This is not the time for B2B sales organizations to make unforced errors. But Boston Consulting Group finds that many businesses are underusing data and analytics in their sales functions––and missing out on as much as 5% to 10% net revenue uplift annually. The reason in most cases is based on false perceptions about the practical value of sales intelligence and a lack of awareness about what it takes to deploy data and analytics efficiently and at scale.

The good news is that these perceptions are reversible. Our project experience shows that B2B organizations that make data and analytics a bedrock of their sales motions reap massive benefits, generating significantly higher rates of revenue growth, improved productivity, and lower churn. This article walks through how other organizations can do the same.

Three Misconceptions About Data Are Holding Companies Back

Sellers in a leading logistics company thought they were doing everything right. Their senior account reps had cultivated deep relationships with key buyers, stepped up coaching to younger sellers, and begun crafting more customized offerings to clients. But sales growth was still well below their target. A closer look revealed that the issue had little to do with the caliber of sales talent. Compared with faster-growing B2B organizations, this company lagged in its use of data and analytics, and the lack of ready insights was forcing sellers to spend their time chasing down information and validating leads, creating inefficiency and missed opportunities.

Because spreadsheets don’t enable systematic insights, sellers often fall back on reactive approaches to customer engagement, based on what has worked in the past rather than being proactive.

This company is not unique. In our conversations and client work with sales teams across industries, we hear three common sentiments that help to explain the low levels of engagement.

- “We already have the information we need.” Many sales leaders view customer relationship management (CRM) and related tools as an administrative hassle that offers little practical value. One senior account rep we spoke to said, “No one else knows the customer better than we do.” Another added, “I manage 15 accounts and know all of them really well.” In our earlier example, the logistics company used manual approaches in which sellers typed client requirements and quotations into spreadsheets that they emailed to their counterparts in other regions and business units. Such approaches limit knowledge sharing and increase onboarding challenges for new joiners. And because spreadsheets don’t enable systematic insights, sellers often fall back on reactive approaches to customer engagement, based on what has worked in the past rather than being proactive.

- “We don't have enough data to create quality analytics.” In large legacy organizations, data is often scattered among many systems and managed in different ways, leading sellers to distrust the insights delivered. Even if they could pull all relevant information together in one spot, some reps say they wouldn’t be able to tell which insights were credible because of redundancies, contradictions and gaps in the underlying data. Other organizations that have relatively few customers often feel the sample is too small for them to draw reliable conclusions. And while third-party data can help plug some of these holes, there’s often no easy way for sales teams to manage or share the information. One sales leader told us, “Our data is such a mess, we don’t even know where to get started, never mind cleaning it up.” Many sales organizations, therefore, haven’t adopted analytics that can help them discern important buying signals regarding their accounts.

- “Our structures, processes, and systems don’t allow us to use data and analytics effectively.” It’s not uncommon for B2B marketing, sales, and customer service teams to maintain different dashboards and databases. At one large B2B in the financial services space, marketing and sales use separate CRM systems. Marketing generates, nurtures, and qualifies leads in HubSpot. Leads are then manually uploaded into Microsoft Dynamics 365 where, as one team member told us, “they go to die.” The lack of feedback loops means that learning doesn’t build over time, thus weakening the quality of recommendations. Marketing teams cannot get conversion data from sales in a timely way, which means they cannot improve the quality of their leads. And sales does not trust the leads that marketing generates, which leaves them reliant on their own incomplete data.

Top Performers Do Things Differently

While the attitudes we’ve just described remain pervasive, some sales organizations have moved beyond them—with notable results.

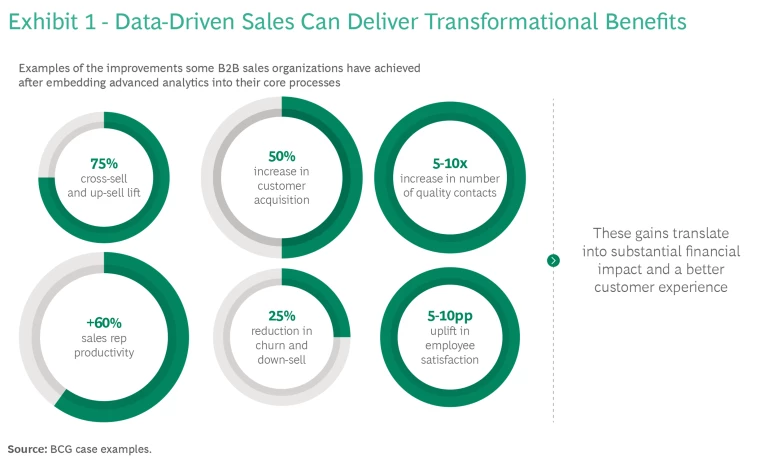

Our research shows that B2B companies that employ advanced analytics across the deal cycle enjoy the highest rates of revenue growth. They have better lead generation, lead nurturing, and prioritization, and more targeted engagement once a customer has onboarded. Those insights are contributing to significantly higher sales performance. (See Exhibit 1.)

One fast-growing B2B has integrated its CRM system into its discount matrix platform, which requires that sales reps enter information such as conversion probability and lead stage into the system before they can obtain pricing approval. The CRM integration creates a “push” and “pull” for sellers, mandating data inputs that help leaders minimize discounting disparities while providing sellers with the pricing insights they need to achieve their targets more easily.

Our research shows that B2B companies that employ advanced analytics across the deal cycle enjoy the highest rates of revenue growth.

Likewise, rather than assume that their data and analytics processes are beyond repair, some companies adopt the mindset of building what they need and refining as they go. For example, a midsize communications company wanted to create a dashboard that would allow sellers to see all their customer opportunities in one place along with a prioritized set of next-best actions, so they figured out what data was mission critical for that task and made acquiring and cleaning it a priority.

Having laid the foundations, top-performing companies can press ahead more easily and adopt newer, next-generation technologies—raising the competitive bar higher for other sales organizations. A large telecommunications company has begun using generative AI to help sellers complete proposals. The tool populates request-for-proposal (RFP) responses with needed information, tailors it to the client context, and does so within minutes. Sellers love the system, which has removed a major time constraint. And the quality of the proposal is also better because the GenAI system pulls from a continually updated source of best-in-class company information and ensures that all RFP requirements are met.

Other organizations can begin building similar capabilities.

Four Actions to Boost Your Sales Intelligence

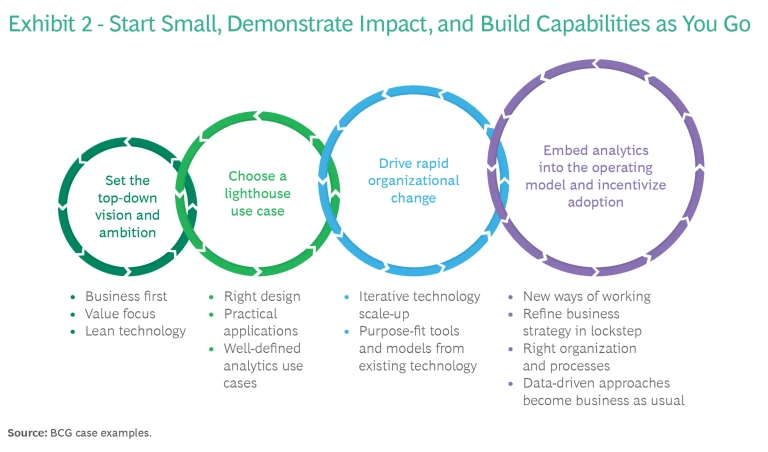

With the right tools and practices, organizations we have worked with have overcome their data and analytics barriers to drive significantly greater revenues. We recommend four specific actions that companies can take. (See Exhibit 2.)

- Set the top-down vision and ambition. Senior leadership needs to articulate a clear vision for how data and analytics can deliver value. They also must provide the governance, organizational structure, and funding to support the journey. A tech company, for example, wanted to make their inside sales function more data driven to achieve higher performance, especially with its more complex products. Sales leaders laid out the ambition, outlined the revenue and customer-experience benefits it could bring, and defined a set of supporting capabilities. These capabilities included acquiring enriched data, embedding performance management tracking and analytics into key processes, and automating routine procedures. They appointed seasoned sales managers to own the transformation and take accountability for achieving the objectives. The program was endorsed by the company’s leadership and communicated widely to the organization as a strategic priority. In the six months since the new capabilities were rolled out, inside sales has improved conversion rates by a factor of ten and increased average order value by 70%.

- Choose a “lighthouse” use case. Rather than launching a sweeping analytics agenda, most companies we work with achieve better results by focusing on a few high-value use cases to kickstart the journey. We recommend running estimations that assess impact versus effort. Leaders should then give priority to use cases that have a clear business objective, build foundational and scalable analytics capabilities and have strong sales buy-in. A leading telco company, for instance, chose cross-selling a new IOT system as its lighthouse use case because it presented sellers with significant market potential in an emerging, high-growth field.

- Drive rapid organizational change. Only about 10% of the lift required to embed analytics into sales depends on technology and infrastructure. Another 20% comes from data, analytics, and related tools. But the remaining 70% comes from adapting processes and the operating model. Adopting agile practices and creating cross-functional teams that comprise a mix of business and analytics skill sets are essential to capturing that 70%. These cross-functional teams can build a minimum variable product for the lighthouse use case, put the prototype into the field, then test and refine it quickly. Early tests not only deliver proof of value, they also build key skills and learning. Moreover, they engender confidence that the organization has what it takes to develop effective applications—factors that speed future deployments. Quick successes are also crucial to help fund the longer-term journey. Organizations can channel the revenue and savings generated to build more sophisticated tools, buy more third-party data, and grow the use case portfolio, all of which can cultivate deeper buy-in across the organization.

- Embed analytics into the operating model and incentivize adoption. Leading organizations involve sellers in the design and deployment of analytics tools, and they make the “what’s in it for me” angle clear from a seller’s perspective. One top-performing B2B company launched an analytics pilot that created specific deal-level recommendations for key accounts. Over a period of 16 weeks, sellers that acted on those recommendations enhanced deal value by an average of 10%. Now other sellers are clamoring to take part in the next wave of pilots. A key unlock has been to bring sales together with other major stakeholders. Twice a week, the sales team, analytics team, marketing team, and product team sit together for 60 minutes to discuss priority accounts and evaluate which recommendations seem to be working and which new triggers they should consider. This working model allows all team members to engage behind a shared goal, pooling needed data and designing specialized account-based solutions and analytics. This kind of collaboration creates a drumbeat for sales to knock down procedural roadblocks, speed the development of pitches and demos, and hasten approvals.

Effective use of data and analytics is becoming a key differentiator between the “good” and the “great” in sales. And the bar is only going to rise as today’s leaders become evermore proficient at creating, deploying, and integrating data-driven approaches across the buying journey. Companies that have been slow to embrace these developments can still catch up—and outpace their competitors. But now is the time to start. The approaches we cite here can make that catch-up process both manageable and attainable, transforming today’s laggards into tomorrow’s leaders.