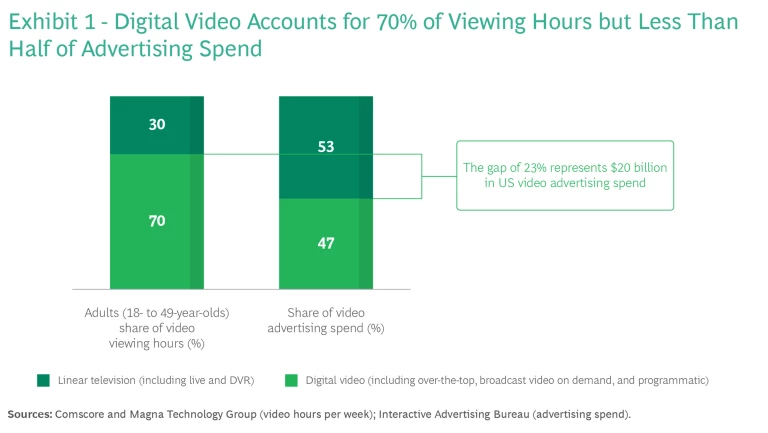

The advertising industry faces a challenging imperative: to adapt swiftly as consumers increasingly embrace diverse viewing experiences across multiple screens. Despite the fact that digital and streaming video account for 70% of viewing hours, less than half of video advertising spend goes to those channels. This discrepancy—caused by a number of industry-wide factors, including lower ad inventory on emerging platforms—represents more than $20 billion in advertising spend that could be better allocated to the platforms where consumers spend their time. (See Exhibit 1.) The longer it persists, the greater the risk that advertisers will miss more opportunities to reach their target consumers and accomplish their commercial objectives.

While this challenge is not new, BCG’s recent research produced two crucial insights that explain why progress has been difficult to achieve. First, there is no standardized way of measuring cross-channel reach for advertisers that want to define a target audience more granularly than by age, gender, or household income. Second, many advertisers apply subjective definitions for “premium” content environments when making channel decisions, which limits the potential to reach the right audience.

To help marketers address these challenges, BCG partnered with Google and Omnicom Media Group (OMG), a leading global agency that is already developing and implementing solutions at the forefront of video planning. Drawing on our interviews and surveys with 190 advertisers and over 90 agency practitioners, we developed a concrete, step-by-step approach to implementing “unified video,” a holistic approach that integrates video planning, buying, and measurement decisions across channels to create connected media experiences for target consumers.

The Challenges of a Fragmented Video Market

Imagine the viewing possibilities for a major sports tournament or an entertainment awards show. Fans can watch on multiple platforms and devices, each with its own distinct capabilities for targeting specific consumer segments. To complicate matters further, these platforms are in constant flux, as consumer preferences shift and platforms offer additional viewing tiers, such as the recent introduction of advertising by Netflix and Prime Video.

This means that what worked in 2023 and what advertisers planned for 2024 may not be a reliable or replicable template for media planning in 2025. Three factors are compounding this complexity:

- A common currency for measuring advertising effectiveness is lacking. Advertisers can no longer depend on single-source metrics like Nielsen’s rating points in the US. Modern marketers target precise audiences, such as consumers in the market for a luxury automobile, and receive detailed measurements within each channel. But due to data-sharing limitations, they must rely on separate sources for each channel. This often results in paradoxical outcomes, with marketing effectiveness for a given channel clear in isolation but ambiguous across channels.

- Different buying windows are available. In many cases, securing content adjacency and discounted rates within broadcast TV requires commitments months in advance, while buys in digital channels tend to take place closer to the time when the ad is actually viewed. This complicates advertisers’ decisions about when, where, and how much to invest. In addition, significant shifts in budget allocations require the approval of multiple stakeholders at a time when faster and nimbler decision making is warranted.

- Fewer proof points exist for newer channels. Advertisers have ample proof of TV’s longstanding effectiveness as an advertising medium, but that is not the case with emerging platforms like TikTok. As a result, advertisers may tend to overestimate television and underestimate newer platforms when making decisions about what media qualifies as “premium.”

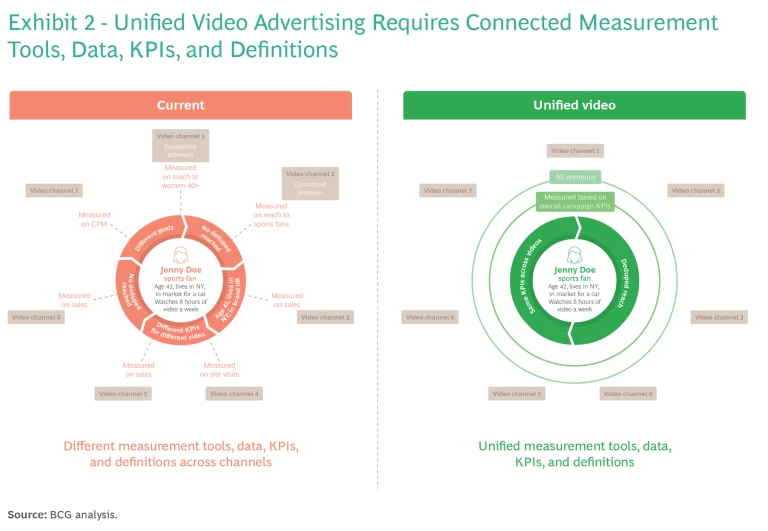

The left side of Exhibit 2 illustrates this current state of complexity, with fragmented measurement tools, data, KPIs, and definitions. The right side shows the emerging frontier of unified video, which already has a strong appeal to advertisers, according to our research.

Defining the Playbook for Unified Video

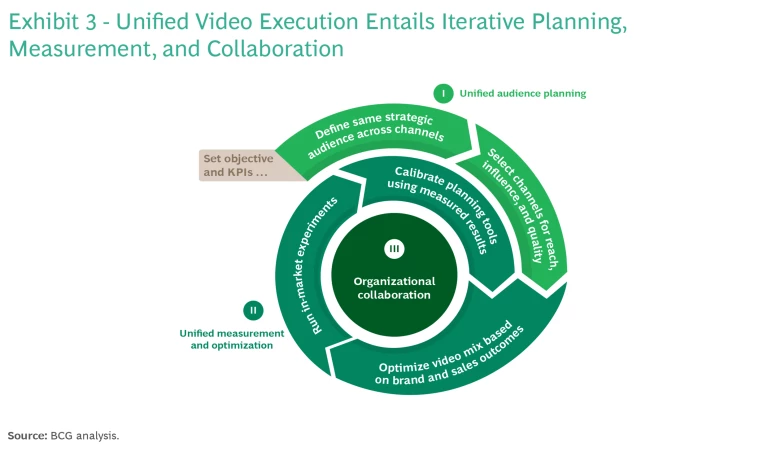

In order to make unified video a reality, advertisers, agencies, and media partners need to agree on what “holistic measurement and buying capabilities” mean and how to deploy them. As shown in Exhibit 3, we have identified three key imperatives:

- Unified Audience Planning. This means defining audiences in the same way across channels and selecting video channels based on the ability to reach and influence their audiences in a quality environment.

- Unified Measurement and Optimization. This involves an iterative cycle of testing video mix against brand and sales outcomes by means of in-market experiments and using the results to calibrate planning tools and set new baselines.

- Organizational Collaboration. This involves redefining ways of working across agency and advertiser teams to balance cross-channel decision making with expertise in each channel.

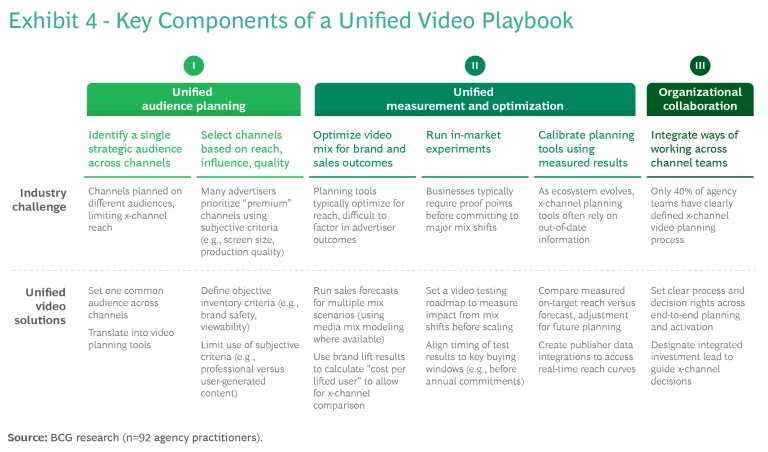

To develop a playbook for acting on these imperatives, we partnered with Google and OMG to select three account teams across two markets to create a unified video planning and buying process. The goal was a process that can be applied to all campaign objectives and scaled for different advertisers and markets. The resulting step-by-step approach comprises the six steps shown in Exhibit 4.

Identify a single strategic audience across channels. Differences in audience definition can make it difficult to establish KPIs measured with a common currency. One channel may target 25- to 54-year-olds, while another focuses on eco-conscious adults in the market for a luxury vehicle. Identifying one strategic audience across all channels helps set priorities and simplify planning.

Select channels based on reach, influence, and quality. While reach-based planning is commonplace, definitions of influence and quality vary. They often include subjective factors like screen size or a preference for professionally produced content. We worked with our agency partners to define inventory guidelines (such as brand safety or viewability) that are objective, quantifiable, and broadly applicable across channels.

Optimize video mix for brand and sales outcomes. Most planning tools are built to optimize for reach, because the industry has historically viewed TV as a driver of reach or awareness. In today’s advertising landscape, advertisers can use video to drive many marketing objectives, and ideally marketers could use the same tools to optimize their video mix for both brand and sales outcomes. For instance, a quick-service restaurant chain might focus on some channels to drive overall brand awareness (by emphasizing broad-reach media) and others to drive immediate sales (by targeting core customers for repeat purchases).

Run in-market experiments. The numerous viable methods for running in-market tests include a design with higher levels of spend in statistically comparable markets. This allows the testing of mix shifts at a small scale in order to understand their impact on brand and sales outcomes. Because one of the main goals of testing is to gain organizational confidence in future mix shifts, it’s important to time such tests ahead of key commitment windows, such as upfronts in the US.

Calibrate planning tools using measured results. OMG agencies we’ve worked with have the ability to ingest reach curves and other data sets from their publishers—such as YouTube or Amazon Prime—to power their planning tools and support reach forecasts. Agencies can further enhance these tools by creating API-based data integrations to access real-time data on potential reach. They can also measure actual on-target reach and create a feedback loop to calibrate and adjust ongoing forecasts.

Integrate ways of working across channel teams. Redefining collaboration between marketers and agency buying teams is crucial for sustaining other changes. Clear process guidelines can be established for setting channel mix, negotiating with partners, and managing activation, measurement, and optimization responsibilities. One challenge, expressed by 39% of executives at the agencies we worked with, is developing expertise across multiple video formats and channels. These agencies have created structures that balance depth of expertise in one channel, so that they understand the best way to activate, with breadth of knowledge across channels, so that they understand and make smart tradeoff decisions across channels.

One carmaker recently tested this playbook, using the hypothesis that a media mix favoring digital channels would yield a large incremental increase in on-target reach. With the help of a unified video plan and the addition of spend on YouTube across a mix of ad lengths, OMG was able to increase reach to the target audience 12% more cost efficiently.

How the Industry Can Move Toward a Unified Video Model

For OMG and Google, the jointly developed playbook marks their first step in accelerating the industry’s shift to the next phase of unified video. But progressing towards a unified video model will be a journey for the advertising industry, not an immediate shift. Inertia supports tried-and-true methods, while imperfect measurement tools and differing timelines for buying channels create substantial barriers to new approaches. Substantive change will require a collective demand from advertisers, agencies, and media partners for new solutions.

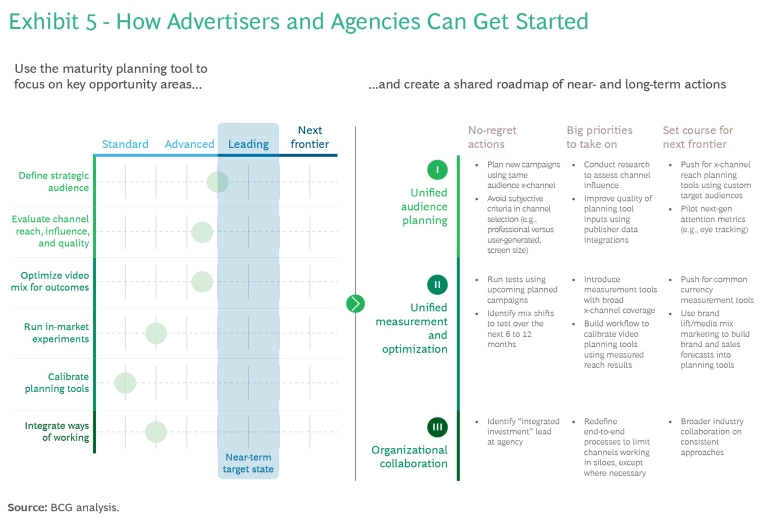

To make the needed next steps more tangible, we have created a maturity planning tool to help marketers map their current practices against the components of a unified video playbook. (See Exhibit 5.) This will allow them to identify the best set of actions to take in evolving their approach.

Marketers can start by working with their agencies to understand the audience definitions, performance metrics, and tools and data that they use across each video channel. They can then align on a shared roadmap for how to unify those approaches. Many of the no-regret moves or big priorities shown in Exhibit 5 can serve as a jumping-off points for that conversation. For more distant opportunities, CMOs should have conversations with top executives at agencies, measurement partners, and other industry bodies to set a common vision for the future.