The worldwide effort to advance and commercialize emerging climate technologies faces new headwinds. The immense enthusiasm that once surrounded these technologies has diminished, and green premiums remain stubbornly high. (See Exhibit 1.)

Sustainable aviation fuel (SAF), for example, remains two to three times as expensive as conventional jet

The energy industry has overcome similar challenges in the past. A historical examination of today’s mature technologies—including combined cycle gas turbines (CCGT), solar, wind, and liquefied natural gas (LNG)—reveals a roadmap for how to accelerate the at-scale deployment of today’s emerging technologies.

Industry, entrepreneurs, financial intermediaries, policymakers, and other stakeholders can collaboratively apply the lessons from the development journeys of legacy technologies:

- Overcoming Technical Barriers. Industry-led efforts to standardize and modularize specifications can turbocharge technical development, as demonstrated by wind.

- Securing Offtake. Niche offtakers in industries where both willingness to pay and aggregated demand are high can kickstart early-stage funding and commercialization, as demonstrated by CCGT and renewables.

- Addressing Market Challenges. Tolling agreements can help reduce market obstacles by limiting risk for large infrastructure investors, as demonstrated by LNG.

- Providing Consistent Policy Support. Consistent policies that promote emerging technologies’ bankability by lowering green premiums and providing demand-side support can create stable offtake opportunities, as demonstrated by solar.

Challenges

All emerging climate technologies share the same goal of riding the rising S-curve of adoption by creating attractive projects for investors. But four familiar types of barriers are slowing progress:

- Technical Barriers. Technical problems drive up green premiums and increase project risk, inhibiting project-level investment. Project delays and cancellations—for example, NuScale’s recently canceled SMR project in Idaho—reflect how technical challenges can raise safety and cost

concerns.2 2 Zach Bright & Brian Dabbs, “Is Advanced Nuclear in Trouble? What’s Next After NuScale Cancellation,” E&E News (November 10, 2023); David Schlissel, “Eye-Popping New Cost Estimates Released for NuScale Small Modular Reactor,” Institute for Energy Economics and Financial Analysis, January 11, 2023. This underscores the need for an industry-wide consensus on safe and commercially feasible design standards and cost-effective modules to guide successful project development. - Offtake Barriers. High costs and a significant level of execution risk limit large offtaker interest in green technologies. Price-sensitive offtakers may be unwilling to pay significant premiums for large quantities of low-carbon supply for core services. For example, to ensure power remains affordable for ratepayers, local commissions often limit utilities’ ability to contract for expensive power via untested solutions.

- Market Barriers. Even when mature technologies and willing offtakers are present, technologies require markets that connect buyers and sellers seamlessly and transparently, and allocate risk to those that can bear it. For emerging technologies, such markets are nascent or do not yet exist. Clean hydrogen, for example, requires substantial infrastructure investments, and the resulting risk of exposure to high prices makes the fuel difficult to sell in a spot market.

- Policy Barriers. Policies vary in their degree of support for emerging climate technologies across countries. For example, Australia is still in the process of implementing US-style incentives for hydrogen, despite having equally strong potential for hydrogen development as the US. In the US, despite extensive clean energy incentives such as those established in 2022, uncertainty about relevant rules—such as available tax credits under section 45V of the legislation—remains.

Historical Parallels

These barriers are familiar to longtime energy professionals. Today’s mature technologies—including solar, wind, CCGT, and LNG—once faced similar hurdles. The stories of their development provide lessons on how to accelerate the deployment of today’s technologies.

Wind Power’s Journey to Overcome Technical Barriers

The standardization of safety, quality, and technical specifications helped wind power overcome a number of technical barriers. For much of its history, the wind power industry was fragmented. Manufacturers developed turbines in isolation, leading to inefficiencies and high costs. This changed in 1988 when the International Electrotechnical Commission (IEC) introduced a series of universal safety, quality, and technical standards for wind

The impact of standardization on wind was significant. Although compliance with IEC standards remained voluntary, adopting them became essential for manufacturers aiming to operate at scale. Importers began to demand IEC-certified components to ensure compatibility and quality, further solidifying the standards in the industry. The existence of established global standards encouraged emerging economies such as India and China to join the wind power sector, and this broader participation drove down costs and opened new markets.

The establishment of standards not only streamlined the value chain, but also fostered confidence among banks and insurers. With standardized products, investors could more easily validate the quality and reliability of specific wind projects, which in turn helped projects attract investment. Simultaneously, turbine component modularization—the process of designing and producing machine parts in streamlined sections for convenient onsite assembly—permitted faster installation and simpler scalability, reducing costs and further improving turbine deployment.

Through an industry-led standardization and modularization effort, wind turbines achieved impressive technical development. Developed in the 1890s, the world’s first wind turbines had a maximum capacity of 12 to 18 kW with highly intermittent

CCGT’s and Renewable’s Pathways to Reducing Offtake Barriers

Long before utilities considered using CCGT for large-scale power generation, niche applications in industries with a high willingness to pay helped commercialize the technology.

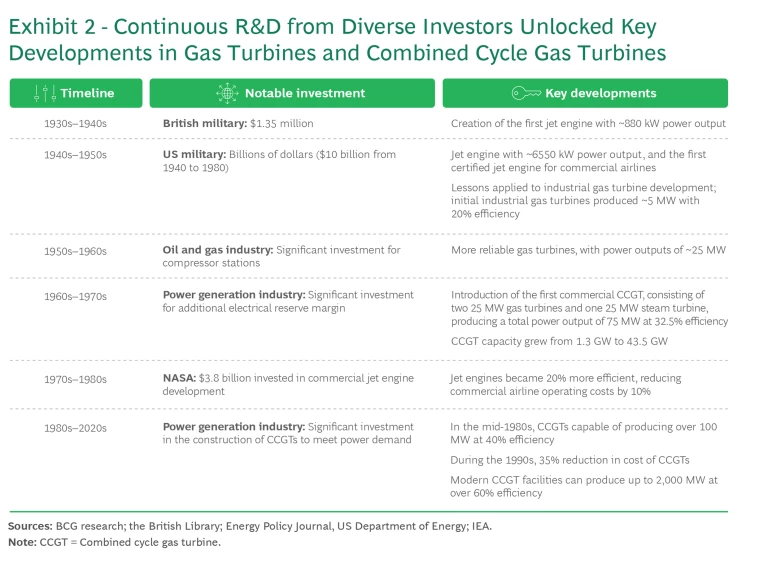

The military's initial interest in jet engine technology led to substantial advances in turbine design. Early jet engines, which shared many components and design principles with gas turbines, benefited from heavy R&D investments by the military. These investments drove innovations in materials, configuration, and high-temperature alloys that engineers later applied to gas turbines.

Later, the oil and gas industry’s need for reliable power for remote natural gas distribution drove interest in gas turbines, which were the ideal power source for the application. With the revenue generated from the oil and gas industry’s procurement of gas turbines, manufacturers funded further R&D, enhancing turbine performance and reliability.

Only after these early niche use cases achieved success did policy support (for example, in the form of deregulated natural gas markets in the US and the UK) ramp up toward today’s low-cost, low-risk CCGT market. Modern CCGT facilities now deliver efficiency rates in excess of 60% and can generate up to 2,000 MW of electricity, versus approximately 5 MW with 20% efficiency in the 1940s. (See Exhibit 2.) Today, CCGT is a key part of the US power generation landscape, surpassing coal capacity in

Renewables adoption benefited from a different approach to reducing offtake barriers: demand aggregation. One example is Clean Energy Buyers Association (CEBA)—previously Renewables Energy Buyers Alliance—a coalition of corporate and institutional energy buyers that are committed to purchasing renewable energy. By aggregating their demand, CEBA has helped its members secure large-scale power purchase agreements (PPAs) with developers of renewable energy and procure renewable energy at competitive prices. This collective approach also gives member companies access to options that they might otherwise not have due to size, location, or other factors. CEBA members have contracted for more than 84 GW of new capacity through US-based projects.

LNG’s Solution to Market Barriers

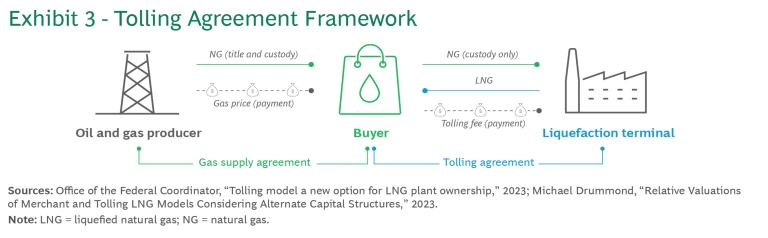

Tolling agreements were pivotal in overcoming market obstacles for large infrastructure investments in the LNG sector.

Introduced in response to the high financial risks associated with LNG projects, tolling agreements capitalized on the industry’s complex value chain in the US, where terminal operators charge a flat fee to reserve liquefaction capacity (calibrated to cover debt servicing, operations and maintenance, and profit margin) but do not take title of the gas itself. This arrangement enables terminal operators to isolate themselves from the risks of upstream and downstream activities. For example, terminals do not directly experience the risks that upstream producers face, such as exposure to natural gas feedstock price volatility or exploration and extraction

By decoupling investment returns from volatile market conditions, this structure effectively reduces financial risk and ensures a stable revenue stream for facility operators. And the lower level of risk associated with projects under these agreements increases investor confidence and prompts the offering of more capital at lower rates. (See Exhibit 3.)

The introduction of tolling agreements marked a turning point in LNG project financing. For instance, the Sabine Pass LNG project in the US successfully leveraged these agreements to secure financing and expedite

Subscribe to our Energy E-Alert.

Solar’s Reliance on Consistent Incentives and Regulation to Overcome Policy Barriers

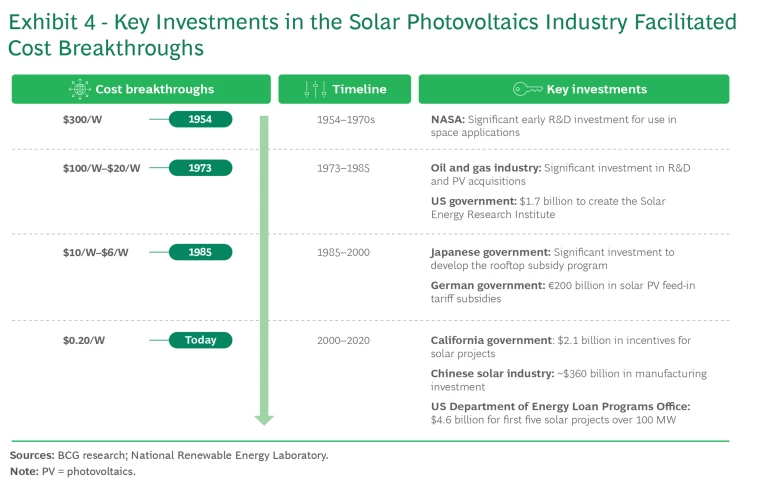

Germany’s integrated policy approach simultaneously combined financial incentives and regulatory measures, increasing demand for solar and reducing its green premium.

For example, the feed-in tariff introduced as part of the Renewable Energy Sources Act in 2000 guaranteed long-term payments to generators of electricity from renewable sources at a rate higher than the market price, increasing the attractiveness of solar investments. In addition, the German government provided low-interest loans, grants, and rebates for solar installations, further alleviating the financial burden and boosting demand.

In the US, consistent policy support, composed of supply-side incentives and demand-side mandates, have helped unlock solar’s potential.

Following the 2008 recession, the US passed the American Recovery and Reinvestment Act, approving more than $90 billion in clean energy investments and tax incentives. In the wake of this legislation, the costs of solar photovoltaic (PV) installations dropped by 60% from 2008 to

Thanks to this integrated approach of incentivization and regulation, solar has achieved remarkable progress. Since the 1960s, the cost of solar cells has plummeted by about 99.9% and efficiency has improved sixfold, and electricity generation from solar PV has grown by a multiple of 220 over the past 20

Applying Lessons Learned

We have successfully overcome barriers and scaled energy technologies before. The pathways that solar, wind, CCGT, and LNG took to maturity provide an encouraging roadmap for how today’s emerging climate technologies can overcome obstacles to at-scale commercialization. (See “Applications of Legacy Technology Lessons to Today’s Emerging Technologies.”) But applying these lessons and accelerating deployment timelines requires support from all stakeholders:

Applications of Legacy Technology Lessons to Today’s Emerging Technologies

Viewed broadly, the barriers facing emerging technologies today, as in the past, resolve into four major categories: technical, offtake, market, and policy. In each case, a straightforward solution offers a way to surmount the central difficulty that the barrier poses.

The Technical Barrier

The key to success in this area is to enhance standardization and modularization. Applying this solution to various specific emerging technologies might take the following forms:

- SMRs. Ensure that suppliers can contribute to multiple solutions, thereby strengthening the supply chain’s ability to scale up and reduce costs. Design and produce components in modules to allow more efficient and scalable installation of subcomponents.

- EV Charging. Continue working toward single-standard charging ports with cross-vehicle applicability.

- Green Steel and Green Cement. Update building standards that ensure green steel and green cement are code compliant, thereby increasing opportunities to use them in construction. Promote a more modular approach to scale green steel and green cement production.

- Clean Hydrogen. Standardize and increase modularization of electrolyzers to move toward a factory-built scaling model.

The Offtake Barrier

Stakeholders can solve this challenge by identifying niche applications and aggregating demand. Specifically:

- CCS and DAC. Maintain investment in CCS from the oil and gas industry (to date, over 70% of CCS projects are for enhanced oil recovery projects) for a low-risk pathway to continued flow of capital.

- Long-Duration Energy Storage. Target remote geography applications and military bases for niche offtake options, likely with higher willingness to pay.

- Enhanced Geothermal. Contract with data centers to provide low-carbon, firm power to finance demonstration projects, given growing demand for electricity in the segment.

- SMRs. Continue DoD collaboration to advance the development and potential deployment of SMRs as a strategic component of energy security.

- SAF. Coordinate among airlines to aggregate SAF demand, creating a stable and substantial market for SAF producers.

The Market Barrier

A valuable solution in this area is to leverage tolling agreements. For example:

- Clean Hydrogen. Apply a tolling framework to hydrogen electrolysis plants to reduce risks for large infrastructure.

- SAF. Establish spot markets for SAF to facilitate smoother transactions between fuel buyers and fuel sellers.

- Green Steel and Green Cement. Leverage a tolling framework for steel and cement plants to reduce the risk and impact of commodity price fluctuations on infrastructure investors.

The Policy Barrier

A proven way to overcome policy-related difficulties is to integrate consistent supply-side and demand-side levers. For instance:

- CCS and DAC. Provide clarity on the applicability of clean energy incentives at the federal level for novel storage solutions (such as mineralization), enabling these technologies to compete on level ground with traditional solutions.

- SMRs. Consider cost recovery for zero-carbon generation projects at the utility commissions level (such as by allowing recovery of construction work in progress).

- Private Industry. Collaboration in formulating new standardization frameworks will help overcome technical barriers for technologies such as SMRs, EV charging networks, green steel, and green cement. Successful standardization requires increased willingness by competitors to share technical details and consolidate specifications to ensure that products can work together in a plug-and-play system.

- Early-Stage Entrepreneurs. Identifying niche offtake applications will help emerging technologies advance. For example, CCS can leverage enhanced oil recovery for continued early-stage development, long-duration energy storage can target off-the-grid use cases with military base and remote site offtakers, and advanced geothermal can collaborate with data centers for first-of-their-kind applications.

- Financial Intermediaries. Structuring deals to more effectively isolate different risks will help investors overcome market barriers. Tolling agreements—which have successfully shifted investment risk in LNG projects from gas price volatility to project risk of volume and throughput—have similar application to hydrogen, SAF, green steel, and green cement projects, all of which require significant infrastructure investment.

- Policymakers. A consistent, integrated approach of lowering green premiums and bolstering demand can promote adoption of emerging technologies. Federally, the US can work to fill gaps in its existing incentives for clean energy, including establishing clear guidelines on which technologies are eligible for carbon sequestration credits under section 45Q of legislation enacted in 2022. State and local bodies can also support these initiatives. For example, utility commissions can improve cost recovery attractiveness for zero-carbon power generation solutions to complement state renewable portfolio standards.

Yesterday’s successes can inform tomorrow’s solutions. Overcoming the technical, offtake, market, and policy barriers to scaling climate technologies doesn’t require reinventing the wheel; we already know what works.

Acknowledgments

The authors would like to recognize the Breakthrough Energy Catalyst team for their helpful thought partnership on this work.

In addition, they would like to thank the following BCG experts and team members for their contributions: Pablo Avogadri, Preben Bay, Michael Bernstein, Alex Dewar, Andrew Foster, Vlado Georgievski, Robert Hutchinson, Marc Kolb, Jennifer Michael, Nairika Murphy, Cristian Navarro Delgado, Bas Percival, Daniel Quijano, Jared Russell, Arian Saffari, and Jessica Xu.