Canada is changing—and fast. By 2030, the Canadian consumer will look dramatically different than they do today. Older, more diverse, but also more skeptical and discerning. BCG has surveyed Canadian consumer sentiment since 2020, and this year has shown a clear shift toward negativity.

Yet, Canada’s evolving consumer base represents great potential. Those businesses willing to move now—to rebuild trust, innovate and meet the needs of tomorrow’s consumers—will not only weather these shifts but thrive as market leaders. This article will look at the full Canadian consumer landscape before we deep dive into two critical segments in future articles of this series.

The New Face of Canada

Canada’s demographic evolution is reshaping the consumer landscape. By 2030, one-third of Canadians will be over 55 and one-third will be foreign-born. While already well covered, its sheer magnitude is important context for understanding the Canadian consumer.

Canada’s birthrate, already below replacement levels in 1990 at 1.7, has dropped to just 1.3 today—among the lowest in the developed world. In addition, Canadians are living longer than ever, with life expectancy rising from 77 in 1990 to 83 today. As a result, the over-55 population is not only growing but staying active longer, giving this group increasing economic influence.

As natural population growth slows, immigration becomes the primary driver of population increases. And despite the decline in birthrate, Canada’s population is surging due to high immigration. Between 2015 and 2030, Canada’s total population will have grown by 20% vs. <10% in the US and the average OECD country.

These shifts—aging and diversifying—are rapidly changing how Canadian’s consume. They also exist within a broader transformation in consumer sentiment.

Shifting Sentiment

Economic pressures and rising costs have created a perfect storm for Canadian consumers. Stagnant growth, inflation, and high interest rates are not only reshaping spending habits but also increasing skepticism toward businesses.

- Economic pressures are mounting: Canadian consumers are feeling squeezed by economic challenges. GDP per capita has flatlined since 2015, compared to 14% growth in the U.S. Meanwhile, there has been 17% cumulative inflation since 2021—the most in a generation. Add to this the world’s third-highest household debt-to-GDP ratio and higher interest rates, and the financial strain is clear.

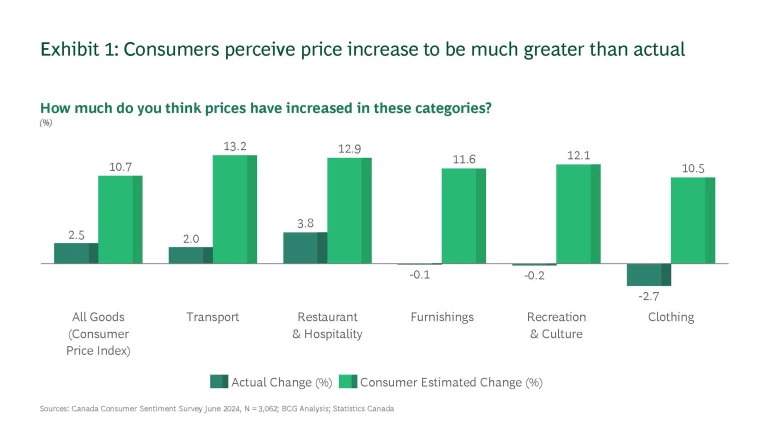

- Canadians are cutting back on spending: While inflation has fallen close to its 2% target, consumers remain psychologically in a world of rising prices. The average consumer still estimates that prices have risen by 10% in the past year. (See Exhibit 1.) As a result, 37% of Canadians plan to reduce consumption, especially in discretionary categories like fashion, dining, and travel. And many are trading down to cheaper products and stores.

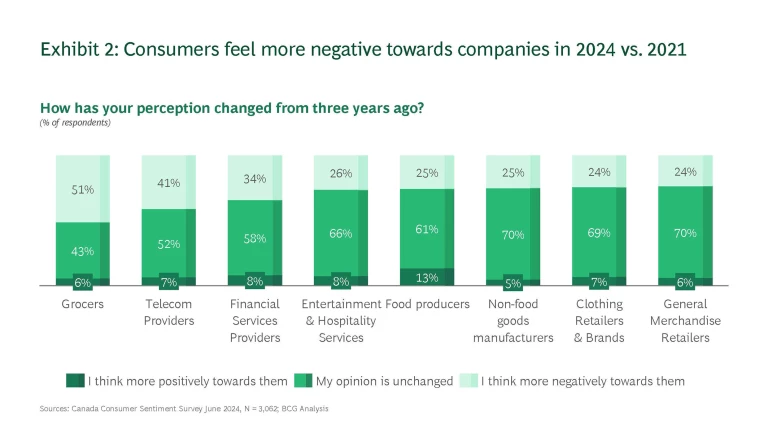

- “Consumer Rage” is growing: More than half (51%) of Canadians feel more negatively about grocers than three years ago. Similar trends exist for telecom providers (41%), financial services providers (34%), and other businesses. (See Exhibit 2.) Rising prices are the overwhelming cause of this anger but about 30% of consumers also believe that the quality of their goods has declined.

This souring sentiment is strongest in two segments: Seniors who often do not have wages to offset the rising cost of living; and middle-income earners who make between $75,000 and $200,000 annually who have been hit hard by declining housing affordability and high interest rates.

With Change Comes Opportunity

Trust is emerging as the ultimate currency in Canada’s shifting consumer landscape. For businesses, demonstrating reliability and value to stand out as a trusted name is one of the most important competitive advantages that can be built.

Trust doesn’t come easy. Building it will require a deep understanding of the consumer - who they are, what they want, and how they feel. Over the coming weeks, BCG will explore the two segments in more depth that have experienced the greatest souring in sentiment - the Aging and the Insecure High Earners.