The energy transition is reshaping the global energy landscape at unprecedented scale and pace—and despite signs of decelerating effort in some geographies and countries, the global impact of the movement on market participants is significant.

Energy companies, including oil and gas players and utilities that explore, develop, produce and distribute the energy that powers everyday life, are at the forefront of this new reality. These pivotal stakeholders must transform their portfolios, operations, and administration in support of a sustainable transition toward a net zero carbon future. To fund the journey, most players must attract and deploy capital investments at an unprecedented scale.

Several external factors make the effort even more challenging, including tightening environmental, social, and governance (ESG) and energy-related regulations, cost inflation, divided investor expectations, and the volatile geopolitical and regulatory landscape.

Chief financial officers (CFOs) and their finance teams play a key role in guiding their companies through a financially sustainable, value-enhancing energy transition. They must bring a rigorous, long-term value perspective to the critical strategic and tactical decision making that will drive performance and ensure the resilience needed if their companies are to navigate the transition successfully.

In this article, we examine how energy CFOs and their teams can best support their companies in meeting the challenges of the energy transition.

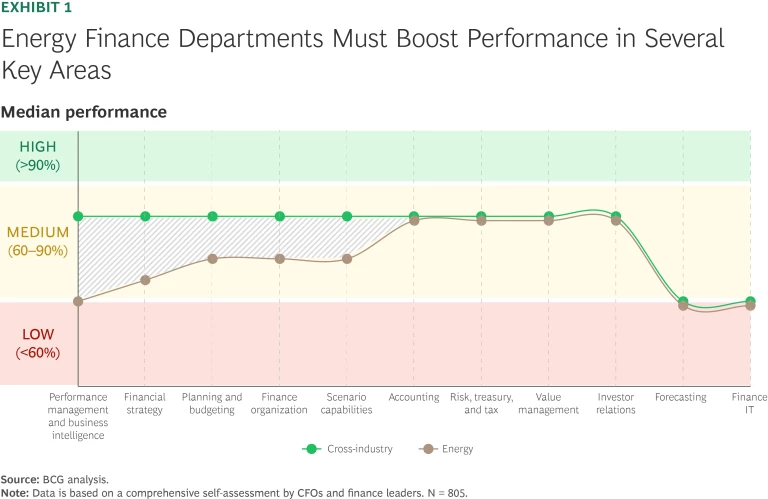

Many CFOs in the energy sector have already embarked on a journey to evolve the role of the finance function. But change needs to happen even faster. Recent data collected from BCG’s CFO Excellence Panel shows that the finance functions in many energy companies are trailing their peers in other industries in both efficiency and effectiveness. Gaps are emerging in capabilities that are essential to effectively manage capital spending and to optimize operational and regulatory performance. (See Exhibit 1.) In short, many energy finance functions are not yet ready to meet the increasing requirements of the energy transition.

To address this shortfall, energy CFOs and their teams should pursue three imperatives that will help shape their companies’ efforts and future-proof the finance support their companies need:

- Shape the strategic transformation with a value lens.

- Drive performance and bolster resilience.

- Aspire to top-level finance function performance.

Shape the Strategic Transition with a Value Lens

CFOs and their finance teams should play a key role in setting a financially balanced and sustainable course for their company through the energy transition. To do so, they must excel in three dimensions.

Dynamic Capital Allocation and Efficiency

As energy companies face unprecedented investment needs, their ability to prioritize, finance, and extract value from capital investments will become a critical factor in their success, particularly given the past few years of tightened monetary policies and increased competition for financing. In the context of new business models, divergent timelines, cost inflation, and a tightening regulatory environment, CFOs and their teams must emphasize flexibility in adapting how they manage spending in conjunction with the business. Several winning moves have emerged:

- Enhanced Portfolio Transparency. Establish a data-driven view of current and future projects, supported by next-generation planning solutions that facilitate dynamic perspectives and aid consistent data capture, to support optimal prioritization of capital allocation decisions.

- Rigorous Prioritization Logic. Using consistent criteria, introduce a “single currency” scoring and prioritization logic that goes beyond spending and financial returns. To provide a strong foundation for tradeoff decisions, a differentiated scoring system should consider various internal and external factors such as the risk profile, ESG, and regulations. Leaders in this area employ algorithms that iteratively optimize the investment plan in line with clear financial and operational constraints.

- Directive Budgetary Envelopes. Provide the business with clear budgetary envelopes that permit dynamic prioritization of investments at a faster pace, both annually and throughout the investment cycle, while ensuring strategic alignment at the portfolio level.

- New Processes and Ways of Working. Drive fundamental behavioral change that embraces the new approach and promotes the new transparency in day-to-day decision making. In many organizations, taking this action may entail adopting a more disciplined approach to articulating and updating plans and clearly framing and tracking the outcomes.

Subscribe to Our Corporate Finance and Strategy E-Alert.

In practice, we have found that the last move noted above is particularly challenging for organizations. It can account for as much as 70% of the change effort and can be a crucial factor in determining the success of the other improvements.

Transformative Equity Story

Expectations from the investment community have increased significantly in recent years. In response, CFOs and their teams need to take the lead in crafting a robust investment thesis that caters to the interests of both traditional and sustainability-focused investors, driving shareholder return by blending a commitment to traditional profit pools with realistic and inspiring decarbonization initiatives.

The proper balance point between these two ends of the strategic continuum will vary from company to company. In any case, however, CFOs should strengthen their investment thesis along several dimensions:

- Define an anchoring vision that outlines the strategic direction and frames a high-level investment thesis.

- Actively communicate efforts to transform the business through full-potential plans that balance shorter-term return expectations, such as return on average capital employed and return on investment, with longer-term decarbonization efforts.

- Expand the set of performance metrics for tracking and communicating commitment to and progress in innovation and sustainability. Investors want clear proof that companies can live up to their promises, especially in high-uncertainty emerging markets such as hydrogen.

- Emphasize transparency in identifying long-term capital needs, anticipated bottlenecks in funding and their impact on financial leverage, and plans for innovative new sources of funding.

- Affirm and demonstrate commitment to safeguarding dividend payouts and share buybacks.

- Highlight progress of flagship projects in renewable and low-carbon energy sources, such as cost curve improvement and project-level profitability, to demonstrate their economic viability and long-term potential.

- Clearly articulate key risks and mitigation plans, including technological and regulatory uncertainty.

Companies should be prepared to provide objective evidence of progress, including detailed plans for transforming their traditional businesses, realistic timelines for investments in low- and no-carbon assets, and certainty around M&A efforts in strategic growth fields such as green technologies.

Advanced M&A, Integration, and Partnering Capabilities

The energy transition is spurring M&A activity around the world. Key drivers include acquisition of renewables, new infrastructure, green tech, upstream and downstream operations, and

carve-outs.

CFOs and their teams should be engaged in this process from end to end, and should build various capabilities to effectively support it:

- Sourcing, Assessing, and Executing on Deals. As part of the due diligence process, finance functions can help determine the strategic fit of each potential deal, providing financial analysis of the potential synergies and ensuring that all resulting deals are well structured and well financed. Advanced modeling capabilities can ensure alignment of M&A activities with the company’s long-term financial and sustainability objectives and plans.

- Postmerger Integration (PMI). Finance teams should build the capabilities needed to take a leading role in planning and executing value-accretive PMI efforts. These capabilities include helping mobilize discrete but consistently managed PMI transformation programs, led by a strong PMI office. The finance team should be responsible for identifying and prioritizing the value levers on which the deal’s success will depend and should push for actions that will create value quickly. Often it is the finance team that needs to ensure that value levers are realized in the long run, even as companies make progress in integration and return to “business as usual.” At the same time, the finance team needs to pursue integration of the target company’s own finance function along a clear roadmap, prioritizing operating model, process, and systems integration.

- Effective Postdivestiture Cost Management. The finance function must actively manage any potentially negative fallout from divestitures. For example, it must identify and dispose of stranded costs, such as the cost of software licenses or IT infrastructure that are no longer needed. This is not necessarily a one-off effort. Transition service agreements may extend the lifespan of underlying cost drivers significantly beyond completion of the divestiture. Finance leaders should prevent slippage by continuously monitoring costs and by ensuring effective cost tracking and reporting. They must also develop budgets that anticipate such effects and drive accountability to avoid long-term stranded costs, thereby safeguarding value delivery.

Drive Performance and Bolster Resilience

The energy transition requires CFOs and their teams to step up their role as true “custodians of performance and resilience.” However, times have moved on from a one-dimensional view of what this means. Finance leaders now need to integrate across many dimensions of performance, including financial and regulatory, sustainability, and societal impact. Strengths in three areas in particular are crucial: enhanced decision support and full partnering with the business; dynamic planning and forecasting; and balance sheet optimization.

Enhanced Decision Support and Full Partnering with the Business

Financial steering requirements are increasing rapidly in the context of the energy transition, driven by several factors. The market and macroeconomic environment in which energy companies operate is becoming more volatile, which makes planning, budgeting, and forecasting far more difficult. Moreover, companies face greater complexity, owing to the expansion of metrics that need to be optimized (such as ESG), increasingly complicated regulatory schemes, and more heterogeneous business portfolios, value drivers, and time horizons for investments.

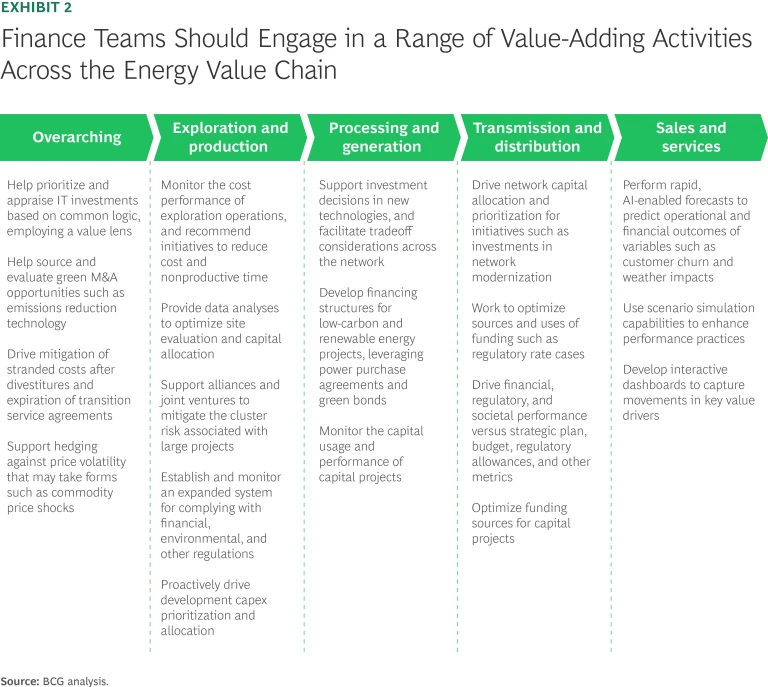

To address these proliferating requirements, energy companies must use a business-centric lens to focus their finance decision support. This means, first, understanding key decision points and value drivers along the value chain, and, second, critically assessing where finance can and should drive value. (See Exhibit 2.)

On the tactical level, CFOs and their teams should expand their performance frameworks and key performance indicators (KPIs) to reflect the new priorities, including ESG, and introduce distinct approaches to managing the performance of new business models such as low-carbon energy sources. They should also tie personal incentives and accountability to the new KPIs and establish new routines to cement new ways of working. Once the proper foundation is in place, they should selectively build new services in support of the business, including regulatory modeling and reporting and ad-hoc simulation of the impact of external shocks on budgets and carbon allowances.

CFOs also need to find ways to bring their finance teams closer to teams in the field. One simple yet effective measure that leading companies have employed is work shadowing. By pairing finance professionals with colleagues from the field force and having them work side-by-side for a few days, the finance team can gain a better understanding of the daily decisions and value drivers that are at stake in the energy transition.

Dynamic Planning and Forecasting

Enhanced financial planning and forecasting has the potential to unlock new levels of decision support and relieve energy companies of resource-intensive and often slow processes. Here, too, a business-centric approach to the process and tools used is key to the effort, as is a relentless focus on business support and value generation. Business centricity requires teams to invest significantly in understanding the business’s needs, including the decision-making process, the relevant value drivers, and the required level of granularity.

To this end, companies should consider redesigning the planning and forecasting process from the ground up—an initiative where Beyond Budgeting tools can help. Using tools such as value-driver trees to identify which elements of the business are creating value can help companies capture the specifics of both traditional businesses and new, low-carbon businesses. Developing scenario-planning and stress-testing capabilities can help companies plan for uncertainty and volatility in the course of the energy transition, as can shifting to driver- or activity-based planning.

Leaders in this space deploy predictive analytics to augment the forecasting process, enhancing their ability to spot market trends such as retail customer churn at an early stage. Finance teams can also roll out various self-service applications for the company’s business users, with drill-down capabilities into areas such as opex drivers.

Integrated tool suites that incorporate planning, forecasting, and reporting will be crucial to supporting the planning process, as will complete, accurate data. Companies should be understand, map out, and address data sources and associated risks early in the process to de-risk costly software implementations.

Balance Sheet Optimization

Responding to the energy transition and the current volatile economic climate will likely entail significantly adjusting energy companies’ portfolios—and that in turn will put pressure on their balance sheets. To boost

balance sheet resilience,

CFOs and their teams should consider the following levers:

- Working Capital. Enhance receivables, payables, and inventory management to preserve headroom for low- and no-carbon investments. For example, AI-enabled tools, can help to predict likely overdue accounts.

- Cash and Liquidity. Improve cash planning and forecasting to avoid liquidity bottlenecks that might result from investments with inherently challenging cash flow profiles.

- Fixed Assets. Deploy rigorous capital prioritization at the project level, using a multidimensional lens that includes financial metrics, strategic considerations, and long-term value potential.

- Capital Structure. Safeguard dividends and buybacks by optimizing and simplifying the company’s capital structure—for example, through enhanced management of the weighted average cost of capital.

- Financing. Deploy traditional and new means of funding—such as hybrid financing and green bonds—to appeal to new investor groups, and optimize the financing mix to bolster credit ratings.

- Partnerships. Consider co-developing and sharing businesses and projects with partners, and investigate alternative business and partnership models such as minority shareholdings and develop-to-flip business models for renewable wind projects.

- Risk Management. Develop strategies to mitigate any financial risks associated with the transition to renewables businesses, such as higher financing costs.

By employing a differentiated approach that reflects the dynamics of the energy transition and by partnering closely with the business along these drivers, finance teams can have a sustained impact on the company’s financial performance, ultimately freeing up cash to fund the transition.

Aspire to Top-Level Finance Function Performance

An efficient and effective finance function can be the backbone of the CFO’s role in the energy transition, leading to stronger financial decision making, a lower finance function expenses, and better regulatory compliance. To achieve this, leading CFOs and their teams are improving finance operations, partnering between finance and the business, and advancing centers of excellence for tax, treasury, audit, and investor relations in three priority areas.

Digital and AI Enablement

Enterprise resource planning (ERP) system upgrades still dominate the digital roadmaps of many energy companies, but the potential of predictive AI and generative AI (GenAI) has been front of mind for energy CFOs over the past twelve months. Although these technologies are nascent in most finance functions, we expect to see a gradual shift from experimenting with individual use cases toward a “string of pearls” approach to drive efficiency and effectiveness within the complex finance systems landscape.

Improving the end-to-end performance of the finance function’s processes, involves viewing the function’s technology mix through an integrated lens, combining ERP, best-of-breed applications, and predictive and GenAI solutions. These technology improvements must be accompanied by changes in the operating model, including processes, organizational models, and ways of working.

Against this backdrop, finance leaders across the industry are modernizing their systems landscape by taking action in several key areas:

- Carrying out large-scale ERP upgrades

- Deploying best-of-breed applications to augment the existing ERP suite

- Rolling out planning, forecasting, and reporting suites, including process optimization

- Evaluating existing ERP and wider tech roadmaps to ensure a pipeline of well-integrated AI capabilities

- Implementing predictive and GenAI pilots

- Building data lakes to consolidate performance data across data assets

Common pitfalls confronting IT projects in finance include too narrow a focus on backward compatibility in trying to replicate legacy processes; lack of business centricity and a clear understanding of users’ requirements; inconsistent attention due to distractions and overburdened teams; and unexpected bottlenecks resulting from issues with data complexity, availability, accuracy, and reliability.

End-to-End Process Excellence

End-to-end process performance remains an evergreen topic in the handbook of finance function excellence. More than ever, however, companies need to take a systematic approach to boosting process performance, employing a mix of levers.

First, leading companies have fully institutionalized the process view by putting global process owners in charge of overseeing end-to-end process performance and aligning the organization accordingly.

Second, they act decisively to reduce complexity in major processes. These efforts include simplifying underlying data structures and operating procedures—including the financial chart of accounts and approaches to allocating costs—and pulling active demand management levers, such as replacing bespoke reports with self-service dashboards and limiting manual commentary by introducing value materiality thresholds.

Third, well-established optimization levers, such as the use of shared service centers, continue to play a critical role in finance leaders' transformation agendas. Notably, the strategic use of shared service centers for the finance team is rapidly shifting from a pure “cost play” to a “talent and value play,” with key participants exploring opportunities to optimize their outsourcing and offshoring strategies.

New Talent and New Capabilities

The finance team’s skill requirements are shifting quickly, prompting changes in hiring profiles across the energy industry. CFOs should build their teams’ capabilities and individual skills systematically in a data-driven finance landscape. The range of capabilities needed will certainly widen, demanding differentiating expertise across the finance function. Already they include a number of capabilities:

- A deep understanding of underlying business processes

- Regulatory acumen and modeling prowess

- End-to-end process engineering and automation knowledge

- Deep expertise in sourcing, manipulating, analyzing, and reporting financial data

- Specific content know-how in areas such as ESG, tax issues, and International Financial Reporting Standards

To close emerging gaps in their capability mix, finance teams should lay out needed capabilities and conduct gap analyses to identify major priorities. For example, one utility company recently decided to build a ring-fenced regulatory team in response to upcoming regulatory changes, facilitating effective capability building through a carefully targeted effort.

Across the energy industry, CFOs and their teams are embarking on transformative journeys to future-proof the finance function for the energy transition. Their success will depend on their ability to channel resources and take a targeted approach to identifying and filling any performance gaps quickly, based on a clear understanding of the status quo, applying both a finance lens and a business lens. Filling these gaps is essential if energy companies’ finance functions are to help lead the transition toward net zero while focusing relentlessly on value generation and business impact.