When your parents bought a car, TV ads showcased new models, billboards promoted local dealers, Consumer Reports guided comparisons, and dealers offered test drives and pricing options.

Today’s buying experience is far different—and far more varied. Some buyers discover vehicles via social media influencers. Others explore virtual show rooms and encounter targeted ads while streaming Hulu. Some may never even set foot in a dealership. But the vestiges of the Mad Men era, especially long lead times and one-size-fits-all campaigns, remain embedded in automotive marketing.

The shift in how consumers buy vehicles, the need to market electric vehicles (EVs) differently from traditional vehicles, and an explosion in the number of marketing channels call for an approach to marketing that is surgically precise, data driven, and agile. This new approach can unlock tremendous value and a 20% to 40% improvement in a marketing return on investment (ROI).

The Urgency to Act

BCG recently surveyed senior automotive marketers. More than half acknowledge that their marketing capabilities are not designed for today’s fragmented landscape of traditional and social media and varied buying experiences.

These shortcomings are especially acute as automakers roll out EVs. Traditional mass marketing strategies are ill suited to reach potential EV buyers with audience-specific messages that address concerns such as vehicle range and charging station availability.

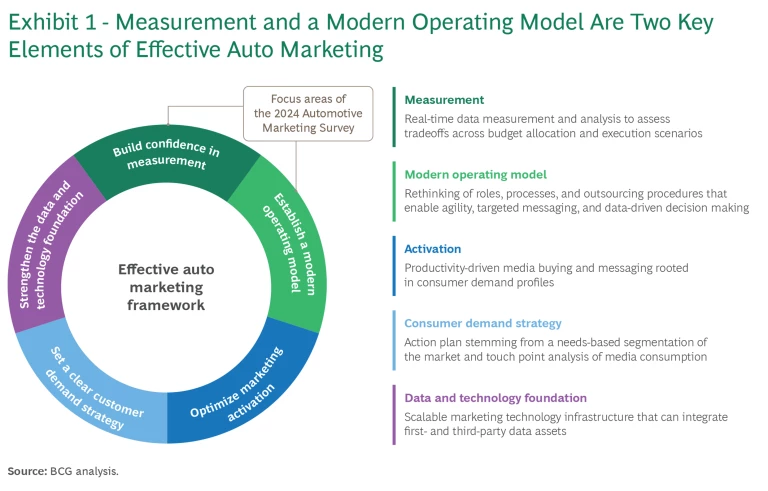

To address the challenges, it is important to tackle all key elements of effective automotive marketing. (See Exhibit 1.) Improving measurement capabilities and building a modern operating model are especially challenging and critical.

Mastering Measurement in a Fragmented Landscape

The foundation of modern marketing is reliable and comprehensive measurement. It enables marketers to make sense of real-time signals and to make tradeoffs across a seemingly infinite set of budget allocation and execution scenarios. But even with the emergence of digital platforms, many automakers still struggle to measure their incremental marketing ROI.

According to our research, more than one-third of marketers feel uncertain about which metrics matter most, and only 30% believe that they have adequate analytics resources to support effective decision making. Being unprepared is costly, as automakers miss opportunities to efficiently allocate their budgets and deliver the messages most relevant for different consumer segments.

To close these gaps, automakers must build an integrated measurement framework. This begins with identifying KPIs tailored to each stage of the consumer journey.

- At the awareness stage, automakers need metrics that indicate brand strength and mind share for specific consumer needs, providing insight into consumers’ perceptions of makes and models. Metrics covering paid advertising, sponsorships, and consumer impressions are often strong indicators of brand strength and mind share. After all, the car is the billboard.

- In the consideration phase, when consumers are beginning to shop for a vehicle, marketers need engagement metrics—such as the number of website interactions, leads generated, and scheduled test drives—to highlight whether the marketing efforts are leading to potential conversion.

- During the conversion stage, the ultimate metric is sales. However, the total number of sales doesn’t capture the effectiveness of automakers’ individual marketing efforts. Marketers need ways to measure each campaign’s effect on incremental sales to justify their budgets. This is a huge gap for many automakers; our survey shows that only 30% of automotive marketers believe they can measure the incremental impact of marketing activities.

Defining the right metrics is just the first step. Automakers also need to acquire a full arsenal of measurement tools to make sense of diverse data sources and support investments on the basis of performance and business strategy; there is no single tool that can measure marketing efforts for the entire funnel.

For example, metrics such as BCG’s First-Fast Response can discern brand strength using advanced survey methodologies. Meanwhile, media mix modeling (MMM) can reveal the relative historical contributions of different channels, which is extremely helpful for channel allocation. However, because it is backward looking, MMM is typically unable to show the contributions of individual creative or ad formats. MMM needs to be augmented by approaches such as in-market experimentation. By analyzing the resulting data, marketers can more precisely show the impact of an ad, for example, on incremental sales.

Building a Modern Operating Model

Measurement insights are valuable only if automakers can act on them. Converting data into action requires an operating model built for speed, collaboration, and agility. For many automakers, this means rethinking where critical functions are housed, how marketing teams are structured, and how they work with dealers.

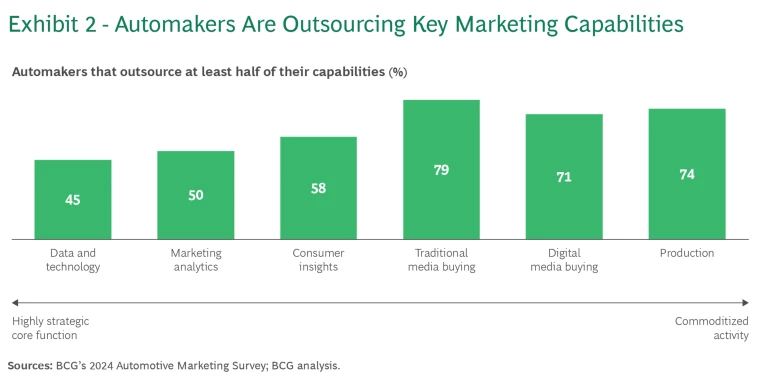

Invest in specialized in-house talent. Automakers have historically outsourced large parts of the marketing value chain to partners. Our survey shows that they continue to heavily outsource even strategic functions, such as data and technology, marketing analytics, and consumer insights. (See Exhibit 2.)

To foster quick decision making and facilitate closer coordination across brand, data, and creative functions, some automakers are bringing select activities in-house, creating a marketing approach that is both flexible and consistent with the brand’s core values.

The approach enables automakers to respond swiftly to consumers’ needs, adjust their strategy on the basis of real-time insights, and assess and adjust campaigns in light of consumer engagement, their ROI, and evolving trends. To work, this approach also requires a workforce skilled in data analytics, marketing strategy, and creative production.

Foster cross-functional teams. Breaking down silos is critical to the operational agility needed for modern marketing. Cross-functional teams that bring together brand, analytics, creative, and media talent can streamline campaign execution and foster innovation. By establishing centers of excellence that house these teams, automakers can leverage cross-functional expertise to design campaigns in both digital and physical channels. These teams can agree on shared goals, hold themselves accountable toward reaching them, and act on real-time data to optimize campaigns.

Our survey shows that two-thirds of automakers lack centers of excellence or other cross-functional groups. However, our survey also finds that automakers with cross-functional teams are better equipped to respond to market shifts.

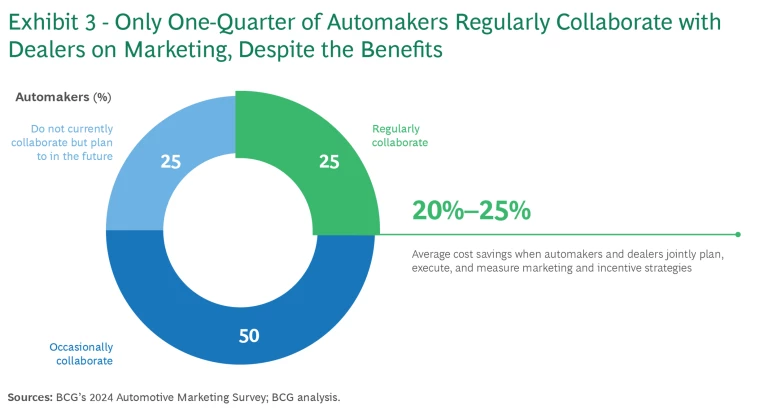

Redefine dealer collaboration. Dealers remain a crucial touch point in the car-buying journey, yet our research shows that only one-quarter of automakers regularly coordinate marketing efforts with their dealer networks. This misalignment generates duplicative spending and inconsistent messaging. It also often leads to automakers and dealers bidding against each other for the same media, driving up costs on both sides.

By collaborating more often and more effectively—for example, by aligning digital and local ad buying or by aligning segmented keyword lists for paid search—automakers and dealers can deliver a cohesive brand experience while avoiding these inefficiencies. Data clean rooms provide a secure way to share consumer insights without actually exchanging data directly, enabling both parties to create unified, targeted campaigns that resonate across markets. (See Exhibit 3.)

Find a role for AI. Automakers are beginning to follow the lead of cutting-edge marketing organizations and exploring how to use AI.

Generative AI can create content for marketing and advertising campaigns, improving speed, efficiency, and personalization. It can produce text, visuals, and videos tailored to specific audience segments and local markets in minutes rather than weeks or months. AI-powered dubbing tools allow companies to translate videos into multiple languages, expanding the reach at low cost.

AI is also transforming how automakers leverage first- and third-party data to make more informed budget allocation decisions. AI enables marketers to predict consumer behavior more accurately and refine audience targeting. Marketers can optimize their investment across different marketing channels and commercial activities, including promotions, rebates, and incentives. By embracing these innovations, automakers can enhance their ability to truly optimize for the bottom line.

These technologies, however, are not plug and play. They need to be thoughtfully introduced when building an operating model and processes that ensure quality and brand protection. Humans need to remain in the loop.

The Road Ahead for Automakers

Leading automakers are already taking steps to adapt to the new marketing reality, learning from other industries, including consumer packaged goods, tech, and retail. Automakers that embrace a data-driven, agile approach to marketing will be well positioned to pull ahead of the pack.

The road ahead demands investment and commitment, but the rewards—greater efficiency and stronger brand loyalty—are well worth the effort.

The authors thank the team at IncQuery for its support in conducting the survey.