The GCC is experiencing a rapid transformation in its energy landscape, with renewable energy deployment expected to accelerate at an unprecedented pace. As intermittent renewable sources grow in prevalence, the need for flexible energy storage solutions is becoming critical. Energy storage solutions, particularly lithium-ion battery energy storage systems (BESS), have emerged as a significant global trend in the power sector. The global demand for lithium-ion batteries is projected to quadruple by 2030, reaching a market value of $400 to $450

The Potential and Benefits of LDES Technologies Within the GCC

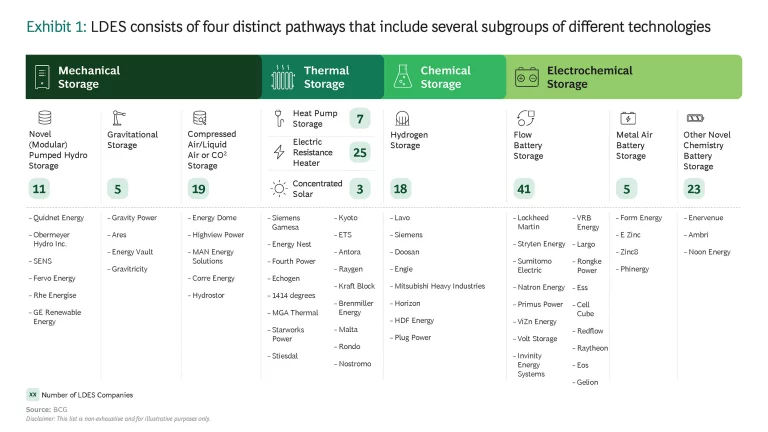

Long-Duration Energy Storage (LDES) is a family of technologies covering four pathways: Mechanical, Thermal, Chemical, and Electrochemical storage. According to BCG analysis, more than 150 companies are active in this space. The fundamental advantage of LDES technologies is that most can decouple energy and capacity, enabling cost competitiveness for longer durations.

The energy-capacity decoupling advantage of LDES makes it a primary candidate for storing energy for intraday (8-24 h), multi-day, and seasonal (24+h) grid-scale use cases. LDES is expected to emerge as a fundamental building block of the power grid as the share of intermittent renewables in the power mix increases, reaching the point where storage for 6-8+ hour durations becomes a system requirement.

Beyond grid-scale applications, LDES technologies offer promising use cases in the evolving energy landscape, particularly within the GCC context. Many LDES technologies (e.g., thermal family) can store and discharge energy directly as heat, with applications ranging from low-grade heat to medium and high-grade (1,000+ deg C). This is particularly useful for industries that rely heavily on heat, such as refineries, chemicals, cement, or pulp & paper. Coupling renewables with heat-storing LDES helps reduce dependence on fossil fuels in these industries, making it a compelling solution for their decarbonization.

Furthermore, LDES addresses power needs for use cases where the grid can't meet the demand quickly (but also for off-grid applications). A case in point is data centers, which are expanding due to the rise of AI and cloud computing worldwide, incl. in GCC. These facilities need continuous and clean power at a large scale to ensure uninterrupted operations and support tech companies’ sustainability goals. With these requirements, relying on power from the grid is often not feasible, as many transmission grids face capacity bottlenecks or are not desirable, as power from the grid still has a large carbon footprint. To power the data centers, their developers, e.g., in the USA, are considering nuclear power, either via reopening old plants or developing Small Modular Reactors. However, deploying near-site renewable power coupled with BESS & LDES solutions is increasingly considered an alternative.

Trends in the LDES Sector and Implications for GCC

Many LDES technologies are still in the preliminary stages of development. Still, more concepts are already out of the lab with developments of LDES pilot/demo first-of-a-kind plants worldwide, some under construction and some operational. Notable examples are Energy Dome’s first commercial-scale 20MW/2000MWh CO2 battery under construction in

According to BCG analysis, investors are increasingly betting on LDES, with $4.2 billion invested over the past 3 years in cleantech venture capital, strategic and industrial investors, and public funding (e.g., in the USA and Europe). For example, Rondo has secured $60Mn in Series B round in

LDES faces significant competition from lithium-ion (Li-Ion) batteries, whose costs are rapidly decreasing through economies of scale and incremental improvements. This is driven by large-scale manufacturing in China, which is fueled by EV mobility growth. We have observed Li-Ion win tenders for increasing storage durations well beyond the typical 1-4 hours and even 6-8

Noting these trends and developments, GCC should position itself strategically. Given the ambitious Net Zero and renewable energy targets in the GCC region, LDES will be required to balance the resulting intermittency. Investing in the most promising LDES technologies could allow the area to help technology to scale faster, secure supply chains, localize production, and ultimately, technological leadership with significant economic and strategic benefits in the mid-term.

Current State and Challenges of LDES Adoption in the GCC

Adopting LDES technologies in the GCC is in its initial stages, presenting challenges and opportunities. While the region has made significant strides in renewable energy adoption, long-term planning for LDES deployment is still developing. LDES is not prominently featured in many energy planners' portfolios, and structured long-term planning for these technologies is in its infancy.

While the more widespread deployment of LDES technologies is anticipated to become crucial by the mid-2030s, the groundwork for this transition must be laid today. Early planning and investment in LDES will unlock technology scouting, piloting, and validation of technologies for storage of heat and power beyond the traditional 1- 8 hour durations. This foresight allows LDES technologies to be considered seriously in long-term energy strategies, potentially positioning the GCC at the forefront of this emerging field.

The investment landscape for LDES in the GCC is still evolving, but there are already positive signs. Several industrial and financial investors in GCC countries have already begun investing in LDES technologies (e.g., Aramco investing in Noon Energy & Rondo, SABIC in Rondo, OIA

in Energy Dome, and NEOM

in Enervenue). The GCC also sees initial deployments (e.g., DEWA’s 700MW CSP project with 15 hours of storage capability and the 250 MW / 10 hours pumped hydro storage facility in

Subscribe to our Climate Change and Sustainability E-Alert.

Global Best Practices to Support LDES Development

Global trends show the increasing willingness of policymakers to support LDES, with many countries implementing incentives for its development. We are already seeing tenders specifically for long-duration storage deployments, e.g.:

- In New South Wales, Australia, a call for 1 GW of long-duration energy storage (LDES) with at least 8 hours of capacity received proposals exceeding 2 GW. This tender is part of the state's Long Duration Storage program, which aims to secure 2 GW and 16 GWh of storage capacity by 2030 to address the shortfall expected from the closure of remaining coal-fired power plants in the next

decade.16 16 https://reneweconomy.com.au/nsw-seeks-a-gigawatt-of-long-duration-storage-and-access-rights-to-4gw-in-new-renewable-zone/ - The California Public Utilities Commission plans to solicit up to 2 GW of LDES as part of a 10.6 GW centralized procurement for emerging clean energy technologies scheduled for deployment between 2031 and 2037. The solicitations will request bids for up to 1 GW of resources with at least 12 hours of duration and an additional 1 GW of multi-day storage resources, with commissioning from 2026 through

2037.17 17 https://www.utilitydive.com/news/california-long-duration-energy-storage-procurement-clean-energy-geothermal-offshore-wind/725396/ - Germany’s Ministry for the Economy and Climate Change (BMWK) plans to tender 500 MW of LDES with more than 8 hours of duration by

2025-2026.18 18 https://www.energy-storage.news/germany-plans-long-duration-energy-storage-auctions-for-2025-and-2026/

In addition, policymakers are increasingly drafting direct support or indirect incentivization schemes, e.g.:

- In California, the Energy Commission's Long Duration Energy Storage program invests up to $330 million to demonstrate non-lithium-ion energy storage technologies and implement long-duration storage systems throughout the

state.19 19 https://www.energy.ca.gov/programs-and-topics/programs/long-duration-energy-storage-program - This year, the U.S. Department of Energy (DOE) will provide up to $100 million for pilot-scale long-duration energy storage (LDES) projects using non-lithium

technologies.20 20 https://www.energy.gov/oced/articles/oced-announces-100-million-non-lithium-long-duration-energy-storage-pilot-projects - The UK Department for Energy Security and Net Zero (DESNZ) plans to introduce a cap-and-floor mechanism to encourage investment in LDES projects based on analyses suggesting that deploying 20 GW of LDES could save £24 billion between 2025 and

2050.21 21 https://www.gov.uk/government/news/new-scheme-to-attract-investment-in-renewable-energy-storage

Recommendations to Policymakers in the GCC

Learning from experiences around the world, the following recommendations should be considered to position the GCC advantageously in the emerging LDES space:

- Develop Comprehensive Energy Plans: Policymakers, regulators, and system planners should expand their long-term planning horizon to consider a full range of power, heat, and water sector decarbonization technologies. They should quantify specific ambitions for LDES deployment, like existing targets for renewable energy and hydrogen in some GCC countries. Further clarity on future ambitions will provide a north star for sector stakeholders and help target efforts for LDES development in the region.

- Create demand for capacities: Once long-term planning has clarified LDES needs (capacities and timing), system planners should mandate or earmark LDES capacity through centralized tenders to stimulate demand. Suitable developer remuneration mechanisms should complement this to ensure long-term viability.

- Foster Innovation Ecosystems: Enable an ecosystem for LDES development by investing in research, development, testing, and scale-up of LDES technologies. This could include establishing innovation hubs, public-private partnerships, and collaboration with international partners. The GCC can leverage its industrial strengths to participate in the LDES value chain, potentially becoming a hub for LDES manufacturing and expertise.

- Support first-of-a-kind projects: Support the initiation of pre-commercial-scale LDES deployments to prove the technology's feasibility and value proposition in the GCC context, specifically focusing on technologies addressing specific regional needs and conditions.

As the world pivots towards sustainable energy solutions, LDES presents a unique opportunity for the GCC to lead in sustainable energy innovation. The region can leverage its expertise and ability to support LDES development, which is necessary for accelerating deep energy transition. This will further bolden the GCC's ambition to transform its energy legacy, evolving from an oil and gas powerhouse to a pioneer in sustainable solutions that could reshape the future of global energy systems.