US grocery consumers are increasingly focused on low prices while also seeking out quality products, including fresh food offerings, and a favorable shopping experience.

The So What

It’s difficult for grocery retailers to do all three well. To win greater market share, they need to differentiate themselves on at least one of these fronts—and preferably more.

Flight to Value. Post-COVID inflationary effects have stretched the budgets of price-conscious US consumers. The resulting search for savings means that price-competitive retailers such as mass, club, and discount stores are winning share over national grocery chains and smaller regionals. According to Mintel:

- 31% of consumers say that rising prices have made them switch to a lower-cost or discount grocer.

- 46% of consumers are purchasing more store brands than in the past in order to save money.

Fresh Offerings. Many consumers are looking to improve their health through better fresh food offerings, including seafood, prepared foods, and produce. Fresh items have delivered double-digit topline CAGR in the mass, club, and discount channels over the past four years, according to NielsenIQ xAOC. Shoppers have become more comfortable with the quality of purchases made outside of the traditional supermarket channel.

Consolidation. In a bid to retain share, national grocers and other large players are consolidating and expanding. Discount supermarket chain Aldi, for one, has announced plans to open an additional 800 stores by the end of 2028, half through store conversions from its Southeastern Grocers acquisition and half in new locations. As of 2023, the top ten grocers in the US generated 50% of the industry’s $1.8 trillion in sales. This is up from 40% in 2009, according to BCG analysis of public filings and Flywheel data.

Dive Deeper

These trends, uncovered with the help of proprietary BCG research mapping consumer demand , have had a variety of channel impacts.

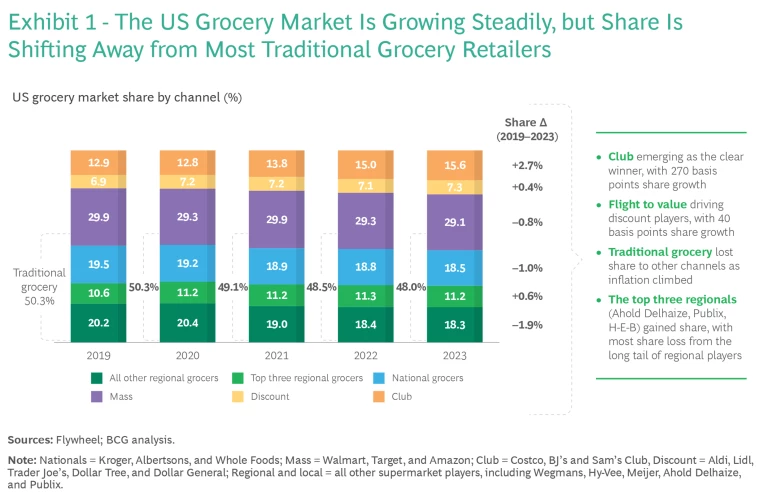

The Club Channel. Some consumers who might have made a faster stop at a traditional grocer are now spending more time in larger store formats such as club to gain cost savings, our research finds. Club stores have also been strengthening their position in fresh categories. As a result, the channel has emerged as a clear share winner over the past five years. (See Exhibit 1.)

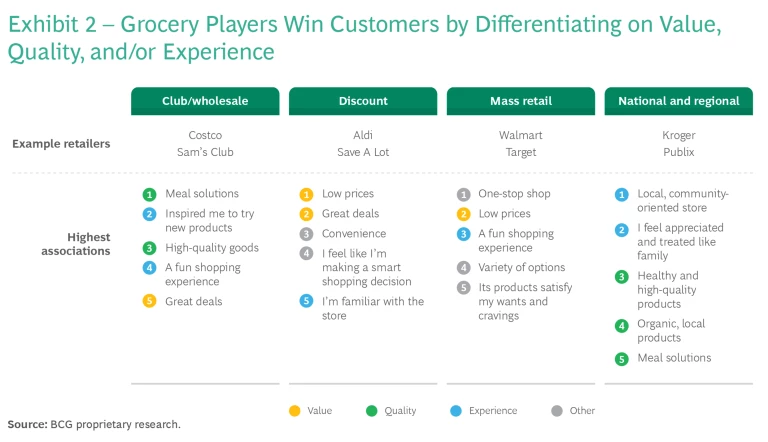

The Discount Channel. The flight to value has proven powerful for discount players, such as Aldi and Save A Lot, which have seen steady gains in share. Discount is the only channel (with the exception of mass retailer Walmart) that consumers associate with “affordability” in our research. It is also winning customers with increasing fresh food selections and by over-indexing on convenience compared to other channels.

The Mass Retail Channel. Mass retailers such as Walmart are well positioned in the grocery industry, having capitalized on the consumer flight to value. Scale and omnichannel sales give Walmart, in particular, an edge.

The National Grocery Channel. While consumers see national grocery store chains as convenient, reliable, and able to deliver the basic necessities, they do not perceive them as strongly differentiated from other retail channels on value or quality. This channel has lost share over the past five years.

The Regional Grocery Channel. Traditional regional grocers struggle to provide strong value, likely due to their lack of scale vis-à-vis mass, discount, and national chains. Nonetheless, many consumers still choose regionals for their community orientation, organic and local offerings, and meal solutions. (See Exhibit 2.) The top-three regional chains, Ahold, Publix, and H-E-B, which have differentiated themselves in these areas, have gained share in recent years.

Now What

In a highly competitive landscape, grocery retailers must explicitly choose what they stand for if they are to stand out. Specifically, we recommend that they define an optimal customer value proposition and take the following actions.

Club stores should concentrate on their strengths, remaining cost-focused while continuing to improve their fresh product offerings. In addition, they can leverage consumer insights to increase their appeal to younger generations of shoppers looking for meal solutions and quality.

Discount players should continue to deliver on price and ease of shopping, while building a product assortment that can win a greater share of the consumer basket .

Mass players should stay laser-focused on pricing and special deals while continuing to advance their omnichannel digital capabilities and “one-stop shop” offering.

National grocery stores, defending their market share against more price-competitive channels, should focus on their ability to deliver convenience. They can do so through their growing store footprints and their resultant ability to scale investments in market-leading digital capabilities, elevating their omnichannel presence.

Regional stores can keep focusing on their strong customer value proposition around healthy, quality products and meal solutions. They should also continue boosting customer loyalty through rewards programs as well as local involvement, such as partnerships with local charities.

The authors would like to thank Peter Jin and Ryan Downey for their contributions to this publication.