There is immense potential for direct online sales in insurance, particularly for non-life products. Yet most insurers have not implemented effective digital sales journeys. Customers often hit obstacles, such as onerous information requests or confusing jargon, that cause them to revert to offline interactions.

BCG recently analyzed the digital sales journeys of more than 70 insurers across 13 European markets to pinpoint challenges and identify best practices. Several markets stand out for more mature digital sales offerings, as innovators have motivated their local competitors to improve as well. The findings suggest that all insurers can excel in digital sales, regardless of market dynamics such as local regulations and data availability.

To become top-tier performers, insurers can follow a set of imperatives that are valid in every market. Successful companies will keep customers in the digital channel throughout the end-to-end sales journey, thereby lowering costs and expanding their customer base to additional segments.

Customers Favor Digital Channels but Face Obstacles

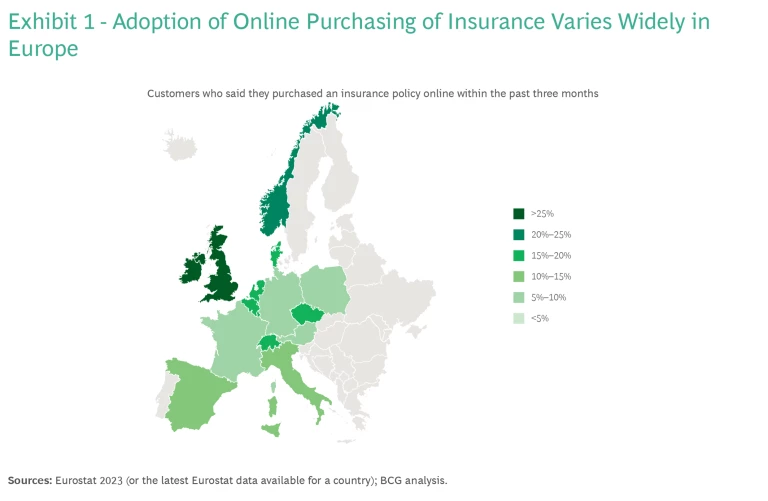

Insurance customers across markets have adopted digital sales, but only approximately 10% use digital for the complete sales journey. For several years, insurers have expected this percentage to grow, but the results have been lower than expected. In Europe, the UK and Ireland are the only markets where more than 25% of insurance customers said they had purchased policies online within the past three months, according to the most recent data. (See Exhibit 1.)

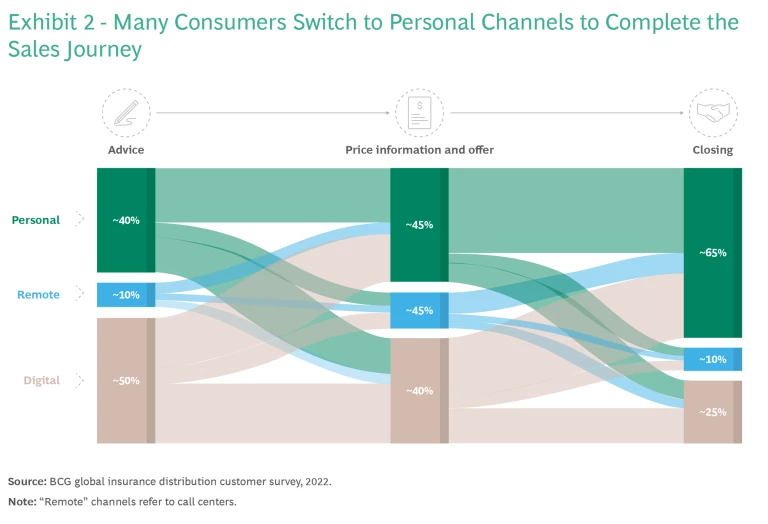

Customers increasingly favor digital channels for gathering initial information and getting quotes, with websites being the preferred platform. But later in the sales journey, many switch to personal channels as they seek help from agents and brokers to deal with complexity, reduce the price quote, and finalize the purchase. (See Exhibit 2.) This outreach through personal channels removes many of the advantages of digital sales and decreases the likelihood of digital self-service later in the insurance value chain.

Customers cite price and complexity as the greatest obstacles to purchasing a policy from a specific insurer. Price comparison websites, or aggregators, have built a sizable customer base in many markets by delivering simplicity and transparency, which traditional insurers often lack.

A major driver of complexity is the fact that most insurers have merely digitized their existing paper forms, resulting in an online sales journey that is an extension of legacy products and requires customers to answer too many questions. Digitized paper forms often ask customers to provide excessive information up front, leading to significant drop-offs in the sales funnel.

Additionally, many insurers fail to utilize well-known pricing techniques that could enhance conversion rates and promote upselling. These include, for example, starting with a low price quote for a basic offering and then providing options to bundle additional features that raise the price.

Comparing Insurers Along Five Dimensions

To benchmark and compare European insurers, we used a proprietary methodology that scored their digital sales journeys on a scale of 0 to 100 along five dimensions.

Digital Marketing and Customer Engagement. To attract prospective customers, insurers need to be visible when customers are searching for insurance or browsing social networks. We assessed insurers’ presence in both contexts.

Personalization and Product Research. Insurers need to guide customers through a simple sales journey. This could involve explaining the main products with a few understandable words or even personalizing a website for a specific user. At the same time, insurers must keep the sales funnel as large as possible.

Insurers need to guide customers through a simple sales journey.

Price Quotes and Application. Insurers must provide the first quote with as little input from the customer as possible while gathering all the necessary data. This requires converting old forms into a modern customer-friendly sales journey that draws on data from external sources, such as motor vehicle registries. It also entails supporting customers who have difficulty completing the journey.

Contracting and First Payment. To finalize the digital sales journey, customers must sign a contract or make a payment. Insurers need to remove any final obstacles and, ideally, avoid the need to involve paper or third parties.

Usability and Delight. Insurers need to learn how to deliver “wow” moments, such as those enabled by the clever use of generative AI. This will allow them to match the digital experience offered by e-commerce businesses as well as that of other insurers.

Most Insurers Are Still Struggling

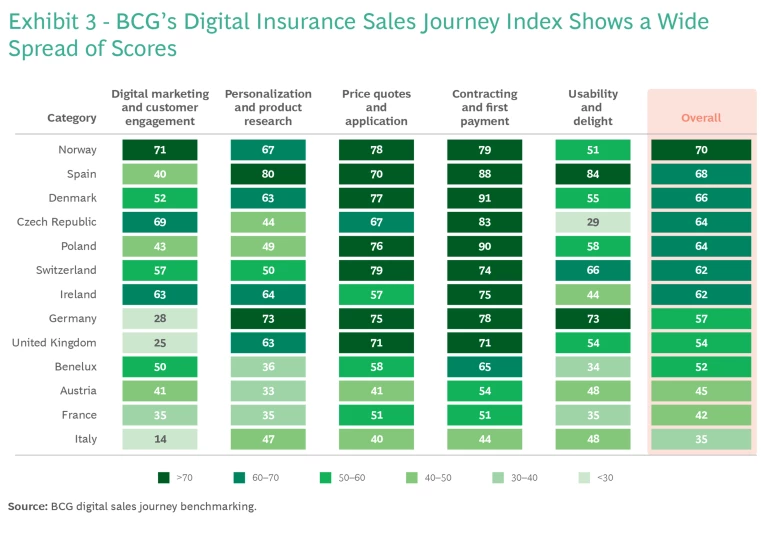

The study revealed a large spread of average overall scores among the markets studied. (See Exhibit 3.) The spreads are even bigger within individual categories.

Insurers in the Czech Republic are front-runners in digital marketing but lag in providing usability and delight during the actual sales journey. In Switzerland, although we observed that insurers have top-tier application forms, they have only average scores in enabling product research, which prevents many potential customers from reaching the application stage.

De-averaging the overall scores, we identified very good performers (those scoring above 75 points) in 9 of the 13 markets. This suggests that all insurers in these markets have opportunities to perform better. The technical capabilities are widely available, but companies must be willing to dedicate attention and resources and gain the required experience.

Five Imperatives for Reaching the Next Level

To enhance the digital customer experience and close the gap with other industries, insurers should follow five imperatives.

Enhance your digital visibility. Although digital space is unlimited, it is crowded with companies competing for consumers’ attention. Moreover, most consumers do not think about insurance unless they are shopping for it. To capture their attention when the need arises, strive to be visible on the web and on social media apps. Strategies include sharing viral videos and building engagement around lifestyle tips (for example, on pension planning) or sponsored events.

Explain insurance jargon. Most people do not “speak” insurance. For example, many people seeking car insurance do not understand terms such as MTPL and CASCO. Ensure that websites explain insurance jargon as clearly as agents do during live conversations. One sentence is usually enough.

Simplify the journey. Insurance may never be a one-click product, but insurers should strive to simplify the sales journey. Often they ask customers to dedicate more attention and effort than necessary—such as by asking for a vehicle’s identification number when the license plate number would suffice or requiring customers to specify a car’s value when that can be estimated by the insurer. To start reducing complexity, identify the low-hanging fruit for simplifying your digital sales journey, such as limiting the number of questions that customers need to answer.

Insurance may never be a one-click product, but insurers should strive to simplify the sales journey.

Digitize the entire journey. Even insurers with digital sales journeys often require customers to take steps in the physical world. Some of these, such as taking a photo of a used car, can be integrated into the insurer’s mobile app. Digitizing such steps also allows agents to focus on more value-adding tasks, such as cross-selling. Determine the share of your current online sales journey that requires steps in the physical world and systematically close the gaps to achieve full digitization.

Provide unique experiences. The vast majority of customers do not understand the technical differences among products offered by competitors. But they do recognize when competitors’ sales journeys are different, and they notice “wow” moments. Assess how you currently stand out among your competitors and pursue ways to provide unique experiences.

Establishing a truly digital sales journey in insurance requires a comprehensive transformation from end to end. A simplified online approach is already appealing in third-party channels, indicating a gradual shift in the traditional insurance distribution model. Once online channels meet customer expectations, a significant proportion of consumers are expected to prefer them. Front-running insurers will gain a considerable advantage over competitors, creating an imperative to move aggressively toward fully digital sales journeys.

The authors thank Stefan Bleyhl, Norbert Dworzynski, Karolien Gielen, Jan Malaskiewicz, Kacper Ostrowski, and Annik Penders for their contributions to this article.