Of all the forces reshaping the global fuel and convenience retail industry, none is having a larger impact than the rise of

electric vehicles

(EVs).

The So What

As EV penetration rises between now and 2035, profit pools will shift, service stations will close, and site formats will evolve.

Reality differs by market. We see three primary market scenarios that are likely to play out globally by 2035. We have modeled each to understand how these markets will evolve. Fuel retailers can use these market scenarios to position themselves to adapt over the short, medium, and long terms.

- Scenario 1: Fossil Is King. The EV market remains nascent in 2035, with about 15% vehicle stock share (share of all the vehicles on the road). Public charging infrastructure is limited as are the convenience retail offerings.

- Scenario 2: The Rise of EVs. Electric vehicles are threatening the dominance of fossil fuels (vehicle stock share of about 30% in 2035) and infrastructure is developing. The convenience offering is mature and is continuing to evolve toward fresher food and a more personalized experience, with customer trips often not associated with refueling.

- Scenario 3: Electric Dominance. EV dominance has arrived (with a vehicle stock share of about 55% in 2035), charging infrastructure is well established, e-trucks are taking off, and autonomous vehicles are beginning to gain traction. Convenience offerings are less mature. However, there is significant growth potential in visits not associated with fueling or charging.

It’s worth noting that there are wild cards that could materially alter these scenarios, including changes in the regulatory environment, pace of technology development (for example, battery-swap, e-truck, and hydrogen), and evolution of fuel and charging margins.

Fuel retailers need to closely monitor market changes and adjust their strategy accordingly.

We see three major market shifts with varying impact across scenarios:

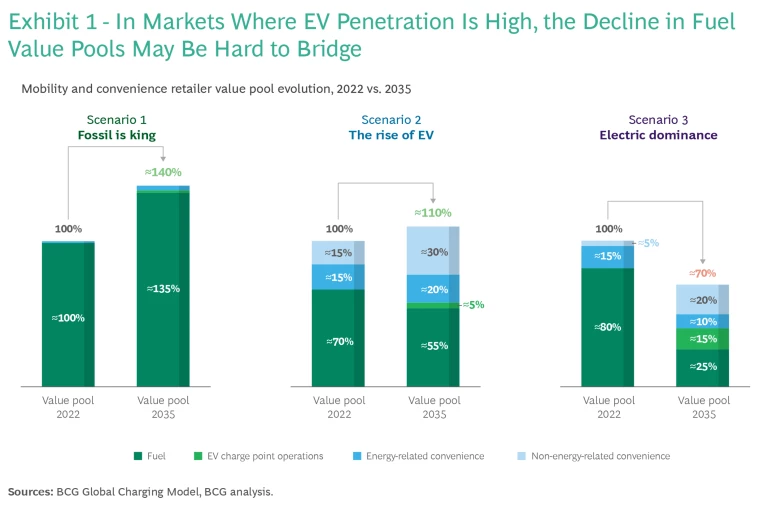

Profit pools will contract where EVs dominate. As EV penetration grows, profits from fuel will decline by up to 60%. In many markets two growth opportunities promise to fully or partially offset this decline in profits. First, charging will be an expanding business, with charge point operators (a role that fuel retailers are well positioned to play) expected to capture more than half of total charging profits. Second, enhanced convenience store offerings, including a broad range of fresh food tailored to local market tastes, may draw customers who are not visiting to refuel—what we call non-energy related convenience. However, where EV penetration is high, the fuel decline will be hard to bridge. Consequently, by 2035 total profits for fuel and convenience retailers in markets where EVs dominate could decline by 30%. (See Exhibit 1.)

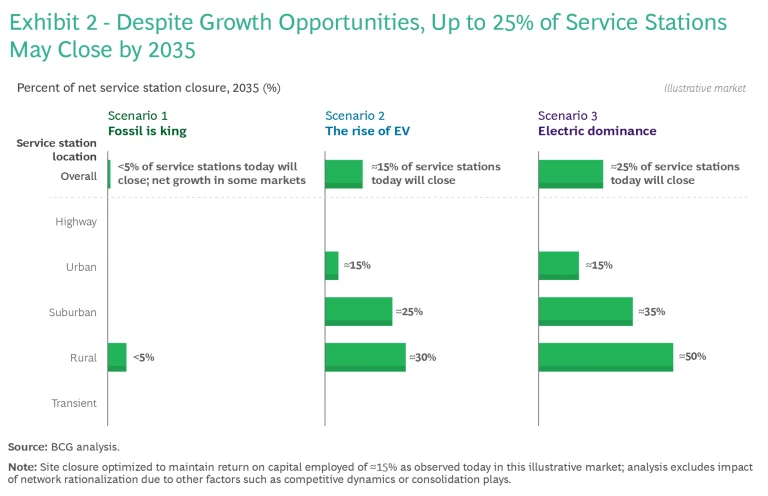

Some service stations will close. Where EVs dominate, up to one quarter of sites may become unprofitable and need to close by 2035. Closures are expected to be concentrated in rural and residential locations where drivers will typically charge at home. Highway and transient sites (such as those near airports or on major roads) are likely to prove more resilient due to the need for on-the-go charging and increased demand for convenience items not linked to refueling or charging. (See Exhibit 2.)

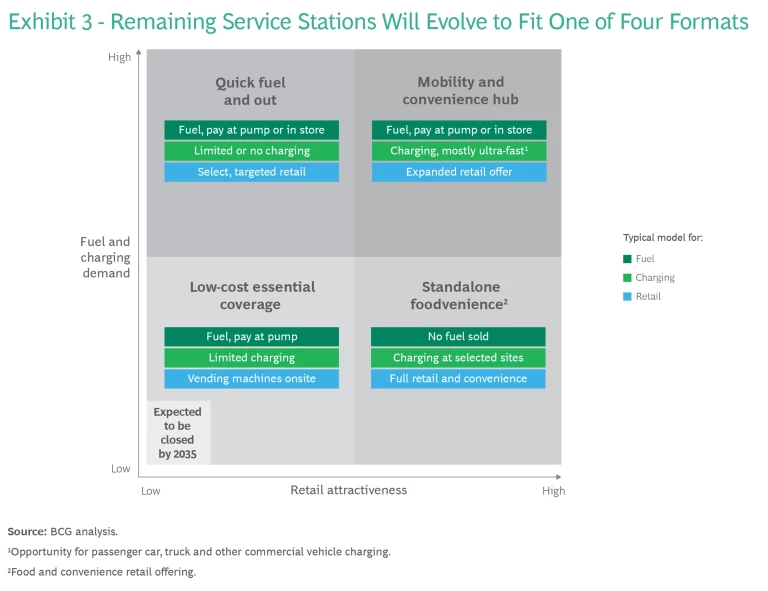

Remaining sites will evolve. The right format for an individual site will hinge on the degree to which there is demand for energy services (fuel and charging) or convenience sales. As shown in Exhibit 3, four primary formats will dominate.

- Quick Fuel and Out. This format is suited to sites focused primarily on fuel sales, with limited or no charging and only select convenience offerings. These sites are typically located on high traffic roads, mostly in urban and suburban areas. However, convenience demand for this format is limited due to local competition and/or space constraints on existing sites.

- Mobility and Convenience Hub. This format will work for premium sites offering a full range of fuels (including alternatives such as biofuels), ultra-fast on-the-go charging, and enhanced convenience offerings. Typically located in highway, transient or spacious urban locations, these flagship sites will emerge as the most profitable and attractive format to own and operate.

- Low-Cost Essential Coverage. This format will be reserved for remote, mostly unmanned sites primarily serving the needs of rural and fleet customers who need greater geographical coverage. As EV penetration rises, declining fuel demand combined with a limited growth in convenience and EV charging may make these locations unprofitable for fuel retailers to operate.

- Standalone Foodvenience. This format focuses on convenience offerings with charging at select locations and will not offer fuels. Possibly co-located with other food retailers, the format is best suited to urban and suburban locations where there is heavy retail traffic. This new format will allow fuel retailers to maximize the value of their real estate where there is insufficient refueling demand.

Now What

Companies will need to implement the right mix of actions at a site-by-site level between now and 2035.

No Regret Moves. These steps make sense in all market scenarios and include:

- Building market intelligence to identify market shifts, including those wild-card changes noted above.

- Evaluating and adjusting the site network at a local and country level through the use of tools such as advanced geospatial analytics.

- Integrating loyalty beyond the pump to create a single platform across fuels, charging, and convenience.

Option Plays. These steps are typically well suited to markets in the rise of EVs and electric dominance scenarios and include:

- Developing mobility and convenience hubs with charging.

- Enhancing the convenience offering to accommodate EV drivers who spend more time at the station.

- Developing “segment of one” personalization.

- Providing fleet charging at customer logistics hubs and beyond.

- Expanding charging offerings to destinations such as supermarkets.

Big Bets. These moves typically fit with markets in the electric dominance scenario.

- Competing head-to-head against traditional convenience store players by building pure-play foodvenience formats where there is insufficient energy demand.

- Investing in on-the-go e-trucking hubs.

- Becoming a mobility platform orchestrator, for example providing charging solutions across a wide range of third-party chargers and locations.

- Selectively pursuing mobility-adjacent opportunities such as vehicle leasing and insurance.