日本の読者の皆様へ

日本政府が脱炭素に向けたグリーントランスフォーメーション(GX)における産業政策の長期戦略を示した「GX2040ビジョン」は、エネルギー安定供給確保、経済成長、脱炭素の同時実現を目指している。これを達成するには、GXと相互に関係するデジタルトランスフォーメーション(DX)もあわせて、両輪で推進することが重要になる。

生成AIの導入をはじめとするDXは、AIエージェントや自動運転モビリティサービスなどの活用を通じて人々の暮らしを快適にしながら、産業構造の変化を導く。その裏では、データセンターの大幅な増設が進み、稼働に伴って爆発的な電力需要が生じる。この需要に対応するためには、エネルギー領域において、再生可能エネルギー、原子力や水素・アンモニアといったクリーンエネルギーを導入することが求められる。

一方で、データセンター事業者は建設地の確保、電力系統の容量確保、再エネの供給、設備のサプライチェーン、建設工事などに携わる人材の確保に関して、課題に直面している。エネルギー業界でも、洋上風力や水素・アンモニアのコスト高騰などによって事業性の担保が難しくなっていることに加え、大規模電源の立地確保やサプライチェーン、技術者の確保といった課題が浮上している。

日本の成長戦略においては「GXとDX」のインフラを構築することが重要だが、この課題解決なくして実現は困難だ。本稿は、テック分野のリーダーである米国において、同様の課題がすでに顕在化していることを示している。日本においても、エネルギー、テック、製造をはじめとする産業界が横断で課題解決に取り組むための一助となれば幸いである。

マネージング・ディレクター&パートナー

平 慎次

計算処理需要は世界的に急増しており、大手データセンター事業者は、このニーズを満たすために2024~2030年の間に1兆8,000億ドルという巨額投資を計画している。この急拡大の背景には、従来型のエンタープライズ向けソフトウェアから

生成AI

アプリケーションまで、データ集約型テクノロジーの利用増加がある。

だが、いくつかの重大な障壁が、この産業の発展にブレーキをかける可能性がある。特に喫緊の課題は、発電インフラのボトルネック、サプライチェーンの制約、資源利用に関する地域社会の懸念、データセンターが環境に与える影響の増大だ。本稿では、データセンター事業者とエコシステムのステークホルダーがこうした難題を乗り越え、今後の機会を捉えるための一連の戦略を、実行可能な解決策に焦点を当てて概説する。

急成長するデータセンター産業

データセンター産業が急激に成長しているのは明らかだが、この成長を後押ししている複雑な要因については十分に理解されていない。ボストン コンサルティング グループ(BCG)は、独自の「グローバル・データセンター・モデル」を活用し、データセンター需要の背景、前例のない規模で進行中の設備投資、この新興産業を形作る世界の動向を明らかにしている。

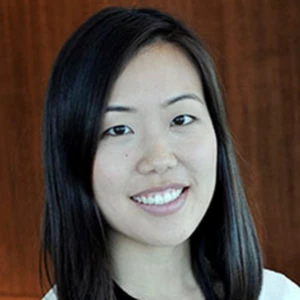

データセンターの計算処理需要は急増している。私たちは、データセンターの電力需要が2023~2028年の間に、世界全体で年平均約16%増加すると予想している。この成長スピードは2020~2023年より33%速く、2028年までに約130GW(ギガワット)に達するペースだ。

実際、現在はファイルのストレージや共有、トランザクション処理、旧来のビジネスアプリケーションなど、AIを活用しない従来型のエンタープライズ用途の処理負荷(ワークロード)がデータセンターの電力需要の大半を占めている。今後もその傾向は続き、2028年時点での割合は約55%となる見込みだ。エンタープライズ型のデータ量が今後も増加し、企業のデジタル化が進むことを受け、2023~2028年の年平均成長率は7%となると予想される。コスト効率の改善、オペレーションの柔軟性強化、スケーラビリティ(拡張性)向上といった利点をもたらすクラウドサービスの普及拡大が、この成長における重要なイネーブラーだ。

同時に、生成AI関連の計算処理需要は、いま最も急速に成長しているセグメントであり、私たちの予測によると2023~2028年の期間におけるデータセンターの電力需要増加量に占める割合は約60%に達する見込みだ。オープンAIのGPTモデルに代表される大規模な基盤モデルの学習用途の処理負荷は年平均約30%で成長すると予想され、学習済みのモデルを使用してインサイトや予測を生成する推論用途の処理負荷は122%と爆発的に増加するだろう。このように急増はするものの、2028年までに生成AIがデータセンターの電力需要に占める割合は約35%にとどまると予想される。

計算処理需要、ひいてはデータセンター増設の正確な見通しとタイミングは、生成AIの計算量が今後どれほど増加するかによって大きく左右される可能性がある。例えば、モデル構造やハードウェアにおける技術の進歩やイノベーションによって、生成AIの学習に伴う電力需要が減少することも考えられる。反対に、プロンプト(指示)ごとに段階的な処理を必要とする「Chain of Thought(CoT: 思考連鎖)推論」などのアプローチが広く普及した場合には、計算処理需要が急増する可能性がある。

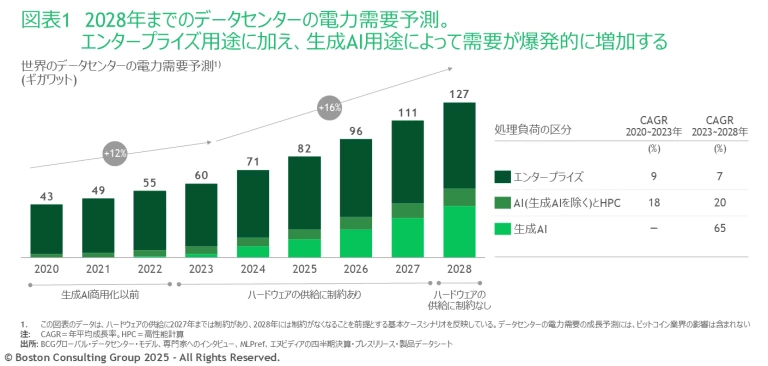

ハイパースケーラーが成長と大規模投資を主導する。私たちの予測では、ハイパースケーラー(アマゾン、メタ、マイクロソフト、グーグルなどの巨大 テック 企業)は、2023~2028年のデータセンター産業の成長の約60%を占め、世界のデータセンターの電力需要に占めるシェアは35%から45%に拡大する見込みだ。同期間に、自社施設内にサーバーなどの機器を設置して運用するオンプレミス(自社運用)のエンタープライズ・データセンターが電力需要に占めるシェアは10%から5%に減少する。その背景には、企業データをクラウドやコロケーションベンダーに移行する動きが続いていることがある。コロケーションベンダーとは、テナントにサーバーや通信機器を設置するスペースを貸し出したり、専用のクラウドサービスを開発したりする事業者で、ハイパースケーラーがこうしたサービスを引き続き活用して増大する計算処理需要を満たすと考えられることから、2028年までのデータセンターの電力需要における残りの50%を占めることが予想される(図表2)。

これだけの成長を実現するには、ハイパースケーラーは2024~2030年の間に米国で1兆8,000億ドル規模のデータセンター関連の設備投資を行う必要があるだろう。

ハイパースケーラーは施設規模の拡大も主導することになる。米国の平均的なデータセンターは現在40MW(メガワット)規模だが、2028年までに60MW規模に拡大し、200MWを超える規模のデータセンターが約3分の1を占めるようになるだろう。

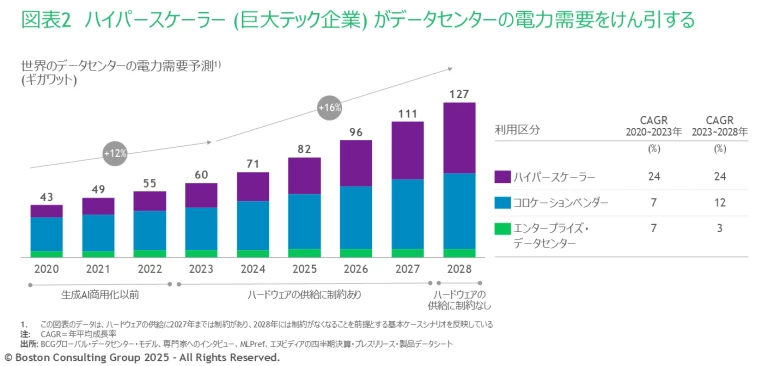

米国がデータセンターの電力需要をけん引

目下のところ米国は、世界に設置されているデータセンターの電力需要の約60%を占めている。現在設置されているデータセンターと、稼働予定のデータセンターに関する公開情報をベースにしたBCGの試算では、2023~2028年に増加するデータセンターの電力需要の大半が米国で発生すると予測している

この需要の拡大は、特定の地域電力市場に集中することが見込まれる。私たちの予想では、2028年には米国のデータセンターの約70%が、PJM (PJM Interconnection: バージニア州、オハイオ州など)、MISO (Midcontinent Independent System Operator: イリノイ州とアイオワ州など)、北西部(オレゴン州など)、南東部(ジョージア州など)の管内に拠点を置くこととなる。

一方で、現在稼働中および稼働予定のデータセンターを対象にしたBCGの予測では、主に3つの要因により、2023~2028年における電力需要の増加の30%を米国外のデータセンターが占めると見ている。

- データセキュリティとデータ主権。データが保管される地域、計算処理の実施場所、あるいは半導体チップの輸出入が可能な場所をも制限する厳しい要件は、データセンターの立地選定に影響を与えるだろう。多くの場合、このような要件の背景には、さまざまな規制や制裁に対する懸念がある。例えばEU一般データ保護規則は、個人データの移転に厳格なルールを定め、その遵守のために、欧州経済領域内でデータ保管・処理を行うよう企業に促すものとなっている。

7 7 出所: 欧州委員会。 同様に、アジアでは複数の国で、データローカライゼーションに関する法律の制定、またはそれに向けた取り組みが進んでおり、これにより特定地域内でのデータセンター構築が加速することが予想される。例えばインドネシアの政令第71号は、国内の公的機関と金融機関にデータローカライゼーションを義務づけている。規制面の圧力以外では、顧客の希望がデータセンターの場所に影響する可能性もある。例えばクラウドサービスの利用者が、サービスレベル契約やセキュリティ契約でデータ処理の場所を条件として指定する場合などだ。 - 低コストで信頼できる電力の選択肢が増加。コストと信頼性の両方の基準を満たすクリーンエネルギーが利用可能になったことで、データセンター事業者は米国外での開発にさらに意欲的になっている。サステナビリティ目標に向けて電力需要を調整しようとしている企業はなおさらだ。例えば北欧諸国は、豊富な再生可能エネルギー源へのアクセスと、強靭な送電インフラ、さらには欧州で最低水準の電力価格という好条件が揃っていることから、データセンター事業者の注目を集める地域となっている。

8 8 出所: ブルームバーグ、Bulk Infrastructure Group AS、Data Center Dynamics。 - レイテンシー(通信応答にかかる遅延時間)要件に縛られないAIアプリケーションの拡大。データセンターがエンドユーザーのリクエストに応答を返すまでの時間を指すレイテンシーは、 AI アプリケーションの範囲拡大に伴い、重要度が低下している。レイテンシーの影響が大きい計算処理の場合は、遅延を最小限にするためにエンドユーザーの近くにサーバーを配置するエッジコンピューティングが頼りだ。だが、前述したCoT推論のようなAIパラダイムにおけるイノベーションによって、数秒以上かかる応答時間も許容されるようになるため、超低レイテンシーの重要性は低くなる。こうした変化を通して、データセンター事業者は、データセンター建設時に利用者との距離よりもコストやサステナビリティなどの要素を優先できるようになり、建設地の柔軟な選定が可能になっている。

BCGのモデルは、公開されているデータセンター建設計画の情報のみを織り込んでいる。上記の不確定要素に加え、未公表のデータセンタープロジェクトがある場合、結果的に予想を上回る速度で成長する可能性や、米国外での成長軌道が変わる可能性がある。中国については、データの制約があり今回の分析では焦点を当てていないが、人材、資本、発電リソースが潤沢にあることから、今後もAI分野の主要プレーヤーとして台頭していくだろう。例えば、アリババの大規模言語モデル(LLM)である「Qwen」は、米国による輸出規制の影響で最先端チップの入手が制限されているにもかかわらず、米国のモデルに匹敵する性能を発揮している。

課題に立ち向かい、データセンターの好機を捉える

世界中の国や企業のリーダーが、AI分野でイノベーションを起こすことを「ミッションクリティカル(必要不可欠)な」優先事項と見なしている。だが、データセンターエコシステム内の企業は、データセンターの新設や大型化を推し進める際に重要な課題に直面している。これらの課題を詳しく調べると、解決に向けた糸口が見えてくる。

電力の確保

データセンターの数や規模の拡大は、電力網の変革を迫るほどの影響を及ぼすだろう。データセンターの電力需要は、世界全体で2028年までに合計で約130GWに達すると予想され、2023~2028年の年平均成長率は16%で、これは2020~2023年の12%を上回る。米国では、データセンターの電力需要が、2023~2030年までの負荷増加量全体の最大60%を占め、交通・運輸機関の電動化など他分野での負荷増加量を上回ると見られる。

こうした状況を受け、大型化が進むデータセンターに必要な電力の確保が重大なボトルネックとして浮上している。これは主に、グリーンフィールド(新規開発)型のデータセンターの開発期間が一般的に2、3年である一方で、電力系統接続の検討やインフラの更新を完了するのに通常4~8年を要するという時間的なずれが原因になっている。

この課題を克服するために、データセンター事業者は電力事業者と積極的に連携して、送電インフラ開発を加速させる必要がある。特に重要な対策が以下の2つである。

- 協力してプランニングと立地選定を行う。データセンター事業者と電力事業者が協力することで、「理にかなった立地選定」が可能になる。開発側のニーズ(都市部へのアクセスの良さなど)と、電力会社側が求める料金と信頼性の最適化という、双方のバランスが取れるためだ。この協力体制には、早期から電力事業者の計画立案サイクルと連携し、データを共有することが必要だ。同時に、望ましい開発候補地にデータセンターを構築するためには、公的機関(規制当局など)に、認可プロセスの合理化などの方法を通じて舵取りしてもらうことも必要になるだろう。

- 送電網拡大のリスクを回避する。送電網の増強における主な課題は、計画対象期間の不一致だ。電力事業者や規制当局は、回収期間が25~30年に及ぶ投資を正当化するために長期オフテイク契約(長期供給契約)を求める。一方、データセンターは、需要の不確実性や地域の特性、(特に生成AI関連の)処理用途や負荷の変動など不確定要素が多いため、比較的短いサイクルで運用するのが一般的だ。データセンター事業者は、テイク・オア・ペイ契約(当初の契約通りに電力を購入しない場合も代金を支払う契約)や債務保証を提供することで、電力事業者が送電網の拡充に積極的に投資するのを後押しできる。負荷の増加予測において、需要を過大に見積もった場合でも、送電網への大規模な設備投資によるリスクを回避できるからだ。あるいはデータセンター事業者は、新規もしくは更新されたエネルギーインフラの共同所有モデルを模索することで、財務上のリスクとメリットを電力事業者と共有することも可能だ。さらには、大口の電力利用者と協力して、地域をまたいで需要を集約することで、新たに投じる巨大投資の根拠となる十分な量の安定した需要を示すこともできる。

企業は計算処理需要の急増に対応する計画を立てる中で、新たなアプローチによって、新規の系統接続が必要な電力設備の新設をどの程度抑えられるかを見定めようとしている。だが、ビハインド・ザ・メーター(BTM)電源の開発と継続的なイノベーションという2つのトレンドを掘り下げて見る限り、両者ともすぐに電力供給の仕組みに大きな変化をもたらすわけではなさそうだ(コラム「データセンターの電力需要問題に簡単な解決策はない」をご参照ください)。

データセンターの電力需要問題に簡単な解決策はない

ビハインド・ザ・メーター(BTM)電源。近年、データセンタープロジェクトにおける送電網のボトルネックを解消し、電力供給までの時間を短縮する手段として、コロケーション型のエネルギー源が注目されている。まだ導入の初期段階であるものの、コロケーション型のガス発電所や水素燃料電池ファーム、バックアップシステムを備えたソーラーパークなどのBTM電源は、データセンターへの電力供給においてより大きな役割を果たすと目されている。こうした電源がどれも必要なのは間違いない。だが、目下注目の的とはいえ、BTMは、2023~2028年にデータセンターで必要になる約70GWもの追加容量をまかなえるものではない。この背景には、大規模実装に伴う重要な問題がいくつかある。

第一に、BTM電源には、定期・不定期の保守管理の必要性や、送電網と関係なく発生する停電のリスクなど、信頼性に関する特有の懸念事項がある。そのため、電力供給に関して極めて高水準の信頼性と冗長性を必要とするデータセンター事業者は、これまで完全独立型のオフグリッドソリューションの検討を避けてきた。系統電力との連携など、信頼性の懸念解消に役立つ可能性のある技術的解決策の導入も考えられるが、こうしたアプローチは開発から実用化まで時間を要するだろう。

第ニに、数メガワット、あるいはギガワット規模で運用されるデータセンターの需要に応えるためにBTM電源を大規模実装するには、技術面で大きなハードルがある。デベロッパーは、オフグリッドの小規模な太陽光発電システムの経験はあっても、天然ガス、太陽光、電池などを含む多様な資源の大規模統合についてノウハウを持っているところはほとんどない。ほぼ瞬時の応答を提供したり広範囲の負荷変動を管理したりするなど、データセンター事業に特有の電力潮流と動的負荷の管理によって、複雑性はさらに増し、プロジェクトリスクも高まる。

第三に、法規制の動きが見通せないことから、BTMソリューションの導入に時間がかかる可能性がある。例えば、送電網の費用配分と安定性への影響については依然として懸念が残っており、最近でも米国連邦エネルギー規制委員会が、データセンター向けにBTM容量を確保するための相互接続契約を拒否している。

結果として、今後も事業者は、データセンターを送電網に接続する方式を選ぶことが予想される。同時に、こうした送電網接続によるデータセンター運用を促進するためには、大容量の相互接続プロセスに関する規制改革や、全く新しい契約形態の登場によって電力事業者が新たな送電インフラに投資する際のリスクを回避し、投資の迅速化が進むことが期待される。このように変化し続ける状況の下でも、規制対象である電力事業者、特に発電から小売りまでを一貫して管理する垂直統合型の電力事業者の場合は、新しい送電インフラと発電設備に投資することで、データセンター拡大により莫大な価値を得られる立場にいるといえる。

イノベーション。グーグルの量子チップ「Willow」などの画期的な進展で注目を浴びている量子コンピューティングは、計算処理をより効率的に扱えるため、データセンターの電力需要の抑制につながるのではないかという声はよく耳にする。だが実際のところ量子コンピューティングは、データセンターの当面の需要や、少なくとも今後10年間に増え続ける電力需要への現実的な解決策にはならないだろう。量子コンピューティングは推論タスクやエンタープライズ向け処理の多くには適していないと考えられ、大規模言語モデル(LLM)の学習に応用できるかどうかはまだ推測の域を出ていない。AIモデルの学習への応用が技術的には可能だとしても、この分野で大規模に活用できる量子コンピューティングソリューションの実現は何年も先のことになる。

ハードウェアの着実な進展としては、エヌビディアなどのリーダー企業や新興企業が開発するチップが、徐々にではあるが影響力のある進化を遂げており、性能や効率性において重要な改善をもたらす液体冷却など、不可欠な周辺技術でもイノベーションが起きている。ソフトウェアとアルゴリズムのイノベーションも同様の役割を果たす可能性がある。

サプライチェーンの課題

データセンター産業の急成長を受け、建設に必要なリソースを速やかに確保したいデータセンター事業者やデベロッパーにとって、サプライチェーンの管理は最も大きな懸念事項となっている。現在よく知られている課題はチップの確保だが、電力系統や冷却装置、ネットワークインフラ、さらには建設作業員にいたるまで、サプライチェーンのあらゆる要素が混乱を招く要因になりうる。例えば、バックアップ発電機などの重要設備の調達にかかるリードタイムは、数カ月から数年になっている。

レジリエンス(強靭性)を備えたサプライチェーンを確立し、容量に関するボトルネックを緩和するために、データセンター事業者がとれる実践的な戦略は以下の通りだ。

- リードタイムが長い設備を一括購入する。データセンター事業者は、エンジニアリング、調達、建設の各パートナー企業と協力して調達に時間がかかる設備を確保し、サードパーティのロジスティクスプロバイダーを利用して一元的に保管することで、開発と建設のスケジュールを大幅に早めることができる。15件のデータセンタープロジェクトを対象としたBCGの最近の分析では、重要設備を一括購入して集中保管した結果、スケジュールを最大6カ月短縮できることが明らかになった。

13 13 出所: データセンター建設のベンチマーキング、BCG分析(2024年5月)。 - パートナーシップと共同開発を進める。データセンター事業者は、共同出資を含め、サプライヤーとより戦略的な関係を築くことで、製造規模の拡大を支援することができる。またパートナーシップを結ぶことで、データセンターのキャパシティ要件についてサプライヤーに長期的な見通しを提示できるため、サプライヤーは十分な情報にもとづいてプランニングや生産を行うことが可能になる。

- 人材育成に投資する。データセンター事業者、電力事業者、専門工事請負業者にとって、特に遠隔地においては専門技術を持つ人材の確保が以前からの課題だ。企業は人材育成プログラムを策定し、教育機関と連携して実施することで、この問題に対処することができる。一例として、マイクロソフトは地域のコミュニティカレッジと協力し、世界中で20カ所近いデータセンター・アカデミーを運営している。

14 14 出所: 「地域社会におけるマイクロソフト(Microsoft in your community)」、マイクロソフト社ウェブサイト。

地域社会との関係構築

データセンターの拡大に伴い、土地や水など周辺地域の資源に与える影響に関して、受け入れ側の地域社会から向けられる目は厳しさを増す。特に、データセンターの拡大に必要な送電網拡充の費用配分ルールや、データセンターの拡大が電力価格に与える影響は、多くの地域社会にとって重要な懸念事項になる。

データセンターエコシステムの主要プレーヤーは、これらの懸念に対して、主に2つの対策を取ることができる。

- 公平な料金体系を設定する。規制当局、電力事業者、データセンター事業者は協力して、商業顧客と産業顧客向けの費用回収の枠組みを見直すことができる。これらの枠組みは、影響を受ける電力利用者間での費用の公平な配分を保証するとともに、電力料金の値上げや電力の信頼性低下から契約者を守るものでなければならない。このような保護措置には、最低容量契約、料金の事前支払い、テイク・オア・ペイ契約などがあり、負荷増加が予測を下回った場合に、契約者を座礁資産のリスクから守ることができる。同様に、データセンター事業者は、自社事業に必要な電力に高水準の信頼性を確保する目的で新規容量を追加する場合、資金を直接提供する契約の仕組みを構築できる。それに加えて、データセンターとの接続に伴う送電網の大規模拡充にかかる費用を公平に配分するためには、データセンター、電力事業者、規制当局の連携も欠かせない。これらのステークホルダーは、電線やケーブルの交換、蓄電池、仮想発電所、系統増強技術なども含め、送電網の拡充や拡大の必要性を軽減する方法を模索するよう電力事業者に促すインセンティブを用意することができる。このような仕組みを導入できなかった場合、発電コストの上昇と電力の信頼性低下の影響は、全ての契約者に及ぶ恐れがある。

- 受け入れ側の地域社会に積極的に働きかける。低中所得世帯向けの省エネプログラムへの資金提供、学術機関と連携した人材育成、契約者に対する直接的な救済措置などの取り組みを通じて、データセンターが地域社会に与えるプラスの影響をさらに高めることができる。また、雇用創出など、データセンターが地域経済活性化にいかに貢献しているかを強調することも重要だ。例えば100MW規模のデータセンターで創出される雇用は、2、3年の建設期間中に約500人(FTE: フルタイム換算)、運用段階では20年で50人(FTE)となる。

15 15 出所: エキスパートインタビュー、datacenterHawk、Uptime Institute、マイクロソフト、データセンター事業者のプレスリリース、BCG分析。

気候変動の影響

今後5年間で上昇する電力需要は、データセンターブームにも一部後押しされ、電力容量の5年間の伸び率を過去最大規模で引き上げる見通しだ。このような前例のない成長を成し遂げるには、風力や太陽光、蓄電池、従来型の原子力など、多様な電源を大規模に導入していく必要がある。電源拡充の主な要因は、データセンターが継続的で冗長性のある電力供給を必須としていることだ。蓄電池を備えた 再生可能エネルギー は安定した電力供給を可能にするものの、コストや電力容量などの蓄電要件を考慮すると、現時点では再生可能エネルギーよりも化石燃料ベースの発電に経済的優位性がある。そのため、電力事業者は再生可能エネルギーの導入を拡大してはいるが、直近の需要を満たすため、温室効果ガスの排出削減対策が不十分な化石燃料発電も並行して拡大したり、廃止を遅らせたりしているところも多い。

一部のデータセンター事業者は、再生可能エネルギークレジットの調達や再生可能エネルギー発電所との電力購入契約(PPA)締結など、自社事業が気候に与える影響に対処するための重要な基本対策を講じている。それに加えて、データセンター事業者は以下のような踏み込んだ

気候変動対策

に取り組むこともできる。

- 化石燃料発電所が環境に与える影響を緩和する。排出削減対策が講じられていない化石燃料で稼働する新設の発電所の寿命は25~40年と見込まれ、長期的なサステナビリティ目標の達成を阻む大きな課題となっている。データセンター事業者は電力事業者と協力して、炭素回収・貯留の統合計画(例えば、適切な孔隙を持つ地層の近くに発電所を戦略的に配置するなど)や、開発プロセスの早期段階での水素活用検討など、これらの資産の移行ロードマップを定めることができる。さらに、炭素税や発電所改修の資金提供を促す規制上のインセンティブなど、相殺可能な市場メカニズムの設計を提唱し支援することで、再生可能エネルギーへスムーズに移行することができる。

- 新しい気候変動テック の導入を促す。既存の技術が果たす役割は短期的に見れば重要だ。しかし、データセンター事業者は、新しい気候変動テックの開発を支援することで長期的なインパクトを生み出せる。小型モジュール炉や強化地熱発電などのソリューションは、サステナビリティ目標とのバランスを取りながら、データセンターの電力需要を満たすのに重要な役割を果たす可能性がある。こうした技術はまだ大規模な実証試験が必要な段階で、より成熟した発電技術に比べれば割高だ。だが、データセンター事業者はこれらの技術への早期投資によって、コスト曲線を引き下げ、大規模導入の促進を図ることができる。

- 制度改革を推進する。データセンター事業者は、これまでの単独の取り組みから脱却することで、システム全体での再生可能エネルギー導入を加速させることができる。クリーンエネルギーの導入障壁には、規制面での制約、天然資源の確保、資金調達のハードルなどさまざまな不確定要素があり、地域によって事情は大きく異なる。とはいえ、データセンター事業者のような大口の電力購入企業は、自社の事業規模と購買力を生かして変革を推進できる特別な立場にある。例えば、データセンター事業者は、パートナーシップやオフテイク契約の締結を通じて、発電事業者に長期的な安定性と需要予測に役立つシグナルを提供できる。また、ステークホルダー間の旗振り役となり、地域の政策や規制の改革を提唱する連合設立を支援することも可能だ。このような連携した取り組みを通じて、データセンター事業者は自社の需要を満たすのに必要なクリーンエネルギーを確保すると同時に、他業界へのクリーンエネルギー普及を加速させることができる。

データセンター産業は極めて重要な岐路に立ち、先行きには不透明感が漂っている。データセンター事業者が電力不足、サプライチェーンの課題、地域社会からの期待の高まりに直面する中で、業界の成長はエコシステム全体がいかにうまく協働するかにかかっている。未来を見据えた戦略とパートナーシップはこの産業のトランスフォーメーションを加速させ、リーダー企業になるか、後れを取るかの分岐点になるだろう。