It is perhaps ironic that in the highest-stakes segment of the insurance industry , where losses and claims regularly run into the billions, the attribute that investors most value is the absence of drama. From a value creation point of view, the reinsurance companies with the most stable year-over-year performance have consistently been the highest performers over the past decade.

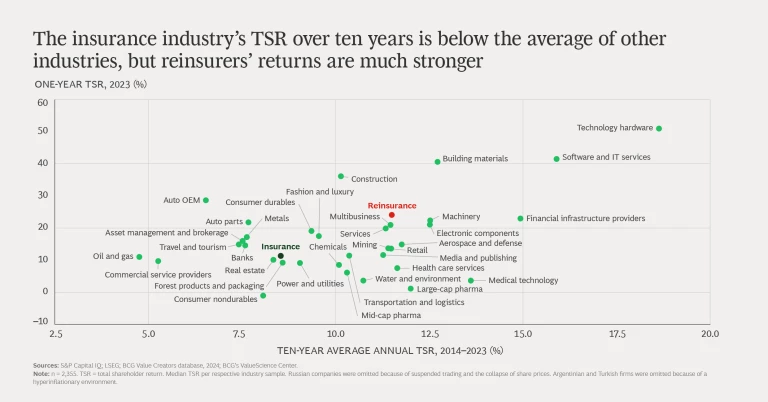

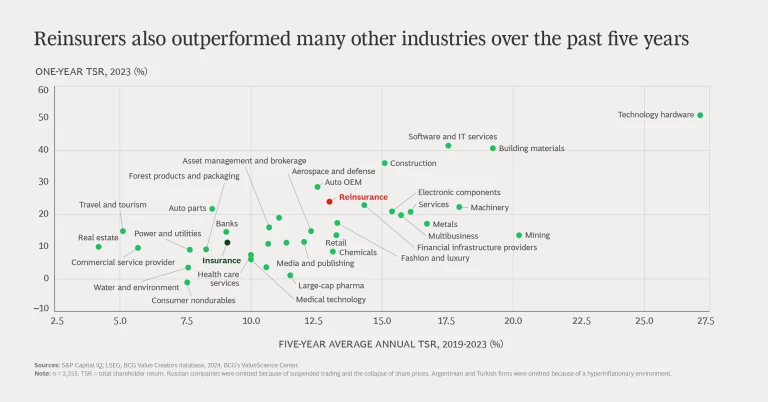

With an annual total shareholder return (TSR) of 11.5 % over the past ten years and 13% over the past five—both well above the cost of equity—reinsurance has outperformed the insurance industry as a whole and would rank close to the first quartile among all sectors as measured in our global value creators rankings . Reinsurance companies have benefited from a relatively quiet period following multiple natural catastrophes in 2018 and 2019 and the COVID-19 pandemic in 2020 and 2021.

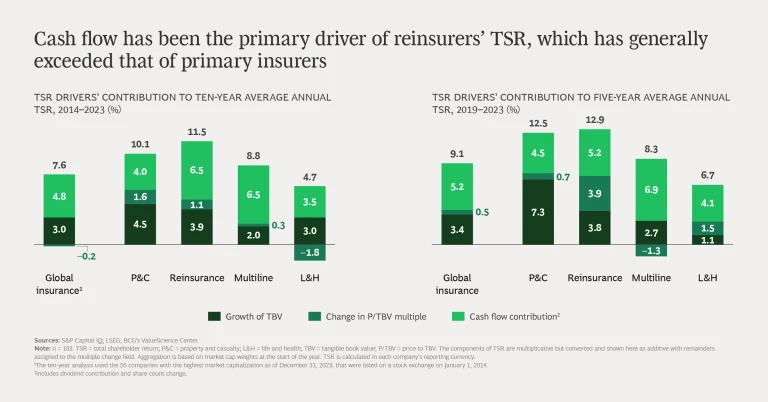

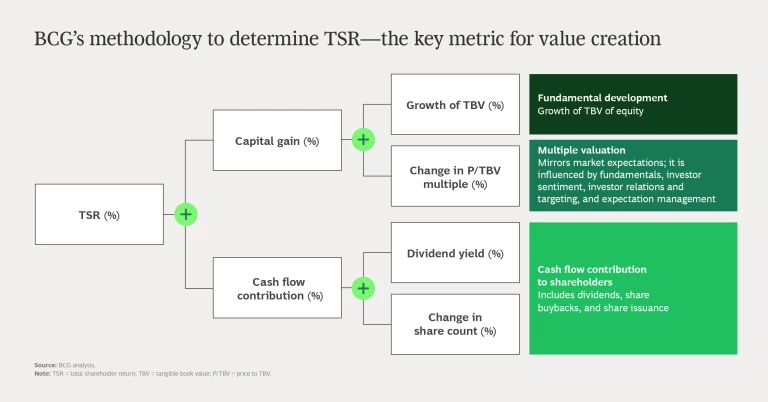

Reinsurers’ TSR performance has been driven by dividends and share buybacks, which together have accounted for more than half of total TSR over the past ten years and 40% over the past five. Reinsurers’ growth in tangible book value (TBV) increased compared with that of 2022, and now it lags only the TBV of the pure-play property and casualty (P&C) segment. A higher return on equity for reinsurers in the past few years drove the improvement.

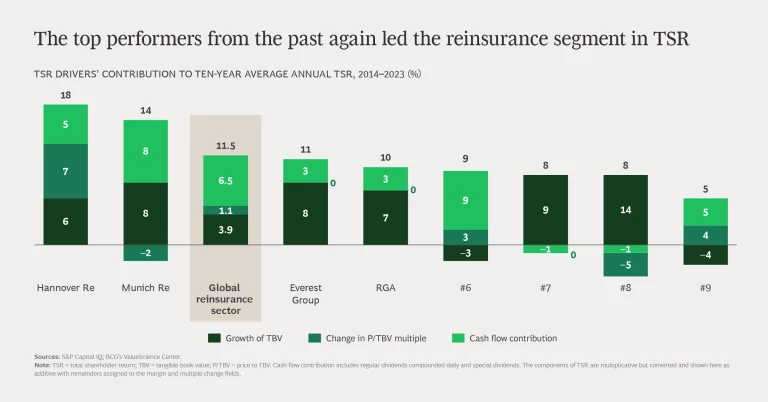

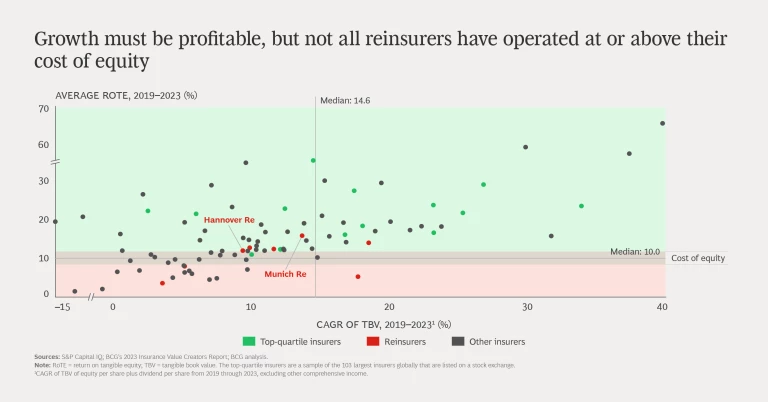

Top performers, which include Hannover Re, Munich Re, and the Everest Group, generate long-term value by selecting, assessing, pricing, and tailoring risk using best-in-class expertise, data, and technology . The companies were not only the most successful from a TSR perspective but also top-rated from a risk-return perspective. A number of companies underperformed, of course, with TSRs below the cost of equity.

The top TSR performers were also top-rated from a risk-return perspective.

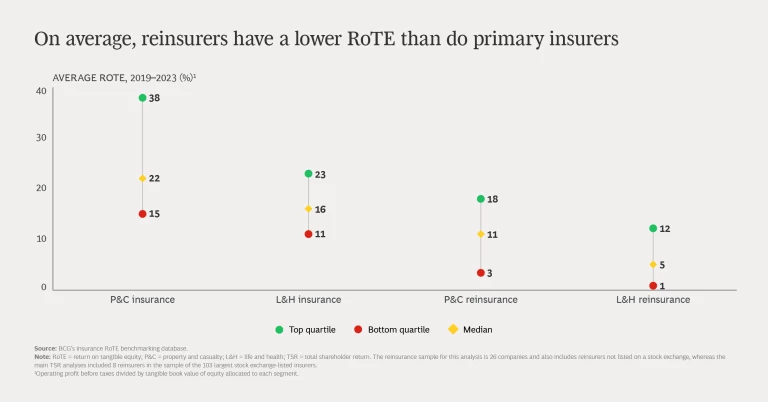

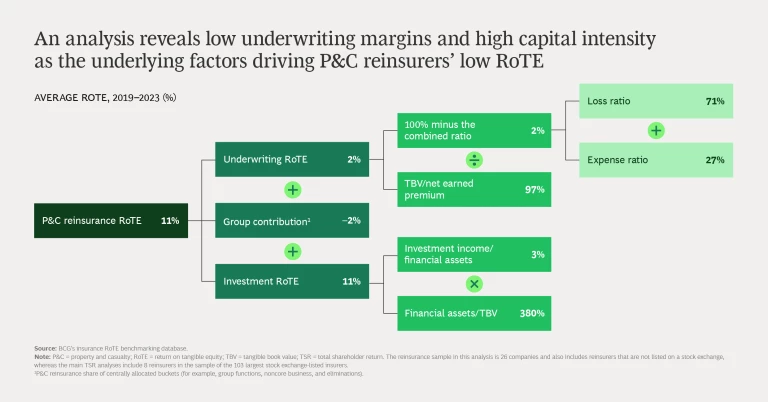

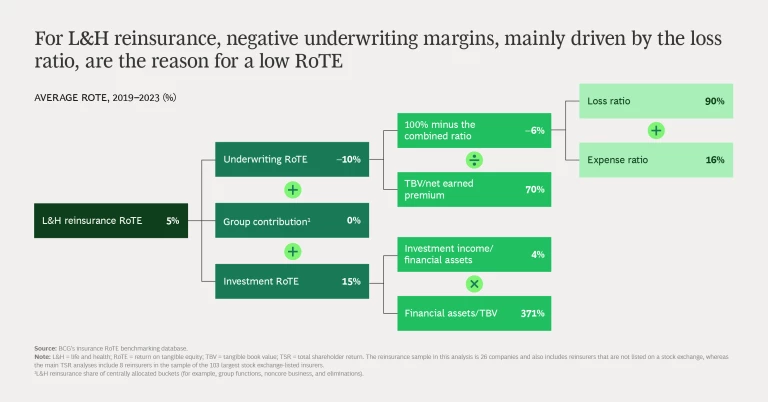

Among reinsurance subsegments, P&C reinsurers achieved higher returns than did life and health (L&H) reinsurers, which showed significant negative underwriting margins. The five-year return on tangible equity (RoTE) for reinsurers has improved compared with the past year, but RoTE for P&C and L&H reinsurers lags the average and top-quartile RoTE for the corresponding primary insurance sectors.

Looking ahead, all reinsurers need to determine how to respond to shareholder expectations for increased TBV growth over time. Top performers achieve their TSR by balancing profitable growth, cash flow contribution, and multiple expansion (which they do not directly control but can influence by how they approach the other two factors). Supporting TSR primarily through dividend increases and share buybacks has its limits and can leave companies in weakened positions in a softening market. The strong market of the past few years should have helped build reserves. But we are now seeing softening in various commercial lines in primary markets, which could affect reinsurance prices in the next few years.

Given the well-recognized shifts in natural catastrophe patterns stemming from climate change, shareholders that take a longer view may be willing to accept lower cash flow contributions to TSR while companies shore up capital to prepare for additional capacity requirements. In addition to rising catastrophe losses, the need to build new capacity fueled by green transition investments is expected to strain the insurance sector, including reinsurance. Together with insurance intermediary group Howden, we recently observed that deploying the $19 trillion in investment that has been committed to financing the climate transition through 2030 will require additional insurance coverage of up to $10 trillion.

In parallel, insurance premiums for physical risks and natural catastrophe protection are set to increase by 50% by 2030, reaching $200 billion to $250 billion globally, the result of climate-related events, losses, and other factors. Beyond climate change, the recent global meltdown in information processing resulting from a cybersecurity patch, which the Financial Times has estimated could cost billions in insured losses, is a harsh reminder of the hazards of a connected world.

In the face of all these developments, investors will continue to look to reinsurance for stable—some may say boring—shareholder returns.