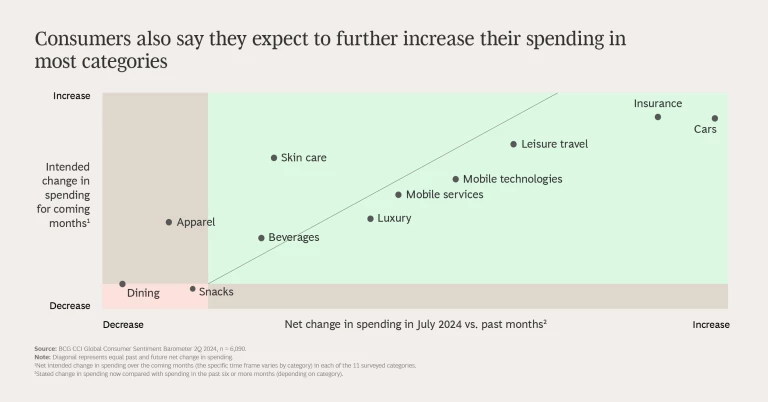

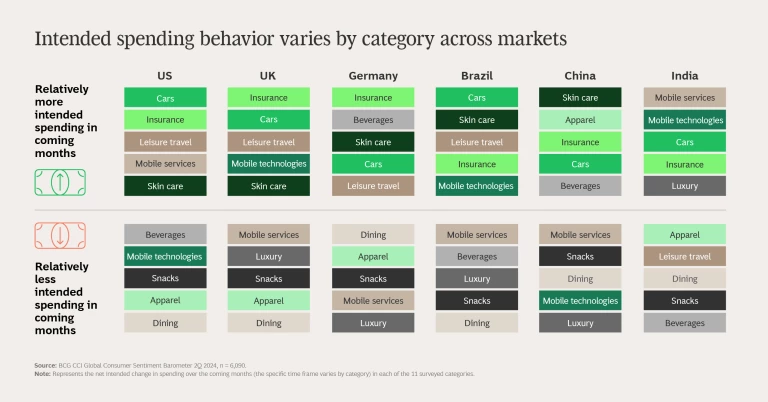

Overall, consumers say they are spending more. And they say they are planning to increase their spending even further, in particular product categories. But companies should not interpret these findings as a sure sign of returned consumer confidence. This outlook is nuanced—it reflects the impact of inflation. That is, in countries where inflation is higher (for example, India and the UK), increases in spending are driven more by higher prices than by deliberate decisions to spend more. Consumers expect this trend to continue. Income plays a role as well: middle-class consumers and particularly “aspirers” (those not yet in the middle class but with the potential to move up) have less positive sentiment about their financial situation than affluent consumers.

Stay ahead with BCG insights on customer insights

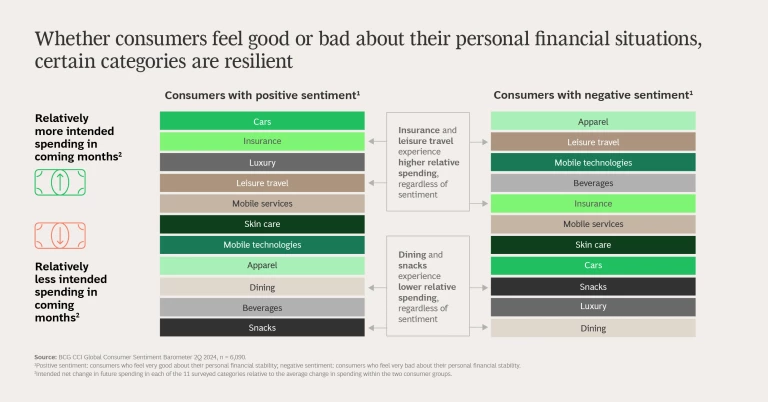

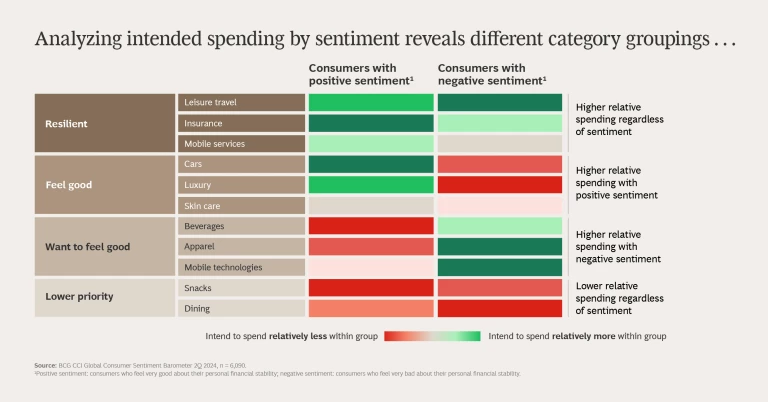

Whether consumers feel very good or very bad about their personal financial situation plays a role in their spending. Based on that sentiment, they tend to spend relatively more or less on particular categories. Looking closely at those spending patterns reveals four broad category groupings:

- Resilient—leisure travel, insurance, mobile services

- Feel good—cars, luxury, skin care

- Want to feel good—beverages, apparel, mobile technologies

- Lower priority—snacks, dining

Among our findings: insurance and leisure travel are particularly good businesses to be in right now in terms of current and anticipated future consumer spending.

With a knowledge of these sentiments and how they affect particular product categories, companies can adjust their strategies:

- By recognizing the role of consumer sentiment by category and segment, they can determine how to manage their portfolio.

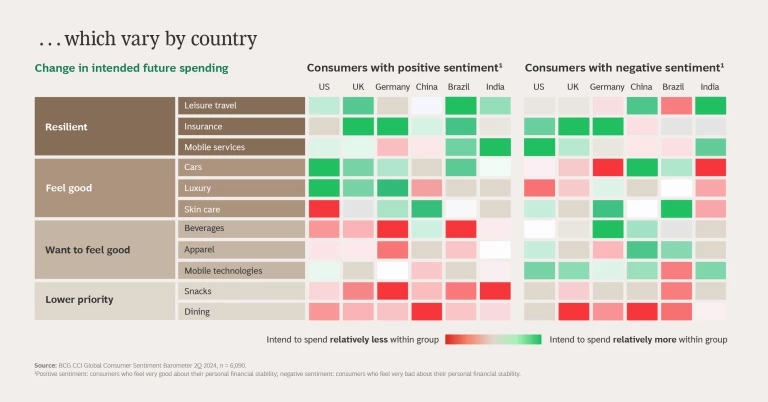

- By taking a market-by-market view, they can anticipate growth.

- By focusing closely on patterns of negative sentiment, they can target new opportunities.

With so many rapidly changing factors impacting how consumers behave and what they buy, staying up to date is key for companies. Beginning with this publication, we will be updating the frequency of our global consumer sentiment surveys and analyses that track sentiment across markets and categories.

The authors wish to thank Jean-Manuel Izaret, Cinthia Chen, Kanika Sanghi, Lara Koslow, Joanna Stringer, Greg McRoskey, as well as Deepti Tyagi, Carolyn Armstrong, Tim Schulz van Endert, Katie Ioas, and our BCG Center for Customer Insight and SurveyOps teams for their contributions to this article.

About our Research

We focused on 11 categories:

- Apparel

- Beverages

- Cars

- Dining

- Insurance

- Leisure travel

- Luxury

- Mobile services

- Mobile technologies

- Skin care

- Snacks