After spending last year on edge over inflation, market conditions, and the possibility of a recession, corporate leaders feel cautiously optimistic about 2024.

At the same time, C-suite executives are making cost management a top priority to address lingering economic, financial, and geopolitical concerns.

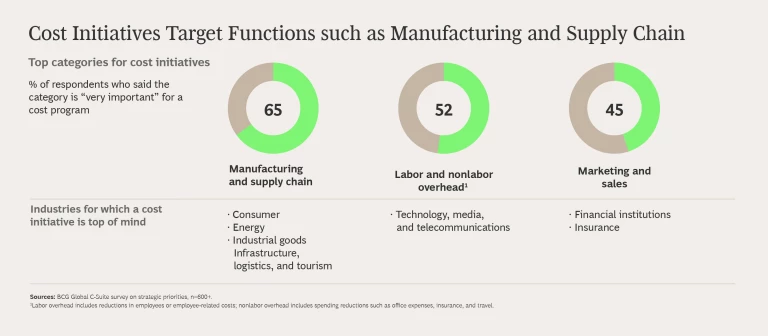

According to new BCG research, executives are initiating enterprise-wide cost campaigns, targeting such functions as manufacturing , supply chain , labor, and marketing and sales .

Cost initiatives may start strong but run into trouble. The vast majority of corporate leaders we surveyed said their cost programs meet or exceed initial savings targets. However, a substantial portion struggle to sustain reductions. Others report that cost cuts hurt business or limit growth.

Companies can sustain savings and power growth if they take a holistic approach to cost management, apply resources unlocked from quick wins to fund innovation, and cultivate a culture of continuous improvement.

Cautious Optimism

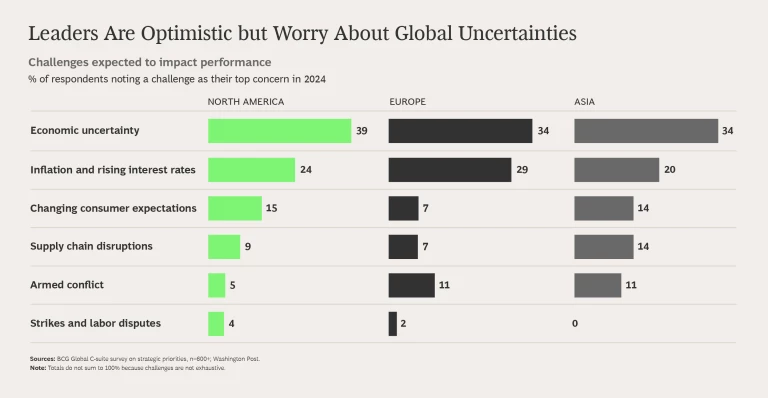

Our survey of more than 600 C-suite executives around the world found that fewer are as pessimistic about macroeconomic shifts as they were in 2023.

Sixty-three percent believe their enterprises are prepared to weather additional global shocks. Even more (68%) believe they have enough visibility to make decisions about long-term capital investments. These positive sentiments—along with more abundant available capital, regulatory changes, and other trends—could cause mergers and acquisitions to pick up in coming months.

Corporate leaders aren’t entirely upbeat. They remain concerned about the possible business challenges posed by inflation, rising interest rates, and the potential for recession. They’re also tracking socioeconomic and geopolitical fallout from this year’s general elections in the US, India, and EU and from ongoing conflicts in Ukraine and the Middle East.

Making Cost Management a Priority

Lingering uncertainty, the need to reshape operations for the future, and disruptive technologies (such as generative AI) are motivating leaders to put cost management at the top of the to-do list. Corporate leaders’ goal of cutting costs stretched across all the regions we studied—North America, Europe, and Asia—and a variety of industries.

After managing costs, C-suite leaders’ top strategic priorities for 2024 are growth and expansion. How they accomplish both of those goals differs by region. Leaders in North America and Asia aim to grow by increasing product lines. In Europe, leaders are targeting growth by managing prices to counter inflation.

Leaders in the consumer goods and infrastructure and logistics sectors are particularly keen to grow by moving into new territories. Companies that are attracted to Southeast Asia’s status as a vibrant market and manufacturing hub are partially responsible for spurring geographic expansion. But interest in new regional markets is dampened in part by ongoing geopolitical tensions in other parts of the world.

Targeting Cost Efforts

Leaders are launching programs to manage costs in every aspect of their business. However, they said initiatives in manufacturing and supply chains, labor, and marketing and sales are “very important” for maintaining a competitive advantage. To lower manufacturing and supply chain costs, companies can optimize procurement, logistics networks, and distribution and warehousing, and invest in digital lean manufacturing and advanced planning processes.

A Strong Start Doesn’t Always Lead to Lasting Cost Savings

More than eight in ten leaders who launch cost programs reported meeting or surpassing their initial savings goals. But a strong start doesn’t guarantee lasting change. More than a third of the leaders we polled said costs eventually come back, and almost as many reported that cost cuts affect their business or growth.

C-suite executives told us that cost challenges are exacerbated by the difficulty of finding specialized talent in a tight labor market. Attracting and retaining people with the right skills is the biggest concern of leaders in health care and technology, media, and telecommunications . Cost initiatives are further stymied by disruptions caused by digital and AI.

A Holistic Approach to Cost Management

We know from years of client engagements that cost transformations are hard, and many don’t stick. Leaders improve the likelihood that their transformations will succeed by adopting a holistic approach that goes beyond one-and-done cost takeouts and by establishing a culture of continuous improvement.

Companies can unlock resources through quick wins and reinvest them in areas that drive growth, such as digital and AI, talent advancement, modernized supply chains, and operational excellence. To support change, top leaders must build a culture that supports it. They can do that by engaging people, translating strategies into measurable actions, treating setbacks as opportunities to learn, and provide other leaders in the organization with the support and resources they need to balance cost and growth goals.

Shifting economic trends, evolving geopolitics, and rapidly changing technologies are forcing organizations to evolve. Many are using the circumstances to improve costs. By taking a holistic approach, organizations can unlock funds to invest in strategic priorities that build competitive advantage for the future.