The year 2025 holds great opportunities for telcos. From AI delivering meaningful impact to transformative M&A , there is a long list of strategies that can boost value creation.

Many of these strategies are on display in the top-ranked companies in our 2025 Telecommunications Value Creators Report, demonstrating that fresh thinking and the right game plan can deliver value—even though the overall record is subdued.

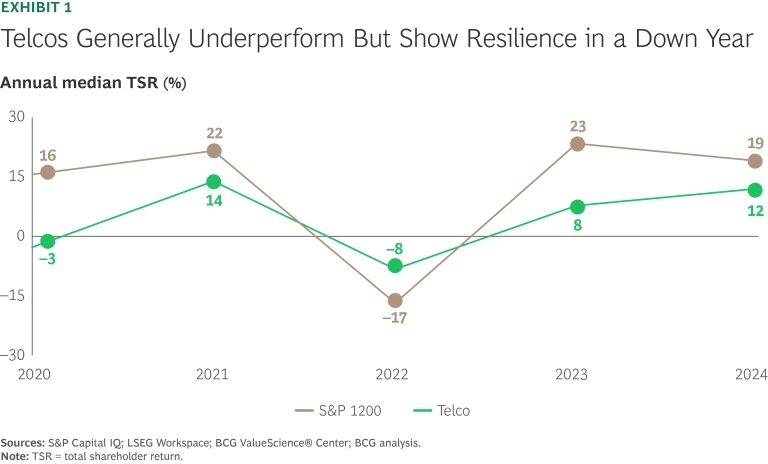

How subdued? In the five years from 2020 to 2024, the telcos in our survey delivered a median annualized total shareholder return (TSR) of about 4%, a decline from the 6% we reported 12 months ago. That’s far below the 12% five-year annualized TSR of the S&P 1200 index of global stocks, leaving them 31st out of 33 industries we track.

One reason is the sharp decline in the five-year TSR of telcos with a global footprint. These industry giants face challenges in leveraging cross-market synergies, which limits their ability to extract value from their scale. As a result, the average five-year TSR for global telcos lags large national and smaller players.

Overall, however, the industry’s below-average returns should come as no surprise. Telcos underperform when the market is buoyant, outperforming in years with a downturn, such as 2022. (Our five-year time horizon is designed to limit the impact of short-term market moves.) Yet the gap with the market is narrowing a little; in 2024, telcos lagged global stocks over five years by 7 percentage points. That’s much better than the 15 percentage points in 2023. (See Exhibit 1.)

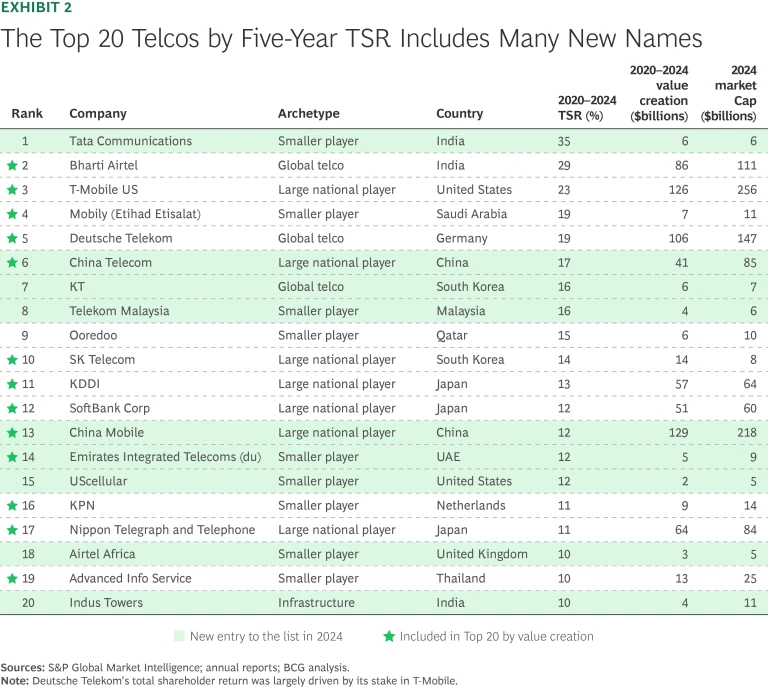

Notably, 13 of the top 20 companies ranked by TSR are also in the top 20 by absolute value creation, demonstrating strong performance by large players. (See Exhibit 2.)

Much of telcos’ investor return is through dividends, a significant driver of TSR for the sector, which ensures that income-oriented investors remain attracted to the telco investment case. Beyond dividends, however, TSR is fundamentally driven by enterprise value. To accelerate and sustain TSR returns, increasing enterprise value is imperative. Later, we describe four strategies that may deliver this, with AI as an overarching enabler.

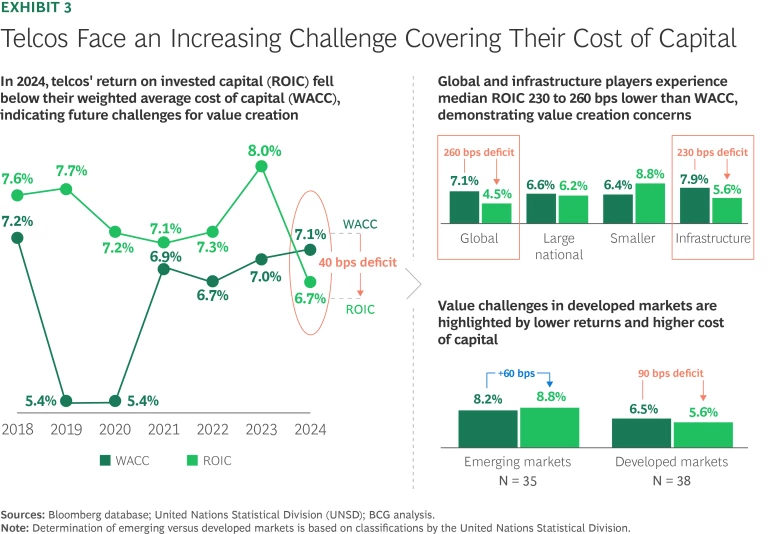

An important development in 2024 was that telcos’ return on invested capital (ROIC) fell substantially below the median weighted average cost of capital (WACC). Over the past five years, median ROIC has hovered around 7% to 8%, dipping a little to 6.7% in 2024. WACC, however, has shown a clear and unwelcome trend, rising from 5.4% in 2020 to 7.1% in 2024. This means that, on average, telcos are not generating enough returns to cover their cost of capital, effectively eroding shareholder value.

Additionally, the relationship between ROIC and WACC varies by market development. Telcos in emerging markets, which represent six of the top ten players by TSR, see capital intensity above the market average as they invest to meet growing demand for connectivity and services. Favorable regulatory environments and these investments contribute to a median ROIC that exceeds WACC by 60 basis points.

In contrast, developed-market telcos have completed much of their 5G rollouts and face slower (or no) growth. The median ROIC is 90 basis points lower than WACC, highlighting their value-creation challenges. There is immense competitive pressure to defend market share through investment by offering faster connectivity and other service improvements. Even without this, networks need continuous upgrades to cope with traffic growth fueled by increased consumer demand, the broader adoption of cloud services, and the digitization of everyday life. In this environment, some investment is a must-have, even if returns fall short of the cost of capital. (See Exhibit 3.)

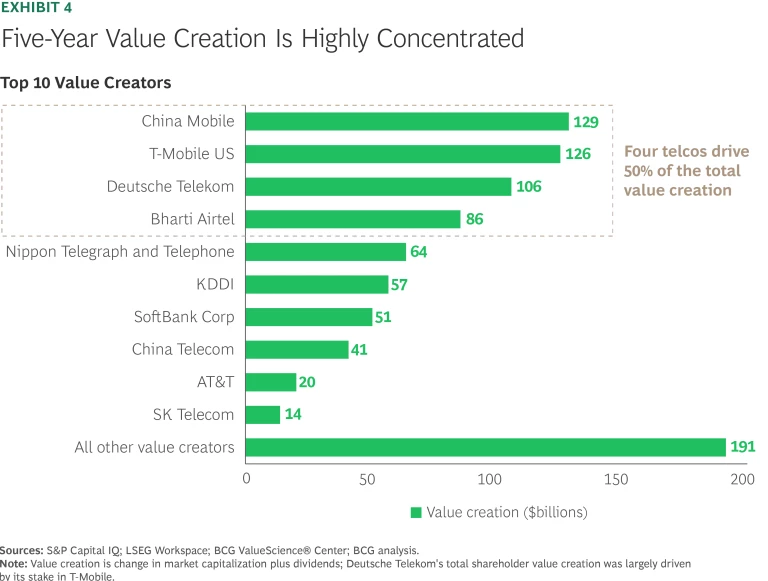

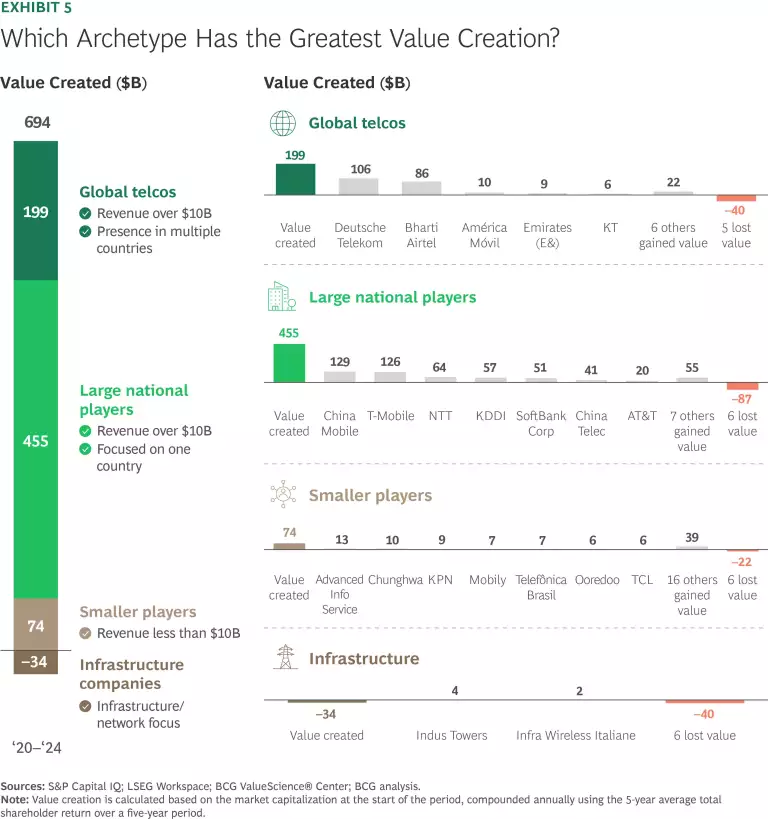

Apart from TSR, the other key metric we track is value created, measuring the absolute change in market capitalization plus dividends paid out, over five years. Here, the picture is brighter, with net value created up 21% since our report a year ago to nearly $700 billion. Despite the industry’s long list of challenges, 50 of the 73 companies in our sample delivered value between 2020 and 2024, creating a combined approximate $880 billion. This figure was driven by a small number of companies, with half that number generated by just four large players: China Mobile, T-Mobile US, Deutsche Telekom, and Bharti Airtel. (See Exhibit 4.)

Offsetting these were the companies that lost value, amounting to $190 billion over the five years. Some of this lost value can be attributed to divestiture and regulatory challenges, but subscriber attrition and slower-than-expected monetization of 5G have also contributed.

Where Value Is Being Created

Telcos range widely in size and business model. We analyze value creation by four archetypes: global telcos , large national players, smaller players, and infrastructure companies, with each having its challenges and tools for solving them. (See Exhibit 5.)

Global telcos face challenges in realizing their cross-border scale.

For decades, industry wisdom suggested that only outsized telcos could generate outsized returns, triggering waves of cross-border mergers. However, in most cases, anticipated interregional efficiencies have yet to materialize, and many face stagnant revenues and pricing pressures across fragmented markets.

In response, several global players have begun divesting parts of their international footprint. For example, as part of its ongoing strategic overhaul, Vodafone recently announced the sale of its Italian operations to Swisscom for $8 billion, following the divestment of its Spanish business for $4 billion.

However, there are grounds for optimism. For instance, global telcos’ capital intensity (capex/revenue) has peaked at 15.1% and is projected to decrease, improving cash flow slowly. Overall, though, returns from these companies have dimmed, with the median five-year TSR falling from 7% in the previous report to just 3.1%.

Large national players show wide variation.

We define these as telcos reliant on a single market with revenues over $10 billion. With good strategy and positive regulation, they can be value powerhouses: Their concentrated footprint provides focus, yet they enjoy economies of local scale. Some have been able to boost revenues with price increases. And, like the global telcos, capital intensity is projected to decrease.

Unfortunately, this single-country focus also means they suffer badly in a less benign environment; many of the lowest performers are in this category, too. Overall, they show a declining TSR, from 6% in the five years ending in 2023 to 4% for the five years ending in 2024.

Smaller players show agility.

This encompasses a wide range of business models, from conventional small-country mobile providers to specialist providers of business-only connectivity. Agility and focus help them overcome the disadvantages of a modest scale, and this varied group has seen five-year TSR, which was 3% in our previous report, rise to 6%, the highest among all archetypes.

An example is Tata Communications, the Indian telco that is our top-rated for TSR, showing a five-year TSR of 35%, driven by growth in areas such as the Internet of Things (IoT), cloud services, and cybersecurity, which it connects to create what it calls “Digital Fabric.” The company does not offer many consumer services but is buoyed by India’s strong growth in 5G through providing domestic and international high-speed connectivity.

Infrastructure companies have seen TSR fall quickly.

Many of these companies are spin-outs from telcos, charged with running and building networks, allowing the former owner to focus on products and services. However, these asset-heavy companies suffer at times of high interest rates, and rates have been elevated for more than half of our five-year lookback period. Capital intensity is projected to decrease faster for infrastructure companies than for any other archetype, but this is not 100% good news; in the long term, lower investment will mean lower revenues. The result is that the median TSR has gone in reverse. Twelve months ago, this archetype posted a five-year TSR of 10%; it has now turned negative at –2%.

Subscribe to receive the latest insights on Technology, Media, and Telecommunications.

The Path to Improved Value Creation

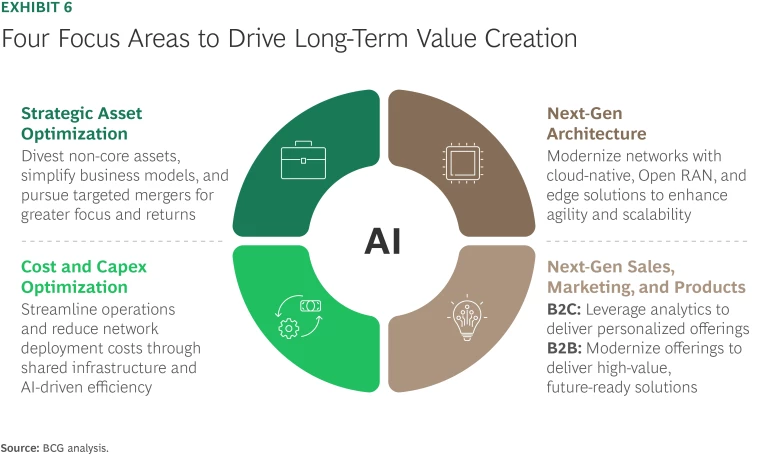

The strategies outlined above, along with those implemented by top value-creators, illustrate effective ways to tackle the industry’s challenges. For companies aspiring to excel in our future reports, we have identified four focus areas that will form the platform for value creation. (See Exhibit 6.)

These focus areas are connected, and to deliver maximum value, they should be combined. They should also be augmented with innovative, business-driven AI as an overarching enabler, adding extra velocity. As such, AI represents a double opportunity for telcos. As large-scale businesses, they can reap huge efficiency benefits—and many of the companies in the mini-case studies that follow are showing the way. But there is a growth dimension too; as trusted suppliers to consumers and business alike, they have sales channels which are ideal for the new generation of AI-powered products. The opportunities are particularly rich for B2B sales in small- and mid-sized firms, where telcos can generate locally relevant solutions, possibly in partnership with hyperscalers or other global tech partners, and monetize them at scale through their existing sales network.

The value creation focus areas and mini-case studies are detailed below.

Drive down costs and capex.

On costs, it is vital to reduce operational expenditures using tools such as shared infrastructure and cloud-based solutions. Workforce optimization and process simplification are also critical and can be turbocharged with AI. On capex, the need for efficiency is underlined by the unpleasant combination of a rising cost of capital and declining ROIC, which have a significant impact on TSR. However, as 5G rollouts and fiber infrastructure development near completion in mature markets, the freed-up cashflow can be redeployed into targeted growth initiatives or returned to investors as dividend income.

AT&T demonstrates how telcos in developed markets can drive down costs. By 2029, the world’s oldest telco will phase out copper-based network services across most of its territory, saving $6 billion annually. About 60% of these savings come from lower network costs, such as reduced real estate and maintenance, which AT&T says are 35% lower. As part of its near-term $3 billion cost-reduction target for 2027, AT&T plans to decommission 1,300 central offices—25% of its footprint. AI is a key efficiency driver, cutting call center volumes by 30% and optimizing truck rolls to streamline network transitions and accelerate in-home troubleshooting.

Optimize strategic assets and simplify.

Telcos have long been streamlining their operations, with some network spinoffs that created our infrastructure archetype occurring over a decade ago. However, these processes must continue at pace to address the challenges in developed, saturated markets. Assets such as data centers and fiber infrastructure can be leveraged strategically to enable better focus and efficiency.

Spin-offs of fixed-line networks are a fresh area of opportunity, facilitating the transformation of telcos into “servicecos” offering a much broader range of services. Telecom Italia in 2024 completed the first spin-off of a fixed-line, former monopoly network in Europe, selling to a consortium led by KKR for slightly more than $20 billion. This reduces net debt/EBITDA from a heady 3.8x to around 2x, similar to peers. Perhaps more importantly, the company says it will evolve its business model away from a traditional, pure telco towards a customer platform strategy that uses its brand and data to launch services in areas such as media, finance, and health—driving non-connectivity revenues from 25% in 2023 to 30% in 2026. This is an emerging trend, and strategies for success are still being refined.

M&A is another key strategy for telcos to strengthen their market position and drive value creation. In-market consolidation is particularly powerful. In mobile, for instance, operators in markets with three players typically enjoy an ROIC 1.5x that of telcos in four-player markets.

Verizon’s $20 billion acquisition of Frontier Communications, announced in 2024 and scheduled to complete in 2026, is expected to expand its fiber footprint and generate $500 million in annual cost synergies by year three. Likewise, T-Mobile US has pursued transformative acquisitions, including Sprint in 2020, Mint Mobile and Ultra Mobile in 2023, and the planned UScellular purchase announced in 2024. The Sprint merger delivered over $43 billion in synergies, while the UScellular deal is expected to save $1 billion annually, enhancing T-Mobile’s pricing, 5G services, and broadband offerings.

Consolidation is valuable even in growth markets. In Indonesia, XL Axiata and Smartfren, the number three and number four players by market size, have recently agreed to create a new merged player with 94 million subscribers and a market share of around 27%. The merged company expects strategic network optimization and resource optimization to generate $300–$400 million a year in synergies, with 20% to 30% of sites decommissioned because of overlaps.

Move to next-gen architectures.

Telcos worldwide accelerated their efforts here in 2024—with real impact. For mobile, the move to Open RAN cuts supplier dependency and creates extra vendor competition, driving down prices, as mentioned earlier. Cloud-native frameworks cut costs and add agility. However, there are revenue opportunities, too. Edge computing can power innovative, new services such as IoT applications, satellites in low earth orbit (LEO), sovereign cloud, and other enterprise services.

Bharti Airtel, a top four performer in five-year TSR and value creation, drives next-gen initiatives including:

- Private cloud to enable scalable IT operations and robust enterprise client support, including a partnership with Google for AI, IoT, and sovereign cloud.

- 5G modernization to boost network capacity and support low-latency IoT and smart city applications, with Open RAN for 5G and 4G.

- Deployment of SD-WAN networking to enhance scalability, reliability, and low latency for enterprises undergoing digital transformation. Bharti Airtel accelerated this by taking a stake in a local specialist startup and striking a partnership with Cisco.

LEO satellites are emerging as an intriguing addition to conventional networks. Starlink (the communications arm of SpaceX) and others are working on direct-to-cellphone technologies that turn satellites into, in effect, orbiting mobile base stations that can connect to conventional phones. Although bandwidth is limited, they can provide a solution for rural, maritime, or conflict zones. Partnerships like those between Starlink and telcos, including T-Mobile, Japan’s KDDI, and Canada’s Rogers, indicate the high level of operator interest.

In October 2024, KDDI demonstrated its Starlink direct-to-cellphone service in Kumejima, a prefecture of remote islands more than 1,000 miles from Tokyo, showing unmodified smartphones sending and receiving text messages via satellites more than 300 miles above the earth’s surface. T-Mobile US plans a beta test in early 2025.

Sovereign cloud services are emerging as a potential enabler for telcos, allowing them to serve customers with requirements for data residency and control. By leveraging sovereign cloud platforms, telcos can host sensitive customer data within national borders, supporting compliance with regulations such as Europe’s GDPR while enabling advanced applications such as AI-powered analytics and IoT deployments. Partnerships play a key role in advancing these capabilities.

Deutsche Telekom’s T-Systems division uses strategic partnerships, such as one with Google Cloud, to enhance its sovereign cloud, compliance, security, and AI capabilities. It has then driven sales of these products by reimagining its B2B go-to-market strategies, offering tailored services for key industries such as automotive, health care, and public services. T-Systems has developed tailored solutions such as predictive maintenance systems for railways and e-mobility charging platforms. The company has also segmented its customer base to prioritize top accounts and created specialist roles, such as client architects and industry-specific experts, to deliver customized support. This strategy, paired with advanced account planning, helped push revenues above $4 billion in 2023, a 5.3% organic growth rate.

Power up next-gen sales, marketing, and products.

In enterprise markets, advanced analytics and AI-powered solutions can unlock new revenue streams, strengthen relationships with business customers, and position telcos as trusted providers of future-ready solutions. For instance, Comcast is expanding beyond traditional connectivity services to include global secure networking via its acquisition of Nitel.

Many of the technologies already deployed in consumer markets are now sophisticated enough to deploy in the more complex enterprise market. At Verizon, for instance, AI-driven tools are enhancing customer interaction and retention. The company has deployed human-assisted GenAI applications to streamline interactions, enhance personalization, and reduce customer churn. AI-driven tools such as “Fast Pass” pair customers with the most appropriate support representatives, while a “Personal Research Assistant” helps resolve 95% of customer inquiries. Additionally, its “Segment of Me” AI proactively identifies relevant services and products for individual users, cutting transaction times by up to four minutes and increasing customer engagement.

Similarly, small- and mid-sized business customers in Singtel’s home market of Singapore are now serviced using an AI engine that recommends the right product at the right time along with personalized marketing. AI chatbots handle routine inquiries from these customers, while humans handle questions that are complex or from high-value customers. This AI-driven approach has significantly improved efficiency, enabling responses to customer emails within 15 seconds and reducing costs by 30%.

Singtel has co-operated with Nvidia to build energy-efficient data centers across Southeast Asia, positioning them as sovereign AI “factories” that process private datasets locally. These facilities could enable businesses and governments to harness generative AI while maintaining data sovereignty, a promising opportunity for telcos to become trusted partners and unlock new revenue streams in industries requiring levels of security and data control.

At KT Corp, a South Korean fixed/mobile operator, AI-driven products are also central to its plan to raise IT revenues from 6% of the total in 2023 to 19% in 2028 by integrating AI into its traditional services, which are otherwise showing low growth. A key foundation is a five-year Microsoft partnership, including a sovereign cloud and a Korea-customized GPT for applications in education, healthcare, and beyond.

The strategies outlined in this report are not niche plays; they represent actionable opportunities that many telcos can implement after adapting to their specific challenges. Taken together and powered-up by appropriate use of AI, they provide a roadmap to move beyond the modest returns that have become the industry norm. These strategies are already being deployed by companies at the top of our TSR and value creation rankings, showcasing the power of strategic innovation and disciplined execution to elevate performance above the industry average.

In fast-growing markets, telcos can drive returns by meeting untapped demand, while in low-growth markets, transformation hinges on adopting advanced technologies and transitioning away from legacy infrastructure. Investments in fiber networks, AI-driven digital transformation, and next-generation architectures will be crucial for telcos striving to remain competitive and relevant.

Top-performing companies like Bharti Airtel and Deutsche Telekom highlight how strategic planning and effective execution can consistently deliver above-average returns. Whether through cost optimization, strategic asset monetization, or leveraging next-gen architectures, the industry has multiple strategies to enhance shareholder value and secure long-term relevance.

As the industry continues to evolve, the companies at the top of future years’ value creator reports will be those who embrace innovation, prioritize customer-centric strategies, and execute with precision, spearheading the transformation from traditional, utility-like service providers to dynamic technology leaders that shape the digital future.

The authors wish to thank Khayla Smith and Martin Link for their contributions to this article.