The advent of video streaming enabled consumers to break free from the longstanding pay TV model, when subscribers paid a flat fee for 150+ channels. Today, consumers can choose from among subscription video on demand (SVOD) services like Netflix, Amazon Prime, Hulu, Disney+, Max, Paramount+, Peacock, and dozens of smaller services. Recently, Disney, Fox, and Warner Brothers Discovery announced a new sports “skinny bundle.” And a bundle with Peacock, Netflix, and Apple TV+ for Comcast subscribers will add even more choice.

The problem for media companies is that the pay-as-you-go streaming model is far less profitable than the big-package model. A primary reason is high churn. The flat-fee TV bundle had high switching costs for consumers, both because unsubscribing meant losing access to essentially all TV content and they often needed to schedule a service call or return set-top boxes to a local retail store.

Streaming, by contrast, has much lower switching costs. Consumers finish their favorite series, click a few buttons to disconnect, and sign up again the next time there is a buzzy show. According to media industry analysts Antenna, the average churn for “premium” streaming services was 5.5% as of January 2024. That implies an average customer life of just under 20 months. Coupled with high acquisition costs, this makes it extremely difficult for content providers to be profitable.

Instead, for sustainable growth and profitability, streaming companies need to be willing to reimagine their business models—again. In fact, they need to rebundle creatively. In practice this means focusing on two approaches: comprehensive streaming bundling, joining forces with other companies to offer multiple streams of content, and multi-product bundling, which provides a range of services—not just streaming TV—at attractive price points.

Small Steps Aren’t Reducing Churn

Media providers’ attempts to combat churn, such as by investing heavily in content and introducing discounts for yearly subscriptions, have not helped much. As an example, according to Antenna, Peacock’s monthly churn has fluctuated in a narrow band between 5.5% and 8.5% since January 2023, despite the service spending significant money on sports and original content. There is a risk that churn is becoming an ingrained consumer behavior as more people use it to manage their monthly entertainment budgets.

There are several reasons for this high churn rate. For one thing, increased competition has generated so much new and exclusive content that many viewers have become inured to it—if they can even find the content in the proliferation of SVOD options. Also, streaming services are not only competing with each other and linear TV but with other forms of media, such as podcasts, gaming, and short-form video, for the time and attention of consumers.

To overcome these challenges, media companies have experimented widely with bundles in recent years. Warner Brothers Discovery offers Max and Discovery+ together. Disney+ can be bundled with Hulu and ESPN+. Verizon customers can access discounted, ad-supported versions of Max and Netflix. Charter subscribers receive ad-supported Disney+ at no additional cost.

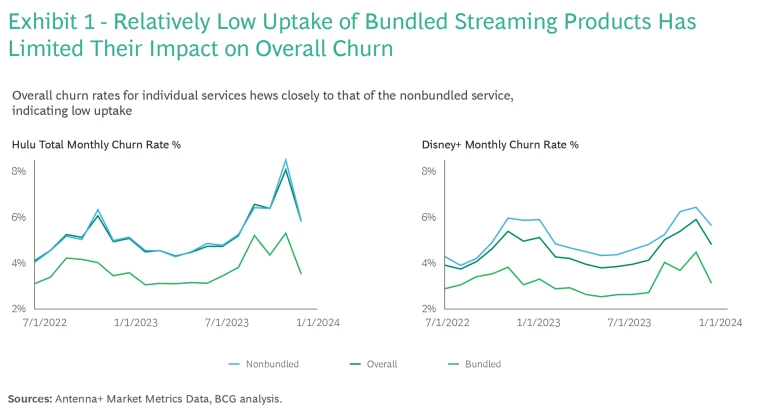

However, consumers have not adopted these mini-bundles in large enough numbers to substantially move the needle on churn. For example, when bundled, Hulu’s churn as of December 2023 was 3.7%. However, just 15% of Hulu’s total subscribers chose a bundled option, and as a result Hulu’s overall churn was 5.4%, almost identical to the churn of its unbundled subscribers. (See Exhibit 1.)

As currently conceived, today’s bundles aren’t working. A successful bundle will yield either better unit economics on existing subscribers (through lower churn or lower customer acquisition costs) or a pathway to acquiring new subscribers. Hitting this mark will require the industry to be bolder.

New Business Models for a New Era of Bundling

To improve the economics of streaming, media companies should consider leaning into two approaches that have largely been overlooked: more comprehensive streaming bundling and multi-product bundling.

Even as media companies continue to experiment with bundles, it is important to acknowledge the practical challenges of forming these tie-ups. For instance, how will the economics be shared? A comprehensive bundle would also raise the critical question: Who is the bundler? A major tech platform, such as Amazon, Apple, or YouTube? The local multichannel video programming distributor, such as Comcast or Charter? Despite these hurdles, we think it is worthwhile to lay out the potential benefits of both comprehensive and multi-product bundles.

Comprehensive Streaming Bundling

Like the legacy cable model, a comprehensive bundle would contain more services than current mini-bundle offerings. It would also provide an integrated interface that houses most or all of customers’ favorite programming, as opposed to the a la carte model where each service has a separate interface and login process. The service would also be discounted relative to the prices of its separate standalone services.

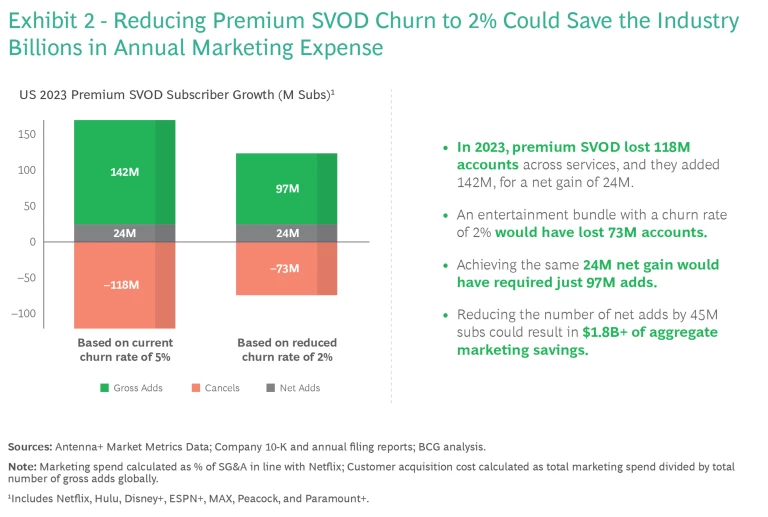

It is possible to quantify the positive impact that this type of bundling could have. In 2023, premium SVOD services collectively gained 24 million net new subscribers. However, because average churn among those services was 6.5% per month, they had to sign up 142 million gross subscribers to achieve that net growth. Many of these users regularly unsubscribe and resubscribe. But what if providers could reduce the churn to, say, 2%—similar to Netflix’s current churn rate? That would reduce the number of gross subscribers needed to realize similar growth by 45 million. Assuming a conservative $40 customer acquisition cost, almost $2 billion in marketing expenses would be eliminated. (See Exhibit 2.)

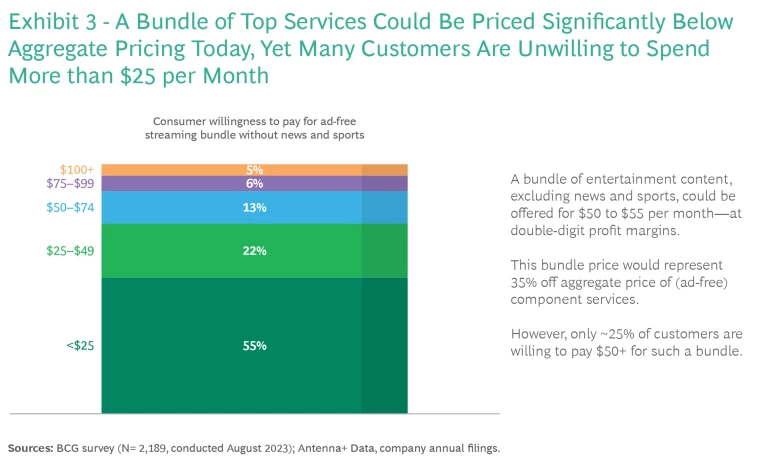

With these reductions, a general entertainment-focused bundle with 80 million subscribers—similar to Netflix’s customer base and 20 million below pay TV’s peak—could be priced at around $50 and enjoy profit margins in the mid-teens, a marked improvement for an industry that in many cases is struggling to make money. These margins could be even better if such a package were paired with a bundle focused exclusively on sports.

The issue, of course, is that consumers with a la carte options have been trained to spend far less than that amount on entertainment. In a recent BCG survey, only 25% of consumers expressed a willingness to pay $50 or more for an entertainment bundle. (See Exhibit 3.) To encourage adoption, even bolder steps may be required, such as a forced bundle—that is, only the bundle is offered and not a less expensive standalone or mini-bundle option, which consumers may find more attractive but will not improve streamer profitability potential. This may sound like an aggressive strategy, but without difficult measures in the current business environment, some streaming services may be forced to shutter stand-alone operations completely anyway.

Multi-Product Bundling

This approach also harkens back to the legacy pay TV model, but in terms of the variety, not volume, of services. In this scenario, media companies would package streaming with other, stickier subscription services. In the early 2000s, cable TV was traditionally bundled with internet and phone service. Today, tech platforms such as Amazon and Apple bundle video service with free shipping, cloud storage, music, and fitness content in multifaceted bundles. Traditional media companies have dipped their toe in this space as well, bundling with grocery and retail subscriptions.

The key to creating such bundles is identifying complementary services—packages that would either motivate customers of one service to sign up for another or encourage customers of both services not to churn. In the ideal situation, the multi-product bundle would contain a portfolio of services that consumers find to be consistently valuable. They may not use an individual service for a while, but will consistently return to the package again and again. For example, Amazon Prime offers a variety of services including video on demand, free shipping, and streaming music, but some people don’t use each service consistently.

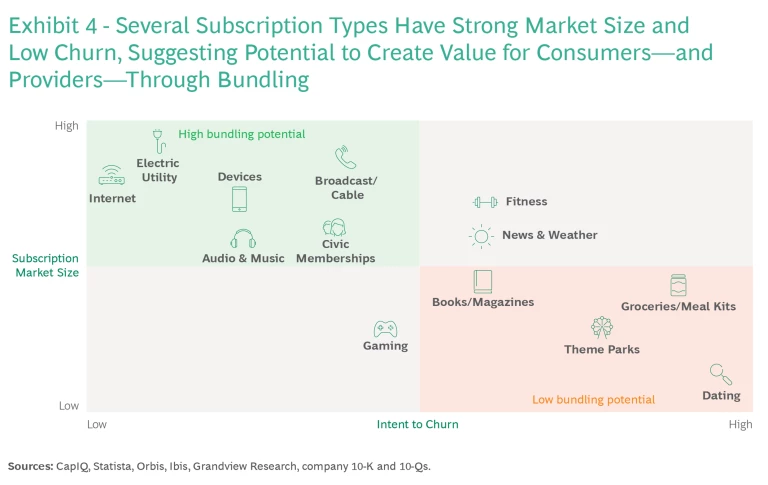

In BCG’s recent consumer survey, we learned that customers are less likely to unsubscribe from subscriptions to audio and music services, devices, or social organizations. Not all of these are ripe for combination with streaming video, of course, but they illustrate media companies’ opportunity to build an ecosystem around video that becomes an essential part of customers’ daily lives. Interestingly, our survey indicates that grocery and meal kits, which have been offered with streaming video in recent years, may not be a viable candidate for multi-product bundles due to their high potential for churn. On the other hand, gaming services as well as utilities may be good options for some streamers. (See Exhibit 4.)

In an environment with so much content and so much choice, streaming platforms have struggled to prevent customers from dropping in to watch their favorite shows and then cancelling. As many companies seek to break even on streaming in 2024 and then achieve profitability, they might find that their current tactics—introducing advertising, raising prices, and cracking down on password sharing—can only take them so far.

More creative solutions are needed. The old pay TV model with scores of channels is gone, but it carries important lessons for today: right-sized, more diverse bundles can create value for consumers and help to mitigate the endless cycle of churn.