Here’s something many CEOs don’t know but most women do: companies consistently fail to offer products and services that meet women’s needs. This means that companies are missing a meaningful opportunity. A global BCG X survey, supported by BCG’s expert Center for Customer Insights, of approximately 15,000 people in 12 countries, of whom about three-fourths were women, found that in key segments such as consumer goods, health care, and financial services, women do not believe that the products and services available to them readily meet their needs. (See “Methodology.”)

Methodology

Methodology

Women manage an estimated $31.8 trillion of global spending, according to Nielsen, and are expected to control 75% of discretionary spending worldwide in the next five years. Companies that don’t develop products explicitly tailored for women and their needs are leaving significant money on the table—something that BCG X’s Innovate Her team, which helps companies better address women’s needs, sees firsthand.

How can organizations do better? Companies can start by identifying women’s specific needs and preferences more directly, through both a quantitative and qualitative approach. Armed with those insights, they can identify gaps and develop new products and services—or, in some cases, adapt their current portfolio of products and services, assessing them through the lens of desirability, viability, and feasibility.

Key Findings

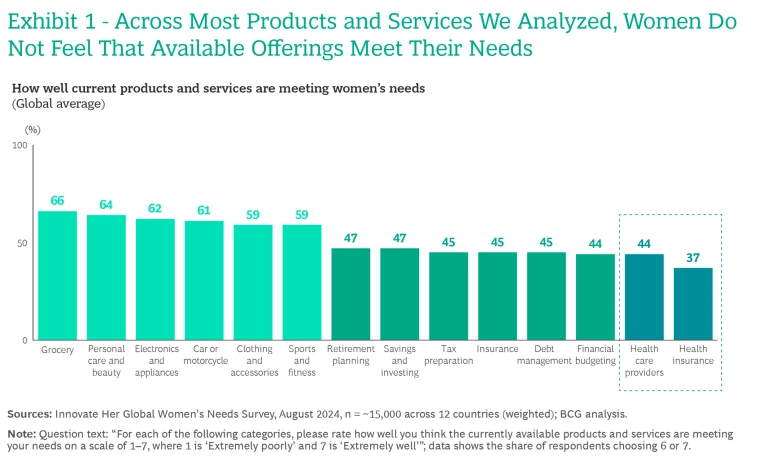

Our study looked at three sectors in terms of how effectively they meet women’s needs: health care, financial services, and consumer products. Although the sectors show variations, a consistent theme across all three is a dissatisfaction among women with the products and services available to them. (See Exhibit 1.)

Health care organizations have the most work to do. Women worldwide report responsibility for a majority of household health care decisions, from 66% in India to 83% in Germany and France. Yet fewer than half of women respondents across the globe (41%) agree that there are sufficient services to address their specific health concerns. Ratings of medical treatment or interactions with health insurers are similarly low—44% and 37%, respectively.

Those findings are in line with other data showing that the health care industry in many markets largely overlooks the unique needs of women. Consider that in the US, just 4% of research spending is targeted at women’s health. Women weren’t required to be included in clinical research studies until 1993—which is partly why they experience twice the rate of adverse events in approved drugs as men. One study found that women in emergency rooms wait 33% longer than men with the same symptoms.

A critical aspect of improving these issues is understanding the attributes of care that women prioritize. In our findings, these are quality care (cited by 87% of respondents), timely appointments (82%), affordability (82%), convenient locations for service (76%), and bias-free, fair, and impartial care (76%). Taking a step further, health care organizations need to understand how these needs differ across lifestyles. For example, 59% of women respondents with children worldwide find telehealth important, while only 37% of women without children do.

Hertility, a UK startup, is a good example of a company that focuses on women’s health care needs. Traditional health care often fails to address women’s reproductive or gynecological issues. Women face a confusing, costly, and slow system, with wide variations in coverage. Hertility offers personalized, at-home hormone and fertility tests, reproductive health consultations, and comprehensive care plans. Leveraging over 835,000 data points on female reproductive health, Hertility creates individualized care plans to meet each woman’s unique circumstances. It also partners with employers and national health systems to ensure that coverage is sufficiently funded and lobbies for expanded benefits, such as fertility treatments.

Financial institutions must meet women at specific life stages. We see a similar shortfall in financial services. Despite the fact that women are adding $5 trillion to the wealth pool every year, outpacing the growth of the wealth market overall, they experience significant gaps in how well the available products and services meet their needs.

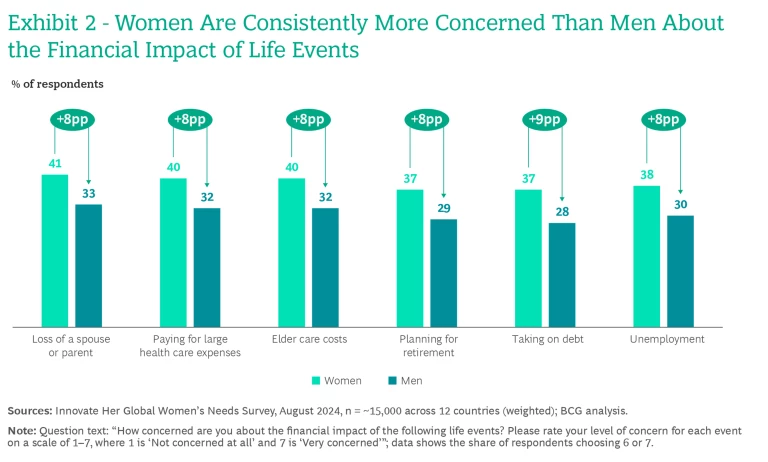

On average, women are more concerned than men about the financial impact of major life events, like debt (a difference of 9 percentage points) and planning for retirement (8 points). These worries evolve across life stages. For example, Gen Z and millennial women rank unemployment as their top concern. For Gen X women, planning for retirement is higher on their list, while baby boomers cite elder care costs as their biggest worry. However, at most stages, women are more concerned than men. (See Exhibit 2.)

Women also report less confidence than men about financial skills. Among boomer respondents, women are 8 points less likely than men to agree that they have the skills and knowledge to effectively manage their finances. Gen X respondents show a 5-point gap between men and women, and millennials and Gen Z respondents show a 4-point gap.

One potential explanation is the persistence of pay disparities between women and men. In many professions, women’s earnings still lag those of their male colleagues in the same roles and levels of seniority. In addition, women in some developing markets are new to financial services; they also confront a system that has long been primarily male-staffed and traditionally targets male heads of households with products and services that are, at best, gender neutral.

Ellevest, in the US, is a rare exception. The company, founded by women in 2014, offers financial planning and wealth management explicitly for women. Models factor in issues such as the pay gap, women’s longer lifespans, and concerns about issues such as divorce. All financial planners at the company are women. Today, Ellevest has about 3 million clients and approximately $2 billion in assets under management.

Consumer companies are failing to capitalize on their customer insights. Although consumer products drew a more favorable reaction in our survey, this is a relative success at best—no consumer category is fully meeting women’s needs today. Even the top-performing sectors, like grocery and personal care/beauty, drew only a 66% and 64% favorable rating among respondents. These results are somewhat surprising, as many companies would claim that they invest in research to understand the needs of consumers—and specifically women.

The business opportunity for consumer companies that improve is clear across virtually all the markets we studied. In our analysis, women in the US would be willing to spend 15% more, on average, for higher-quality clothing and accessories, or up to $228 more per person each year. Similarly, women in the US would spend 15% more for safer sports and fitness products, equivalent to $123 more each year.

Technology such as generative AI is one way for companies to better meet women’s needs. For example, in L’Oréal Paris’s consumer products division, many customers shop online (where in-person advice isn’t available) or in stores (where it can be intimidating). Customers find the beauty world overwhelming in general, given the vast array of products, information sources, and trends. Some are hesitant to ask for advice from younger beauty advisors, especially for sensitive topics like acne or hair loss.

To address these issues and offer richer self-service to its customers, L’Oréal teamed up with BCG to build Beauty Genius, an AI-powered virtual assistant delivered through the L’Oréal app or online. It offers personalized diagnostics, recommendations, and insights, capitalizing on the company’s extensive IP in hair care, makeup, and skin care, along with clinical studies. Critically, the tool is built on secure and trustworthy AI, to reassure users.

How Companies Can Improve

To capitalize on the business opportunity from women-centric products and services, companies should focus on three key elements: desirability, viability, and feasibility.

Desirability. Organizations need to start by determining whether a potential new product or service is something that women want—whether it addresses some unmet functional or emotional need—using both qualitative and quantitative approaches. That could entail conducting new research to map the market and identify opportunities, as well as to test specific ideas; for example, determining how a woman’s body might respond to a specific treatment or conducting ethnographic research to see how women interact with a specific digital service or physical product in beta testing. Most companies already have strong capabilities in identifying unmet needs and reaching target consumer segments. They just need to apply those existing skills to better reach the core segment of women consumers. Using those insights, companies can develop new products and services, or they could modify existing products and services already in the portfolio.

In addition, companies need to look at their go-to-market strategy through the lens of desirability—considering how they segment women’s needs in marketing, including which channels and messages are most effective, so that they tell a story that resonates at the right moment and in the right context. In some cases, an existing product may already meet women’s needs but is simply not being marketed to effectively signal that to consumers.

Viability. The second key element to consider is whether a product or service makes economic sense for the organization to build and put into the market. Companies need to develop a clear business model and case for investment, including subordinate elements like cost of acquisition and retention, pricing, cost of goods, etc. to show that the new offering can succeed.

Feasibility. After desirability and viability, companies must consider feasibility—how they can stand up this business and get a pilot into the market. What are the required changes to operations, procurement, and other key functions? What’s the distribution strategy: Through existing channels and supply chain? Direct-to-consumer? In addition, companies may need to adjust the back-end functions that create a differentiated experience for women. For example, an organization may need to rethink its approach to customer service to answer the distinct questions that women may have about a given product or service.

Lastly, representation matters. To succeed, companies need a core contingent of women—on the leadership team and at all levels of the company—who understand the lived experience of women in the category and can effectively address customers based on personal experience.

A critical consideration across all three elements—desirability, viability, and feasibility—is speed. Currently, most organizations still use a highly linear, waterfall approach to product development. This conservative strategy simply isn’t fast enough. Instead, companies should look to get products into the market as rapidly as possible—ideally in six to nine months (although products in heavily regulated industries like health care and financial services may take longer)—to get in-market feedback from women, iterate quickly, and refine products and services through a test-and-learn mindset.

Our data should send a clear message to health care, financial services, and consumer companies: Do better. Women make up half the population, and they control the vast majority of household spending. The fact that most are not satisfied with the products and services offered to them is surprising, but it also points to a sizable opportunity. The companies that take proactive steps to identify and address the functional and emotional needs of women consumers can capitalize on a clear means to grow their business and build a more loyal base of customers.