Embedded insurance is transforming the way consumers interact with insurance products. This rapidly growing offering—with sales of $87.4 billion, anticipated to increase at a CAGR of 20.2% from 2023 to 2032—digitally bundles insurance with a wide variety of products and services online. It enables insurers to create partnerships with businesses selling everything from rental cars and airline flights to concert tickets and real estate, all underpinned by technology that streamlines the full underwriting, policy, and claims process.

The tech-driven nature of embedded insurance also gives insurers the ability to dynamically define, monitor, and adjust their insurance propositions using real-time data, quickly adapting to market demands and consumer preferences—a highly attractive capability in today’s swiftly evolving market landscape.

As a result, insurers are seeing increased attachment, or sales, rates vis-à-vis separate insurance offerings for the same products. They are also benefiting from higher margins than for traditional insurance, which carries greater distribution costs.

Nonetheless, traditional insurers looking to offer embedded coverage must overcome internal hurdles and learn to compete with more agile, digital-native insurtechs and tech-driven managing general agents (MGAs). And they must do so quickly—or risk being locked out.

The Challenges of Legacy Tech

The key internal challenge for traditional insurers is their legacy IT systems, which tend to be inflexible and monolithic. In addition, traditional insurers usually focus on conventional distribution models, such as sales agents, limiting their agility when adapting to e-commerce. And they typically lack well-documented data definitions and business APIs, making it challenging and costly to integrate their technology infrastructure with the modern APIs of partners, third-party solutions, and broader ecosystems. Evolving regulatory and compliance demands present another layer of difficulty, especially when insurers must embed their products across various platforms.

In contrast, insurtech companies and tech-driven MGAs capitalize on modern, API-driven architectures, enabling seamless integration with e-commerce platforms and other partners when embedding insurance products. These players can leverage advanced

data analytics

to offer precisely tailored insurance solutions, empowered by lean processes that reduce costs and allow for competitive pricing.

Two Leading Business Models

Traditional insurers that aim to offer embedded insurance should begin by choosing the business model that best matches their goals. Two primary models comprise distinct roles, responsibilities, and revenue mechanisms.

A Pure Risk Carrier with an Outsourced MGA. In this model, the insurer focuses exclusively on underwriting, product management, and risk assessment while partnering with an external MGA that is responsible for managing customer interactions and maintaining relationships with the distribution platforms.

The insurance carrier benefits from strengthening its core business, enabling product innovation and diversification across different distribution platforms, without having to directly manage customer interactions. Its revenue stream comes from the returns on underwriting risk.

The MGA, in turn, earns a commission on each sale, which allows for rapid scaling without the burden of financial underwriting risk. It can also access the data from consumer interactions to improve its customer journeys and enhance its platform’s ability to drive insurance sales. But the MGA relies on the insurer for pricing and product innovation.

An MGA and Risk Carrier. In this fully embedded model, the insurer provides both the technology and the insurance products, acting as the MGA as well as the risk carrier. This dual role gives it full control over product, pricing, and distribution—in addition to the financial risks associated with underwriting.

In this case, the carrier earns the revenue from commissions on product sales and the returns on capital for carrying the insurance risk. But the added responsibility of risk management means that it must have robust capabilities in risk assessment, claims management, and compliance, making this a more complex if potentially more profitable model.

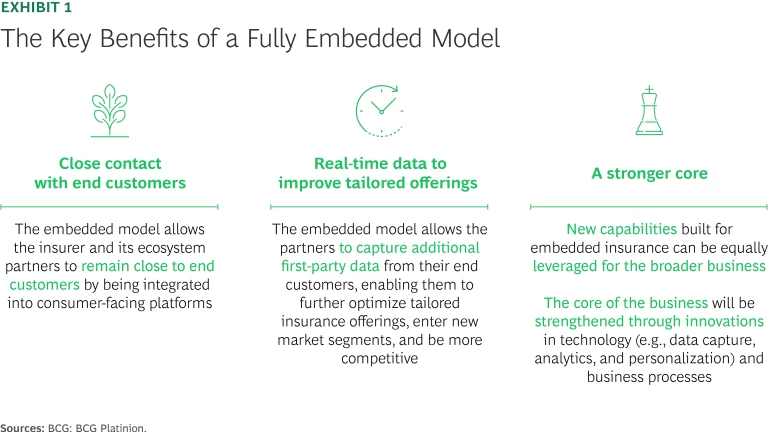

The model is beneficial across three areas: the insurer maintains close contact with customers, captures real-time data for tailored insurance offerings, and strengthens its core business by integrating product innovation with risk management. In addition, by owning both the customer-facing and the core insurance processes, it can dynamically adapt its offerings and refine its pricing models, positioning itself as a fully autonomous insurance provider. (See Exhibit 1.)

Enhanced Business Capabilities

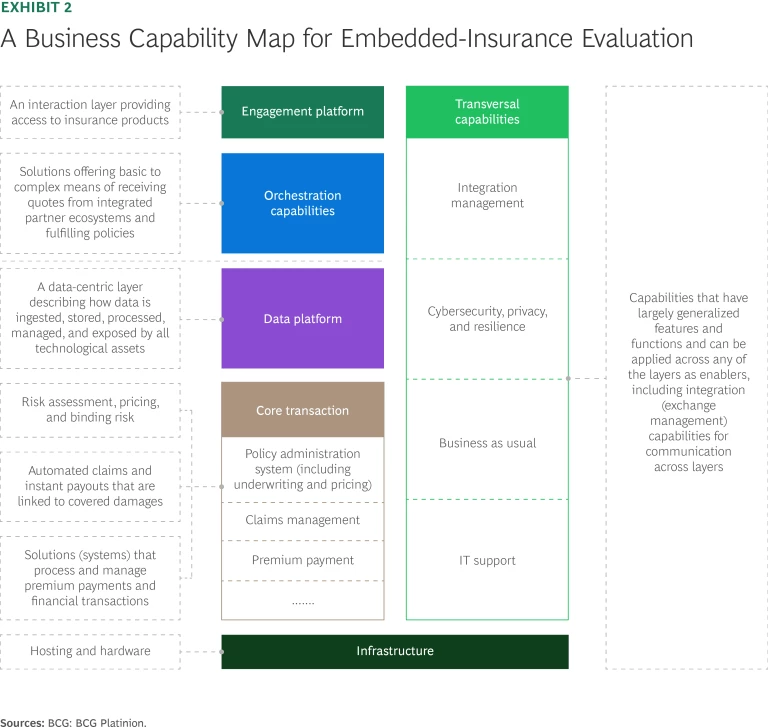

After choosing the appropriate model, carriers need to understand their existing capabilities and the gaps they need to fill. They can do so by analyzing their technological architecture and its distinct layers—each of which has unique requirements. (See Exhibit 2.)

For the engagement platform layer of its architecture, for example, a business choosing to act as the MGA as well as the risk carrier requires front-end capabilities such as the ability to manage a partner portal and orchestrate the customer journey. Both are vital to supporting the seamless onboarding and servicing of embedded-insurance products. In contrast, a business acting as a pure risk carrier relies heavily on the MGA to manage these interactions, making the capabilities less critical for them.

As illustrated in Exhibit 2, other essential capabilities across the insurer’s layers include:

- Orchestration. Quickly receive the latest quotes and fulfillment policies from, and manage interactions between, the different partners in the ecosystem.

- Data Management. Manage data effectively, using it to handle risk and enhance underwriting processes (pure risk carriers) and leveraging it for customer engagement and core transaction processes (combined MGA and risk carriers).

- Complex Insurance Functions. Handle the more complex insurance functions such as underwriting, claims management, premium payments, and risk assessment.

- Transversal Capabilities. Provide essential functions such as integration management, cybersecurity, privacy, business as usual, and seamless communication while ensuring a high level of resilience, security, and regulatory compliance.

A Robust Architecture

An

insurer’s IT architecture

should align with its strategic goals and be resilient enough to adapt to the rapidly evolving embedded-insurance landscape. There are several key success factors to consider:

- Partner Integration. A strong IT architecture should facilitate seamless integration with the insurer’s external partners through business-friendly APIs and middleware. This ensures smooth onboarding and interoperability while adhering to regulatory standards and maintaining high integrability across platforms.

- Product Modularity. Flexibility is essential to providing tailored insurance solutions. The architecture should be modular, supporting extensive customization and configuration of offerings without requiring significant code changes. This modularity promotes innovation and ensures that the architecture can adapt to future market demands.

- Process Efficiency. To enhance operational efficiency, the insurer should implement automated and configurable workflows, which streamline customer onboarding and service delivery, minimizing manual intervention and improving the overall user experience by ensuring quick, accurate, and efficient service delivery.

- Service Choices. An architecture that offers the insurer’s core capabilities as services provides scalability and flexibility. It should also allow configurable options that meet internal requirements and the diverse needs of external partners, enabling insurers to respond rapidly and effectively to market changes.

- Flexible Setup. The architecture must be lean, with minimal dependence on legacy systems, to promote agility and innovation. This ensures that the system can swiftly adapt to new technologies while remaining compliant with evolving regulatory requirements.

- Platform Excellence. The target architecture needs to be built with a focus on technical excellence, ensuring high performance, robust security, and optimized data management. It should support advanced analytics capabilities to provide meaningful insights for decision making, ultimately enhancing the insurer’s and partners’ capabilities to deliver superior products and services.

By incorporating these success factors into their target architecture, insurers can build a resilient, agile, and future-ready platform that supports the dynamic needs of the embedded-insurance market.

Buy, Build, or Reuse?

The next step means answering a practical question: should insurers buy, build, or reuse the components they need to support their business capabilities? This decision varies with the business model and plays a critical role in shaping the insurer’s strategic path, with each option presenting its own set of tradeoffs.

In general, the decision to buy is preferable when speed to market is critical and existing solutions provide the necessary functionality without significant customization. This approach reduces time and resource investments; however, it may come with tradeoffs in flexibility, customization, and control.

Opting to build is most suitable when a company requires a highly customized solution tailored to specific operating needs. This route offers the greatest flexibility and potential for differentiation in the market. But building solutions in-house can require significant time, resources, and technical expertise, shifting the IT organization’s focus toward talent retention.

Alternatively, reusing existing assets—such as established APIs, modular platforms, and proven components—can strike a good balance among cost, speed, and customization.

The Right Vendor

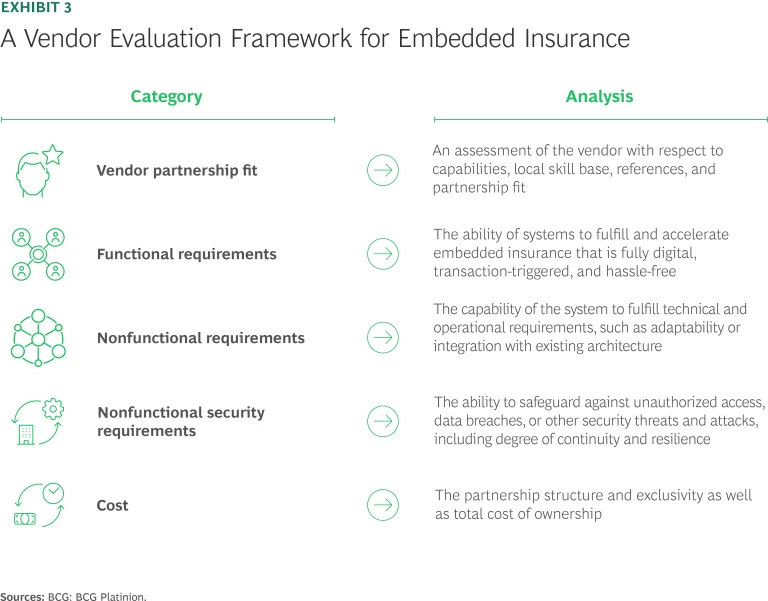

Vendor selection is a crucial factor in realizing a scalable, effective, embedded-insurance offering. When assessing potential collaborators, whether for embedded solutions or standalone elements, insurers can apply a structured evaluation framework to help ensure that the vendors they select align with their strategic and operational needs. Key evaluation criteria include fit with the insurer, functional and nonfunctional requirements, and cost considerations. (See Exhibit 3.)

Vendors typically excel in some areas and fall short in others. In addition, there is often a tradeoff between choosing a best-of-breed solution that offers top performance in specific areas and selecting a more cost-effective option that meets essential requirements without excelling across all dimensions. Insurers should prioritize the criteria that best align with their long-term vision and product strategy while supporting current operations and long-term goals.

A Transformative Opportunity

By integrating insurance directly into the purchasing journey, insurers can enhance the customer experience, streamline operations, enhance margins, and become more flexible and dynamic. We recommend they take the following steps:

- Reevaluate existing distribution channels, identifying opportunities to create embedded partnerships that work seamlessly across digital ecosystems.

- Invest in scalable technology that enables real-time underwriting, automated claims processing, and hyper-personalized offerings tailored to customer behavior.

- Prioritize strategic collaborations with high-volume partners to maximize their reach and optimize unit economics.

- Foster a culture of agility—continually refining product structures, renegotiating contracts, and leveraging data-driven insights to enhance margins and customer engagement.

The future of insurance lies in seamless integration—insurers that take bold steps today will lead the industry tomorrow.