For industrial businesses ready to invest in their future, harnessing the potential of integrated space services will yield considerable value.

The So What

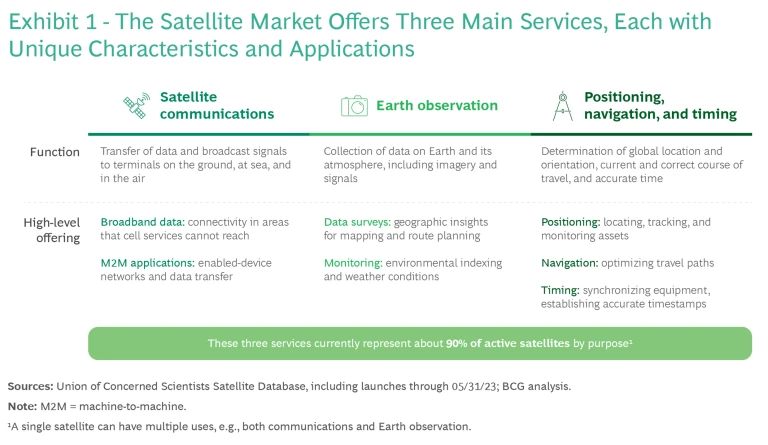

Individual space services—satellite communications (satcom); Earth observation (EO); and positioning, navigation, and timing (PNT)—provide crucial support to contemporary industrials. (See Exhibit 1.)

Combining these rapidly developing space services and incorporating them into product development and operations can take an industrial company to another level. It can grow the enterprise and help meet the company’s sustainability goals.

For companies using integrated satellite solutions, benefits include:

- Low-latency, reliable visibility into data-intensive activities

- Fewer geographic restrictions than terrestrial alternatives

- Standardized solutions across country borders, improving scalability

- Real-time communication of observational and navigational data between mobile assets and central control

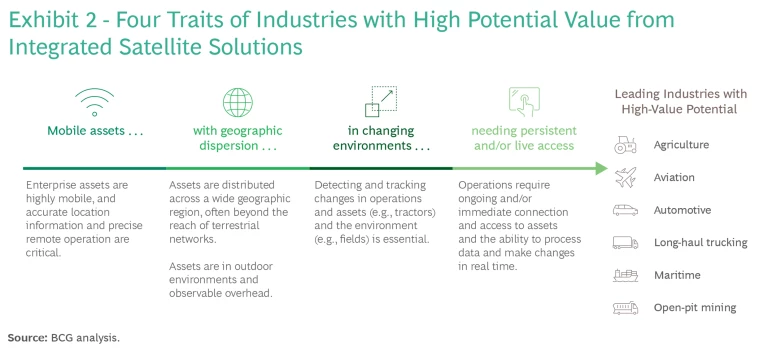

From the expanses of agricultural fields to the skies navigated by commercial airlines, integrated space services are reshaping operating landscapes. They are supporting new applications and product development, generating data-driven insights, and enabling operations on a global scale. This is especially true for businesses whose assets have four key traits: they are geographically dispersed, mobile, operate in changing environments, and need persistent and/or real-time access and management. (See Exhibit 2.)

The results, based on our analysis, include:

- Up to 15% increases in gross margins

- 25% growth in revenues

- 10% reductions in operating costs

- 10% lower fuel emissions

In the agricultural industry, for example, using satellites for soil- and crop-health monitoring can boost yields by up to 15% while reducing water, fertilizer, and pesticide usage by up to 20%. And in aviation, airlines can optimize flight paths, reduce fuel costs, and use predictive maintenance to cut asset downtime significantly.

The Backdrop

The space services industry is evolving rapidly. Fleets of satellites are transforming from geostationary (GEO) satellites that orbit over the same location to growing constellations of low-Earth-orbit (LEO) and medium-Earth-orbit (MEO) satellites with global coverage and modern high-performance payloads. GEO satellites remain essential, but LEO and MEO can be less expensive while offering a host of improvements such as greater coverage, lower latency, higher-bandwidth communications, more timely imagery, or more accurate position data.

Satellite-based capabilities are also becoming more and more robust, with a host of new entrants in the space industry driving rapid innovation, and the number of satellites available poised to increase dramatically. These advancements will be bolstered by improvements on the ground, offering greater opportunities for different satellite technologies to converge. For example:

- Satcom operators and suppliers are developing multi-orbit, mobile terminals for trucks and other vehicles, allowing consistent connectivity anywhere in the world.

- Earth observation operators are improving the availability and ease of access to data through APIs, allowing for direct integration into operations management and decision-making tools.

- PNT ensures that end users can rely on precise data no matter where their operations may be.

Because of the recent availability of more advanced space capabilities and because adopting integrated space services is complex, many industrial companies have not yet tapped into the full potential of these services.

Many industrials are still employing out-of-date technologies or have failed to integrate available space services in a way that creates value greater than the sum of their parts—often purchasing and leveraging space services in a siloed manner. One challenge is that integrated solutions must be industry- and, in many cases, business-specific. There are few viable off-the-shelf integrated-space-services solutions currently available, and businesses will typically avoid developing, employing, and scaling cutting-edge tools independently. This is primarily due to the complex technical requirements and perceived high initial-investment costs of space services.

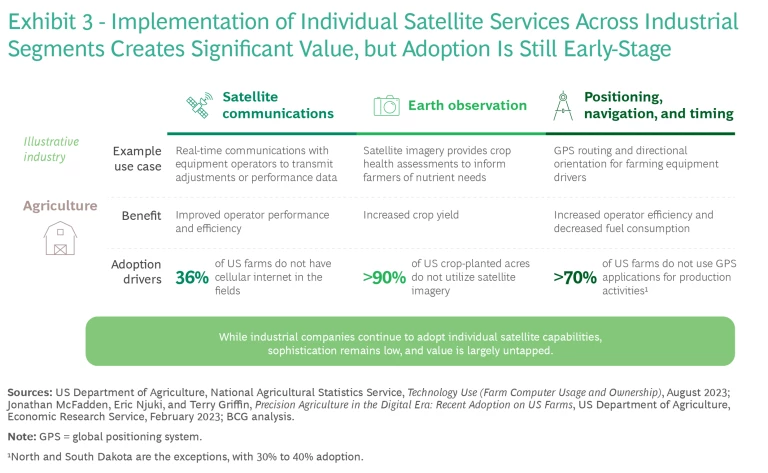

But some keen competitors are beginning to change the paradigm, achieving substantial gains in business performance. (See Exhibit 3).

The Idea in Action

John Deere, a US manufacturer of agricultural and forestry equipment and other heavy machinery, has already equipped roughly 600,000 tractors and other pieces of agricultural equipment with connectivity, primarily through cellular, but is working to connect over 1.5 million machines in total by filling in signal gaps with satcom—allowing its customers to manage their fleets via a fully integrated suite of space services. Deere has already enabled the employment of cutting-edge agricultural techniques using Starfire, its own satellite- and ground-based PNT system; aerial imagery provided by drones, aircraft, and satellites; and signals from cellular networks (where available).

Going forward, its customers will no longer be constrained by cell networks. Instead, their equipment will have access to always-on high-speed connectivity that allows not only the exchange of mission-critical machine data but also real-time sharing of equipment location, farming progress, and sensing data of their fields. These benefits will ensure that most of the fleet will enjoy features such as machine-to-machine communications that offer near-real-time updates, helping to optimize routing based on the individual progress of each machine in the field.

Now What

To implement integrated space services successfully, industrials need to align them strategically with their company’s core use cases (such as asset management or precision agriculture) and develop a clear understanding of the potential impact on customers and the business. They need to:

- Assess the specific needs and technological readiness of their business and formulate a nuanced understanding of today’s rapidly advancing space capabilities.

- Identify the highest-impact use cases for integrated services in their industry and prioritize the most appropriate for their unique business.

- Bring potential vendors and technologies together to develop a customized, integrated solution.

Not every use case will require all three individual space services in equal measure. However, there are several key types of high-value, integrated use cases, all of which depend on low-latency connectivity via satcom, working with EO and PNT to varying degrees. These include:

- Fleet management

- Machine-to-machine coordination

- Route optimization and smart navigation

- Semiautonomous and fully autonomous operations

- Equipment monitoring and predictive maintenance

- Site safety and oversight

With the solutions chosen, CEOs should prioritize the role of space services within the overall business strategy—understanding and communicating their fit with product development, business operations, and the company’s digital transformation. Doing so will help ensure a smooth transition to advanced satellite systems, fostering innovation and driving sustained growth.

The authors would like to thank David Potere and Alessio Bonucci for their contributions to this article.