Online B2C marketplaces have taken over e-commerce. Today, marketplaces account for 67% of global e-commerce sales, a jump from 40% only a decade ago—and they’re still growing.

Marketplaces are popular because shoppers like the variety, competitive pricing, and convenience. Retailers like the ability that marketplaces give them to increase the breadth and depth of what they sell, with minimal resources or investment relative to the return. Retailers also like the data they can harvest from marketplace sales, which can inform their decisions about products and strategy.

However, Amazon and Alibaba have amassed such significant scale and capital that they are winning the “everything store” marketplace category. As a result, retailers launching or expanding their marketplace business model must take a different path. The most promising is operating a marketplace that serves a specific niche/category vertical that the retailer can become a destination for and where they can host third-party sellers that enhance their standard offerings with adjacent products and categories.

But setting up a specialty marketplace isn’t as simple as building the technology platform and lining up sellers. We’ve identified seven elements that are essential to the success of a retailer-run specialty marketplace. They include a well-defined customer proposition tied to the company’s broader e-commerce strategy, smart product selection from a variety of competing sellers, and a stellar customer experience. Retailers must extend the same excellent treatment to sellers in order to entice them to join the platform, adopt modern technology, and once they’ve mastered the fundamentals, add extra services that boost sales.

Why Retailer Marketplaces Have Taken Off

For retailers, marketplaces represent a new business model. In addition to selling their own products, often referred to as first-party (1P) products, retailer-run marketplaces sell products from third-party (3P) sellers, with the operators taking a commission on each transaction. (See “Retail Marketplaces Defined.”) Retailers manage fulfillment and shipping for 1P products, and sellers of 3P brands typically handle those activities for their own products. The dynamics and business model of B2C retail marketplaces are different than those of B2B marketplaces , which connect business buyers and sellers.

Retail Marketplaces Defined

Online retail marketplaces started out as “everything” stores, such as the one-stop shops that Amazon, Alibaba, and JD.com operate. Newer-generation marketplaces are more specialized, focusing on specific product categories or customers. The newest B2C marketplaces add social commerce to the mix, offering shopping live streams, games, and entertainment to the shopper’s experience.

When we think about marketplace, we’re excited about it from two dimensions. One is the customer experience, broader assortment, great style, and edited selection, and the other is the additional flexibility of carrying assortment that may be more profitable for us versus in our own distribution channel. — Adrian Mitchell

The B2C marketplace model has gained in popularity and market share for several key reasons:

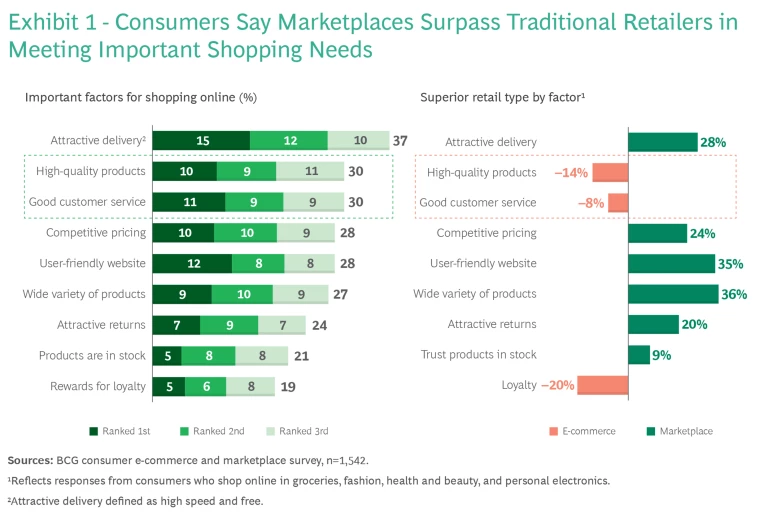

Consumers like marketplaces. According to a BCG survey of more than 1,500 consumers in five countries, marketplaces outperform traditional e-commerce sites in six of the nine aspects that they value the most when shopping online. (See Exhibit 1.)

One aspect of marketplaces that consumers like is variety—and successful retailer marketplaces provide that. Retailer marketplaces increase SKUs by an average of 63% in their first year of operation, according to data from Mirakl, an e-commerce SaaS solution for retail marketplace technology.

Consumers also rate marketplaces higher than other types of e-commerce for delivery options and competitive pricing. The pluses could be why we found that 87% of consumers plan to spend the same amount or more on purchases through marketplaces in the next year.

Marketplaces are relatively simple to operate. A marketplace operating model allows retailers to offer a vast inventory while leaving it up to their 3P partners to handle sourcing, pricing, promotions, merchandising, and product fulfillment. This efficiency enables retailers to rapidly and efficiently scale the assortment they offer. Retailers can add new sellers or SKUs to their marketplaces in a matter of days—less time than it would take to add a new product to their dedicated e-commerce site or brick and mortar store.

Retailer marketplaces are steady money makers. Marketplace operators typically earn commissions of 8% to 15% on transactions—and as high as 25% to 30% for fashion. Marketplaces require a small capital investment to launch and yield high returns, contributing EBITDA margin of 7% to 9%.

Marketplaces produce valuable data. By monitoring changes in product assortment and sales across a wide array of third-party sellers, retailers can spot emerging trends and shifting consumer preferences faster than they could on their own. Retailers can use the extra insights that this additional data provides to better manage their business. They can use the higher volume of consumer data that marketplaces generate to personalize customers’ experiences. Finally, retailers can use the data to improve targeting of potential customers, which ultimately could help increase the revenue they derive from the

retail media networks

that more of them are operating.

The Marketplace Evolution

E-commerce B2C marketplaces have changed since the dawn of the first digital-native, everything store-type marketplaces during the dot-com era. (See Exhibit 2.) The scale needed to operate such sites today has led retailers to differentiate themselves by launching marketplaces within niches where they have an established reputation, such as electronics, home improvement, health and beauty, fashion, or sporting goods. Of the consumers we surveyed, 70% prefer shopping on specialized marketplaces over everything stores that have the same products at a similar price because they perceive the customer service and prices to be better and because they have more trust in the brands.

Retailers’ existing customer base and omnichannel offerings make them well positioned to operate specialty marketplaces. They typically have significant existing traffic to their e-commerce sites, which means their customer acquisition costs are generally lower than what pure-play, digital-native marketplace operators must spend. Retailers’ existing physical footprint and customer trust and loyalty to their brands also differentiate their marketplace ventures from pure plays and drive sales.

Retailers that have launched specialty marketplaces in the past five years have done well. (See Exhibit 3.) A health and beauty marketplace that Douglas launched in Germany in 2019 contributed to e-commerce sales at the company that have doubled since 2022. A Belgium-based marketplace for sports apparel and gear that Decathlon established in 2021 is forecast to reach the equivalent of $1.1 billion in sales in Europe by 2026. The B&Q UK-based home improvement and DIY marketplace that Kingfisher launched in 2022 was profitable from day one and now accounts for 41% of the company’s total e-commerce sales.

Keys to Success for Retailer Marketplaces

Based on our research and experience in the field, we’ve found that successful retailer-led marketplaces include seven essential elements.

Clear customer proposition tied to existing e-commerce strategy.

Launching a marketplace allows retailers to expand their product assortment and volume, which can help them accelerate their overall commercial strategy. But to succeed, a marketplace must fit the company’s existing customer proposition, e-commerce offerings, and established customer experience. For those reasons, C-suite leaders should oversee a marketplace initiative to ensure that the venture fulfills those objectives and isn’t just bolted on.

When launching a marketplace, a retailer also must be clear about how it is different from the offerings of other players. For example, how does the marketplace draw upon their existing retail assets to provide a competitive advantage? Retailer 1stDibs, which runs a luxury furniture, art, and jewelry marketplace, carved out a niche for itself by offering vintage and new items, auctions, and connections with interior designers, and by publishing a weekly digital magazine.

Value based on competitive prices.

The consumers that BCG surveyed said they would switch to shopping at a retailer-run marketplace instead of an everything store if prices were similar. Retailers can ensure that their prices are competitive by hosting multiple third parties that sell the same product. Integrating a competitive pricing tool similar to Amazon’s buy box into the user interface is one way to do that. Such a tool uses an algorithm to show customers one seller for a specific product from multiple competing sellers based on a combination of factors such as price, delivery speed, and seller rating. The majority of leading marketplaces, including both digital natives and retailer-operated ventures, use competitive pricing tools to drive their success.

Smart curation of sellers and products.

Unlike everything stores, retailers can’t afford to work with any and all third-party sellers. They have too much invested in their existing brand, reputation, and customer relationships to team up with just any outside parties that could put those at risk. And consumers we surveyed cited trust in a brand as a key reason they prefer to shop on a retailer-led marketplace over an everything marketplace giant.

To protect their brands, retailers must curate what’s available on their marketplaces, which requires striking a balance between control and scalability. Best-in-class retailers do this by carefully vetting sellers and then giving them the autonomy to offer whatever they want within certain commercial guardrails.

To be comfortable ceding third parties a measure of control over what they offer, retailers must institute quality controls as well as processes for instantly removing unqualified goods. Walmart conducts regular checks to confirm that sellers on its online marketplace maintain an order defect rate of less than 2% and respond to customer emails within 24 hours, both of which are spelled out in sellers’ service-level agreements.

From day one, customers trusted the marketplace due to the power of B&Q’s brand. — Marc Vicente

A superior customer experience.

Marketplaces can have the right pricing, product, and seller mix and still fail by not delivering an excellent experience to customers. Our consumer survey found that marketplace customer service practices lag behind those of traditional retail sites, something that retailers could improve upon to differentiate themselves.

Overinvesting in customer service can help retailers protect their brands, and providing seamless returns for marketplace purchases is one way to do that. Retailers that use their physical stores for pickups or returns also create a key differentiator between themselves and digital pure-play marketplaces.

Excessive product assortment and poor navigation are other common customer experience stumbling blocks for retailer-operated marketplaces. Prior BCG research found that more than half of shoppers on marketplaces such as Walmart and eBay struggled to locate their desired products or secure the best prices.

Optimizing findability avoids those hurdles. Solid navigation and search functions, including comprehensive sorting capabilities, can put the right product in front of the right customer at the right time. Enhancing basic navigation with advanced personalization can improve consumer engagement and conversion rates. For example, Alibaba implemented an advanced navigation and personalization system across its entire ecosystem with sophisticated algorithms that offer users personalized recommendations from a catalog of more than 200 million products.

A superior seller experience that leads to higher GMV.

Creating a positive experience for sellers is just as important as smoothing out bumps in the purchase process for shoppers and can attract more sellers to a retailer’s specialty marketplace. That’s important because we’ve found a direct relationship between sellers, SKUs, and the retailer’s gross merchandise value (GMV). Especially in a marketplace’s early years, having more sellers leads to higher GMV.

Sellers typically are active on more than two marketplaces, and based on data from Mirakl, more than 6 in 10 expect to increase the number of marketplaces they partner with in the future. To retain existing sellers and attract new ones, retailers must make it easy to get onboarded onto their marketplace. They also should provide tools and a supportive environment that will help sellers’ business grow, which creates the positive experiences that help retain sellers and ultimately boosts traffic and GMV.

A scalable and flexible technology stack.

Marketplaces require a modern technology architecture that can be integrated into existing systems to support features such as dynamic pricing. To stay competitive, retailers need to keep up with technology changes and incorporate advancements such as generative AI. For example, eBay recently adopted AI to improve product descriptions.

It’s true that developing marketplace technology in-house allows for more customization. However, outsourcing commodity components—such as the underlying technology that runs a retailer’s marketplace platform—from third parties can reduce the time needed to get it up and running. This can lead to a shorter break-even point and give competitors less time to catch up. The majority of retailers work with technology providers to avoid building capabilities in house and instead can invest the capital elsewhere. Outsourcing also lets retailers put more energy into mission-critical areas such as user experience. What’s more, using standard marketplace components that sellers may already be familiar with could accelerate the seller onboarding process, which can bolster a retailer’s attractiveness as a partner.

Advanced services.

Retailers that have mastered the basics can add advanced services to their marketplaces, which can enhance their value proposition with prospective sellers and boost their own marketplace EBITDA by 3% to 5%.

One of the most important advanced services being added is retail media. Through their networks, retailers can offer current and potential third-party partners targeted, high-conversion advertising opportunities on their marketplaces, websites, or other properties in exchange for collecting customer data plus a portion of sales revenue. Margins for retail media networks can be upwards of 60% to 70% of collected advertising revenue, substantially higher than typical margins across many retail sectors.

In the first quarter of fiscal 2025, Walmart’s global advertising grew 24%, led by growth of 26% in its Walmart Connect retail media network, according to the company. In the same period, the company reported that US ad sales reflected more than 50% growth from sellers on its marketplace.

Retailers with mature marketplaces also are adding data monetization. Retailers can aggregate and sell the marketplace data on sales or trends to 1P or 3P sellers, which can use it to change pricing, time promotions, launch new products, or optimize what they offer in some other way.

Taking over warehousing, delivery, and other fulfillment services is another natural add on—one that can improve delivery reliability, a key consumer demand. Walmart’s third-party fulfillment arm, which services sellers on its marketplace, grew five-fold in gross merchandise value in 2021. Retailers can offer other, smaller add-ons that help sellers’ performance, including translation, product, and data.

Retailer e-commerce marketplaces are only getting bigger. Consumers like the selection and prices. Retailers like the opportunity marketplaces afford them to simplify operations while scaling what they offer. Operating a specialty marketplace that plays to retailers’ existing brand, strengths, and customer allegiance can help them stay competitive and gain or regain market share. But for those marketplaces to succeed, retailers must adopt smart curation, competitive pricing, easy navigation, and other best practices to create a positive experience for both consumers and third-party partners. And the world of e-commerce marketplaces is moving fast. The time for retailers to get in the game is now.