China’s insurance market has reached an inflection point. Given the country’s aging population, its heightened interest in health and wellness in the wake of the COVID-19 pandemic, and a prevailing low interest rate environment, China’s personal insurance sector is poised for a growth spurt of 5% to 10% by 2035.

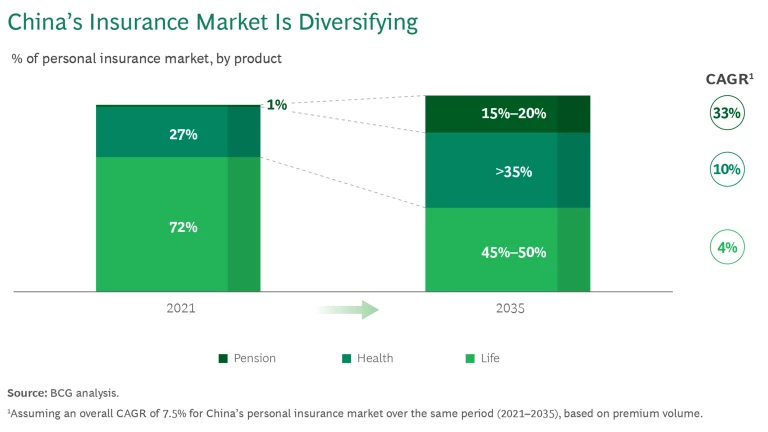

The potential for growth is underpinned by the expansion of a relatively untapped market for pension and health insurance. We estimate that, by 2035, these product lines will account for around 50% of China’s personal insurance

To capture these opportunities, insurance firms need to position themselves strategically, leveraging specific opportunities in health and pension insurance while also investing in digital transformation.

What to Expect

Based on our forecasts, the personal insurance market in China will expand from its 2021 level of RMB 4 trillion to between RMB 6.6 trillion and RMB 12.6 trillion by 2035, with the focus of the sector shifting from rapid expansion to higher-quality insurance products.

Along the way, we expect significant changes to the mix of insurance products and features, a greater integration of financial services, a more balanced channel structure, and new sources of value creation.

Product Mix. By 2035, nearly a quarter of China’s population will be above the age of

According to estimates from China’s insurance regulator and our own analysis of industry reports, the current mix of products in China is dominated by life insurance , with 72% of the market, followed by health insurance at 27% and pension insurance at 1%; by 2035, life insurance will comprise 45% to 50% of personal insurance products, with health insurance accounting for more than 35% and pension insurance 15% to 20%.

Product Features. The portfolio of personal insurance policies will transition from being less diversified and short- to medium-term in length to a focus on more comprehensive, long-term policies that balance savings, protection, and health and pension services. As societal wealth increases, the importance of long-term and comprehensive features in personal insurance policies related to health, longevity, and affluence will become more prominent. The terms of savings-type life and annuity products designed to supplement pensions will be extended. Health insurance products for supplementing basic social security will become more diverse.

Financial Integration. The integration of insurance and financial services has been relatively limited in China thus far, but market maturity, strengthened business operations, and low long-term interest rates will result in growing sales of new investment-linked products. In most markets, however, long-term investment value will be capped, to a certain degree, by high volatility in the financial markets. Outside of the US, new products tend to scale rapidly during a stock market boom and shrink quickly when there is a financial crisis; this makes it difficult to maintain scale over the long term. As such, the share of products linked to financial markets in China will likely increase by 2035 but not exceed 10%.

Channel Structure. The diversification of insurance products will lead to more balanced distribution channels, with a change in emphasis from recruiting more insurance agents to winning customers with professional services. Per industry estimates, the current channel structure in China tilts heavily toward agent sales, at 57%, with bancassurance at 32%, direct sales 7%, and brokerage sales around 4%.

In the coming decade, the agent channel will still dominate, but its share in the sales structure will be reduced to nearly 45%. The bancassurance channel will maintain its unique advantage in the savings and annuities segment, with its value being further unlocked through the promotion of pension-related policies. This channel will remain mostly stable, at nearly 35%. The direct sales channel might shrink a little to 5%, while brokerages are expected to expand by more than three times their current size, to 15%.

Value Creation. For insurers, the source of value will shift from being investment-led to having increased sources of profit. As China’s social and economic development enters a new phase and interest rates and investment returns decline, the high-profit model driven by spreads will become unsustainable. Consequently, the personal insurance sector will need to diversify its sources of value.

Tapping into China’s Growth Potential

Our research indicates that once a market reaches a certain level of macroeconomic development and per capita income—about $20,000 to $30,000—personal insurance premiums plateau and per capita spending on premiums (also known as insurance density) stagnates.

China is currently far from that point. By 2020, the per capita GDP of China was close to $12,500; it is currently stable at that level but remains significantly lower than other developed markets. In the same period, personal insurance penetration in China was 3.28%, with a density of $342. The space and opportunity for growth is therefore

Strategic Positioning and Capability Optimization

Insurance firms can position themselves based on the size of their operations. Small and medium-sized personal insurance companies should strive to be experts in specific segments, addressing the unique needs of those customers. Large insurance companies should tap into new development models for promising insurance lines while enhancing their digital and operational capabilities and improving their support service and product offerings.

Reinsurers should innovate with newer products and support small and medium-sized insurers with data analytics and service platform development. Across the board, insurers should establish a smart operations infrastructure with sound data governance and effective models to empower offline services, business development, and operations.

Health Insurance Opportunities

The next phase of growth in commercial health insurance will likely be driven by supplementary payments for out-of-pocket expenses, additional coverage for premium medical services, and compensation for income lost during illness. To this end, insurers need to:

- Tailor products to distinct customer segments. Low-income and elderly consumers would benefit from supplementary insurance products like those offered under Medicare and Medicaid in the US. On the other hand, middle-income consumers might find value in fixed-benefit products such as critical-illness insurance. To cater to those consumers, insurers should develop a comprehensive matrix of special-purpose health insurance products, each covering specific financial expenditures across different customer life stages and risk scenarios. Except in cases where a complex illness is involved, high-income individuals can be offered specialized products delivering premium services, steering these consumers toward private health care providers and reducing the burden on public hospitals.

- Develop proprietary operational and technological systems. Compared to traditional life insurance, health insurance entails more frequent claims and more documents. However, insurers’ existing IT systems and operational processes have been designed for life insurance; they cannot handle the complexities of health insurance. Insurers should therefore prioritize the development of proprietary operational and technological systems tailored for health insurance. This includes not only addressing the more complex claims process but also integrating direct billing services and creating a seamless interface with the social security system.

- Nurture and manage the broader health ecosystem. To optimize customer experiences and manage claim costs efficiently, insurers need to manage the multitude of stakeholders within the health care ecosystem, including social security agencies, health care providers, and pharmacies. Insurers must deepen their relationships with these entities while engaging in initiatives such as the development of the National Reimbursement Drug List, volume-based procurement negotiations, and integrating data with health care providers. These efforts are vital for controlling costs, improving service quality, and delivering superior value to consumers. Additionally, insurers should proactively engage in the coordinated reform of medical care, medical insurance, and pharmaceutical industries.

Improving the Supply of Pension Insurance

Compared to similar retirement-focused insurance markets like those in the US and Germany, the pension insurance market in China is in the nascent stages of development. It also faces the challenge of competing with other short-term financial products distributed via banks. To win in the pension insurance market, insurers must take a more proactive approach and do the following:

- Target middle- to high-income consumer groups. Research on the US market indicates that most retirement insurance policyholders are those with stable careers and considerable assets. Insurers interested in the pension insurance market in China should focus on this demographic—middle- to high-income groups who have the financial stability and surplus funds necessary for long-term investment. They should approach consumers with the intent of raising awareness about the importance of retirement planning given the longer life expectancy and the necessity of early preparation for a financially secure old age.

- Offer product flexibility and comprehensive insurance benefits. Compared to other pension-related financial products, pension insurance offers relatively lower flexibility, which can be a barrier to consumer interest. To mitigate this challenge, insurers should make their products flexible by allowing for customizable payment plans and investment choices. They should also adequately highlight that pension insurance includes protection against longevity risks and higher and more stable expected returns in the long run.

- Enhance long-term investment and value creation. Pension insurance operations face the challenge of negative interest spread over multiple economic cycles. Recognizing pension funds as the crucial source of income for policyholders in their retirement years, insurers need to focus on secure and prudent investment strategies that emphasize long-term value. The link between the pension annuity insurance and capital markets offers opportunities for mutual growth.

- Upgrade account management and core systems. Effective pension fund management requires seamless integration with banking and social security platforms. This entails improvements in account management capabilities and real-time fund tracking for consumers. In addition, with the emergence of more flexible pension insurance products, insurers must address the need for core technological systems which can manage policy modifications and additions.

- Expand distribution channels and enhance efficiency. Banks have now become the designated institutions for opening accounts for all tax-preferential pension-related financial products, including pension insurance. For such products, therefore, insurers must develop the bancassurance channel. This includes proactively establishing close partnerships with banks to acquire customers and implementing precision customer-targeting strategies to unlock effective cross-selling. For non-tax-preferential pension insurance products, insurers should capitalize on the responsiveness of specialized insurance agency and brokerage channels.

Subscribe to our Insurance E-Alert.

Digital Transformation

In early 2022, the China Banking and Insurance Regulatory Commission initiated a significant push toward digitalizing the banking and insurance sector. The policy requires insurers to integrate digital transformation into their core strategic planning, setting a target for substantial advancements by 2025.

Despite sincere efforts, however, the slow yield from digital transformation initiatives, along with their limited and fragmented impact, has somewhat dampened the industry’s enthusiasm to deploy a full-scale and sustainable digital strategy. However, insurers should not only focus on overcoming immediate operational hurdles through digital transformation but also on fulfilling long-term goals, addressing broader societal issues.

To this end, we recommend insurers focus on three core objectives for digital transformation:

- Navigating insurance transformation challenges to unlock high-quality development.

- Embracing a customer-centric mindset.

- Fixing the basics to advance technological, organizational, and cultural transformation.

Increased consumer awareness, demographic shifts, and the need to prepare for a longer, healthier life will spur the expansion of the pension and health insurance markets in China. The journey toward 2035 looks promising; for insurers looking to make inroads into the country or expand their investments, this is the time to plan, innovate, and firm up their China strategy.

This article is based on a report that was written in collaboration with China Re.