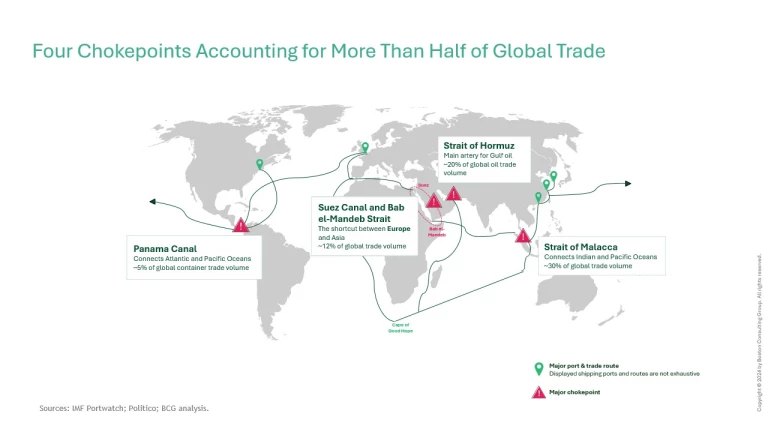

Right now, more than 50% of global maritime trade is at threat of disruption in four key areas of the world.

While the conflict in the Red Sea has been high in the news agenda, there are three other maritime passageways that risk becoming chokepoints due to either geopolitical or environmental factors.

1. The Suez Canal and Bab El-Mandeb Strait.

The Suez Canal, which connects the Red Sea to the Mediterranean, normally accounts for about 12% of global maritime trade.

- Since the start of Houthi attacks on international shipping in late 2023, some 470 container vessels have already been re-routed. Sending ships around the Cape of Good Hope adds between 9 and 17 days of transit time.

2. The Strait of Hormuz.

This strait, between Iran to the north and UAE and Oman to the south, is significant for both energy and goods shipping.

- Some 20%—30% of oil trade passes through this strait, and a significant amount of global shipping volumes.

If Iran were to be drawn more directly into the ongoing conflict in the Middle East, the free passage of vessels through the strait could be at risk.

3. The Straits of Malaca and Taiwan.

The Strait of Malaca, between Singapore, Malaysia and Indonesia, is the shortest shipping route between East Asia and the Middle East and Europe and accounts for 30% of global trade.

- Two-thirds of China’s trade passes through the strait of Malacca each year, including 80% of its energy imports.

There is an ongoing dispute between China and several members of the ASEAN trade area over a large area in the South China sea.

- Also in the region, the strait of Taiwan is another important shipping lane—40% of the world’s container fleet pass through it.

Both trade routes are subject to heightened geopolitical uncertainty.

4. The Panama Canal.

The canal, which links the Atlantic Ocean and the Pacific Ocean, accounts for 5% of total global container trade, and some 46% of the trade from the US East Coast to East Asia.

It is facing a severe drought due to the El Niño weather phenomenon.

The authority that manages the canal has responded to low water levels by temporarily reducing both the number of transits and ensuring the weight of the cargo is suitable.

The So What

“These geopolitical risks could turn into a physical impossibility of moving goods to certain destinations. In the short term it will extend lead times on goods. In the longer term, it is likely to make firms seek shorter supply chains because of the risk and higher capital costs associated with maritime transport,” says Michael McAdoo , a BCG partner and director, and one of the authors of BCG’s Future of Trade report.

“The financial impact is likely to impact producers most as they adapt their routes to market. But, as with almost any disruption, there are also opportunities, especially for freight companies to bring new solutions,” says

Peter Jameson

, a BCG managing director and partner who specializes in shipping.

Now What

- Diversify shipping routes , and transport choices. Shippers should proactively work with their logistics providers to build new solutions. Options to consider include alternative shipping routes through the Arctic, combining ship and air (for example by shipping to Dubai and then flying to Europe), or using rail for parts of the journey to avoid choke points.

- Escort vessels. The use of military or private escorts could be considered to protect ships carrying cargo. Some governments will have a strong national interest in protecting both trade and/or their national shipping companies.

- Prioritize advanced communications. Leveraging advanced technologies, especially artificial intelligence, is key for proactive risk management, allowing for the anticipation of disruptions and rapid response. Ships should become even more connected to each other, sharing locations and observations. Customers will also benefit from real-time updates on the progress of cargo.

- Build inventories and storage. Companies need to plan for resilience, and may need to update or expand infrastructure, including port capacity or storage facilities. Reassessing the design and capacity of warehouses, for example, could help create a hedge around potential disruptions. As happened at the height of the COVID pandemic, companies and governments will need to assess their strategic priorities.

- Step up contingency planning. Companies should examine how different bottlenecks may emerge or could be alleviated, and pinpoint specific areas where they are structurally exposed. Digital twins and modelling can help here. They can also look for existing points of redundancy in existing supply chains to free up capacity. Strengthening financial strategies, including comprehensive insurance and prudent financial planning is also vital to safeguard against the economic setbacks of unexpected logistical challenges. Pricing strategies may also need to be reconsidered in order to protect margins.