Conversations with private equity (PE) investors reveal a growing consensus: For many portfolio companies, sustainability has become a proven lever for value creation, whether through reduced operating costs, lower risks, or green-related revenue opportunities. That’s why many PE firms are stepping up, driving tangible improvements in sustainability across their portfolios. For example, compared to the ESG Data Convergence Initiative (EDCI)’s 2023 benchmark, renewable energy use at portfolio companies is up, and both job creation and gender diversity representation in private company C-suites continue to outpace public companies.

See the full report appendix for additional details on the composition of the EDCI benchmark and member survey, as well as submission rates across EDCI metrics.

However, the picture isn’t entirely rosy. Job creation at portfolio companies has slowed—a reflection of the current economic climate and ongoing investment in digitization and automation. And private companies still trail their public peers in gender diversity at the board level.

The substantial increase in EDCI data points available for analysis this year tells its own story. We collected over 150,000 data points covering around 6,200 private companies held by more than 260 PE firms—a 45% jump from last year. This uptick signals a strong push within the private equity ecosystem toward improving the quality and consistency of sustainability reporting.

With another year’s worth of data to analyze, it is becoming increasingly clear that PE firms are well positioned to make a real impact on the portfolio companies they own. While private companies often start with weaker sustainability profiles, those owned by PE funds that put a focus on sustainability show improvements across several critical metrics, on average, including renewable energy use and safety outcomes during their traditional hold-period. This mirrors the broader ability of private equity to professionalize and enhance businesses under their ownership.

Making Progress

The PE industry is increasingly recognizing that for many portfolio companies improving sustainability outcomes is good business. The means of value creation will vary for different companies in different industries, but the opportunities arising from stronger sustainability practices can take many forms, including:

- reduced operating costs, such as through energy efficiency measures and adoption of lower-cost renewable energy;

- lower risks, such as by avoiding regulatory fines;

- new green growth and revenue expansion pathways through new circularity value pools, the ability to capture green premiums, and appealing to customers who have supplier sustainability targets; and

- the business opportunity inherent in a more diverse leadership team driving company agendas forward.

BCG highlighted previously how climate leaders can realize these and other commercial benefits and gain competitive advantage in two World Economic Forum reports: “Winning the Race to Net Zero” and “Winning in Green Markets.”

Given the sheer scale of the private equity industry, the potential for significant, lasting impact in the coming years is enormous. The good news is that many portfolio companies under PE ownership are making strides across key sustainability metrics, and particularly in renewable energy usage, job creation, and C-suite diversity.

Renewable energy

Globally, the commercial case for renewable energy is becoming difficult to ignore, and leaders are responding by scaling up their usage. (See “The Renewable Energy Advantage.”) Since last year, both public and private markets in aggregate have nudged their renewable energy usage upward. Among private companies that use renewables, the median EDCI company increased its usage to 30% in 2023, up from 28% last year. In comparison, public companies saw a rise from 29% to 32% over the same period.

The Renewable Energy Advantage

“Encouraging portfolio companies to develop a renewable energy procurement model suitable for their ambition and industry is one of the first levers we look to pull as we establish their decarbonization plans,” says Enol Osorio Rodriguez, Director, EQT Infrastructure. To bring additional expertise to their portfolio companies, EQT partners with technical advisors like Schneider Electric and Southpole to assist in identifying the most appropriate instruments and sources of renewables, optimized specifically to each portfolio company’s energy needs.

Options include deploying on-site renewables, entering into Power Purchase Agreements with energy suppliers, and securing Energy Attribute Certificates (EACs) (instruments that represent proof of securing clean, carbon-free generation of energy). These partnerships allow EQT to bring its considerable buying power to the table. For example, EQT in combination with the chosen technical advisor can negotiate bulk EACs to meet the needs of companies across the firm’s portfolio, often resulting in significant cost savings when compared to companies seeking such certificates individually

In partnering with management teams across its portfolio of companies to procure meaningful quantities of renewable energy, Osorio Rodriguez says, “We believe we are not only delivering on our climate ambitions but also building competitive advantage for our portfolio companies as they become more mature, cost-effective, and independent in a competitive and crowded market.” Osorio Rodriguez cites several commercial benefits for companies that have incorporated renewables into their mix, all of which align with BCG’s own experience, as we highlighted in

Even more promising is the narrowing gap between private and public companies in adopting renewable energy. The percentage of private companies that boosted their renewable energy usage by 25 percentage points or more rose by 2 percentage points from last year to 12%, compared to just 6% of public companies during the same period.

At the regional level, private companies in North America still lag significantly behind their European counterparts. Factoring in companies that use no renewables at all, the median European company sources 22% of its energy from renewables. By comparison, the median renewables source rate in North America is just 1%, up from 0% last year.

Last year’s report noted that recent policy changes and incentives in the US could drive improvements in renewable energy consumption. While these developments are still expected to shape the renewables trajectory, the International Energy Agency anticipates that the most significant impacts on the availability of renewable energy will not materialize until the second half of the 2020s, given the lengthy deployment timelines.

As a result, we expect a more rapid acceleration in renewables adoption among private companies in the US later in the decade, as policy support strengthens and cost competitiveness with fossil fuels improves. Already, there has been some progress in North America, with the percentage of private companies using no renewable energy decreasing from 54% in 2022 to 49% in 2023.

The decision to switch to renewables can be complex, but as the commercial benefits become undeniable in many contexts, we urge PE firms to encourage their portfolio companies toward greater renewable energy use—unlocking value for shareholders and stakeholders alike. As it stands, significant value is being left on the table.

Job creation

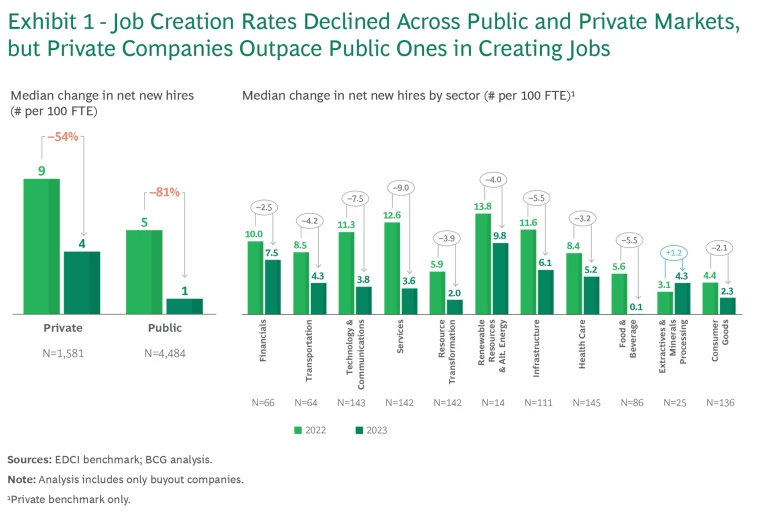

Last year’s EDCI results dispelled the myth that private companies are slower to create new jobs, net of attrition, than their public counterparts. This year, however, job creation has slowed across the board—down from 9 net new hires per 100 full-time equivalent employees (FTEs) at private companies to 4 new hires, and from 5 to just 1 at public companies. This deceleration reflects the challenging macroeconomic environment, higher interest rates, slower company growth rates, and increasing emphasis on digitization and automation. Still, private companies continue to create jobs at a higher rate than public ones.

The slowdown is consistent across regions and sectors, with job creation in the US slowing more than in Europe or Asia, albeit from a higher baseline. At the sector level, the most notable declines were in Services and in Technology and Communications, where median net new hires per 100 FTE fell by 9 and 7.5, respectively. (See Exhibit 1.) Yet it is reassuring that job growth remained positive despite significant layoffs at several major professional services and technology companies over the past year. Other sectors that saw significant shifts in hiring patterns included such workforce-intensive sectors as Food and Beverage and Infrastructure.

Diversity

For the third year in a row, private companies are outpacing public companies in gender diversity at the C-suite level, but they are still lagging at the board level. Seventy-seven percent of private companies have at least one woman in the C-suite, compared to 64% in public markets—a significant margin. But the proportion of private companies with at least one woman on their board rose 3 percentage points this year, to 61%, while a similar increase brought the percentage for public companies to 89%.

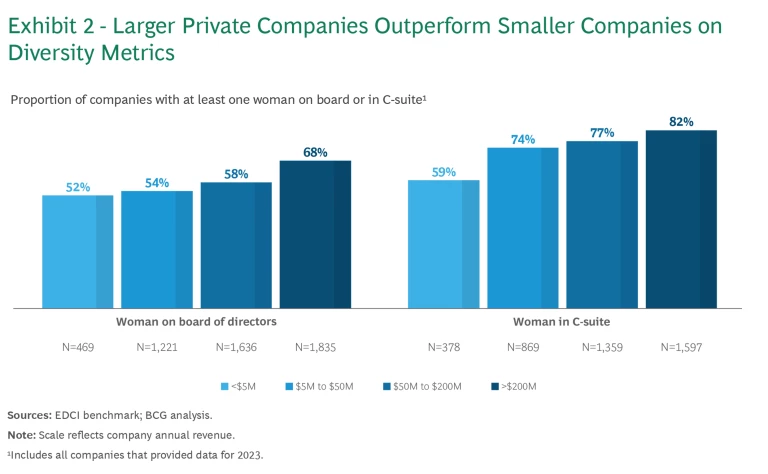

Discussions with leaders at several private equity firms suggest that a primary reason is the smaller board size at many private companies compared to public companies. This observation is supported by our research; the smaller companies in our data set tend to have smaller boards. Nearly 70% of companies with more than $200 million in revenue have at least one woman on the board, compared to just over half of those with revenues under $50 million. (See Exhibit 2.)

Moreover, portfolio company boards often include senior investment team members from PE firms, who themselves tend not to be diverse at senior levels. Still, the slow progress in this area is concerning, as diverse decision-making teams have been shown to drive better business outcomes. Expanding or diversifying boards is one of the easiest ways to foster better company oversight, and we hope to see more progress in this area in the years ahead.

Holding On

Among the key strengths of the PE investment model is the longer time horizon that PE firms operate on compared to publicly traded companies, which are often under pressure to deliver quarterly results. This timeframe allows PE firms to focus on improving the performance of their portfolio companies over their period of ownership. Last year, the EDCI began asking GPs to provide data on how long they have held the companies in their portfolios. The goal was to gain a better understanding of how the hold period affects both financial performance and sustainability progress. The results are clear: Over the duration of a fund’s ownership of a company, sustainability metrics improve on average, particularly in renewable energy usage, work-related injuries, diversity, and employee engagement.

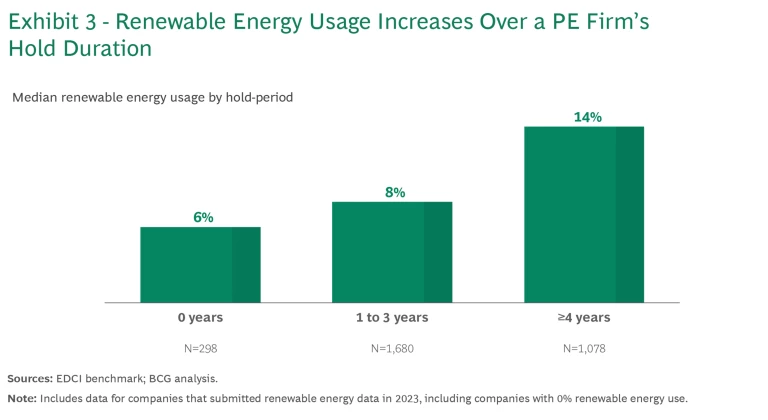

Renewable Energy. As we’ve seen, private companies are increasingly adopting renewable energy. With an additional year’s worth of data, we can track this progress over time. PE firms typically acquire companies with low levels of renewable energy usage—just 6% on average at acquisition. But over the course of the ownership period, this figure climbs to 14%. (See Exhibit 3.) PE firms are capturing long-term commercial benefits from increasing renewable energy usage over time and are often effectively incorporating this as a strategic lever for meeting fund-level decarbonization commitments.

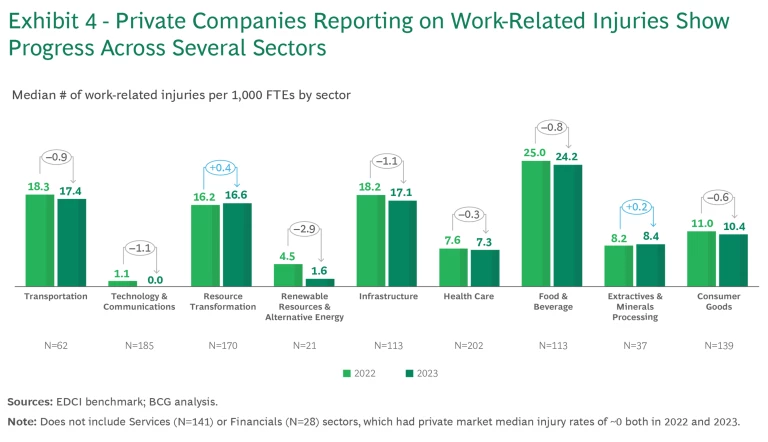

Work-Related Injuries. The hold period also positively affects the rate of work-related injuries at private companies across most sectors. Overall, companies that have reported injury rates for the past two years have reduced their median rates from 2.2 per 1,000 FTEs in 2022 to 1.8 in 2023, an impressive 22% decrease. Some high-risk sectors, notably Infrastructure and Transportation, have made especially good progress in this regard, while others, including Resource Transformation and particularly Food and Beverage, have not. (See Exhibit 4.) The different absolute levels of injuries often reflect the nature of roles within those companies. For example, the Food and Beverage sector experiences high levels of injuries as workers can experience cuts, punctures, scrapes, burns, and falls when processing, packaging, transporting, and manufacturing foods.

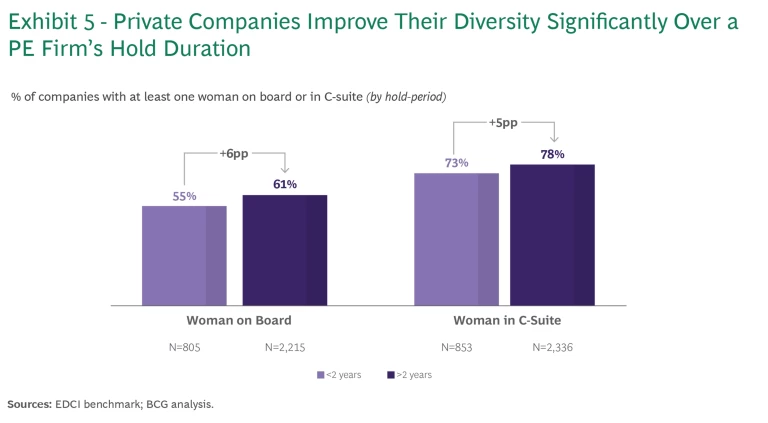

Diversity. The same hold-period phenomenon is also true for gender diversity in key management roles. Over 60% of companies held for more than two years have women on their boards, 6 percentage points higher than those held for less than two years. Similarly, women play a role in the C-suite at almost 80% of companies held for more than two years, compared to 73% of those held for shorter periods. (See Exhibit 5.)

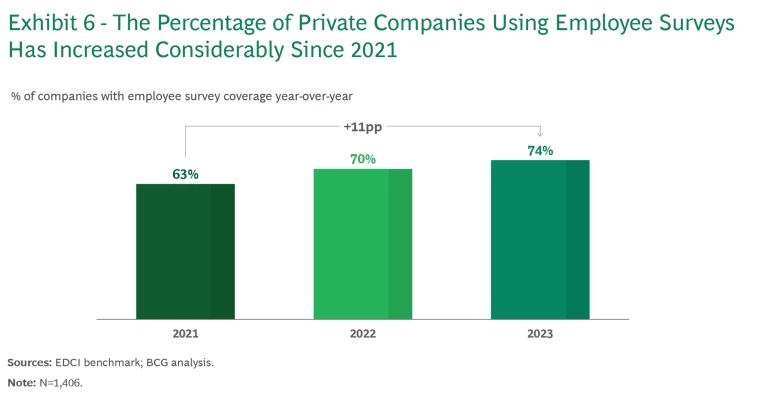

Employee Engagement. One area where the EDCI has had a particularly catalytic role has been the deployment and use of employee surveys. These surveys are vital for gauging employee engagement, offering avenues for them to provide feedback to management, and, when acted upon, improving the employee value proposition and reducing turnover. The use of these surveys has grown significantly among EDCI member companies, rising from 63% in 2021 to 74% in 2023.

We at BCG are pleased to see that the EDCI’s emphasis on best practices in sustainability is driving positive outcomes in this key area. Indeed, we've heard from EDCI members that including this metric has encouraged more widespread use of surveys across their portfolio companies. We expect this trend to continue as companies increasingly take the “no-regrets” path to actively engaging with employees and gathering their feedback.

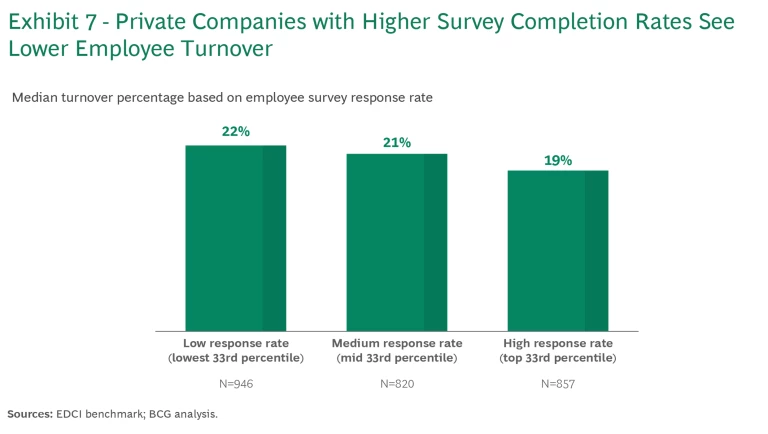

However, employee surveys are only effective if they are completed and if employers act on the feedback they receive. Therefore, the EDCI also tracks survey completion rates. It is reasonable to assume that employees who believe their company approaches internal surveys with the intention of improving the employee value proposition are more likely to complete them—and in turn benefit from the outcomes. And in fact, private companies with higher employee survey completion percentages experience lower employee turnover. (See Exhibits 6 and 7.)

This is crucial: In many instances, lower employee turnover can directly impact performance, reducing employer expenses through lower recruiting and onboarding costs while boosting productivity. Reduced employee churn also opens up more opportunities for upskilling and promotion within the workforce. These insights align with recent research by Jobs for the Future and the Workforce & Organizational Research Center, which highlights the critical role that PE firms’ efforts in managing human capital and fostering quality jobs can play in generating sustainable, long-term value across their portfolio companies.

Evidence from the third year of the EDCI continues to demonstrate that while PE-owned companies may initially have relatively weaker sustainability profiles, over the duration of a fund’s ownership they are able to significantly improve sustainability outcomes, including renewable energy use, safety, diversity, and employee engagement. These enhancements not only align with broader sustainability goals but also drive measurable business value, contributing to the long-term success and competitiveness of portfolio companies.

This is no time for the PE industry to become complacent. This year’s results also highlight the many opportunities for private companies to enhance their sustainability performance, particularly in rapidly scaling renewable energy adoption and diversifying board leadership. As the link between sustainability initiatives and commercial success becomes increasingly evident, we anticipate that PE firms will continue to intensify their focus on these areas, pulling these levers strategically to create more value in the years ahead.