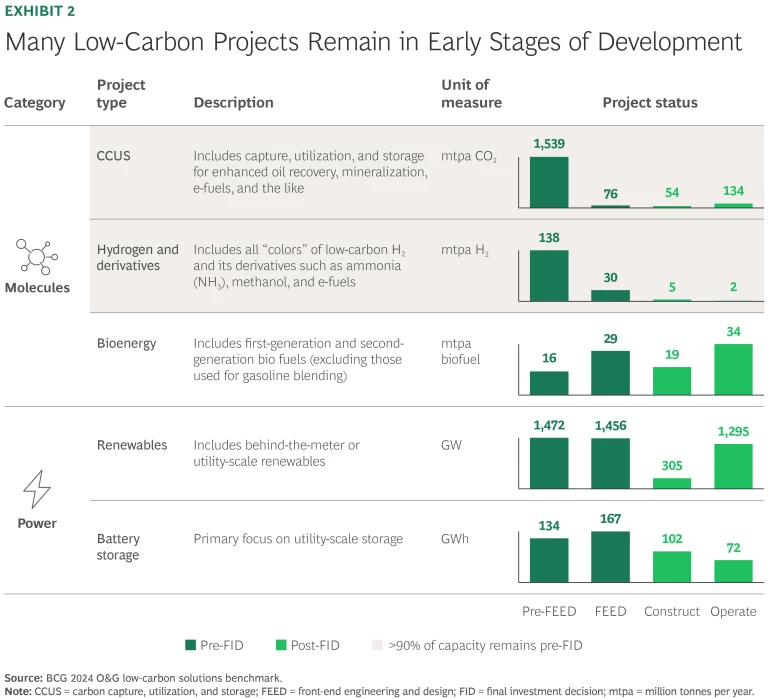

Oil and gas companies have a major role to play in the energy transition, particularly in low-carbon solution (LCS) development. But those efforts face serious obstacles today, including regulatory uncertainty, cost challenges, and uncertainty about project returns. Such challenges are a key reason that more than 90% of LCS project capacity in areas such as carbon capture, utilization, and storage (CCUS) and hydrogen and derivatives have not moved into full development.

Still, the opportunity to develop LCS businesses at scale is undeniable. LCS offerings are poised to reshape global energy markets and provide critical pathways for other industries seeking to meet net zero targets. Success in this space represents not just a chance to capture new revenue streams, but also an opportunity for oil and gas players to redefine their long-term role in the energy transition.

To understand how companies can seize this opportunity, we conducted a benchmarking survey of 28 oil and gas companies worldwide. Our findings indicate that the winners in the LCS market will be those that adopt the right operating model, focus on areas where they have a differentiated competitive edge and supportive regulatory environment, and foster collaboration across the broader LCS ecosystem. By making such bold but strategic moves, oil and gas companies can position themselves to unlock long-term growth.

Subscribe to our Energy E-Alert.

The Low-Carbon Opportunity—and Challenges

BCG’s third annual oil and gas benchmarking study comes at a pivotal moment for the industry. Most notably, the new US administration has expressed strong support for core oil and gas businesses, along with a focus on energy independence and lighter regulation. These policy shifts will have an impact on strategy in the near term, but decarbonization and the development of low-carbon businesses will remain major imperatives for the US energy industry in its planning for long-term success and global competitiveness.

Our benchmarking study covers 28 global energy companies and themes in four primary areas:

- Carbon capture technologies, including CCUS and negative emission technologies

- Low-carbon fuels and feedstocks such as hydrogen and derivatives and bioenergy

- Power, including utility-scale and behind-the meter renewables, storage, geothermal energy, and advanced nuclear

- EV-related offerings, such as products in green mobility (primarily EV charging) and lithium

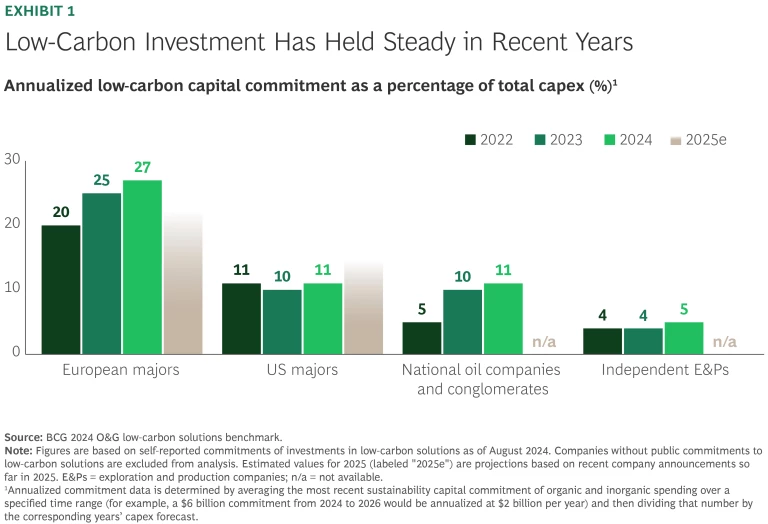

Investment in low-carbon solutions continues. National oil companies and national oil conglomerates have increased their low-carbon investment share as a percentage of total capex over the past three years, while increases have been more muted among European and US majors. In 2024, increased investment in these areas was relatively modest across all

Since 2022, major oil and gas companies in the EU and US have collectively invested $20 billion to $25 billion per year in LCS development—capital deployed both internally and via a portfolio of external vehicles such as M&A, ventures, and partnerships. Investments increased in the value chains for carbon capture and for low-carbon fuels and feedstock, with total LCS investments in Europe alone hitting $16.8 billion in 2023.

In 2024, a number of low-carbon businesses reached key milestones. For example, two new partners joined ExxonMobil’s planned Baytown Hydrogen project: diversified energy player ADNOC brings capital via its purchase of a 35% equity stake in the facility while Mitsubishi signed an agreement to advance discussions for the potential offtake of low-carbon ammonia and equity participation in the

Petronas, meanwhile, acquired land in Malaysia for its southern carbon capture and storage (CCS) hub. The company has teamed up with eight Japanese companies to develop a CCS value chain that will capture CO2 from steel and power plants in Japan, liquefy it, and transport it for storage in

And Repsol increased its number of service stations supplying 100% renewable fuel from 60 at the beginning of 2024 to 600 by the end of the year. Renewable fuels are a central pillar of Repsol's strategy to reduce transportation emissions and become a net zero emissions company by

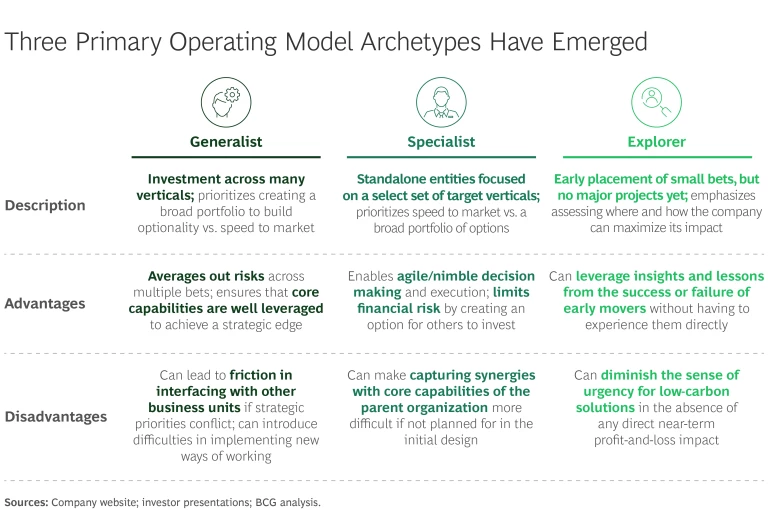

As companies push ahead to build LCS businesses, our benchmarking survey found that three primary operating models are taking root. (See “Three LCS Operating Models .”)

Three LCS Operating Models

- Generalist. This operating model is most common among oil majors in the EU and US that are active in multiple verticals (such as CCUS and bioenergy), focus on scale, and maintain strong balance sheets and development capabilities. Companies in this category typically generate cash flow from one or two of those verticals, and often the most senior leaders in the organization lead the LCS business.

- Specialist. Companies with this operating model focus on one or two verticals that offer the closest strategic fit, sometimes in partnership with others. They often create self-sufficient standalone LCS units or carve-outs.

- Explorer. This operating model appeals to a relatively large number of players—including national oil companies, conglomerates, and independents—that are in an early phase of their LCS journey. Companies in this category are still assessing where to play and how.

Each archetype comes with its own pros and cons. For example, standalone units can be a great model for companies that want to attract external finance and streamline decision making. Such an approach, however, can create challenges when it comes to realizing and equitably sharing synergies with the parent company (See the exhibit.)

Still, the outlook for investment in 2025 and beyond is mixed. Some companies are at an inflection point—including in Europe, where LCS investment this year is expected to be slightly lower. Meanwhile, US major ExxonMobil increased its 2025 commitment and now plans to spend up to $30 billion on low-emissions opportunities through the end of the decade.

Headwinds build. Many LCS projects, including more than 90% of CCUS and hydrogen and derivatives projects, have not yet completed the pre-final investment decision (pre-FID) phase. (See Exhibit 2.)

Large, complex LCS projects require strong regulatory support, stable financial returns, and broad stakeholder support. But headwinds in each area are holding projects back and triggering shifts in investment. Three challenges in this area are especially relevant:

- Regulatory Uncertainty. Over the past decade, regulatory support and government commitments to decarbonization have increased. Now, however, uncertainty about tax and regulatory support is growing, prompting companies to reevaluate their capital allocation decisions.

- Returns Below Core Business. The LCS business is still in its early days, with 62% of respondents in our benchmarking survey reporting that LCS was contributing only 1% to 5% of net company earnings. Despite the nascence of many efforts, companies are beginning to articulate differentiated returns for various low-carbon sectors: less than 10% for power and renewables, and 10% to 15% for hydrogen and low-carbon fuels. Such returns are often below those of many traditional oil and gas projects today, with 87% of companies in our benchmarking survey reporting that LCS profitability was lower or about the same as core business profitability. Not surprisingly, they cite high costs as a key factor limiting returns. But another factor is customer reluctance to pay a green premium in the absence of regulatory support or compelling benefits in comparison to established solutions. It follows that financials are not the primary driving force behind many investments today: instead, more than 70% of respondents in our survey cited corporate social responsibility and investor pressure as reasons for investing in LCS, and 60% cited environmental impact. Only 34% pointed to financials.

- Need to Build Stakeholder Support. Large and complex LCS projects can run into public opposition. For example, UK government investments in CCUS have come under fire from advocacy groups asserting that the government has spent or committed £500 million in funds to date on LCS projects that have not made any major progress. In the US, meanwhile, public opposition to low-carbon energy projects has included recent pushback from environmental groups against new hydrogen hubs.

The low-carbon imperative remains in force. Despite these complications, our research and work with clients across the industry make clear that oil and gas companies will continue to pursue smart, strategic investments in LCS for a host of reasons.

First, their core business is subject to pressure, with higher marginal extraction costs outside the most cost-advantaged fields. At the same time, the social license to operate in the traditional business is likely to face a higher bar in many jurisdictions—as permitting processes grow more arduous, water management requirements become stricter, and the need to deploy methane compliance technologies increases. In an environment subject to these dynamics, low-carbon investments provide an avenue for companies to reduce emissions within the core business and capture share in emerging green markets.

Second, even if LCS initiatives continue to generate lower returns than traditional oil and gas projects, they can provide a stable cash flow, particularly when supported by favorable regulatory environments. For example, investments in relatively mature low-carbon areas such as renewable energy carry less volatility and a lower weighted-average cost of capital. These projects can diversify portfolios and provide stability in a dynamic market.

Third, LCS projects offer critical benefits that extend beyond the immediate direct impact they have on a company’s income statement. For example, companies with a growing LCS business are likely to be more appealing to younger workers, increasing talent attraction and retention.

How to Win in LCS

For companies moving to seize the LCS opportunity, we have identified a series of best practices that can position them to win:

- Think strategically. Companies must think through how LCS integrates into their long-term strategy. For some companies, the LCS business may provide a hedge against future cyclical declines in the core business. For others, it may represent a significant new growth opportunity. This strategic lens will also determine whether the company should adopt a generalist, specialist, or explorer operating model.

- Develop a signpost-based action plan. Companies should identify signposts that mark shifts or turning points in the market—and be ready to act when they reach one. Signposts may take a form such as a decline in costs to a targeted level or the introduction of incentives that make a project economically appealing.

- Tap core assets and differentiated capabilities. Companies can build from their base to maximize value. For example, Essar Oil UK Limited launched a joint venture to produce low-carbon hydrogen and green fuels at an existing manufacturing complex and is establishing a biofuels storage facility at its Stanlow Terminals

infrastructure.5 5 Source: https://www.essar.com/inthenews/essar-oil-uk-to-build-360-million-carbon-capture-facility-to-deliver-on-its-ambition-to-be-a-leading-low-carbon-refinery/ Veri Energy, meanwhile, is planning to repurpose existing infrastructure to develop CCUS facilities that can receive and securely store up to 10 million tonnes of CO2 annually from isolated emitters in the UK, Europe, andbeyond.6 6 Source: https://verienergy.com/blogs/news/veri-energy-ocean-power-and-amplus-energy-services-enter-memorandum-of-understanding-for-groundbreaking-offshore-electrification-project#:~:text=Veri%20Energy%20holds%20four%20carbon,contributing%20to%20global%20climate%20goals Companies should also explore how vertical integration can accelerate their efforts. A company with natural gas assets that deliver near-zero methane emissions, for example, can leverage the natural gas to produce blue ammonia, improving the business case for the new venture. - Use decarbonization efforts to fuel LCS progress. To stabilize returns, many LCS projects seek an anchor offtaker that can ensure reliable demand for their product and thus stabilize cash flow over a long-term contract. In many cases, companies can serve as that anchor offtaker, simultaneously advancing both LCS and decarbonization efforts.

- Focus on financing. Companies can adopt new commercial and financing models. For example, some companies have adopted asset rotation—a process in which a company sells more advanced or mature assets in order to raise cash for investment in newer projects. In addition, smart use of alternative financing can help bolster equity returns.

- Embrace multistakeholder collaboration. Complex low-carbon projects often demand commitment from multiple stakeholders, including lenders and investors, regulators, technology providers, logistics players, and offtakers. The most successful oil and gas players understand the role they must play and their right to win within a broader ecosystem. This includes gaining clear insight into customer needs and developing offerings, often in partnership with customers, that address those requirements.

The rise of the LNG market reflects the embrace of some of these best practices and can offer insights into the path ahead, particularly for sectors such as hydrogen and bioenergy. (See “Lessons from LNG.”)

Lessons from LNG

Ultimately, LNG grew from a niche market to a mainstay of today’s energy mix, thanks to several strategic moves that companies in the LCS market can embrace. First, LNG players signed early deals with anchor offtakers. LCS players can similarly seek deals with customers whose decarbonization needs are most pressing. Second, LNG companies unlocked innovative forms of financing and contracting, including tolling agreements that involve having a company pay a fee to an LNG plant operator to process natural gas into LNG without taking ownership of the gas or the LNG. LCS players can leverage similar financial tools today. Third, LNG company investments in R&D led to the development of modular units and larger shipping vessels, which ultimately helped the sector lower costs. R&D investments in the LCS sector can likewise yield significant cost improvement and strengthen returns in the long term.

Despite encountering both new and persistent challenges, the oil and gas sector will benefit from a sustained commitment to low-carbon investments. Oil and gas companies are in a strong position to lead in this area, given their existing assets and capabilities.

We are seeing many players make the necessary moves. Collaboration through high-level alliances, for example, is picking up steam, including through the HyNet Alliance to encourage development of low-carbon hydrogen across private and public sector partners.

Companies that adopt success factors above can weather the current storms and emerge as leaders.