Space operations have shifted from the public sector to the private sector over the past two decades, with enormous implications for governments. In the past, agencies like NASA had a monopoly on space program execution. In the current era of Space 4.0, most space functions—both in orbit and on the ground—are handled by a proliferation of commercial players, with new entrants continuing to join the market. As a result, agencies at the national and state level need a far different set of capabilities than they did in the past.

Our experience supporting governments has helped identify four key imperatives that all space agencies seeking to spur economic development and expand their

space economy

must prioritize:

- Set clear growth targets for the local space industry.

- Create a differentiated value proposition to entice private sector players.

- Develop the right end-to-end investment framework.

- Build a flexible operating model.

These are tested strategies that leading space agencies around the world are already successfully applying. They serve as a benchmark for space agencies looking to capitalize on the new era of commercialization in space.

New Space Agencies Are Emerging—and Their Mandates Are Evolving

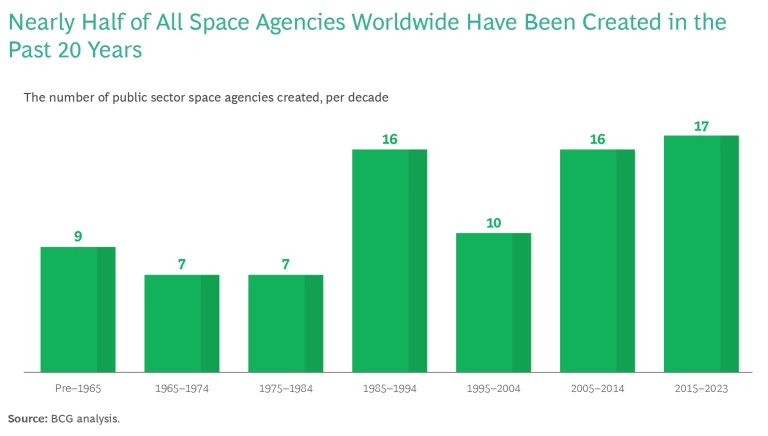

There are nearly 90 national and state-level space agencies operating around the world. (See the exhibit.) Of that total, close to half were created in the past 20 years, many in countries without traditional programs focused on human space flight or exploration.

For most governments with an interest in space, however, the commercialization of the space sector has expanded and diversified the mandate of these agencies. Countries with established space programs now seek to partner with industry to develop more rapid and innovative solutions to technical or engineering challenges. They also leverage the commercial space industry to help with emerging use cases for space services (such as earth observation for climate and sustainability initiatives), support research transfer from academia to industry, fund early-stage space companies, and collaborate with international partners on next-generation space missions.

Many of these countries want to work with the private sector to further develop the space economy at the regional or state level—reflecting the expanded opportunities for smaller nations and regional authorities to engage in the space economy and create the capabilities they need, such as satellite communication.

In addition, countries that don’t have—or want—a national space program can still engage in the space economy by putting their domestic industrial base to use and helping to develop commercial companies that support the space sector.

Four Imperatives

The evolution of the space sector landscape is requiring well-established space agencies to adapt and new agencies to carefully consider what role they will play vis-à-vis the commercial sector. In our experience, both types of organizations share several imperatives that are essential for success.

Set clear growth targets for the local space industry. Establishing clear and measurable goals, in both the short and the long term, is crucial for space agencies to strategically engage with the market and maintain accountability for their progress. Formulating these objectives requires a comprehensive assessment of the local space economy across the value chain, including research, ground operations, manufacturing, launch activities, and space-related services. From that baseline, organizations can set ambitious yet achievable targets in each segment, supported by specific steps to achieve their aims.

This goal-setting process not only serves as a roadmap for organization development but also promotes transparency and collaboration within the agency. By clearly defining objectives and the steps needed to succeed, all stakeholders—including employees, investors, and the public—gain a better understanding of the agency’s direction and aspirations.

The Australian Space Agency is a good example of setting growth targets. Established in 2018, the agency defined clear objectives, such as increasing the Australian space market from $3.9 billion in 2019 to $12 billion by 2030. Key steps to accomplish this growth are to welcome international investment and collaboration, build national capabilities (primarily launch infrastructure), and develop a regulatory framework that ensures safety and security but does not limit expansion. A $1 billion capital investment pipeline funds research through 2025.

The agency also aims to triple the number of space-related jobs, from 10,000 in 2019 to 30,000 by 2030 (with additional positions stemming from spillover effects). Key initiatives for job growth include fostering enthusiasm for space among young Australians and investing in STEM education. The agency aspires to reach more than 10 million Australians annually to enhance awareness of space activities and their impact on the local economy.

Create a differentiated value proposition. The space market is increasingly competitive, and governments must develop a clear and differentiated value proposition to attract private sector players. Factors such as advantageous geographic conditions that support space activity, partnerships with industry, a strong space sector workforce, collaborative relationships with other government organizations, advanced research and innovation, and financial terms and incentives can all help an agency differentiate itself.

The space market is increasingly competitive, and governments must develop a clear and differentiated value proposition to attract private sector players.

Florida has long been a hub of space activity, home to well-established facilities that have hosted many of the most famous space launches in history. The state remains a leader in the space sector owing largely to the business model of Space Florida, the state agency charged with promoting and developing Florida’s space economy. Space Florida has effectively used Florida’s geographic advantages, unique space heritage, and infrastructure to expand its space industry through a differentiated value proposition:

- Geography. Florida is uniquely positioned geographically to support space operations. The Space Coast is perfectly situated for a launch over water, with attractive azimuth options, and existing infrastructure to transport and deliver payloads and equipment. The Spaceport Improvement Program—a partnership with the Florida Department of Transportation that also benefits from private funding—will create a statewide spaceport system with enhanced infrastructure and new facilities.

- Regulations. The state is host to more than 16,000 aerospace-related companies, in part because of attractive regulations (such as a 2023 law that limits the legal liability of commercial launch companies in the event of injuries to crew or passengers).

- Workforce. Florida has a strong existing space sector workforce, with more than 151,000 aerospace employees, and is investing to further develop its talent base. A recent $30 million initiative supports workforce development along the Space Coast, linking Space Florida, the Department of Education, and other government agencies and NGOs. Florida’s universities also support the space sector.

- Partnerships. Collaborations are a key differentiator for Florida, including a 30-year agreement between NASA and Space Florida to operate and manage the facility that hosted Space Shuttle landings (and is available for commercial activities).

- Innovation. Space Florida is helping drive innovation. A 2013 partnership with the Israel Innovation Authority allocated $20 million to support the research, development, and commercialization of aerospace and technology projects to benefit both governments.

- Funding. Space Florida has been effective at securing financial conditions and incentives to expand the space sector, executing more than $500 million in financing transactions since 2000. These include major projects like a $24 million deal to fund the construction of the Horizontal Integration Facility for Boeing’s Delta IV launch vehicle program.

Develop the right end-to-end investment framework. Government space organizations need to clearly establish a funding ecosystem that supports agency-specific goals. This means identifying how funds will be sourced (for example, from government budget allocations and/or private capital) and deployed (all upfront or annually), along with ensuring that allocation decisions are transparent and meet the needs of both established players and startups.

Funding must be sustainable. Space organizations should proactively engage with stakeholders—including policymakers, private investors, and the public—to garner support for and build confidence in the agency’s financial framework. Some agencies may opt to establish financial reserves and contingency plans, which can help them manage unforeseen funding challenges or budget fluctuations.

The Luxembourg Space Agency (LSA) is a good model for sustainable funding. LSA was founded in 2018 with the goal of using state funds—from the national government, the EU, and the European Space Agency—along with private sector financing for three main objectives: research, support for space ventures, and broader funds aimed at expanding technical industries. Luxembourg’s space sector now comprises approximately 70 space and satellite companies. The country’s approach shows the importance of guaranteed sources of funding in attracting promising space firms and investors for the long run.

Build a flexible operating model. The operating model for space agencies falls on a continuum between two archetypes. One is the direct-control operating model—used by traditional entities such as NASA—with a large organization structure segmented into multiple functions and activities. The other model is an industry growth platform, which tends to be smaller in scope and narrower in focus. But all agencies, regardless of where they fall on the spectrum, must be flexible enough to support commercialization and the development of their national or local space sector, with governance that helps the organization integrate industry perspectives and capabilities and promotes growth across the value chain.

NASA clearly uses a direct-control operating model, but it still has many elements that focus on commercial growth and is fully committed to partnering with industry to develop the overall space economy. By law, NASA is mandated to “seek and encourage … the fullest commercial use of space,” and its operating model seeks partners to support research, design, and other mission-related activities. Several features of the model show this flexibility in action:

- Individual research centers and NASA facilities have distinct partnership priorities. For example, the Goddard Space Flight Center has a Strategic Partnerships Office that helps facilitate and promote technology transfer to the private sector and aims to foster broader collaboration between NASA and industry. Individual centers also support industry partners in expanding their relationship with other elements of the NASA enterprise.

- NASA seeks commercial input for addressing critical objectives in space sector development. The Commercial Low Earth Orbit (LEO) Development Program is designed to foster commercial activity and will help NASA adopt a more efficient approach to meeting its operational requirements in LEO. As part of this program, NASA works with private sector partners including Axiom Space, Blue Origin, and Nanoracks to develop commercial LEO destinations in space, which NASA expects will begin offering satellite services to both government and commercial customers in the late 2020s.

- NASA uses public-private partnerships to develop the commercial space industry and capitalize on new capabilities to meet key mission priorities. For example, the initial Next Space Technologies for Exploration Partnerships (NextSTEP) program supports the next generation of human space flight. Through this program, NASA works with industry to solve technical challenges in areas like habitation systems, propulsion, and deep space logistics.

In this way, NASA has evolved its operating model to help expand the space industry, develop new capabilities, and shift key government activities to the commercial sector.

The commercialization of space dramatically changes the industry’s dynamics and creates new opportunities. Space agencies can capitalize on this shift, provided they evolve and diversify their mandate. By focusing on the four imperatives that we identified—clear growth targets, a differentiated value proposition, sustainable funding, and flexible operating models—agencies can collaborate more effectively with private firms. In doing so, they can develop a synergistic relationship in which the public and private sectors combine to make countries more innovative and competitive.