Continued growth has become a challenge for insurers. This is especially true for those that operate in mature markets and traditional lines of business such as home, motor, travel, or life insurance. There are numerous players, and the customer base has largely been penetrated. Moreover, it’s not easy to establish differentiation in a highly regulated market. The insurance industry is meant to be secure, consistent, and relatively uniform from year to year. Insurance products don’t see many changes in fashion.

We have found that the best way for insurers to build market share in this climate is through a customer-centric approach that tailors offerings, value propositions, and go-to-market strategies to specific customer needs and personal preferences. Greater personalization can boost cross-selling by as much as 20% and in some instances has helped double customer retention and triple conversion rates.

Ideally, insurers would provide a customized experience for every individual client. This is an achievable goal in the long run, and in the coming years technologies such as generative AI (GenAI) will help make it easier than ever to offer customized data, content, and interactions. However, insurers can begin developing innovative customer-focused strategies now, with the human intelligence they already have. Even with GenAI in place, a human understanding of customers will be essential to providing deeper personalization.

Even with GenAI in place, a human understanding of customers will be essential to providing deeper personalization.

Insurers already know their customers. They have pools of data that they use to assess risk and determine premiums. And insurance agents learn a great deal about their customers’ interests through both formal transactions and informal conversations. This data can be a starting point for developing a more personalized approach to selling and servicing policies.

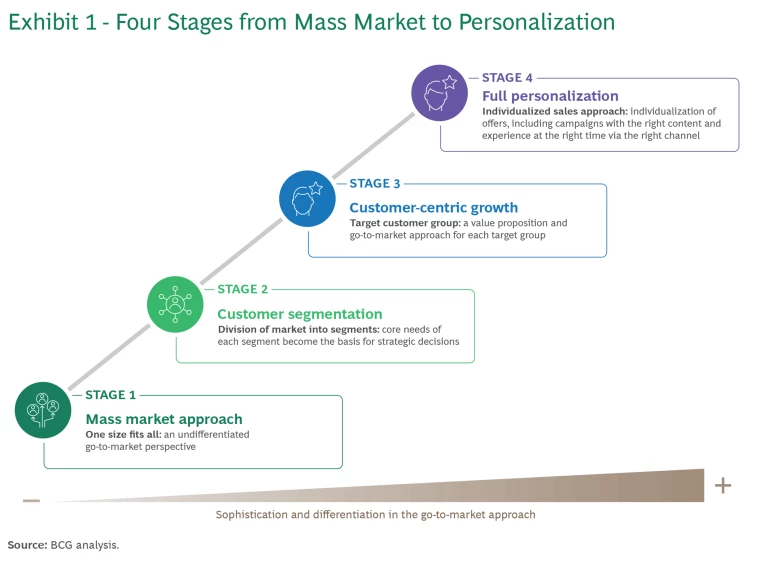

We have developed a roadmap to help insurers move from the traditional service model toward full personalization and organized it into four stages. (See Exhibit 1.) For most of its existence, the industry has been at the first stage: the mass market approach. This is a one-size-fits all perspective in which there is little or no differentiation in product or service offerings. However, to gain additional market share, it is becoming essential that insurers evolve to stages two (customer segmentation) and three (customer-centric growth) and eventually move toward the fourth stage (full personalization). That means dividing existing and potential customers into strategic segments and targeting each group with a unique value proposition and go-to-market plan.

Three Steps to Customer-Centric Growth

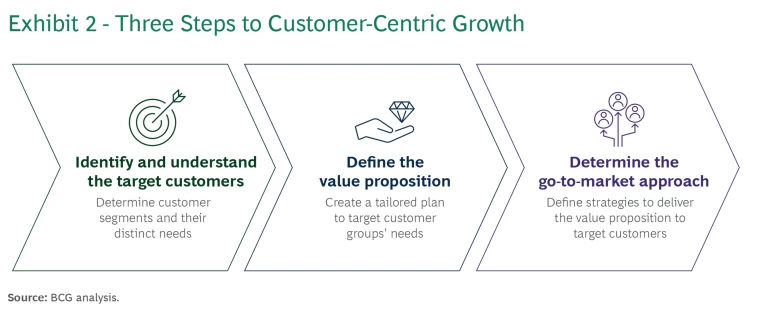

Insurers should be bold and innovative in building a customer-centric strategy. To do that, we recommend that they take three steps. First, identify the target customers by dividing the market into several groups and work to understand their needs. Second, create an operational plan for each group to determine the value proposition that will appeal to those customers. Third, decide on a go-to-market strategy that will deliver the value proposition. (See Exhibit 2).

Identify and Understand the Target Customers

The customer data that insurers already have can help them develop a set of target groups based on strategically aligned criteria such as sociodemographic factors or age. For example, an insurer might divide its customer base into familiar and easily identifiable generational segments such as Gen-Z, Millennials, Gen-X, and Baby Boomers.

Within each generation, there are of course many factors that distinguish one customer from another. To begin breaking the information down further, each generational segment can be divided by such factors as geography, income, and education level.

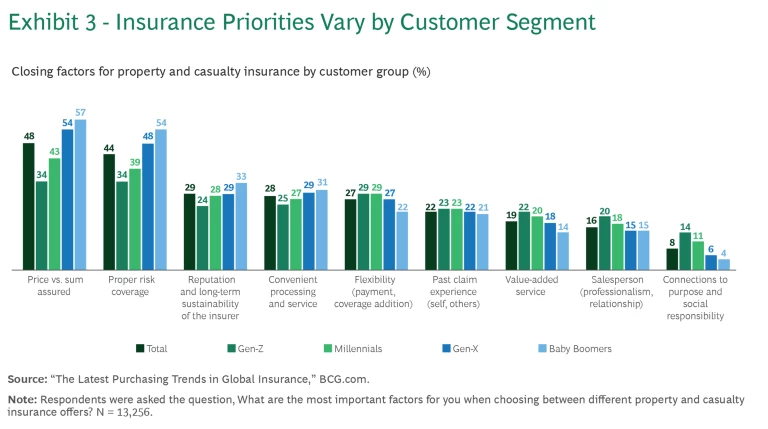

While the data about a customer’s demographic factors creates a base, it is also important to categorize customers with a focus on their core needs when it comes to insurance. For example, in a 2023 BCG study of purchasing trends, we found that when customers weighed one property and casualty policy against another, the importance of factors such as price, risk coverage, and reputation of the firm varied significantly by age. (See Exhibit 3.)

The study found that older customers—Gen-X and Baby Boomers—were the most sensitive to standard concerns like the price of the policy and the risk coverage. Gen-Z customers, on the other hand, were highly purpose driven and cared more than previous generations about buying products that offer a social component.

Insurance providers should draw on their knowledge of customers and what motivates their purchasing decisions to determine which target groups the organization should prioritize. Those decisions should be based on strategic key criteria such as the potential growth for the market in question, the existing penetration, and the fit with the company’s overall positioning.

From there, dig further for information about such factors as lifestyle, preferred marketing and communication channels, and insurance concerns. This research will help create the value proposition and go-to-market strategy for the target group.

We worked with a client on developing a plan to reach young adults in one European country and found a number of ways to build value and loyalty among customers who were considering insurance purchases for the first time in their lives. (See the sidebar “Targeting the Gen-Z Market.”)

Targeting the Gen-Z Market

Through a market survey, we found that most of the Gen-Z age bracket had a fairly low level of understanding when it came to insurance products. The information they had came largely from their parents and digital channels. Despite their digital savviness, however, Gen-Z customers expressed a preference for buying insurance policies face-to-face, because they felt they needed personal guidance and advice with their purchases.

Social concerns were highly relevant, and value-added services such as connecting the policy to a purposeful cause were more important to most Gen-Z customers than the actual insurance product itself. Leisure activities accounted for a high share of their spending, so an entertainment tie-in was another possible way to add value.

The insurer came up with a unique idea for adding value to its home insurance products. Most of the cities in this particular country have excellent public transportation, so the insurer created a bundled deal in which a Gen-Z customer receives a subscription that allows them to ride buses or trains for free at night. The offer helps lower the safety risks that come with a young person driving after dark, while also addressing Gen-Z concerns about carbon footprint.

Define the Value Proposition

The key factors for competing on value proposition are offering, price, and service level. An insurer might offer discounts for first-time buyers or for customers with multiple products. To add value to the service component, there could be a white-glove amenities package for those who buy premium coverage or with a certain number of policies.

Think in terms of new approaches, including bundling insurance products with non-industry services. While it is fairly common for insurers to offer some financial advisory services, we are now seeing offerings that go so far as to tie in with media platform subscriptions, transportation authorities, or nonprofits to appeal to certain customer groups.

One straightforward way to offer customers a personalized value proposition is through their major life events. An insurer might offer advisory services to go along with a new home purchase, a new car, a marriage, a career change, or an impending retirement. With customers age 50 and above, an insurer might expand on more conventional tie-ins to offer investment advisory services or estate planning.

Subscribe to our Insurance E-Alert.

Determine the Go-to-Market Strategy

There must also be a concrete plan for going to market with the value proposition for each target customer group. The go-to-market strategy should consider the marketing plan, the distribution channel mix, and the ongoing advisory role, with special attention paid to the following considerations:

- The Marketing Plan. When coming up with a marketing plan, take into account which media platforms will reach the target group and what message will resonate with them. Marketing campaigns should be highly targeted to the group in question. Are they moving out of their parents’ home and thinking about renters’ insurance? Are they nearing retirement age and planning to move or travel? Plan to test the effectiveness of each campaign, making continuous adjustments to refine the scope and details through the use of marketing automation tools.

- The Distribution Channel Mix. Look at the best ways to reach each particular target group. An insurer might build a sales force that specializes in a specific customer group or use geographic analytics to set up agencies in areas that are located nearby. The sales effort should be focused on where each group goes for advice on insurance. Do they rely on trusted advisors, or do they look to social media or targeted online newsletters? Are they interested in purchasing insurance online, in person, or through a hybrid approach? Do they want to keep in touch with their insurance agent by phone or by email?

- The Ongoing Advisory Role. Each sale should be the beginning of a long-term relationship that will evolve as the insurer develops a deeper perspective on the client’s needs. Insurance advisors should be prepared to stay focused on the specific interests of each target group and offer advice about insurance requirements that come with a life event or whatever circumstances might be a concern for a particular demographic.

Just as the relationship between advisor and client will continue to evolve, the insurer should expect to continuously refine their customer segments and the value proposition and market strategy for each. It is important to establish a continuous feedback loop by using customer insights to adjust the approach. The ongoing insights will ensure lasting benefit and relevance as the customer segments grow narrower and more individualized over time.

The Path Toward Personalization

The shift to more targeted markets requires not just refining products but also adopting a mindset that’s focused on deeply understanding and meeting the distinct needs of each customer group. When insurers begin to embrace a customer-centric approach, they are doing far more than just responding to market demands: they are building a foundation for lasting relationships that can set them apart in a demanding industry.

Achieving full personalization—the ultimate “segment of one”—is an ongoing journey that requires continuous learning and adaptation. Insurers should approach this goal as a progressive transformation, with customer-centric growth as an achievable, impactful next step.

When insurers begin to embrace a customer-centric approach, they are building a foundation for lasting relationships that can set them apart in a demanding industry.

The journey will also necessitate internal adaptation. Incentivizing agents and employees to use customer relationship management systems effectively will be essential. Agents who recognize the value of personalization are better equipped to build connections that foster customer loyalty.

Incremental gains in customer engagement will provide a competitive edge and raise the standard of service. Ultimately, this commitment to personalization will redefine insurance, transforming it from a transactional necessity to a trusted, lifelong partnership.