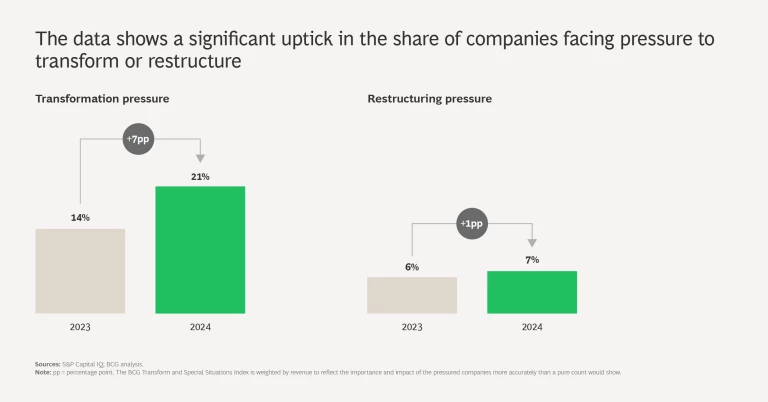

Amid challenging economic conditions and ever-evolving technology, companies in Europe must adapt to stay viable. Roughly one in 5 European companies now faces strong pressure to transform. About one in 15 face even stronger pressure and may consider more severe measures to restructure both their operations and their balance sheet.

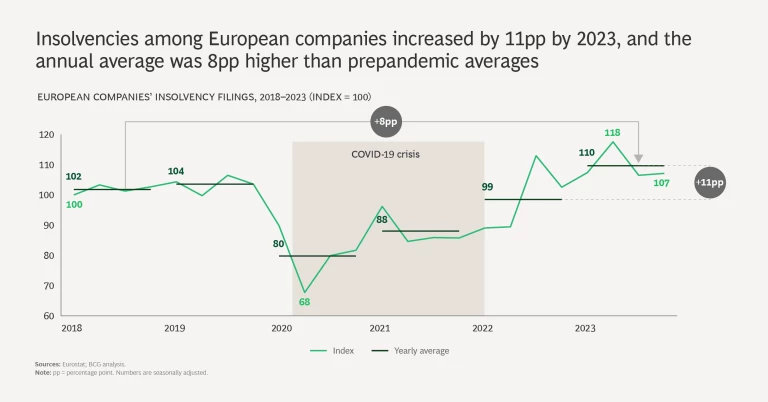

Those are insights gleaned from the BCG Transform and Special Situations (TSS) Index, which tracks the share of companies showing signs of operational challenges and financial instability. This is the second year we’ve analyzed the need for transformation and restructuring among European companies. Since we published our first analysis in mid-2023, the pressure on European companies to act has increased. Costs are rising, driven by inflation, higher interest rates, volatile energy prices, and supply chain disruptions. Low consumer confidence is limiting top-line revenue growth, margins are shrinking, and capital is scarce given greater scrutiny from lenders.

Leadership teams face challenging decisions, especially given the difficulty of implementing changes that stick. To transform successfully, companies need to think about the what and the how of transformation. Most important, they need to be proactive and take steps before their situation worsens.

Key Findings

The key findings of our analysis include the following:

- About one in 5 European companies (21%) currently face strong pressure to transform, an increase of 7 percentage points compared with 2023 results.

- About one in 15 European companies (7%) are in a more challenged position and face strong pressure to restructure, up 1 percentage point over 2023.

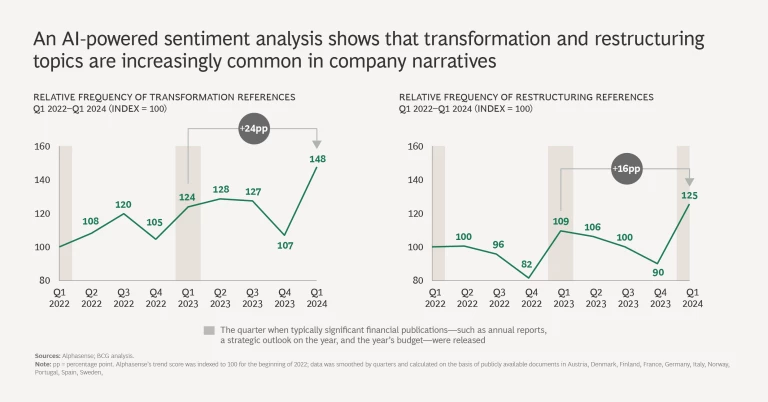

- Our AI-driven sentiment analysis shows that transformation and restructuring topics are becoming more prevalent in company filings and public statements, increasing 24 and 16 percentage points, respectively, over 2023.

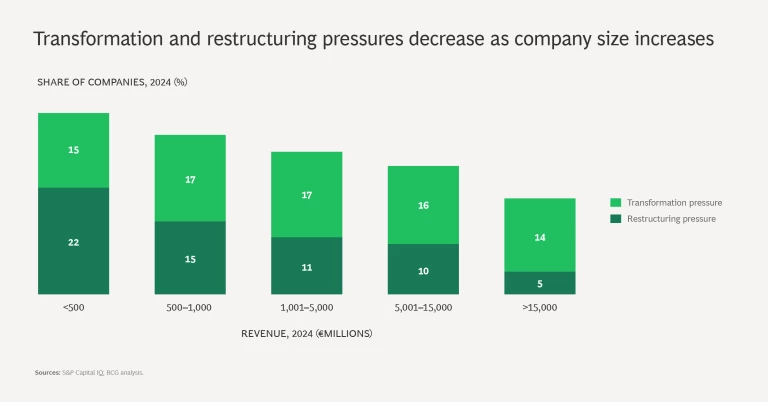

- Smaller companies are also likely to be in trouble. Among those with less than €500 million in annual revenue, roughly one in three companies now face pressure to transform. (Although private companies are not included in our index, their situation is unlikely to be any better; they may have limited access to financial markets or face a high-interest burden if owned by a private equity firm.)

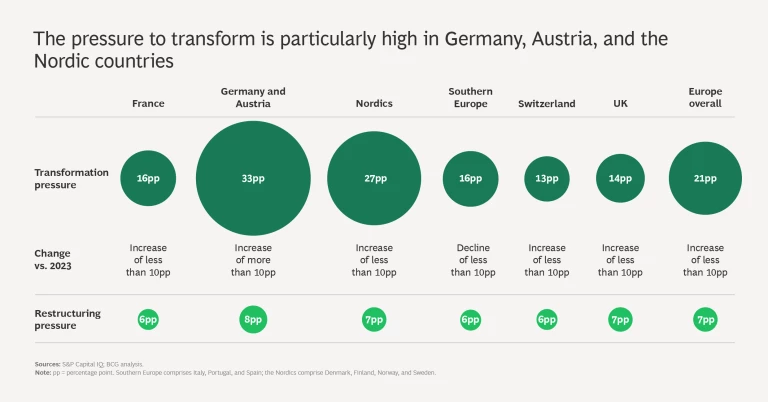

- Companies in Germany, Austria, and the Nordic countries face the most significant transformation pressure right now.

Our Analysis

We identified companies that show alarming performance indicators, such as weak or negative operating results (EBITDA), low or negative cash flow, or negative shareholder returns. We also looked at warning signs regarding financial stability, such as high amounts of debt, low equity ratios, low credit ratings, or frequent CFO or CEO changes. Companies with transformation pressure show warning signals in either performance or financial stability. Companies with restructuring pressure show accumulated warning signals in both.

A Closer Look at the Challenged Sectors

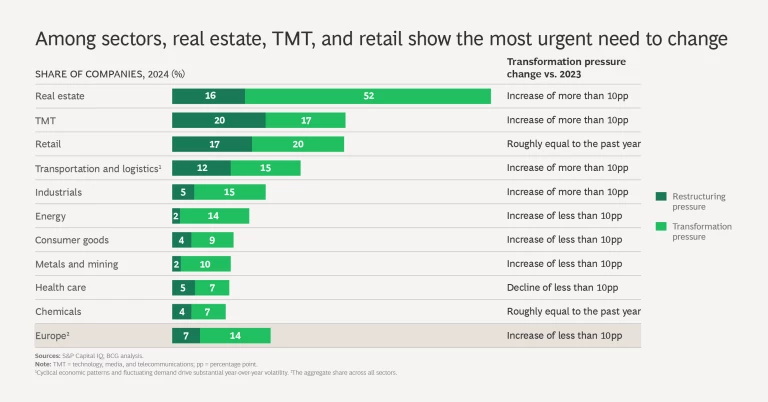

Among sectors, the four facing the greatest transformation pressure are real estate; technology, media, and telecommunications (TMT); retail; and industrials.

- Real Estate. Demand is down for both segments—in residential because of high mortgage rates and commercial because of remote work policies and a shift from physical retail to e-commerce. High interest rates, significant impairment risk, high amounts of debt, and considerable regulatory pressure for sustainable buildings are factors as well.

- TMT. Inflation is raising the cost base (which includes energy and labor costs) for TMT providers , as households and enterprise customers scale back their TMT budgets. Of the TMT executives we spoke with, 69% are worried about an uncertain economic outlook.

- Retail. Consumers are more price sensitive, and retailers are struggling to justify large networks of physical stores amid the continued shift to e-commerce.

- Industrials. European industrials face high energy costs, steep regulatory hurdles regarding sustainability, and internal friction from bureaucracy. As a result, they are struggling to compete, especially with companies in foreign markets, and particularly with those in China.

These sectors cannot wait for macroeconomic tailwinds to improve. Interest rates, inflationary-driven wages and costs, and energy prices are expected to remain high. Moderate GDP growth in Europe is not going to significantly help their situation either. At the same time, foreign competitors will put strong pressure on established market shares. Challenged companies must evolve and transform internally in order to succeed.

Success Factors for Change

Acknowledging the need to transform is only the first step. In addition to the what, a successful transformation requires critical focus on the how. Our experience points to

several factors

that can dramatically shift the odds of success in a transformation or restructuring program.

- Fix things before they break.

- Ensure that leaders buy in.

- Don’t rely solely on cost cuts.

- Think long term.

- Have a formal transformation plan and program.

Our data should serve as a wake-up call for leadership teams in Europe. The current environment is getting tougher, and many companies will need to transform or restructure simply to remain viable. The good news? By taking proactive measures, companies can dramatically change their trajectory. In that way, they still control their destiny.

Explore the BCG Transform and Special Situations Index for Countries and Regions

| BCG TSS Index: Europe | BCG TSS Index: Nordics |

| BCG TSS Index: Southern Europe | BCG TSS Index: Switzerland |

| BCG TSS Index: France | BCG TSS Index: UK |

| BCG TSS Index: Germany & Austria |