$200 billion by 2030. That’s the amount of enterprise value that industrial software as a service (industrial SaaS) is likely to add to companies in North America by the end of this decade, according to the latest BCG estimates.

We define industrial SaaS offerings as data-based services that manufacturers can provide to enhance the value of digitally connected products and that they can monetize through subscriptions. Not only are such industrial hardware-based digitally-delivered services becoming a large and lucrative business, but also the market is likely to continue growing rapidly in the foreseeable future.

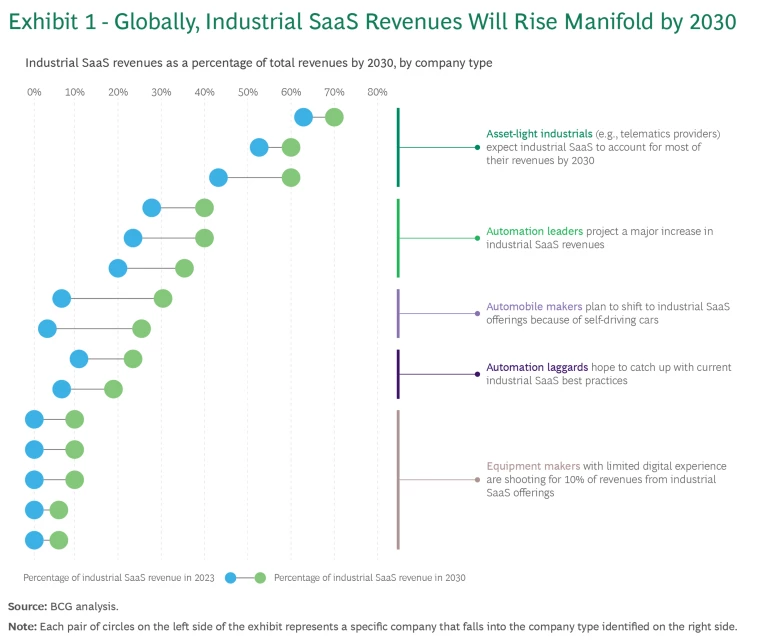

Several companies are trying to fuse the machines spawned by the Industrial Revolution with the Industrial Internet of Things (IIoT), connectivity and cloud storage, and GenAI systems enabled by the Digital Revolution to develop industrial SaaS offerings. Up to 55% of North American manufacturers plan to use industrial SaaS-based business models to grow in the near future, according to a recent survey conducted by the National Association of Manufacturers. Accordingly, they are setting ambitious industrial SaaS revenue targets for 2030. (See Exhibit 1.)

Yet only 15% of manufacturers have successfully built industrial SaaS-based businesses, according to the same survey. A gap between aspiration and actuality becomes evident when industrial companies try to develop digital services. This happens for a variety of reasons. Fundamentally, industrial SaaS offerings require new business models and distinct capabilities that can be challenging to infuse into an industrial hardware business.

The traditional industrial business model of one-time equipment sales, followed by the supply of parts and support services, has existed for centuries. Changes to that paradigm can’t be achieved overnight, which is why industrial companies must start with the right vision, make adequate investments, and transform their talent and ways of working right away.

Before attempting to establish an industrial SaaS business, manufacturers must consider whether they can develop a winning SaaS strategy for their specific context. (See “Is an Industrial SaaS Strategy Suitable for My Organization?”)

Is an Industrial SaaS Strategy Suitable for My Organization?

Q. Do our products have major effects on customers’ profits or value creation? Most winning companies’ products materially affect customers’ operations and profits, or deliver advantages such as customer satisfaction. For customers that make purchase decisions on the basis of economic value, the products create additional value by providing better performance, greater efficiency, or lower downtimes.

Q. Do our products play a central role in customers’ operations? Products with SaaS potential must be integrated into the customer ecosystem and contribute significantly to customers’ operations in terms of criticality, cost, and performance.

Q. Are our products connected, and can they be upgraded over the air? If they are to add incremental value, products must be digitally connected and must generate data that the company can use to optimize the system with regular updates.

Q. Do we interact with end customers? Companies that operate close to end users and develop long-term relationships with them gain deeper insights into customer needs and behavior. They can use these insights to extract the full value of their goods and influence customer behavior.

To illustrate the framework’s application, consider two companies. One is a farm equipment manufacturer that uses connected equipment, data analytics, and AI to improve its products’ operational efficiency and boost its customers’ profitability. An analysis shows that this global leader meets all of the criteria indicative of an industrial SaaS-based business model that will deliver results:

✓ Customer Impact and Added Value. The company’s analog products are critical for customers to generate revenues and make profits. They greatly influence farmers’ operations, and recent advances in digital technologies improve farmers’ operational efficiency and boost their profit margins.

✓ Relevance. The company provides a wide range of machinery that covers almost every aspect of farming, from ploughing to harvesting, and is central to customers’ daily operations.

✓ Connectedness. Almost all of the company’s products are connected. For instance, its tractors are connected to the internet, allowing remote operation and monitoring.

✓ Relationships. The company has a vast amount of experience in every aspect of agriculture, with direct access to farmers and data. It has also built an extensive dealer network to ensure that it stays close to customers.

The other company is an automobile manufacturer that introduced a subscription service for features such as heated seats and steering wheels some years ago. Customers were so hostile to the idea of paying for those features that the manufacturer had to discontinue the service within a year of launching it. Applying our criteria shows why that happened:

x Customer Impact and Added Value. Customers didn’t see any value in paying fees for features that the manufacturer traditionally installed in the vehicle before sale and included in the vehicle’s purchase price.

✓ Relevance. Subscriptions were tied to a core part of the product experience, but users expected those features to be included in the upfront sale, given the premium product positioning.

x Connectedness. The features offered were not integrated into the company’s or the automobile’s digital ecosystem, and so offered no potential for additional value.

✓ Relationships. The automobile manufacturer was a well-recognized global brand with direct access to end customers and had built an extensive dealer network.

In addition, they must learn to use data and digital technologies , drawing on the experience of software players and peer pioneers. This article lays out the competitive advantages of such a transformative effort for industrial companies and details the two foundational steps involved in executing industrial SaaS business models.

How First Movers Are Using Industrial SaaS Business Models

Some industrials are developing innovative software-centric products and services, driven by technological advances such as inexpensive sensors that capture real-time data; low-cost cloud-based storage; affordable connectivity; the IIoT; and the rising adoption of AI and spatial computing. For example, software-defined car manufacturers and commercial vehicle makers are leading the charge into the future. BCG forecasts an eightfold increase in the market share of software-defined vehicles—whose functionality and features are primarily enabled and controlled by software rather than traditional hardware components—from 3% in 2022 to 24% by 2032. Makers of commercial vehicles, in particular, have prioritized fleet management, fuel efficiency, and total cost of ownership by providing advanced telematics, real-time diagnostics, and predictive maintenance in their trucks and buses.

Similarly, automation companies are finding success in combining IIoT and machine learning (ML) to offer predictive maintenance and process optimization services. One North American corporation has seen much demand for a digital service that it developed in-house. The offering helps its customers anticipate equipment failure, reduce downtime, and improve productivity, all through a service that scales easily and updates continuously.

Machinery manufacturers are using industrial SaaS offerings to integrate themselves more deeply into their customers’ businesses. For instance, a maker of agricultural equipment has created a digital agribusiness hub where farmers can access, view, and manage all of their data, from soil conditions and weather patterns to machine health and operation. The manufacturer provides digital tools for field planning, planting, spraying, irrigation, and harvesting, enabling farmers to monitor machine performance, optimize logistics, and analyze agricultural data in real time. The tools enable farmers to make decisions that increase productivity and help them manage their farms more cost-effectively.

The Many Merits of Industrial SaaS Business Models

An industrial SaaS strategy unlocks fresh value for customers. Investors, too, place a hefty premium on it. But while the opportunity is evident, capitalizing on it will require shrewd investments and radical changes in the way industrial companies work.

The shift from one-time sales to recurring revenues increases the importance of aligning the incentives between the manufacturer and customers. Until recently, most manufacturers didn’t maintain close connections with their customers after selling them equipment. That led to misaligned interests, with manufacturers benefiting from the need to maintain, repair, and provide spare parts for customers’ machines, contrary to the customers’ interest in minimizing these interventions.

In contrast, an industrial SaaS model gives manufacturers incentives to continuously increase customer value, exerting pressure on them to align more closely with customers’ needs. Besides, customers share some of the value created with the manufacturer even as they use the product or service instead of making a single upfront payment. Because equipment failure results in lost value for both customers and manufacturers, both have an incentive to maintain machines and minimize downtime. This alignment of interests encourages manufacturers to play a bigger role in customers’ success. As a result, industrial SaaS business models catalyze faster growth, yield higher margins, and provide less-cyclical revenues, according to BCG studies.

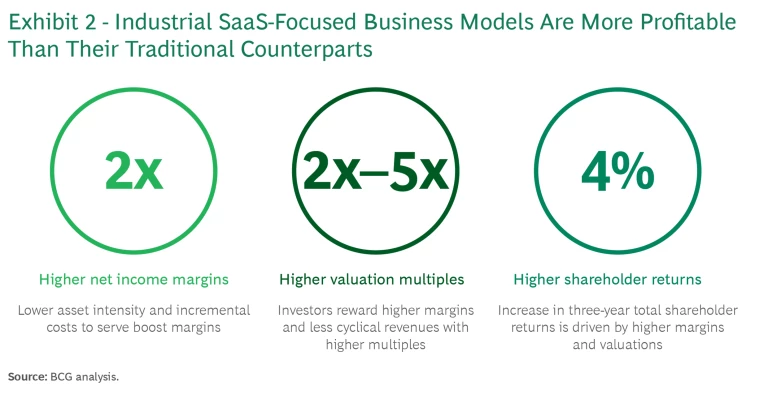

This hasn’t gone unnoticed in the capital markets. Shifting to industrial SaaS-oriented business models enhances industrial companies’ valuations, often resulting in price-earnings multiples that are two to five times as high as those of peers that haven’t made the transition. (See Exhibit 2.) Growth in recurring revenues also correlates with total shareholder returns; the returns that top innovators reported were around 4.3% higher than those of the other companies in our sample.

There’s one catch, though. Revenues from industrial SaaS business models command valuation premiums only for companies that generate them at scale. A BCG analysis shows that an industrial SaaS business must account for at least 10% of the company’s revenue to boost its market capitalization; a shift smaller than that won’t suffice. Indeed, investors have begun to regard industrial SaaS shifts and recurring revenues as standard elements of CEO performance expectations. This signals a subtle change: companies can no longer satisfy investors by saying that they’re planning for the future; they must start executing industrial SaaS transformations today.

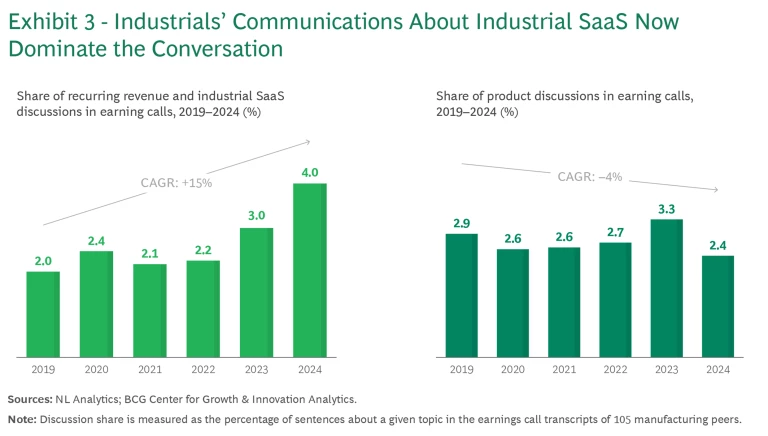

Another telltale indicator: a BCG GenAI analysis of approximately 100 industrial companies’ earnings calls in 2023 revealed a 15% growth in discussions about recurring revenues over the past five years. (See Exhibit 3.) Such conversations are now more frequent than discussions of traditional industrial hardware-related topics, which declined by 4% over the same five-year period, underscoring the value that investors now place on industrial SaaS business models.

Two Steps to an Industrial SaaS Future

Deep domain knowledge, established brands, and long- standing customer relationships, combined with the ability to invest, give industrial companies the ability to develop industrial SaaS products to complement their machines. However, many companies lack the expertise to build those solutions. According to the National Association of Manufacturers survey cited earlier, just 15% of manufacturers have made significant progress in deploying SaaS business models at scale.

There’s no dearth of failures. A global shipping company set out to create a software offering by using customers’ supply chain data to identify bottlenecks, but it failed to create a suitable product and a convincing value proposition. A large automation player rolled out several SaaS products but was tripped up by its inadequate go-to-market and pricing strategies. Another advanced automation player ran afoul of turf disputes between its sales teams that derailed the success of its software products.

Industrials that get industrial SaaS strategies right have three things in common. One is that they develop software that complements the hardware they manufacture. They don’t treat the digital business as a sideshow, but rather as a way of reinforcing their core industrial business.

Another shared characteristic is that successful industrial SaaS offerings solve customer problems that go beyond the hardware’s use. For instance, charging for a heated seat doesn’t create incremental value—but offering a subscription fee for autonomously driven vehicles, so customers don’t have to drive at rush hour or park in the city, does create fresh value.

A third point of commonality is that a well-conceived industrial SaaS offering delivers recurring value. If it did not, customers would perceive the payments they were making as installments for a capability that they received in the past or had always enjoyed. To avoid pushback, industrials must develop software that improves machine performance in real time, and they must provide over-the-air upgrades.

Meeting these criteria will enable industrial companies to forge deeper customer relationships and reinforce their leadership positions, making their businesses bigger, less cyclical, and more profitable. For instance, a telematics company realized some years ago that its customers needed to continually track their large truck fleets. Working closely with them, it developed a digital tracking solution that expanded to monitoring truck safety, fuel use, and drivers. Later, the company offered the underlying hardware for free, shifting entirely to a recurring revenues model. The telematics company executed the transition in 24 months, outperforming rivals by achieving gross margins of over 75% and a 20 times price-earning valuation multiple.

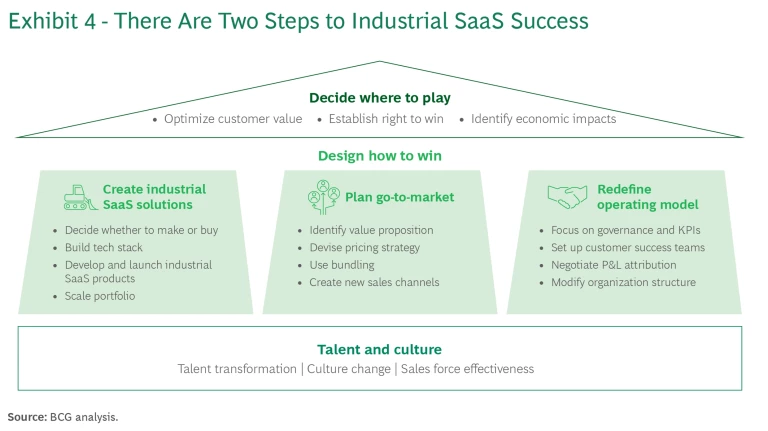

Winning industrial SaaS companies start from similar points, but they differ in how they identify value, choose offerings to develop, and execute product rollouts. Usually, however, their success or failure depends on their decisions about where to play and how to win. (See Exhibit 4.) Those two sets of decisions build on each other, generating a roadmap for creating and capturing fresh value.

STEP 1: DECIDE WHERE TO PLAY

Zeroing in on the growth opportunities that an industrial SaaS strategy offers is usually a back-to-basics exercise. The starting point is to identify your main customers’ current and emergent pain points. Then, figure out how you can fuse your existing hardware with data, digital technologies, and AI to deliver services with better results—financial, operational, and environmental—for your customers.

The manner in which you articulate your solution’s value proposition is critical to bringing customers on board.

Developing an industrial SaaS strategy just because you have customers and customer data won’t work. The key to success is the customer value proposition. Value propositions vary by industry and customer segment, but four themes run through successful industrial SaaS-based businesses:

- Efficiency. Offerings that focus on plant asset performance management will optimize operations, reduce downtime, and improve resource allocation, addressing the growing demand for streamlined and cost-effective processes.

- Effectiveness. Using SaaS products to promote data-driven and resource-efficient practices will grow top lines.

- Reliability. Deploying software for predictive maintenance to enhance safety and operational continuity will mitigate risks and reduce the impact of unplanned machine downtime.

- Sustainability. Industrial SaaS offerings can help align business value (for example, reduced energy consumption) with societal value (such as lower emissions).

Consider, for instance, an agriculture equipment manufacturer that has equipped the machines it makes with digital cameras; developed ML algorithms that can analyze color differences to differentiate between crops and weeds; and written targeting software that triggers the right quantity of herbicide to kill only the weeds growing in a field. The service helps farmers reduce pesticide consumption and costs, increase productivity and revenues, shrink environmental footprints, and boost bottom lines.

A good way to understand the impact of an industrial SaaS-based strategy is by projecting the likely short-, medium-, and long-term outcomes. Doing so will lead to prioritizing services on the basis of their financial attractiveness and technical feasibility. Conducting this exercise systematically will help manufacturers identify the hills that are worth climbing and the sequence in which to make the ascents. Focusing initially on a few big, easier-to-implement objectives will generate the most favorable financial results.

STEP 2: DESIGN HOW TO WIN

Developing an industrial SaaS business strategy requires a dual perspective. It entails fostering the growth of hardware-software products from concept to market, both technically and commercially.

Solutions Development. The first step is to define each solution from a technological standpoint. This will require the collaboration of the hardware team, the software product owner, designers, engineers, and solutions architects. Together, they must build, iterate, and refine the software design until the company is ready to turn the blueprint into technical specifications.

At the outset, industrials must decide whether to build the product in-house; acquire a specialized—and often smaller—solutions player; or partner with a digital solutions company. Smaller industrials may prefer to develop digital capabilities in-house, but larger ones will look to acquire them. In recent years, a BCG analysis shows, industrial companies have increasingly taken to acquiring industrial software providers at a premium. Many choose to acquire even to augment their go-to-market capabilities.

Before resolving the make or buy question, would-be industrial SaaS companies must evaluate the tech stack they will need to support the transformation. This study should encompass the company’s digital capabilities and scalability, not its IT infrastructure, in the context of customers’ current and emergent needs. Equally important, the industrial company must honestly assess its ability to absorb one or more software firms.

For instance, a large automation company recently acquired a software firm in order to develop solutions that would increase the energy efficiency of customers’ manufacturing processes . The acquirer focused the firm’s software product development on areas that would either generate synergies with its hardware or offer some strategic value. Realizing that the postmerger software product portfolio would be critical for success, the acquirer made some tough decisions, phasing out several nonsynergistic products at the cost of losing revenues in the short run.

In a similar vein, an IIoT company, which develops its core software in-house, expanded its capabilities and offerings by acquiring ten software firms over a period of three years. Its postmerger product strategy also revolved around dropping many noncore products and continuously improving synergistic ones. Two years after making its last acquisition, the IIoT company’s recurring revenues had shot up to a third of the total.

Go-to-Market. The biggest hurdle most industrials face is in developing a go-to-market strategy for industrial SaaS offerings. Market entry requires significant investments in sales, marketing, and customer support; software takes several years to scale and industrial companies have to spend large sums on customer conversion and product development.

Consequently, industrials must also learn to manage investor expectations; operating costs will rise in the short run as companies invest in developing digital capabilities.

Sales, marketing, and customer success teams, accustomed to sealing one-time sales of costly machines at periodic intervals and signing break-fix maintenance con- tracts, must completely change the way they think about their offerings and their selling processes. They will need to shift their focus from sales volumes to customer outcomes, a transition that often requires retraining traditional teams and/or acquiring new capabilities.

It isn’t easy. For example, a plant equipment manufacturer initiated its industrial SaaS transformation by launching an enhanced maintenance solution. The new offering, it hoped, would enable it to break into the predictive maintenance and process optimization businesses. Its sales teams’ incentives were tied to sales of hardware and break-fix maintenance contracts, however, while the digital team was offering a software product that improved the reliability of existing machines. Moreover, to strengthen customer relationships and land more deals, the hardware sales teams often offered the software products for free, “sprinkling it on top,” as one executive told us. Customers were confused about the software product’s real value and became reluctant to pay for it, since they could get it for free when buying new machines. No wonder the company’s industrial SaaS business model eventually failed.

By fostering close alignment between traditional sellers on the one hand and SaaS specialists, marketing, IT, and customer support on the other, industrial companies can ensure seamless customer journeys. Industrial SaaS sales teams must be able to explain to customers the manufacturer’s choices with regard to platform, data architecture, and data security—areas in which traditional sales teams have little or no experience. When a food processing equipment manufacturer introduced a recurring revenue solution, it chose to recruit specialized talent to spark and sustain customer engagement. Later, the company acquired a software firm that had expertise in digital product sales.

Three insights are particularly useful for selling industrial SaaS products, as the experience of a large transportation provider shows. First, the executives who make purchase decisions about hardware-based software products aren’t the same ones who buy your hardware. Consequently, the conversations need to shift from the equipment purchasing department to the digital organization.

Second, and because of that, the skills that companies need will change. Industrials must hire talent well-versed in selling software services, and educate them in industrial hardware rather than trying to upskill the traditional sales organization. Moreover, the focus of value creation in a subscription model shifts from a one-time sale to an ongoing relationship, which creates opportunities for additional sales to existing customers. Companies must develop new capabilities in customer success, which will catalyze customer retention and expansion.

Third, the basis of compensation techniques will have to change. Our interviews with several industrial SaaS providers showed that most companies have tied at least 20%— and up to 50%—of variable compensation to software sales in order to incentivize the shift from selling machines to providing services. Companies have even linked compensation to new metrics such as lifetime customer value, annual recurring revenues, and customer churn rates.

Pricing and Packaging. As part of their go-to-market strategy, the industrials need to define pricing and packaging. They can use many different pricing structures, such as subscriptions, promotions, freemiums, and, as the company’s offerings increase, bundling. Bundling drives revenue growth—and by increasing adoption, it facilitates cross- selling and customer retention.

Bundling also simplifies buying decisions; instead of researching and purchasing analog products and software services separately and then finding systems integrators to combine them, customers can get everything they need in one package. This practice is well suited to companies that have large portfolios of offerings with low marginal costs or with large variations in customer willingness to pay.

In addition, bundling create value for sales channels, which gain new ways of adding value by fostering manufacturer-customer partnerships. It also streamlines the sales motion, which should appeal to companies buying bundles for mission-critical applications and to consumers who are less tech-savvy.

For instance, automobile manufacturers often tailor pricing to customer groups, and a few premium car makers offer all-inclusive bundles with flexible subscription options.

These packages include unlimited car swaps and no-fee cancellation, and appeal to customers that value their image. Other manufacturers focus on delivering high value and cost efficiency, but sign multiyear contracts with customers to increase revenue predictability. Such subscription models include some level of assisted driving, and they are tailored to the preferences of customers that value efficiency and safety.

Operating Model. Smart organizations establish tools, processes, and roles that will drive collaboration and alignment across existing businesses and the industrial SaaS solutions business from the get-go. These companies embed financial and operational goals in their operational metrics, and they establish objectives for industrial SaaS revenues by business unit as well as setting targets for leading and lagging operational indicators.

An organization’s mindset needs to pivot from selling hardware to selling outcomes, which is a huge change. To catalyze that transformation, an industrial must rebuild the capabilities of almost every process it uses. For example, the finance function must learn to track new measures—such as monthly and annual recurring revenues, and customer lifetime value—because the company’s leaders will need to understand how deal flow and profitability are changing, and whether renewals are more profitable than new contracts. Even investors in SaaS-centered industrial companies will track different metrics, such as net retained revenue and customer retention rate, because the principles of revenue recognition for industrial SaaS offerings differ from those that govern equipment sales.

Customer support will have to shift from transactional interactions to continuous customer engagement and customer success. Organizations must enable their existing customer success teams to explain complex billing structures such as recurring billing, usage-based pricing, and tiered subscription models, even as they educate customers about adoption and long-term success. Effective customer success teams use predictive analytics to forecast potential dissatisfaction and churn, proactively intervening to maximize customer retention.

Chasing growth through industrial SaaS-based business models that complement the core hardware business—and may equal it over time—poses a number of challenges. The level of upfront investment for a full-scale SaaS initiative can be daunting, and the development, sales, and marketing training required to scale an initiative will take time. The solution, however, is to adopt a customer-first approach.

Your customers can show you how to assist them, so that both of you benefit. Approach your customers with the right mindset, and they will help you develop software services that solve their real problems. They will teach you how to talk to them about creating value and pricing in a way that captures value for both. And your customers will be the first to let you know if things aren’t working out. Remember, the cornerstone of winning with an industrial SaaS business model is the pervasive organizational belief that your company will win only when your customers win.