Countervailing winds of change are a constant in the biopharma industry, and they are picking up speed. Novel treatments based on innovative science and new modalities are emerging faster than ever. Intensifying competition, payer pressures, and a steep patent cliff are testing the economic viability of biopharma’s business model . More than ever, biopharma is a high-stakes business, fraught with risks. But it also remains capable of delivering life-changing benefits to patients worldwide.

There are a couple of reasons why any management team can look to an uncertain future with confidence. First, this is a unique moment. An unprecedented level of knowledge about human biology is converging with the rise of novel therapeutic modalities to enable the development of transformative and potentially curative treatments. Second, technologies such as artificial intelligence (AI) and advanced translational models are poised to accelerate drug discovery and development.

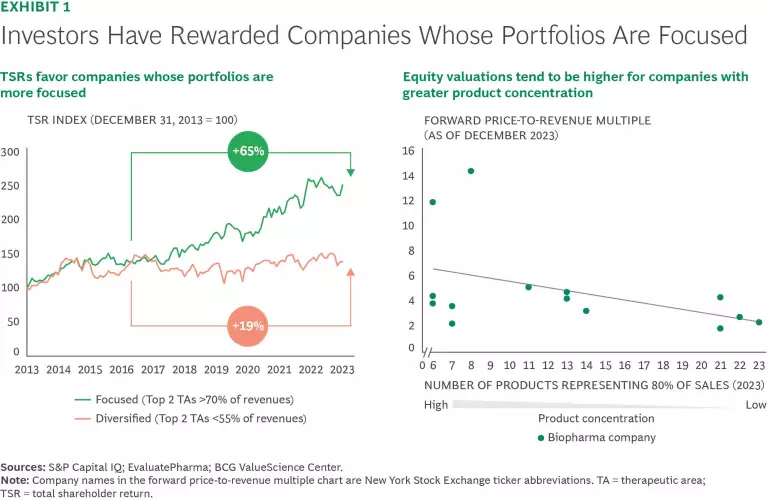

In this context, focus and leadership matter. Our research shows that over the past decade, companies that derive 70% or more of revenues from a subset of therapeutic areas (TAs) have seen a 65% increase in total shareholder return (TSR), compared with only 19% for more diversified firms. (See Exhibit 1.) These companies often hold a leadership position in select TAs, anchored by a few blockbuster assets and a positive flywheel effect, deriving meaningful expertise, cost, and relationship benefits from their scale. In light of this, we believe that concentrating R&D and commercialization resources and expertise on areas of core strength is the most effective way to cut through complexity, de-risk investments, and deliver results for patients and shareholders alike. The companies that thrive will build leadership in their core areas to drive innovation and efficiency while accelerating speed and agility. By establishing deep connections with stakeholders, they can also more effectively shape the health care ecosystem and payment models to maximize patient access to innovative treatments. All of this needs to be balanced with a certain amount of flexibility to periodically replenish and diversify into other TA or disease areas where there is potential to establish future leadership, by capturing opportunities in new areas of emerging science.

Here’s our take on how biopharma companies can navigate and thrive amid the industry’s complexities.

Identify Strengths and Opportunities

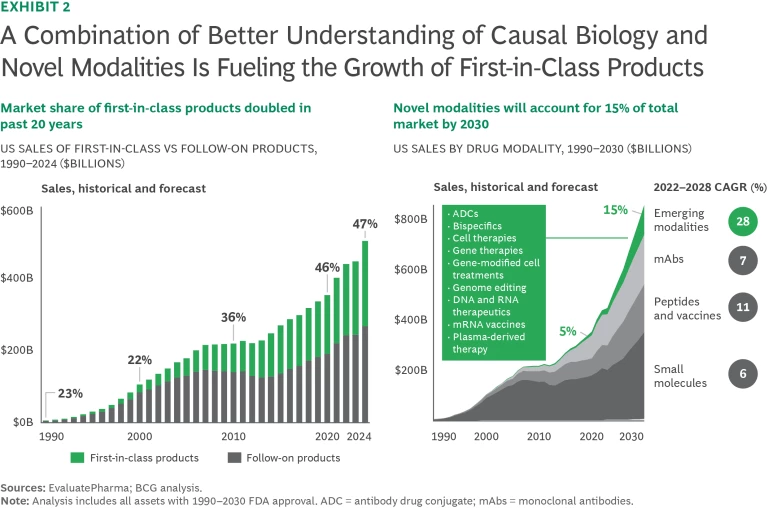

Scientific understanding of the biological drivers of disease, combined with the ability to influence human biology, has never been greater. Looking ahead, we expect new development to accelerate, delivering a wave of breakthrough drugs that will transform the treatment of diseases with significant unmet need. Momentum will be fueled by a surge in the identification of more compelling biological targets and the expansion of therapeutic modalities that enable modulation of both newly discovered and historically undruggable targets. Examples of current new treatments include gene therapies for spinal muscular atrophy, hemophilia A, sickle cell disease, and CAR-T therapies for multiple myeloma. Already, the market share of first-in-class products has risen from 20% in 2000 to 50% today. We estimate that some 15% of the market in 2030 will consist of novel modalities versus only about 5% in 2020. (See Exhibit 2.)

In this context, biopharma companies must focus strategically on therapeutic areas (TAs) where they have both deep insight into the underlying disease biology and differentiated capabilities. To maximize R&D impact, companies should target a wide range of mechanisms within core TAs, balancing smaller and larger bets. Concentrated investments in R&D and commercialization can optimize ROI from core TAs and technology platforms, reducing selling, general, and administrative costs and ensuring that the company directs resources toward high-potential areas with measurable outcomes. By leveraging a combination of internal expertise and external innovation, the company can deploy an array of modalities to address underlying causal biology without overstretching internal resources. Global markets, such as China, present other opportunities for innovation and commercialization, but they require companies to navigate additional complexity. (See the sidebar, “The Opportunities and Challenges of China.”)

The Opportunities and Challenges of China

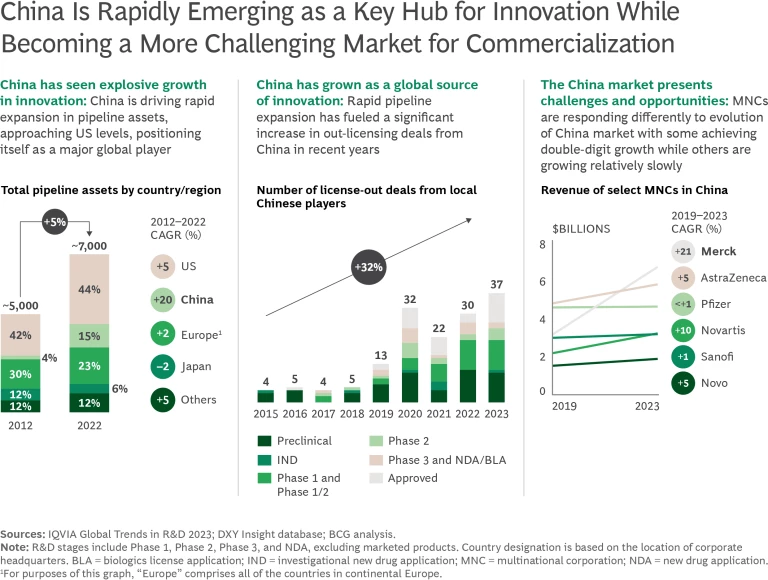

While traditional Chinese pharma companies focus on fast-follower strategies, local biotech startups are increasingly pioneering competitive or potentially superior treatments as well as first-in-class therapies. They are also expanding globally through strategic partnerships. Successful collaborations, such as Merck's partnership with Kelun-Biotech and Janssen’s with Legend Biotech, highlight the growing potential for sourcing innovation from China.

At the same time, commercialization in China is becoming more complex for multinational companies. Challenges arise from complex regulatory processes, IP risks, pricing pressure, and geopolitical tensions, the last exemplified by the US’s proposed BIOSECURE Act, which “prohibits entities that receive federal funds from using biotechnology that is from a company associated with a foreign adversary.” Local competition and operational complexities within China’s health care system further intensify these challenges.

Still, global pharma companies should regard China as a source of innovation and explore creative structures beyond traditional in-licensing and partnership models. The rise of larger innovation players in China also creates commercialization challenges for multinational companies, posing strategic questions about how best to serve the Chinese market. One thing is clear: no large multinational pharma company can afford to ignore China, given its increasing importance as a source of innovation and its potential as a market. To maximize its opportunities, however, each company will need a coherent strategy aligned with its global goals and context.

As the treatment paradigm shifts from symptom management to disease modification—and even to cures—thoughtful planning on issues of reimbursement and patient access is critical to achieve desirable patient impact. For example, while some curative gene therapies, such as Zolgensma and Luxturna, have seen commercial success, others have struggled despite positive clinical outcomes and a positive review from the Institute for Clinical and Economic Review. Barriers include concerns about treatment durability and reimbursement structures, given the one-time up-front payment involved. To succeed, biopharma companies must work with payers, providers, policymakers, and patient advocates to create flexible payment models (such as pay-over-time or outcome-based agreements) and invest in infrastructure to track outcomes and streamline treatment delivery.

Invest in New Tools

Technological advances, most notably AI and new translational models, will accelerate drug discovery in coming years.

AI’s Rising Impact. The ability of AI to analyze vast data sets quickly, screen compounds, and design potential drug candidates could help shorten timelines and reduce the cost of preclinical activities, giving companies with strong AI capabilities an edge over those using traditional methods.

AI-driven approaches have shown initial promise, with reported Phase 1 success rates greater than 85% in some cases. In addition, modeled scenarios suggest that AI could reduce preclinical discovery time by 30% to 50% and lower costs by 25% to 50%. Despite this promise, however, traditional pharma and biotech companies have been slow to adopt AI. More than 40% of them have yet to incorporate AI materially into their drug discovery processes.

In contrast, AI-first biotech startups are building therapeutic pipelines more quickly, especially in data-rich, commercially viable TAs such as oncology. Although these early pipelines, which are largely focused on small molecules, are expanding, it remains to be seen whether AI-driven discoveries will consistently outperform traditional approaches, particularly with regard to late-stage success rates, where the data is still immature (and highly anticipated). If AI is to truly transform drug discovery, companies must refine their AI strategies, adapt their operating models, and upskill their workforce to harness its full potential over the long term.

New Translational Models. New translational models can be a game changer in preclinical validation. Our research indicates that the availability of a good translational model has often been the factor that unleashes a company’s ability to innovate and make progress in combating a disease. One example is the history of developing a cure for hepatitis C. By 1993, researchers had identified viral targets that were accessible to small molecules. But despite repeated efforts, development proved fruitless until the discovery in 1999 of the replicon model, which resulted in the successful development of direct-acting antivirals that specifically target hepatitis C. Today, cure rates for chronic hepatitis C have reached 90%.

Many traditional models based on animals or biochemical assays have a low concordance with actual human disease biology, particularly in neuroscience. Advances in translational models, such as organoids and organ-on-a-chip technologies, could transform preclinical drug development by providing more human-relevant models of disease. These models aim to replicate tissue and organ functions more accurately, improving the predictive power of preclinical testing. By identifying ineffective compounds earlier, they could help reduce late-stage failures and accelerate the path to clinical trials.

There has been an 11-fold increase in publications referencing organoid-adjacent translational models from 2014 to 2024, evidence of rapidly growing research activity. Despite the interest, however, much of the investment in recent years has focused on developing novel therapeutic modalities rather than fully advancing translational models into mainstream R&D processes. Although regulatory agencies are beginning to recognize the potential of these innovations, further clinical validation is necessary.

Sectorwide collaboration is essential to advance this crucial yet underdeveloped segment of the drug research and development value chain and unlock its full potential. Pharma companies, regulatory agencies, investors, and academia all must commit more resources to developing these models and integrating them into R&D workflows. Even modest improvements in predictive value during preclinical development can significantly boost overall productivity.

Subscribe to our Biopharma E-Alert.

Deliver a Differentiated Experience to the Full Ecosystem

As the clinical differentiation between products shrinks, pharma needs to focus on delivering an exceptional customer experience for the full ecosystem of stakeholders throughout the treatment journey. All field teams share this responsibility. Field medical teams should transition from simply gathering insights to becoming true thought partners with providers, willing to challenge perceptions that run counter to what the data shows. Reps and field reimbursement specialists must deliver an exceptional prescribing experience for providers, their staff, and patients, making treatment initiation as seamless as possible. Pharma companies should seek to engage with provider institutions on above-brand topics such as partnering to conduct real-world studies, optimizing care pathways, providing education for all stakeholders, and engaging in highly targeted contracting. Such tactics will help position pharma companies as partners in caring for patients and unlock downstream access for their field teams.

Navigate Revenue and Cost Pressures

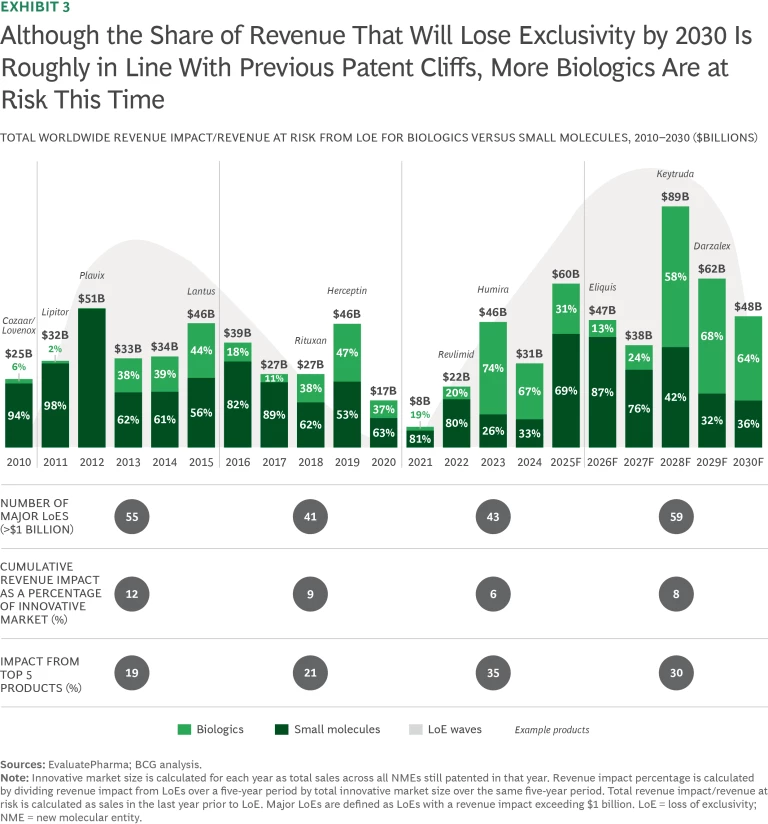

Pharma is fast approaching a steep patent cliff, as drugs representing some $350 billion in annual worldwide revenues will lose their exclusivity through 2030. The top 20 pharma companies account for 80% of this revenue loss. Although the percentage of cumulative branded drug revenue at risk appears similar to that in the most recent previous major wave of loss of exclusivity (LoE)—8% for the period from 2026 to 2030 compared with 12% from 2010 to 2015—there are at least two major differences this time. (See Exhibit 3.)

First, as many biologics face LoE, the rise of biosimilars is adding competitive pressure, particularly in the US, where biosimilar adoption has been slower but is now accelerating, and branded companies can no longer rely on long tails of post-LoE revenue retention. Second, pricing tailwinds in the US were crucial to overcoming the last period of LoE. Similar price increases are unlikely today, and the Inflation Reduction Act, passed during the Biden Administration, puts additional pressure on future revenue streams by shortening the exclusivity period for many drugs.

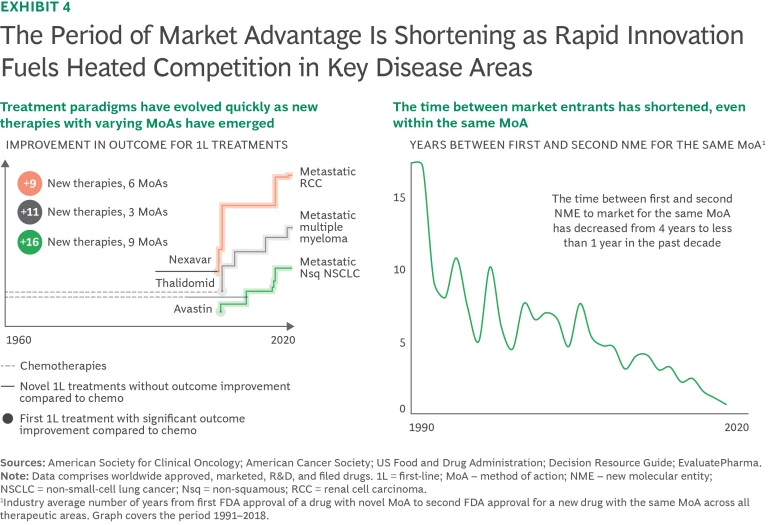

Compounding the revenue pressures from LoE, the period of market advantage for new drugs is shortening as rapid innovation fuels heated competition in key disease areas. (See Exhibit 4.) Treatment paradigms are evolving quickly as new therapies with varying mechanisms of action (MoAs) come to market in rapid succession. Examples include treatments for metastatic multiple myeloma, metastatic renal cell carcinoma, metastatic non-squamous non-small-cell lung cancer, and psoriasis.

In addition, the amount of time between new entrants coming to market within the same MoA is shortening: the typical span between FDA approval of the first and second new molecular entity with the same MoA dropped from about eight years in the early 2000s to less than one year in 2020. As a result, the leading product's average market share in each class has declined from about 90% to about 70% over the past three decades. In essence, speed of innovation is outpacing the traditional product life cycle for many disease treatments. These developments are forcing companies to rethink innovation models, commercial strategies, life-cycle planning, and business development. To maintain market leadership, individual companies must accelerate life-cycle management, next-generation therapies, and combination treatments.

Historically, pharma companies have responded to revenue and cost pressures by adopting merger and consolidation strategies. During the last major wave of LoE, Pfizer and Merck & Co. both pursued megamergers (with Wyeth and Schering-Plough, respectively) while Bristol Myers Squibb engaged in a “string of pearls” strategy that focused on acquiring smaller and medium-size players and forming strategic partnerships.

Although there currently is sufficient growth in the market to replenish LoE revenue losses, the sources of this growth are primarily concentrated in a combination of the top 20 pharma companies (where consolidation would require a megamerger that might attract government scrutiny) and a long tail of more than 100 smaller companies with revenues of $3 billion or less. The highly competitive industry environment may drive companies to pursue multiple smaller to medium-size acquisitions. The magnitude of the coming LoE impact on revenue will shape M&A strategy and feasibility for each individual company, and the change in US presidential administrations could affect the regulatory outlook for M&A.

Finally, as we argue in an upcoming paper on margin pressures, top companies will need to take a strong, structural approach to costs. In recent years the percentage of companies with eroding margins has steadily risen. For winners over the next decade, effective cost control will be a source of advantage.

Pharma has dealt with the challenges of change before—many times. The revenue pressures may be more powerful, but the opportunities, especially for transformative treatments and cures, are bigger than ever before. By focusing their resources and efforts on the TAs where they have the greatest strength, the clearest distinguishing capabilities, and the strongest strategies, pharma companies can approach a fast-changing future with confidence.