This article is part of the 2024 European Consumer Sentiment Report series , which examines consumers’ shopping habits and preferences.

It’s been a year of change and uncertainty in the UK. Brexit continues to affect business and trade. Violence and social unrest have spilled into the streets. The first Labour party prime minister in more than a decade arrived at 10 Downing Street in July.

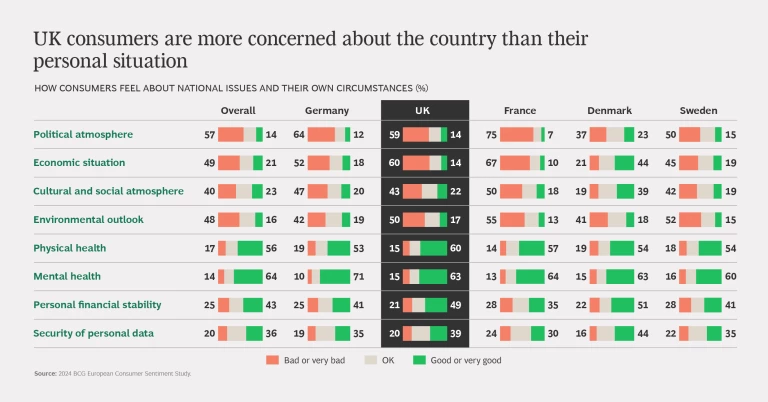

Given the circumstances, it’s not surprising that in the first half of 2024, people felt worse about the country’s politics, economy, social atmosphere, and other national issues than they did about their own circumstances.

People also worried about consumer prices that rose faster than their incomes and savings. To compensate, British consumers bought less rather than trading down to lesser-quality goods. Other shopping trends:

- UK residents are adopting sustainable habits, including recycling packaging and bringing their own bags to the grocers. But most are unwilling to pay more for green products.

- Going online has become a standard part of shopping for many items – if only to research options or browse. However, shopping in store is still very relevant, in particular for frequent small purchases.

The trends are among the highlights of a consumer sentiment survey we conducted of 1,400 people in the UK between July 1-9. It’s part of a larger survey of consumers in five European countries we did to understand people’s feelings about current affairs and their personal lives and how those sentiments affect shopping habits and preferences.

To strengthen ties with consumers and stay competitive in the face of the trends, companies should consider making changes to product assortment, pricing, and promotions. For changes to be successful, they also need a strong data analytics foundation.

UK Consumers Are More Concerned About the Country Than Their Own Circumstances

UK residents’ concerns about politics, the country’s social and cultural atmosphere, and their outlook on the environment were on par with the European average. In the first half of 2024, Brits felt better about national issues than people in Germany and France, but not as good as residents of Sweden and Denmark.

More people in the UK than the overall average felt “bad” or “very bad” about the country’s economy (60% v. 49%), a possible outcome of Brexit’s lingering effects on trade. The portion of the population worried about the economy trails that of France, where people were the most pessimistic about the economy of any group we polled (67%).

The UK populace was more upbeat about their own circumstances. They felt better than or on par with the average about their physical health (60% v. 56%), mental health (63% v. 64%), personal financial stability (49% v. 43%), and the security of their personal data (39% v. 36%).

Attitudes about national and personal issues differed by generation. Gen Z and Millennials were generally more optimistic about the UK’s politics, economy, and social situation than Gen X and Baby Boomers. But Baby Boomers felt better about their personal finances.

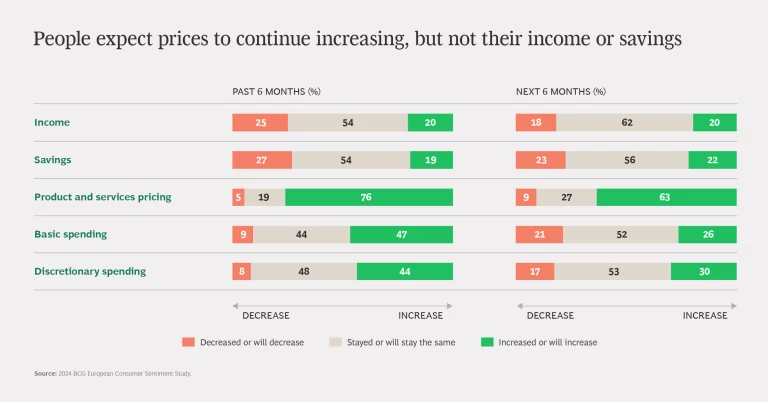

Squeezed by higher prices, people are buying less. The vast majority of UK consumers – 76% - reported paying higher prices for goods and services in the first six months of the year. Almost the same portion said that their earnings and savings stayed the same or decreased during the same period.

Higher prices and decreasing or stagnating income and savings have squeezed people’s wallets. Close to half reported spending more in the past six months for basics (47%) and non-essentials (44%). Grocery prices were the biggest contributor to higher spending – 46% of consumers said they spent more on groceries than they had six months before.

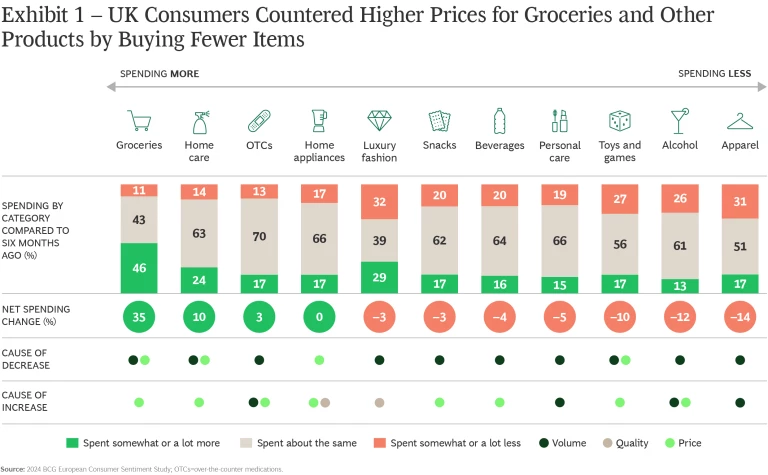

To make up for higher prices, consumers cut back on quantity rather than quality. They mainly bought fewer non-essentials such as apparel, alcohol, and toys and games, and skipped snacks and beverages like sodas. (See Exhibit 1.)

For basics that they couldn’t do without, specifically groceries and over-the-counter medication, people cut back both on how much they buy and traded down to lower priced goods.

There could be a light at the end of the price increase tunnel. Fewer consumers believe that spending will increase over the next six months than reported spending increases during the first half of 2024. That applies to spending on basics – 26% expect spending on basics to increase in the next six months compared to 47% who said they spent more in the first half of the year – as well as on non-essentials (30% v. 44%). It’s a sign that people are starting to feel slightly more optimistic, which eventually could lead more of them to increase spending on discretionary items.

Traditional Purchase Criteria Still Top Sustainability

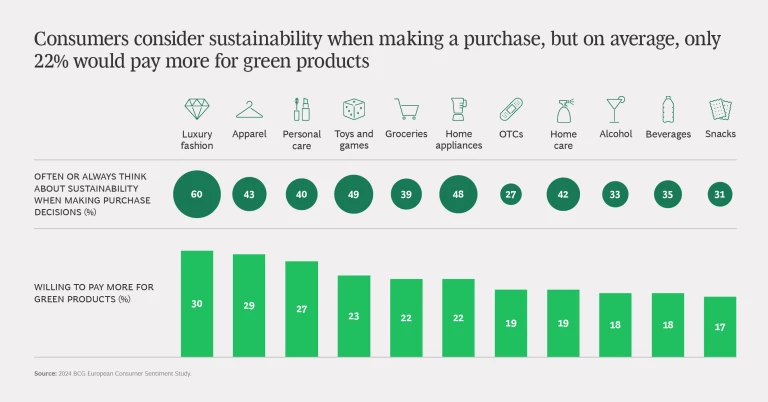

UK consumers care about the planet. That much is evident from the behaviours they’re adopting to act more sustainably. They bring reusable bags to the grocers, recycle packaging materials and beverage containers, and donate used clothes and toys to charities or friends. These green behaviours are most closely associated with shopping for groceries, beverages, and home care and personal care items.

But a gap exists between adopting green behaviours and spending more for green products. Although many people often or routinely consider sustainability when deciding what to buy, only 22% would pay a premium for a sustainable product. A slightly higher portion would pay more for sustainable luxury goods (30%), apparel (29%), personal care items (27%), or toys and games (23%).

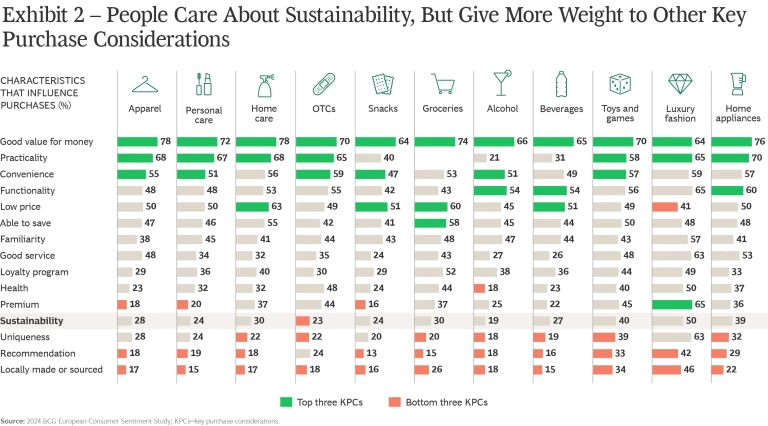

The reason for the gap can be explained by the factors that UK shoppers consider when making a purchase. Although they value sustainability, they still see other, more traditional purchase criteria as being most important. Depending on the product, those criteria include getting a good value for the money, practicality, convenience, function, and low price. (See Exhibit 2.)

It’s interesting to note that shoppers rated sustainability higher than some of the other characteristics we asked them to rank as important when making a purchase. Sustainability outweighed uniqueness, recommendations, and being locally made or sourced. In categories such as snacks and beverages, sustainability ranked higher than “premium.”

People’s appreciation for sustainability as a purchase consideration is slightly higher in certain product categories where shoppers commonly gravitate to high quality items that are built to last. Those include luxury fashion, home appliances, and toys and games.

Shopping in Person Still Matters

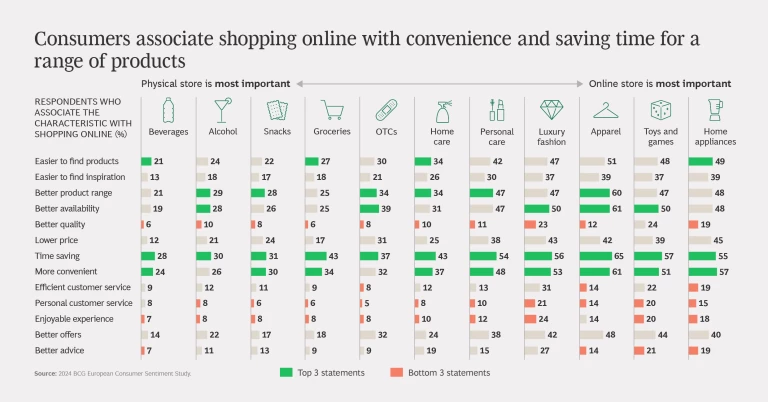

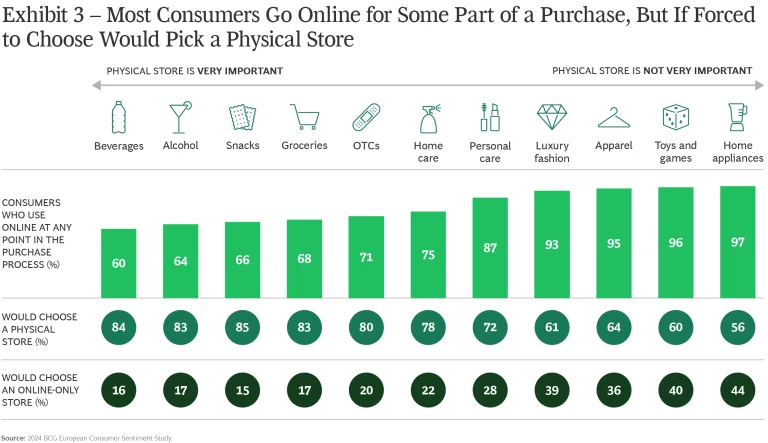

In the quarter century since the dawn of e-commerce, going online has become essential to shopping. Depending on what they’re shopping for, 60% or more of UK consumers go online before, during, or after making a purchase. The portion of shoppers who go online at any point of a purchase is the highest for non-essentials and high-ticket items that people may research extensively before buying, including home appliances (97%), toys and games (96%), apparel (95%), and luxury fashion (93%). (See Exhibit 3.)

The extent to which people go online at each stage of a purchase varies by product category. When people buy home appliances, luxury fashion, apparel, and toys and games, they spend considerably more time online at every stage, including browsing, buying, and getting customer service. For beverages, snacks, or over-the-counter medications, people prefer to look, buy, or get help in person. That’s likely because it’s easier or more convenient to shop in person for items that don’t require as much pre-purchase research, or because another aspect of the in-person shopping experience makes it more enjoyable.

For actual purchase transactions, preferences diverge. People overwhelmingly prefer to shop at a physical store for necessities and items they buy a lot, such as groceries, over-the-counter medications, and home care items. Shopping in person is also their preference for grab-and-go purchases such as snacks and alcoholic and non-alcoholic beverages.

How Companies Can Address the Trends

To strengthen ties with UK consumers and stay competitive, companies should consider taking action in two main areas: product assortment and pricing. We’ve found that the impact is greater when companies launch changes in both areas simultaneously. Due to the time and resources needed, however, most companies choose to address one area at a time. These actions also enable companies to strengthen and differentiate their sustainability offering. In addition, for all the changes to be successful, companies need a strong data analytics foundation.

Localize product assortment. UK consumers have different preferences for where they like to shop, and many still like buying in a physical store. To adapt, companies could customize what they offer in their physical locations to meet local demand and offer a more broad, global range of products on their e-commerce platform, which could appeal to shoppers who go online to browse or be inspired. In addition to increasing customer satisfaction, such changes minimize excess inventory.

To localize store range, retailers and brands that sell directly to consumers should take into account both local consumer demographics and the specific shopping missions that a particular store serves.

To manage costs during inflationary periods, retailers and brands could adjust product assortment by reducing the number of offerings in non-essential categories. At the same time, they could increase the value brands, affordable items, and private labels in their product mix.

Adopt dynamic pricing. When UK consumers feel squeezed, they become more price sensitive. Companies could use data-based dynamic pricing strategies to counter shifting consumer preferences while improving their ability to respond to fluctuating volumes, local market conditions, commodity prices, and competition.

Companies can apply dynamic pricing across sales channels and combine it with zone pricing to tailor price tags to local demographics and competitor moves. Retailers can start by applying dynamic pricing to specific product categories, such as essentials, where price sensitivity is more acute.

Subscribe to receive the latest insights on Consumer Products Industry.

Use sustainability as a differentiator. UK consumers are adopting sustainable practices, and a segment of the population would pay more for green products. But the majority still values other factors more, including functionality and good value. Companies can win over the larger group and gain a competitive edge by making sustainability a strategic differentiator. To do that, they should find the sweet spot where sustainability and cost-out meet and use it to attract wallet-weary consumers. For example, we found that 31% of UK consumers shopping for home care items and 20% shopping for personal care items look for products with recyclable packaging. Makers of those products could switch to recyclable packaging to better appeal to those shoppers.

Companies can use localized assortment and dynamic pricing to offer more relevant eco-conscious products. To cater to consumers in areas with strong environmental awareness, a company could stock household cleaners with earth-friendly chemicals and recycled packaging. In areas where consumers value cost over sustainability, the company could promote refill options, to play up the product's affordability and promote cost savings. In product categories where consumers have begun to embrace sustainability, companies could boost their value proposition through promotional language that emphasizes product features that save people money, such as energy-efficient home appliances that help people cut their electric bills.

Enhance data collection. To successfully launch initiatives in product assortment pricing, and sustainability, companies must improve their ability to collect rich data on consumer behaviours and preferences across sales channels. If they revamp their digital presence and loyalty programs, companies can use the access they have to first-party consumer data to capitalize on customer relationships in ways that were not possible in the past.

Acknowledgements

The authors would like to thank Mary Patrikiou and Martina Scrocco for their helpful comments and suggestions. The authors would also like to thank Megan Moore for conducting the research upon which this report is based.