Focus groups, surveys, segmentations, customer journey maps, customer data platforms, data appends, and the practice over the past five to eight years of naming C-level customer officers—companies spend a lot of time and energy on the customer.

Going for Gold

In our first article in this series, “Filling the Empty Chair,” we detailed how executives and their organizations go to great lengths to delve into the mind and behaviors of their consumers because consumer-centric companies deliver far better results: uplifts of approximately 10% to 20% in revenue growth, 15% to 25% in cost savings, and 20% to 40% in brand advocacy, based on BCG experience.

The amount of available consumer data has exploded in recent years, but companies have struggled to harness this abundance of data to create value. With the rise of AI and GenAI, however, we believe that organizations have a unique opportunity over the next three to five years to better address these challenges and transform their consumer intelligence capability into an enterprise-wide ecosystem that creates a more holistic view of the consumer than ever before. In our first article, we outlined how companies can use AI and GenAI to help build this ecosystem—and what it will take to get started.

As a follow-up to that work, from March 7 to March 24, 2024, we surveyed C-suite-level and senior executives who work at companies that have 1,000 or more employees and who are responsible for consumer insights, pricing, sales and marketing strategy, and/or product development. Our objective was to better understand these leaders’ views on consumer intelligence and the impact of AI and GenAI on consumer intelligence, and to identify what they are doing with AI and GenAI today. The study focused on five countries—China, France, Germany, the UK, and the US—but it also included supplemental data (from Australia, Canada, India, and Singapore) to provide a more global view. We supplemented this research with expert interviews with current and former chief marketing officers at large, US-based consumer goods companies.

In our survey and throughout this article, we define AI as including both predictive AI (tools that automatically perform tasks, learn, and adjust to new information, such as Google's search or basic customer service bots) and generative AI (tools that create new, logical content, such as text or images, on the basis of input information, as seen in tools like ChatGPT and DALL-E).

An Endurance Run

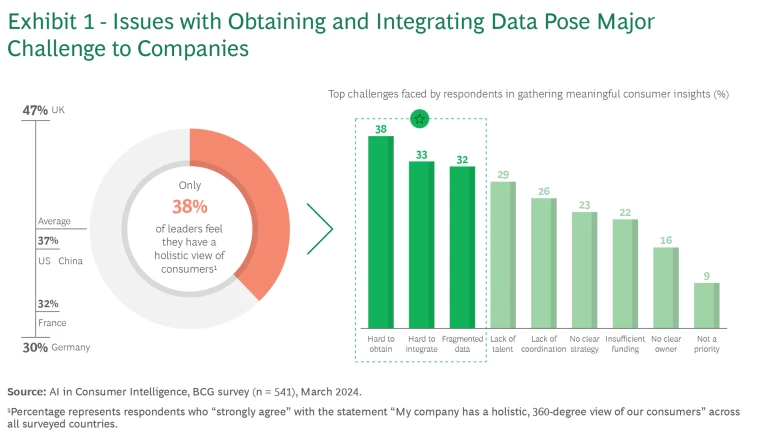

Despite all the time and effort organizations invest to deeply know the customer, only 38% of industry leaders report that they have achieved a holistic view of their consumers, and many say that they face challenges related to obtaining, consolidating, and integrating data. (See Exhibit 1.) Others point to the lack of suitable talent, silos in the organization that hinder coordination, the absence of a clear and unified strategy, and insufficient funding for data, research, talent, and technology.

New Shoes

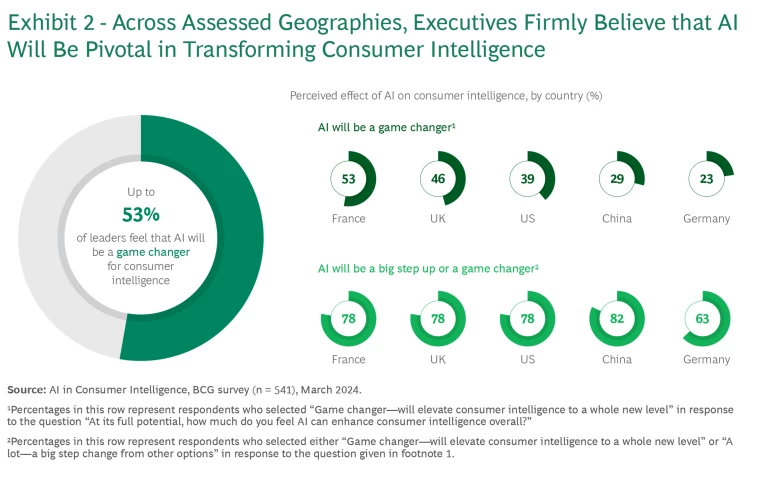

Faced with these challenges, up to 53% of industry leaders across all countries feel that AI will be a game changer for consumer intelligence—elevating their companies' view of their customers to new heights. (See Exhibit 2.)

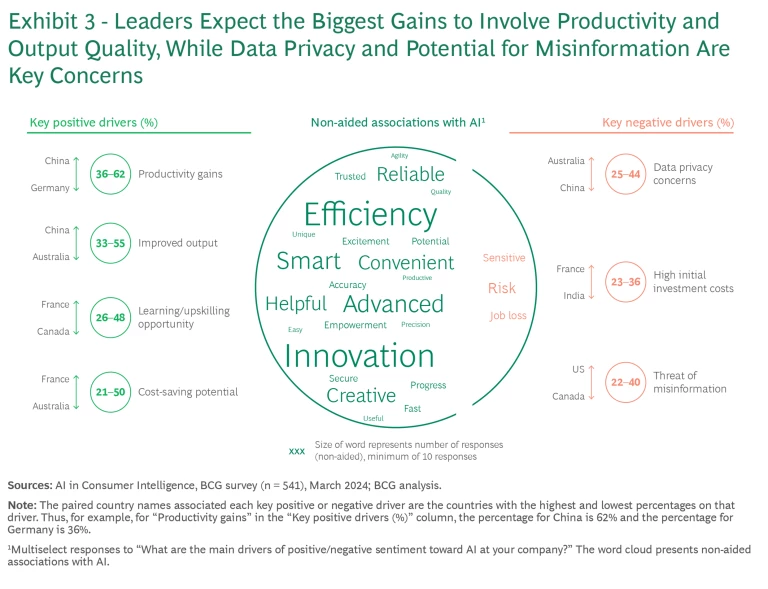

Fueling this sense of optimism about AI and its likely impact on consumer intelligence are expectations of significant productivity gains (held by varying percentages of leaders in different regions, from 36% in Germany to 62% in China) and improved output (from 33% in Australia to 55% in China). These positive expectations prevail despite some misgivings about data privacy issues (cited by a low of 25% of leaders in China, and a high of 44% in Australia) and high initial investment costs (cited by just 23% of respondents in India but by 36% of respondents in France). (See Exhibit 3.)

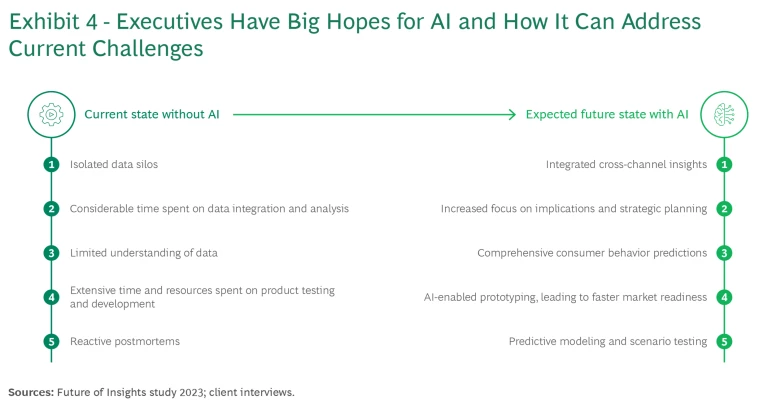

Looking forward, many executives believe that AI will address a number of their critical consumer intelligence issues. (See Exhibit 4.) They hope that AI will facilitate the integration of cross-channel insights, increase the focus on implications and strategy, provide a better view of likely consumer behavior, expedite product prototyping to enable faster market launches, and provide much more rigorous regular predictive modeling and scenario testing to inform better decisions.

The Medalists

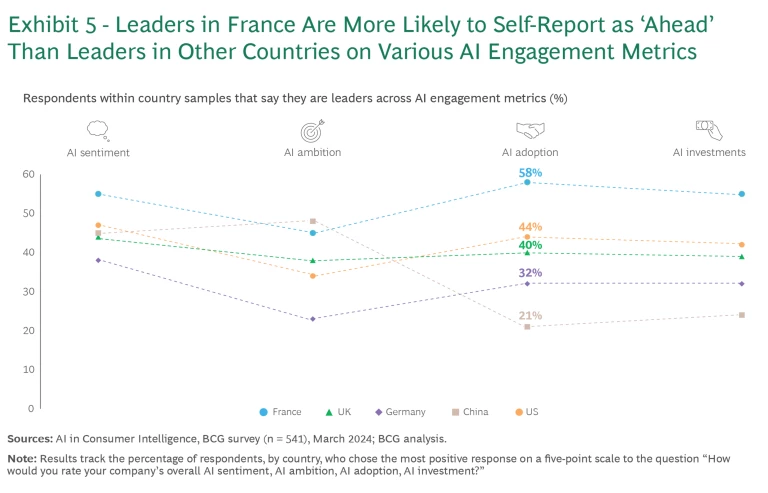

Who are the AI leaders in consumer intelligence globally? Invited to self-report on this question, 58% of respondents in France said that they are leaders in AI adoption, versus 44% in the US, and 21% in China. (See Exhibit 5.)

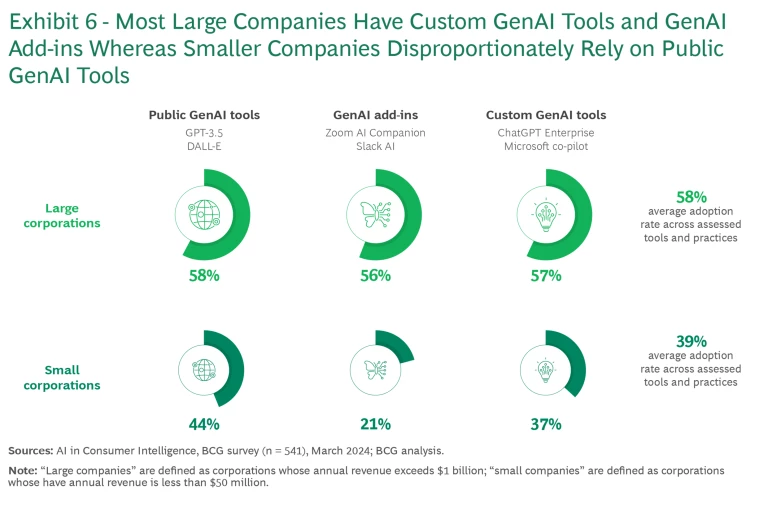

Not surprisingly, across countries, large corporations are adopting more AI tools than medium or small companies. Overall, 57% of large companies possess custom GenAI tools and 56% have deployed GenAI add-ins. In contrast, smaller companies tend to rely disproportionately on public GenAI tools such as ChatGPT (44%). (See Exhibit 6.)

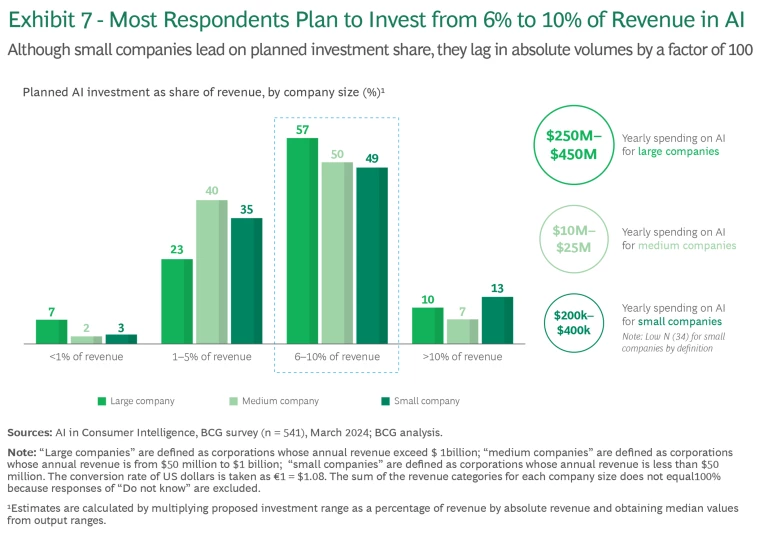

Looking ahead, we expect this gap in AI adoption between larger and smaller companies to widen. Although more than 50%+ of companies report that they plan to spend from 6% to 8% of their revenue on AI this year—and although 57% of smaller companies plan to do so—the absolute investment volumes of smaller companies lag the $250 million-plus that larger companies plan to spend every year by a factor of 100. (See Exhibit 7.) As such, smaller firms will likely need to leverage vendors to access economies of scale in AI development – and may have less bespoke solutions.

The Starting Blocks

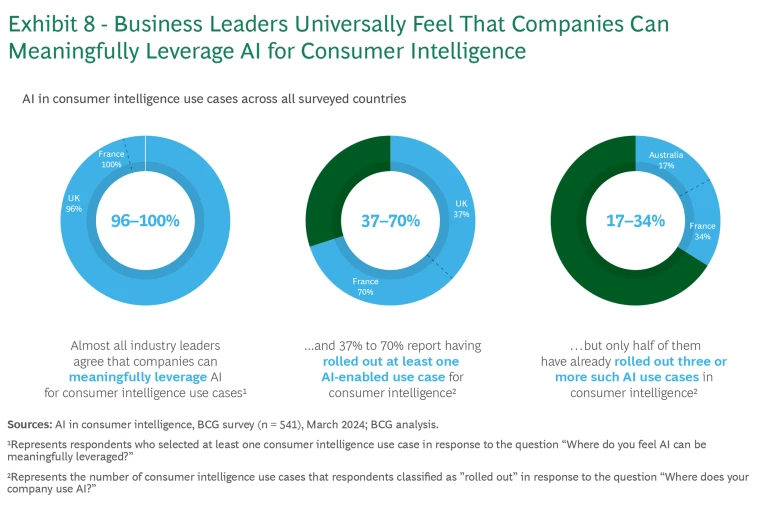

In looking specifically at AI in consumer intelligence, we found that industry leaders from across the countries we surveyed overwhelmingly agree that companies can heavily leverage AI across different use cases. (See Exhibit 8.) The percentages of leaders agreeing with this proposition range from 96% in the UK to 100% in France. Although 37% of respondents in the US and 70% in France report that their company has already rolled out one or more such use cases, about half of those that adopted at least one use case (from a low of 17% in Australia to a high of 34% in France) have already rolled out three or more AI use cases, an indication the early stage of business development that the technology is in.

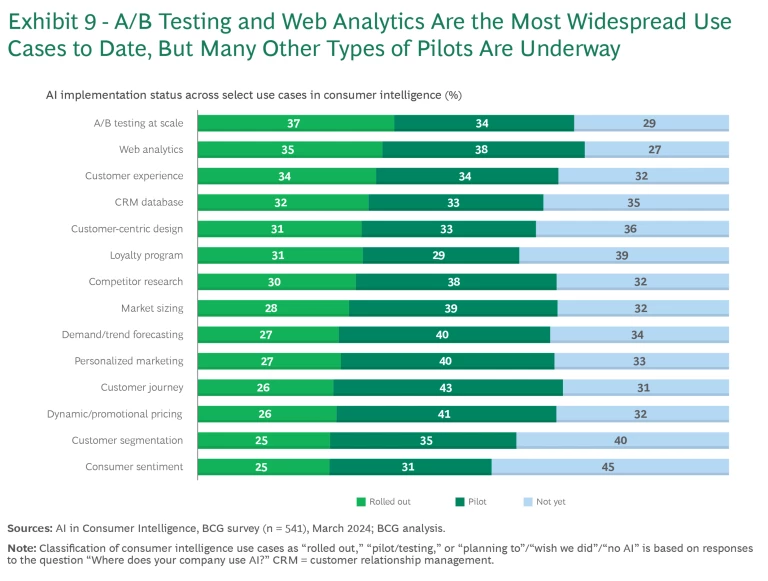

A/B testing (37%) and web analytics (35%) appear to be the types of use cases most frequently rolled out across industries. (See Exhibit 9.)

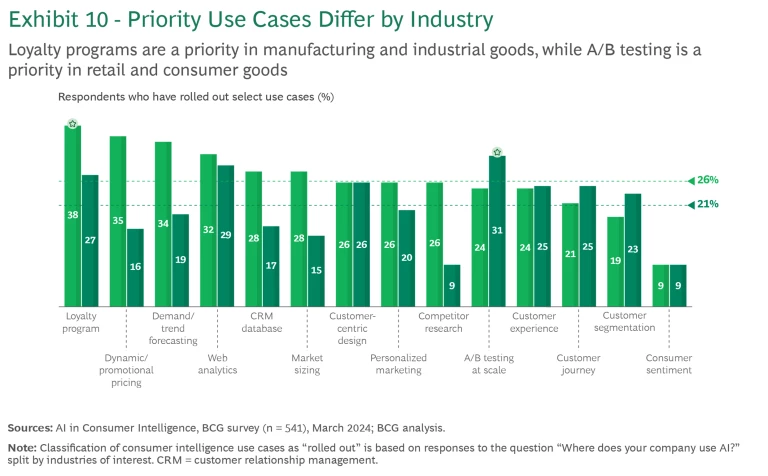

Even so, priority use cases vary across industries. For example, A/B testing is a priority in the retail and consumer goods sector, but loyalty programs are most popular in the manufacturing and industrial sector (38%). (See Exhibit 10.)

Turning Pro

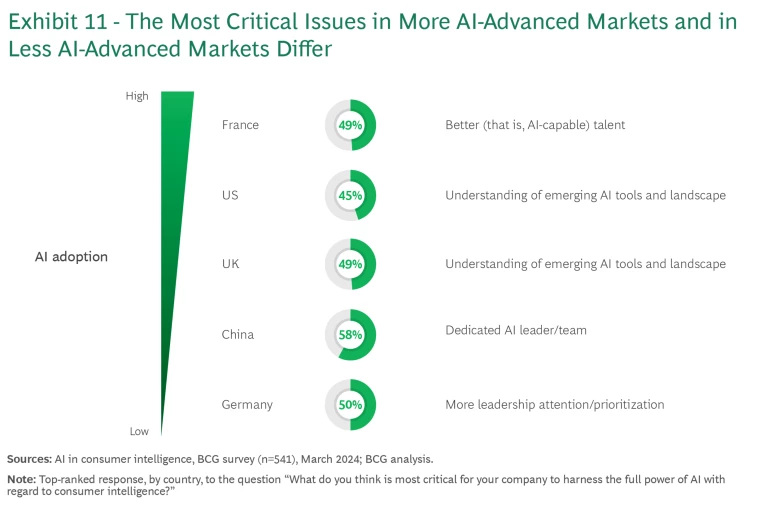

The maturity of AI varies by market, as do the needs of each market to further evolve. For example, in relatively mature markets such as France and the US, leaders see strengthening AI-capable talent and better understanding available tools as most critical tasks to harness the power of AI. (See Exhibit 11.) But in less mature markets such as China, respondents tend to identify instead the need for strong leadership guidance.

Given the speed of AI's development, the strategic approach for all companies, regardless of their maturity, should be to start small, demonstrate impact, and adapt their organization and technical capabilities iteratively. Of course, the key challenge will be to keep pace. As one former fashion and retail CEO told us, “Today, the speed of the technology is much faster than the speed of the organizations using it.” But for those who put on their running shoes as AI continues to fuel the evolution of the consumer intelligence capability, it may usher in an era of comprehensive consumer understanding that will benefit us all, as consumers ourselves.

About the Research

About the Research Study Leaders

Jean Lee is a is a partner and director in the firm’s Seattle office, focused on customer growth and strategy across a range of consumer sectors. She has deep expertise in the travel and tourism sector and served as North America leader for BCG’s Center for Customer Insight for many years. You may contact her by email at lee.jean@bcg.com.

Verena Damovsky is a project leader in the firm’s Lagos office, with experience working with clients across Europe, Africa and Asia across different industries and functions. She has expertise in customer segmentation with a focus on the social impact space. You may contact her by email at damovsky.verena@bcg.com.

Kenechukwu Obinwa is a consultant in BCG’s Lagos office, with experience working with clients in various industries and functions across Africa and Asia. He has experience developing customer engagement strategies, particularly in the social impact space. You may contact him by email at obinwa.kenechukwu@bcg.com.

Acknowledgments

- Silvia Mazzuchelli, BCG Senior Advisor

- Amanda Helming, Former Chief Marketing Officer, UNFI

- Marissa Jarratt, Executive Vice President, Chief Marketing and Sustainability Officer, 7-Eleven

About BCG’s Center for Customer Insight (CCI)

About BCG

To succeed, organizations must blend digital and human capabilities. Our diverse, global teams bring deep industry and functional expertise and a range of perspectives to spark change. BCG delivers solutions through leading-edge management consulting along with technology and design, corporate and digital ventures—and business purpose. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, generating results that allow our clients to thrive.