This article is part of the 2024 European Consumer Sentiment Report series , which examines consumers’ shopping habits and preferences.

For Germany, 2024 has been a year of uncertainty and change. Extremist political parties have gained broader acceptance at the same time the country has recalibrated after a period of sustained inflation across most consumer spending categories. The circumstances could explain why, according to new BCG consumer research, Germans felt better about their individual situations than about national affairs.

Those good feelings stopped at spending. Inflation-fueled price increases and stagnating salaries caused people to spend more for groceries and other basics. Germany consumers compensated by cutting back on luxury goods and other non-essentials-buying fewer goods, trading down to lower-cost brands, and looking for deals.

Our research also found that Germans are embracing sustainability, adopting such behaviors as bringing their own bags to the grocery store, recycling, and repairing clothes. However, their green ways stop at their wallets. Despite regularly considering sustainability when making a purchase, just one in five said they would pay extra for green products.

More than other Europeans, Germans still prefer going into a physical store to make a purchase-especially for groceries-over buying something online.

The trends are a snapshot of how Germans felt about the economy and themselves during the first half of 2024. They are based on a BCG survey of 1,400 people in Germany conducted July 3-11, part of a larger survey of consumers in five major Europe countries we did to capture people’s feelings about current issues and their personal lives and how those sentiments affect shopping habits and preferences.

To strengthen ties with consumers and stay competitive, companies should consider making changes to product assortment, pricing, and promotions. For changes to be successful, they also need a strong data analytics foundation.

Germans Worry More About the Country Than Themselves

The combination of a fluctuating economy and the continued rise of right-wing political parties has made 2024 a year of unpredictability and unease, leading Germans to feel worse about national affairs than their personal circumstances.

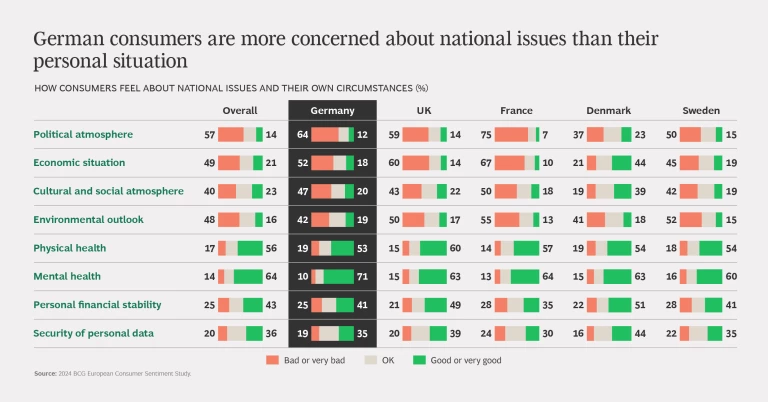

In the first six months of 2024, Germans reported feeling "bad" or "very bad" about the country’s politics (64% v. 57%). Of all the European peoples we surveyed, only the French were more pessimistic than Germans about their country's politics (75% v. 64%). Germans also reported feeling worse about the nation's economy than the cross-country average (52% v. 49%).

Feelings about the environment were more measured, with only 42% of Germans expressing pessimism about the state of the natural world, compared to an overall average of 48%.

German people felt better about their personal situation, including about their physical health, financial stability, and the security of their personal data. They were the most upbeat about their mental health- 71% said they felt “good” or “very good” about their emotional and psychological wellbeing, higher than the 64% average and the largest percentage of the five countries we surveyed.

Attitudes toward national and personal issues vary by age group. Gen Z and Millennials were generally more optimistic than Gen X and Baby Boomers about the country’s situation and their individual circumstances. However, older generations felt the best about their mental health: 82% of people ages 65 and older said they were in a good place mentally, compared to 62% of people ages 18 to 35.

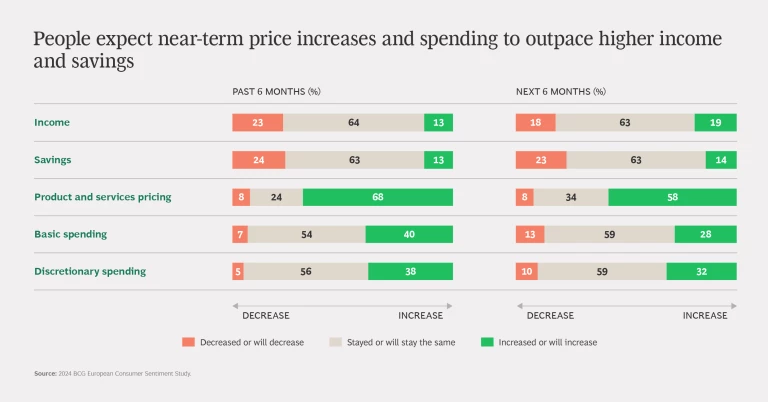

Price increases led people to cut back. One area where Germans weren’t upbeat is prices. German consumers said prices for products and services climbed in the first half of 2024. During the same time, people said their incomes and savings stayed the same or dropped.

More Gen X and Baby Boomers than younger generations reported being affected by price hikes and spent more for basics and discretionary items as a result. Fewer younger people, especially Gen Z, reported price increases or expect to see them in the near future. Fewer Gen Z than other age groups reported spending more during the first half of the year or expected increases to continue in the second half of the year.

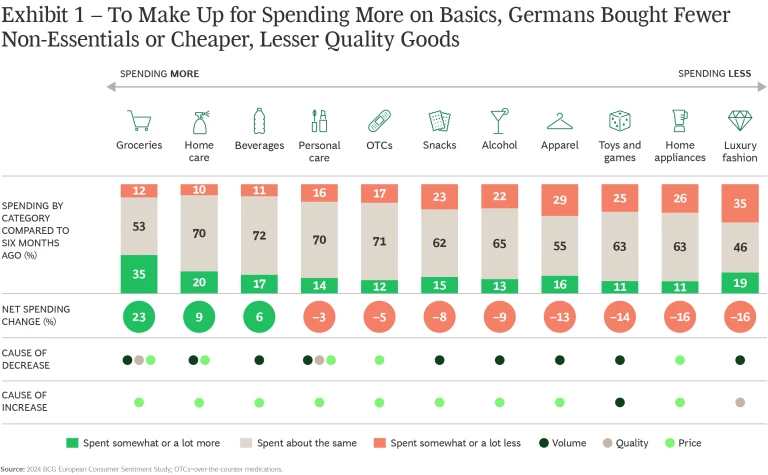

To counteract price increases, people reduced how much they bought, traded down to lower-cost brands, and hunted for promotions or discounts. The only categories where consumers reported not being able to fight price increases were essentials such as groceries, home care, and beverages-all basics for which it’s harder to cut spending. In fact, more than a third of respondents (35%) reported spending more on groceries, three times the number of people who reported spending less during the period. (See Exhibit 1.)

When consumers cut back on non-essentials, the products that saw the steepest cuts were luxury fashion, apparel, toys and games, snacks, alcohol, and home appliances. Luxury fashion was hit the hardest, with 35% of people reporting spending less on those items, leading to a 16% drop in total spending in that category.

People believe current price and spending trends will continue through the end of the year, though to a slightly lesser degree. Only 58% expect future price increases compared to 68% who reported price increases in the first half of the year. Slightly more expect incomes to increase, and fewer people than in the past expect to spend more on basics or non-essentials.

Sustainability Matters, but Other Shopping Factors Win Out

German consumers care about the sustainability and climate change. It’s leading them to adopt a range of sustainable behaviors, including bringing their own bags to the grocery store, recycling packaging, and repairing clothes.

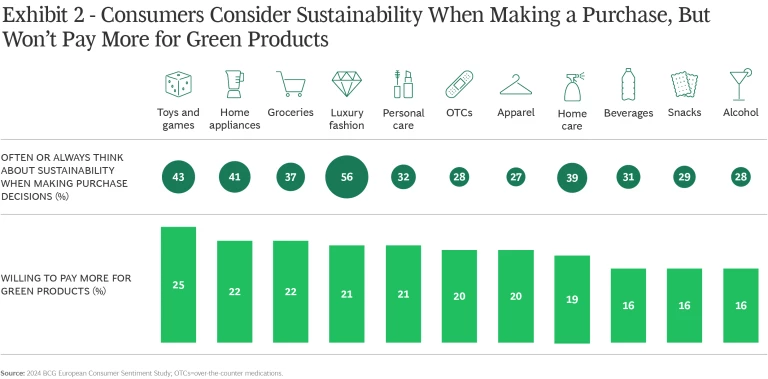

The portion of the population that often or always considers sustainability when buying something ranges from 27% for apparel to 56% for luxury fashion. (See Exhibit 2.)

However, many of these practices are low-level, indirect behaviors rather than directly related to the products. When it comes to making a purchase, a much smaller portion of consumers is willing to pay extra for sustainable products- 16% to 25% depending on the type of product. It’s an indication that for consumers, sustainability alone isn’t enough to justify higher prices.

For Germans consumers, traditional purchase considerations continue to be bigger factors in their decision making, most significantly good value for the price, convenience, and practicality. In fact, sustainability is one of the last characteristics that people think about when they’re buying groceries, luxury fashion, or apparel. Even so, sustainability ranks higher than a handful of other purchase considerations, including whether something is locally made or sourced as well as uniqueness, and recommendations. For items such as personal care items and non-alcoholic and alcoholic beverages, people also rank it higher than premium value.

People Still Prefer to Shop in a Store

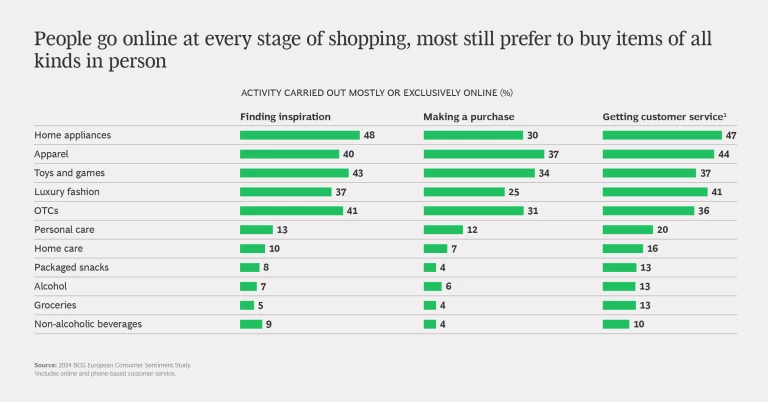

Germans are more married to shopping offline than the average or people in any other country we surveyed. The preference for shopping at a physical store is most apparent for basics and convenience items people buy a lot. Those items include beverages, snacks, alcohol, groceries, and home care items, categories for which 85% to 90% of people said if asked to choose would opt to buy from a physical store. (See Exhibit 3.)

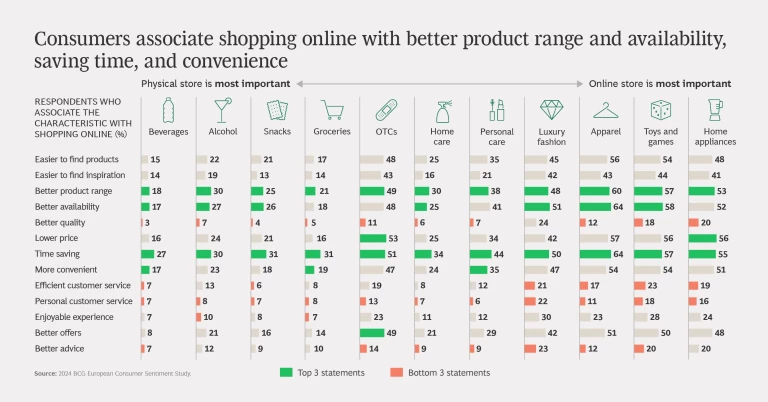

For these product categories, consumers associate physical stores with making it easier to find inspiration and products, getting more personalized customer service, and having a more enjoyable experience than shopping online.

Even so, close to half of German consumers or more report going online for at least some part a purchase. For example, more than 90% of people buying apparel, luxury fashion, toys and games, and home appliances go online at some point, even if it’s just to browse from time to time. In addition, Germans are more likely to complete larger, less frequent purchases online, including for home appliances, toys and games, luxury fashion or apparel. For those products, consumers believe buying online offers better convenience, product range and availability, and saves them time.

Younger shoppers are fonder of buying things online than older generations. Even so, apparel is the only product category for which the portion of Gen Z shoppers who prefer to buy something online outweighs the portion who prefer to buy something in person at a store.

Subscribe to receive the latest insights on Consumer Products Industry.

How Companies Can Address the Trends

To strengthen ties with German consumers and stay competitive, companies should consider acting in three areas-product assortment, pricing, and promotions. We've found that the impact is greater when companies launch changes in all three areas simultaneously. Due to the time and resources needed, however, most companies choose to address one area at a time. In addition, for changes to be successful, companies need a strong data analytics foundation.

Localize product assortment. German consumers are spending less, especially on non-essentials. They have different preferences for where they like to shop, and many still like buying in a physical store. To adapt, companies could customize what they offer in their physical locations to meet local demand and offer a broader, more global range of products on their e-commerce platform, which could appeal to shoppers who go online to browse or be inspired.

A typical example of adjusting range is adding products that appeal to local consumers' preferences or customs. Consumers highly value brands such as local microbreweries, farm products, or coffee roasters because of their uniqueness, making the products ideal candidates to stock in local stores as well as online.

Adopt dynamic pricing. German consumers are feeling squeezed and are becoming more price sensitive. Companies could use data-based dynamic pricing strategies to counter shifting consumer preferences while improving their ability to respond to fluctuating volumes, local market conditions, commodity prices, and competition.

Amazon is renowned for repricing electronics, wine, and other items multiple times a day based on inputs such as competition pricing, inventory levels, consumer demand, even time of day.

A leading European furniture retailer adopted dynamic pricing as part of a strategy to sell lower-cost items in order to respond to inflation and consumers’ desire for more affordable home furnishings. To manufacture lower-priced products, the company intensified its cost focus across the board, including for design, material development, production, and marketing. To make the new items affordable to consumers in its different regions, the company used an advanced pricing engine to adjust prices dynamically across sales channels and regions. The changes enabled the company to increase sales despite continued challenges in the furniture industry.

Make promotions hyper-personalized. In addition to being more price sensitive and reluctant to buy non-essentials, German consumers show less interest in loyalty programs relative to other shopping factors. Companies can counter such sentiments by individualizing loyalty programs and promotions.

Companies with successful loyalty programs use advanced analytics —including AI— to offer a level of personalization to loyalty members that other personalized promotions cannot match. The exclusivity that analytics-based promotions offer keeps consumers engaged and meets their need for good value and quality, making it more likely that they will keep shopping.

Nike's membership program is a prime example of an AI-powered, hyper-personalized loyalty experience. People who download the free Nike membership app receive special access to exclusive products and experiences, free shipping, and more lenient return policies. In exchange, Nike collects consumer data from both the app and offline channels that the company uses to improve the company's highly targeted, relevant promotions. A Nike loyalty program member who typically buys outerwear during the winter may get related promotions before the season starts.

Enhance data collection. To successfully launch initiatives in product assortment, pricing, and promotions, companies must improve their ability to collect rich data on consumer behaviors and preferences across sales channels. Rich data includes consumer demographics, interests, and motivational drivers; what people buy, when, how, where, and why; and how they engage with sales channels, including through promotions or loyalty programs. If they revamp their digital presence and loyalty programs, companies can use the access they have to first-party consumer data to capitalize on customer relationships in ways that in the past were not possible.

Acknowledgements

The authors would like to thank Mary Patrikiou, Max Moehlmeyer, and Martina Scrocco for their helpful comments and suggestions. The authors would also like to thank Megan Moore for conducting the research upon which this report is based.